Is Hanju capital safe?

Business

License

Is Hanju Capital Safe or Scam?

Introduction

Hanju Capital is a forex broker that has emerged in the trading landscape, claiming to provide a wide array of trading services to its clients. Operating primarily in Canada, the broker offers various trading instruments, including equities, bonds, and derivatives. However, the legitimacy of Hanju Capital has come under scrutiny, prompting traders to exercise caution when evaluating this broker. In the volatile world of forex trading, it's crucial for traders to thoroughly assess the safety and reliability of their chosen brokers to avoid potential scams. This article aims to investigate the safety and legitimacy of Hanju Capital by analyzing its regulatory status, company background, trading conditions, customer experiences, and risks associated with trading on its platform.

Regulatory Status and Legitimacy

The regulatory framework surrounding a forex broker is pivotal in determining its legitimacy. A well-regulated broker typically adheres to stringent guidelines that protect traders' interests. Hanju Capital, however, presents a concerning picture regarding its regulatory status. According to available information, Hanju Capital lacks proper regulatory oversight, which raises significant red flags for potential clients.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Canada | Not Verified |

The absence of regulation means that Hanju Capital is not subject to the same level of scrutiny and accountability as regulated brokers. This lack of oversight can lead to potential risks for traders, as there are no guarantees regarding the safety of their funds or the integrity of the trading practices employed by the broker. Furthermore, the accumulation of complaints from users, particularly concerning login issues and withdrawal difficulties, further underscores the potential risks associated with trading with Hanju Capital. Traders should be particularly wary of engaging with a broker that operates without valid regulatory information, as this may indicate a higher likelihood of fraudulent activities. Therefore, the question remains: is Hanju Capital safe? The evidence suggests that it may not be.

Company Background Investigation

Hanju Capital's background provides further insights into its legitimacy. Established in Canada, the broker claims to have been operating for approximately 2 to 5 years. However, detailed information regarding its ownership structure and history is limited, raising concerns about transparency. A lack of transparency in a broker's operations can be indicative of potential issues, as it may suggest that the company is not forthcoming about its practices or financial health.

The management team behind Hanju Capital has not been extensively documented, making it difficult to assess their qualifications and experience in the financial industry. A broker's management team plays a crucial role in determining the firm's credibility and operational integrity. Without clear information about the backgrounds of those in charge, potential clients may find it challenging to trust the broker. Furthermore, the level of information disclosure on Hanju Capital's website is minimal, which could be a tactic to obscure potential issues and prevent scrutiny.

Given these factors, it is essential for traders to approach Hanju Capital with caution. The lack of regulatory oversight and transparency raises questions about the broker's reliability. Therefore, when pondering whether Hanju Capital is safe, the available evidence suggests that it may not be a trustworthy option for traders.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience and profitability. Hanju Capital presents various account types, including micro, standard, and ECN accounts, each with differing minimum deposit requirements and leverage options. However, the overall fee structure and trading costs associated with Hanju Capital are critical factors to consider.

| Fee Type | Hanju Capital | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | 3.0 pips (Micro) | 1.0 - 2.0 pips |

| Commission Model | No Commissions | Varies |

| Overnight Interest Range | Not Specified | Varies |

While Hanju Capital advertises no commissions on trades, the spreads offered, particularly for micro accounts, are relatively high compared to industry averages. High spreads can significantly erode a trader's profits, especially for those engaging in frequent trading. Additionally, the lack of transparency regarding overnight interest rates raises concerns about potential hidden costs that could affect traders' bottom lines.

Moreover, the imposition of deposit and withdrawal fees, which are not explicitly mentioned, can further complicate the cost structure for traders. These hidden fees, if not disclosed upfront, can lead to unexpected expenses that may deter traders from engaging with the broker. Therefore, when assessing whether Hanju Capital is safe, potential clients should consider the overall cost of trading and the implications of high spreads and hidden fees on their trading strategies.

Customer Funds Security

The safety of customer funds is a paramount concern for any trader when choosing a broker. Hanju Capital's approach to fund security is an area that warrants careful examination. According to the available information, there is no clear indication that Hanju Capital employs robust measures to protect client funds. The absence of regulatory oversight further exacerbates concerns regarding the safety of traders' deposits.

In a well-regulated environment, brokers are typically required to implement measures such as segregated accounts, investor protection schemes, and negative balance protection policies to safeguard client funds. However, Hanju Capital's lack of regulatory backing raises questions about whether such protections are in place. Without these safeguards, traders may be at risk of losing their deposits in the event of financial difficulties faced by the broker.

Additionally, there have been numerous complaints from users regarding difficulties in withdrawing funds, which raises further alarm about the broker's financial stability and operational integrity. Issues related to fund access can be indicative of deeper problems within the broker's operations, potentially suggesting that traders' funds may not be secure. Therefore, when evaluating whether Hanju Capital is safe, the lack of robust fund protection measures and the history of withdrawal complaints point to significant risks for potential clients.

Customer Experience and Complaints

Customer feedback and experiences play a crucial role in assessing a broker's reliability and service quality. Hanju Capital has garnered a significant number of complaints, particularly concerning poor customer service, account cancellations, and withdrawal difficulties. These issues have been frequently reported by users, indicating a pattern of dissatisfaction among clients.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Difficulties | High | Poor |

| Poor Customer Support | Medium | Poor |

| Account Cancellations | High | Inconsistent |

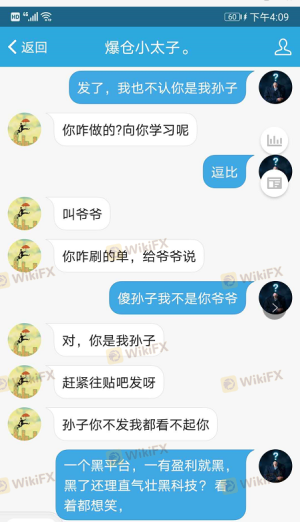

The severity of these complaints is concerning, as they suggest that Hanju Capital may not be adequately addressing client issues. For instance, many users have reported that their withdrawal requests were either delayed or denied without proper justification, raising suspicions about the broker's operational practices. Additionally, the quality of customer support has been criticized, with clients expressing frustration over unresponsive or unhelpful service.

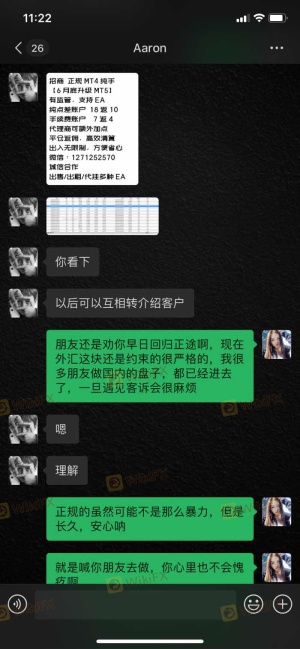

Two notable case studies highlight these concerns. In one instance, a trader reported that their account was suddenly canceled without explanation, resulting in significant financial loss. In another case, a client struggled for weeks to withdraw their funds, only to receive vague responses from customer service. These experiences underscore the potential risks associated with trading on the Hanju Capital platform.

Given the prevalence of complaints and the company's inadequate response to client concerns, traders should carefully consider whether Hanju Capital is safe as a trading partner. The evidence suggests a troubling pattern that may indicate deeper issues within the broker's operations.

Platform and Trade Execution

The trading platform's performance and execution quality are critical factors that can significantly influence a trader's success. Hanju Capital offers access to popular trading platforms, including MetaTrader 4 and MetaTrader 5, which are known for their user-friendly interfaces and robust functionalities. However, the overall performance and reliability of these platforms are paramount for traders seeking a seamless trading experience.

Feedback from users regarding the platform's stability has been mixed, with some traders reporting issues such as slippage and order rejections. These problems can severely impact trading outcomes, particularly for those employing high-frequency trading strategies. Additionally, concerns have been raised regarding potential platform manipulation, with some users alleging that their trades were executed at unfavorable prices without clear justification.

The combination of these factors raises questions about the overall integrity of the trading environment provided by Hanju Capital. When considering whether Hanju Capital is safe, the mixed reviews regarding platform performance and execution quality suggest that traders may encounter challenges that could hinder their trading success.

Risk Assessment

Engaging with any forex broker involves inherent risks, and Hanju Capital is no exception. The lack of regulatory oversight, combined with the accumulation of complaints and issues related to fund security, presents a concerning risk profile for potential clients.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight. |

| Financial Stability Risk | High | Complaints regarding withdrawals and fund access. |

| Customer Service Risk | Medium | Poor response to client issues. |

| Platform Reliability Risk | Medium | Mixed feedback on platform performance. |

To mitigate these risks, traders should conduct thorough research and consider alternative brokers with robust regulatory frameworks and positive customer reviews. Additionally, traders should only invest what they can afford to lose and maintain a diversified portfolio to spread risk.

Conclusion and Recommendations

In summary, the evidence gathered raises significant concerns regarding the safety and legitimacy of Hanju Capital. The lack of regulatory oversight, coupled with a troubling history of customer complaints, suggests that traders should exercise extreme caution when considering this broker. The absence of robust fund protection measures and the potential for hidden costs further exacerbate the risks associated with trading on the Hanju Capital platform.

For traders seeking a safe and reliable trading environment, it may be prudent to explore alternative brokers that are well-regulated and have a proven track record of customer satisfaction. Brokers with strong regulatory oversight, transparent fee structures, and positive user feedback can provide a more secure trading experience. Ultimately, the question of whether Hanju Capital is safe appears to lean towards a negative response, warranting careful consideration before engaging with this broker.

Is Hanju capital a scam, or is it legit?

The latest exposure and evaluation content of Hanju capital brokers.

Hanju capital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Hanju capital latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.