GLO 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive GLO review presents a neutral assessment of this emerging forex broker. GLO has generated mixed feedback since its establishment in 2021, creating uncertainty among potential traders. GLO positions itself as a multi-asset trading platform offering access to forex pairs, commodities, indices, and precious metals. Our analysis reveals significant concerns regarding regulatory transparency and trading condition clarity that potential traders should carefully consider.

The broker targets novice traders and investors seeking diversified trading instruments across multiple asset classes. While GLO's multi-asset approach may appeal to traders looking for variety, several issues raise red flags about platform reliability. The lack of comprehensive regulatory information and limited transparency in trading conditions creates serious concerns. GLO has received a TrustScore of 2, indicating substantial user satisfaction challenges that warrant careful examination before committing funds to this platform.

Important Notice

Traders should be aware that GLO's regulatory status remains unclear across different jurisdictions. This situation potentially exposes users in various regions to different levels of legal protection and risk. The absence of clearly stated regulatory oversight may result in varying compliance standards and dispute resolution mechanisms depending on the trader's location.

This GLO review is based on currently available public information and user feedback compiled from multiple sources. Due to limited official disclosures from the broker, some aspects of their service offering remain unverified. Traders are advised to conduct additional due diligence before opening accounts.

Rating Framework

Broker Overview

GLO emerged in the forex trading landscape in 2021 as a UK-based brokerage firm. The company attempted to establish itself in the competitive online trading market with ambitious goals but limited transparency. GLO positions itself as a comprehensive trading solutions provider, offering access to multiple financial markets including foreign exchange, commodities, stock indices, and precious metals trading. Despite its relatively recent establishment, GLO has aimed to attract traders seeking diversified investment opportunities across various asset classes.

The broker's business model centers around providing multi-asset trading capabilities through what appears to be an online platform. However, specific details about their proprietary technology or third-party platform partnerships remain unclear in available documentation. GLO's approach targets both newcomers to forex trading and experienced investors looking to diversify their trading portfolios beyond traditional currency pairs. The company's operational transparency and regulatory compliance status present significant concerns that potential clients must carefully evaluate.

GLO offers trading access to major forex pairs, various commodities, global stock indices, and precious metals including gold and silver. Unfortunately, specific details regarding their regulatory authorization, licensing jurisdictions, and compliance frameworks are not clearly disclosed in publicly available materials. This represents a significant transparency gap for this GLO review assessment.

Regulatory Status: Information regarding GLO's regulatory oversight and licensing remains unclear in available documentation. This situation raises concerns about client protection and operational compliance standards.

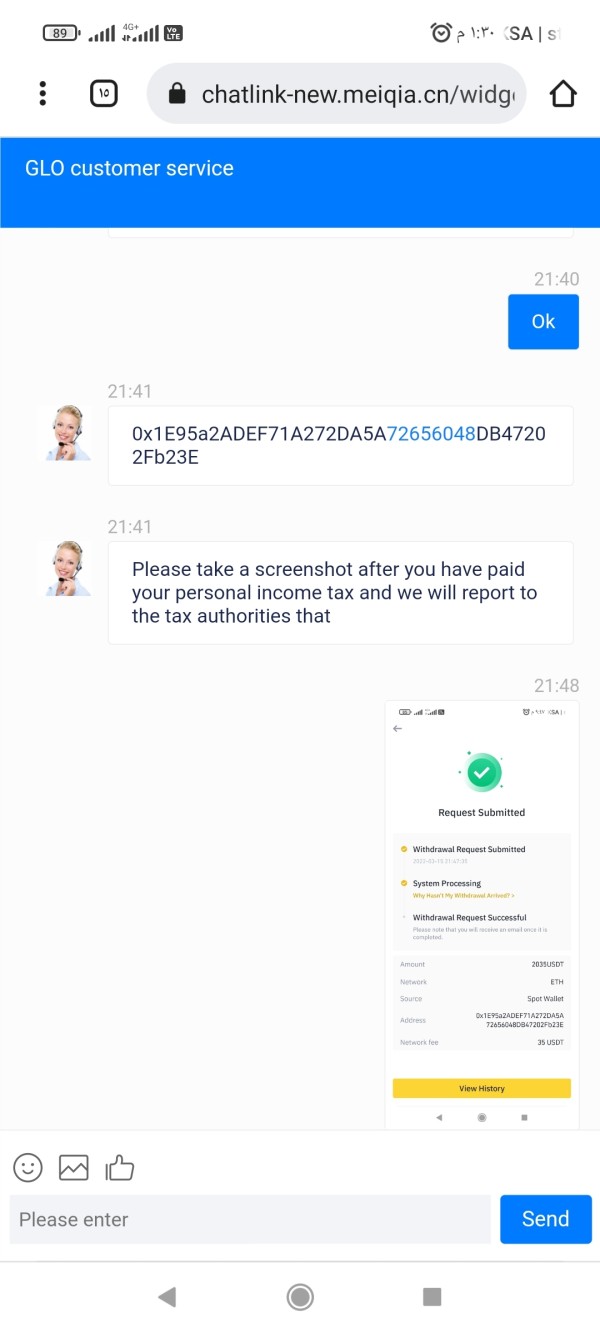

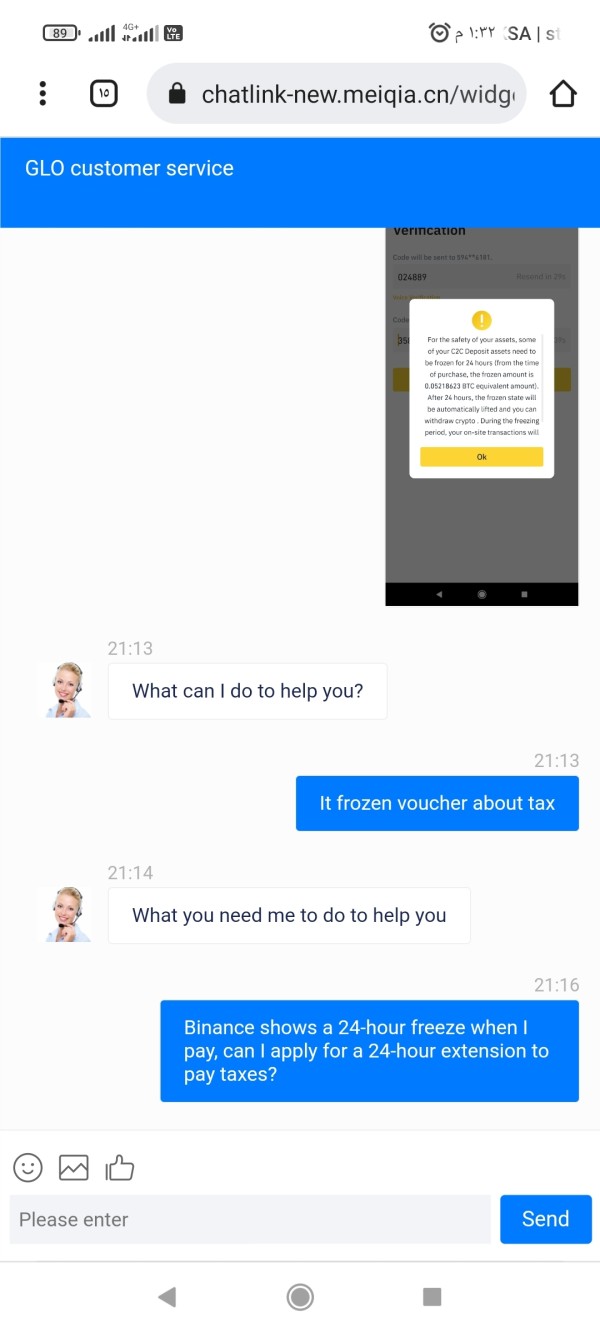

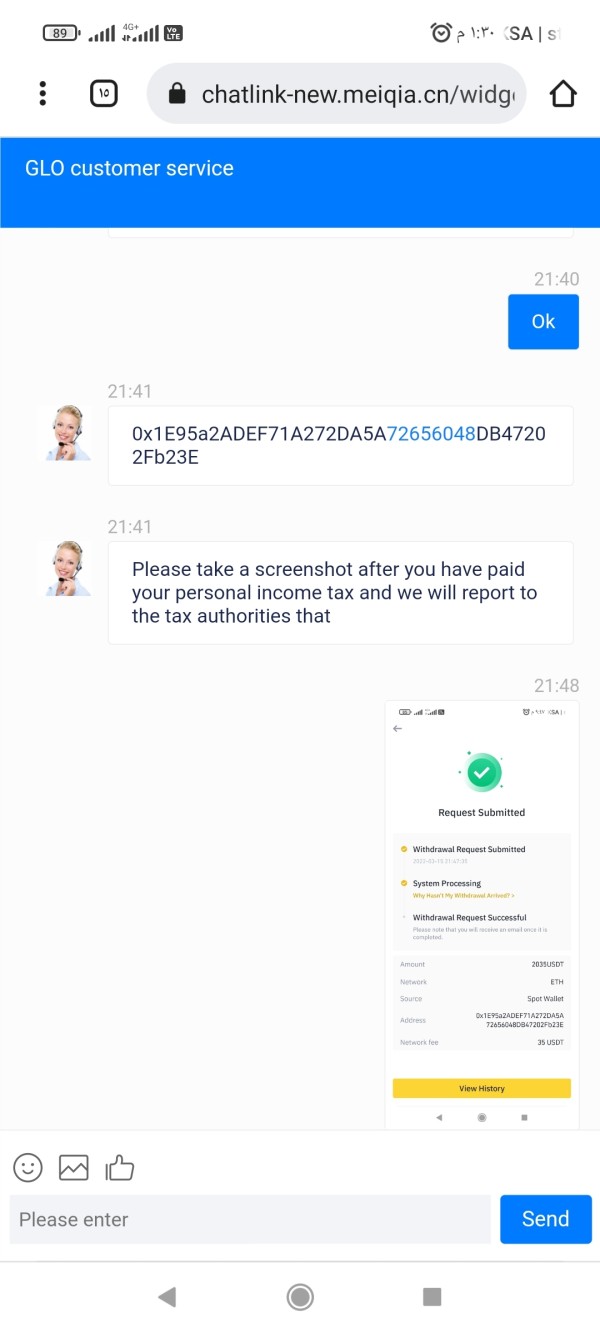

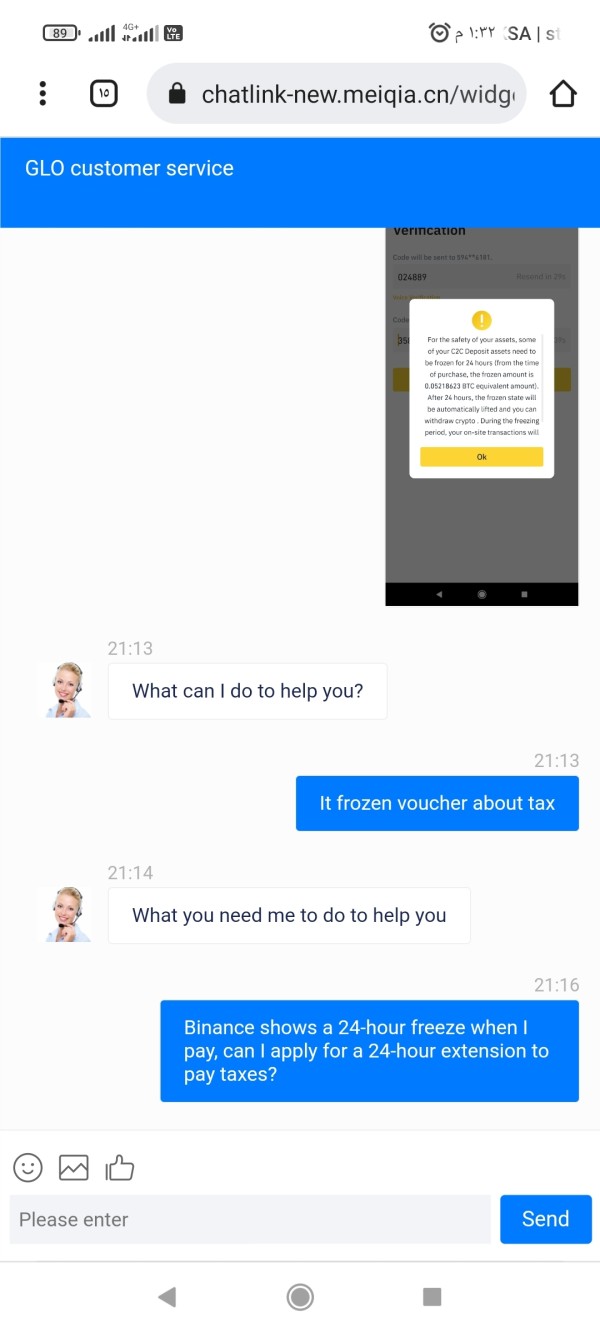

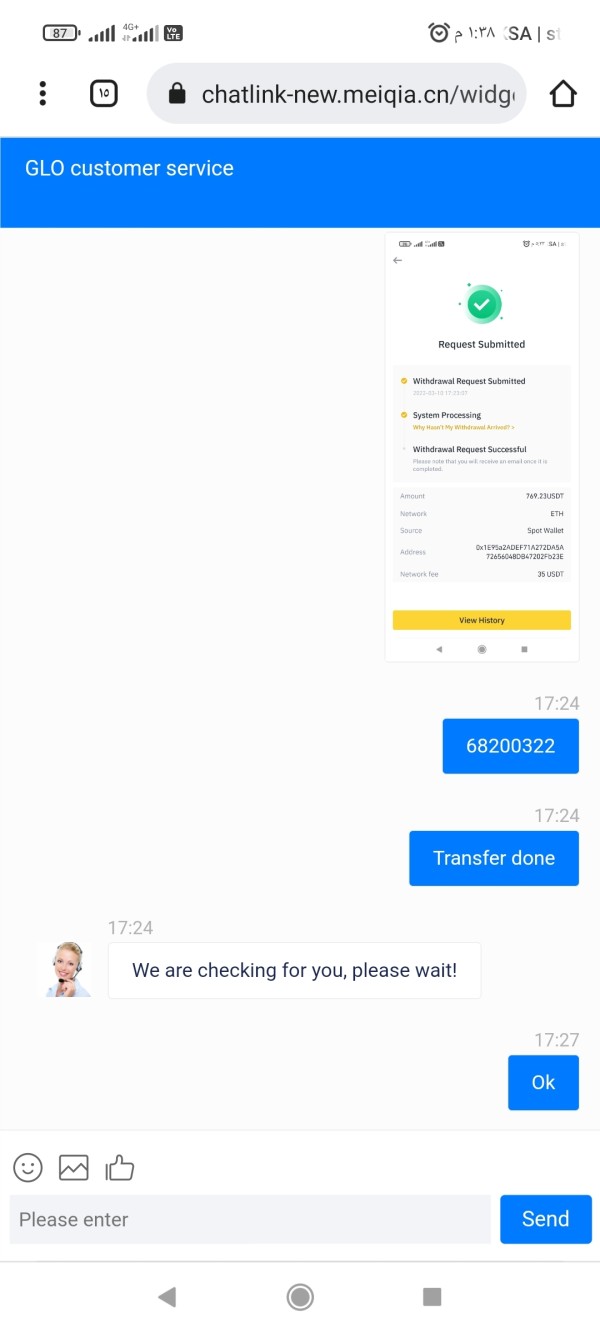

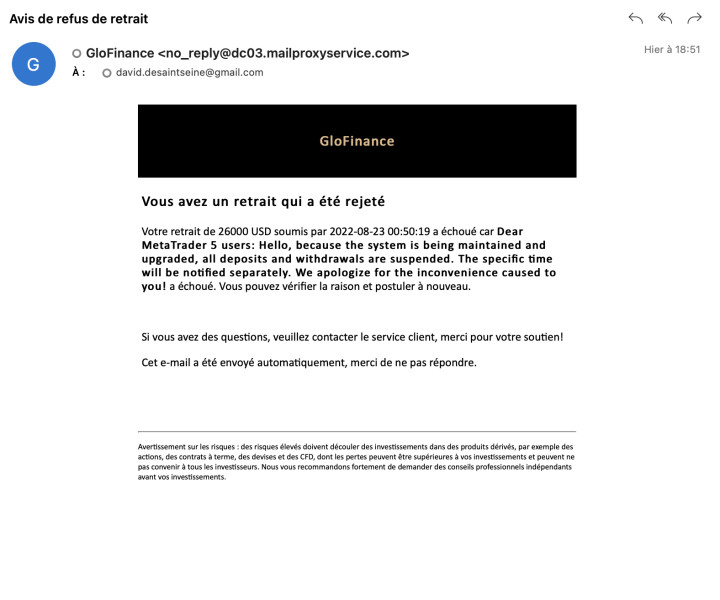

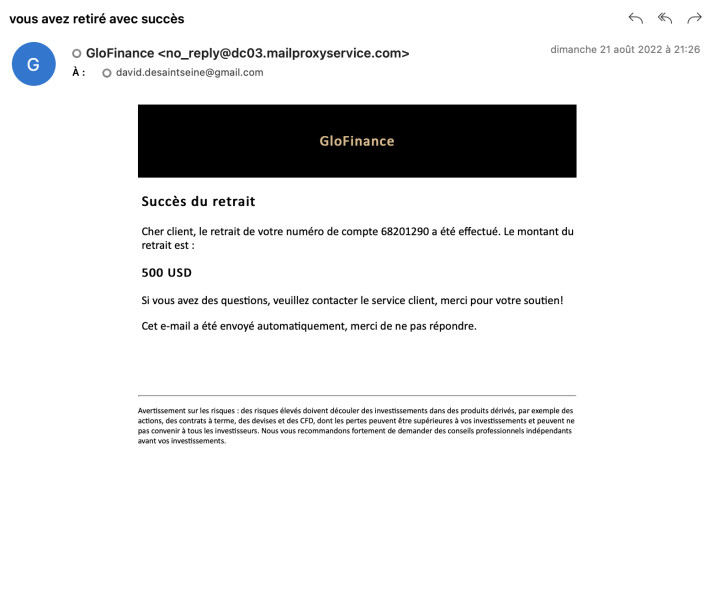

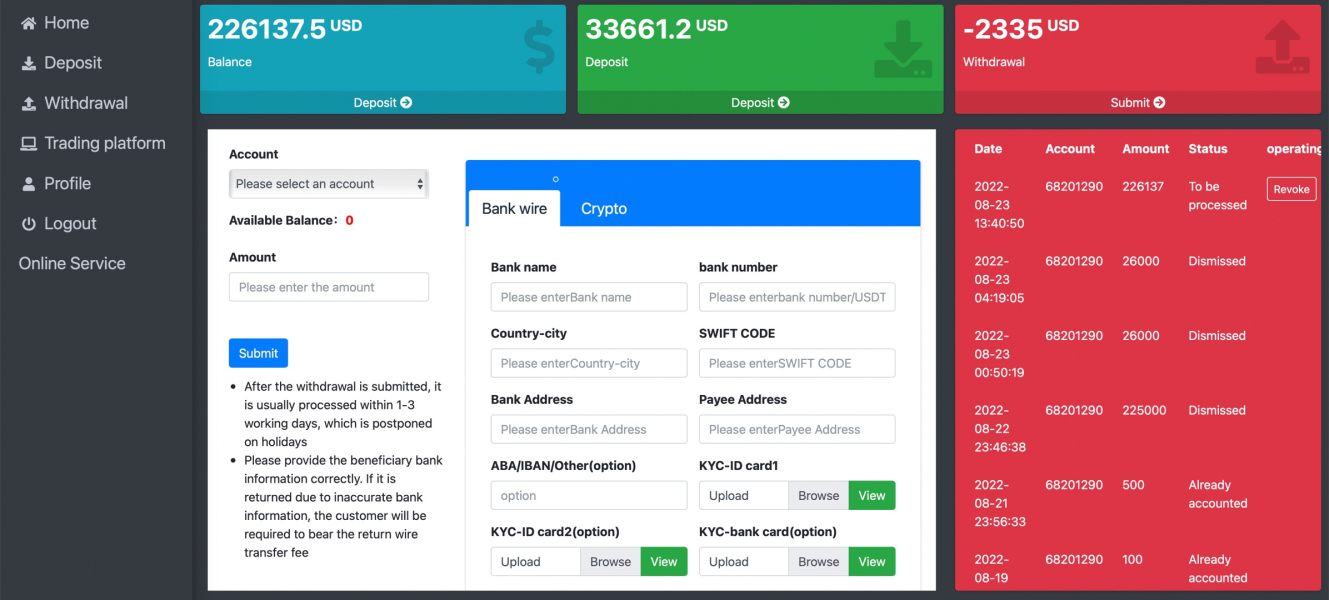

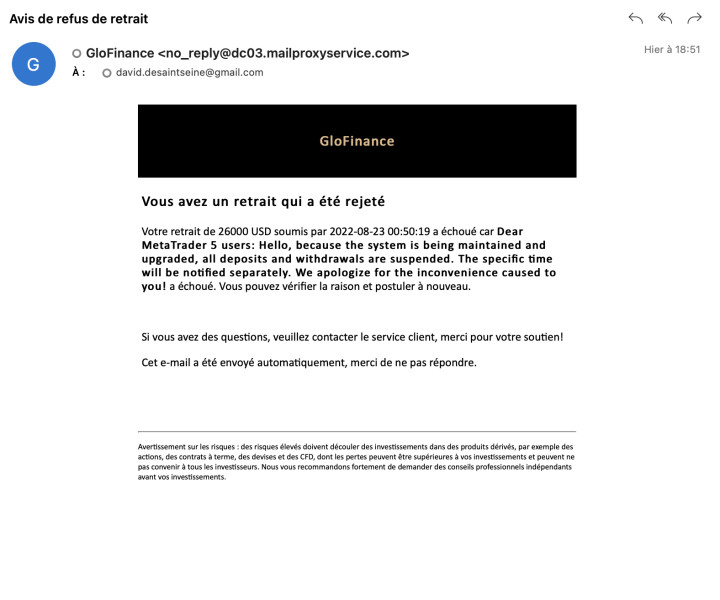

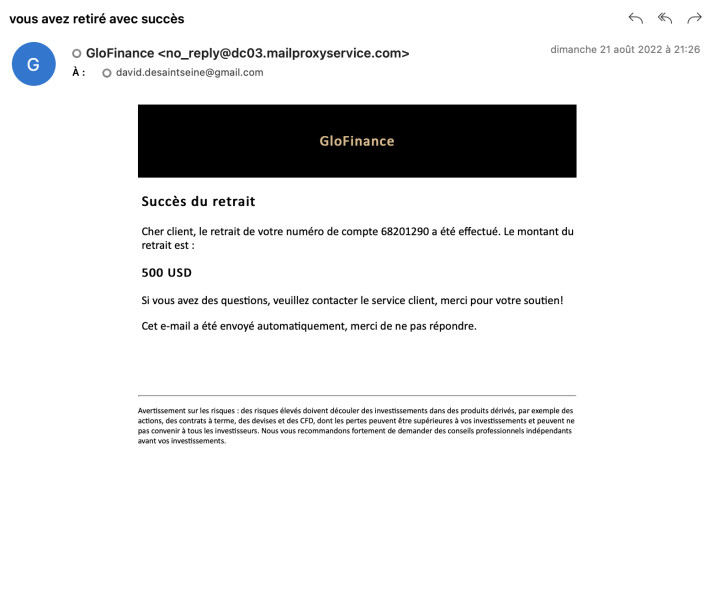

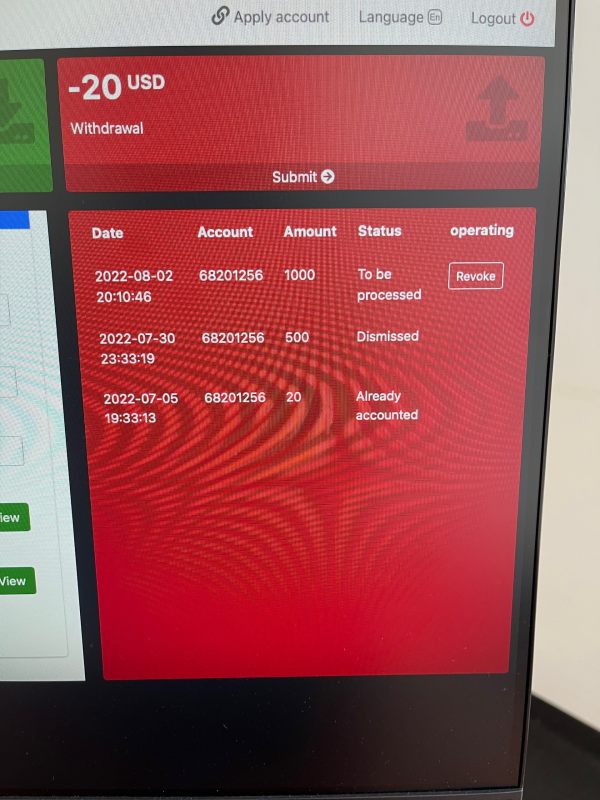

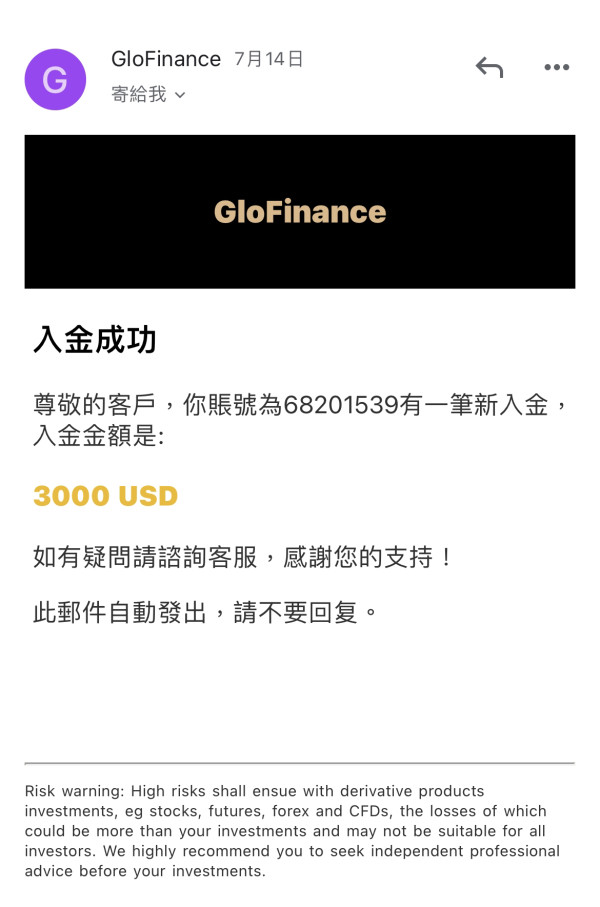

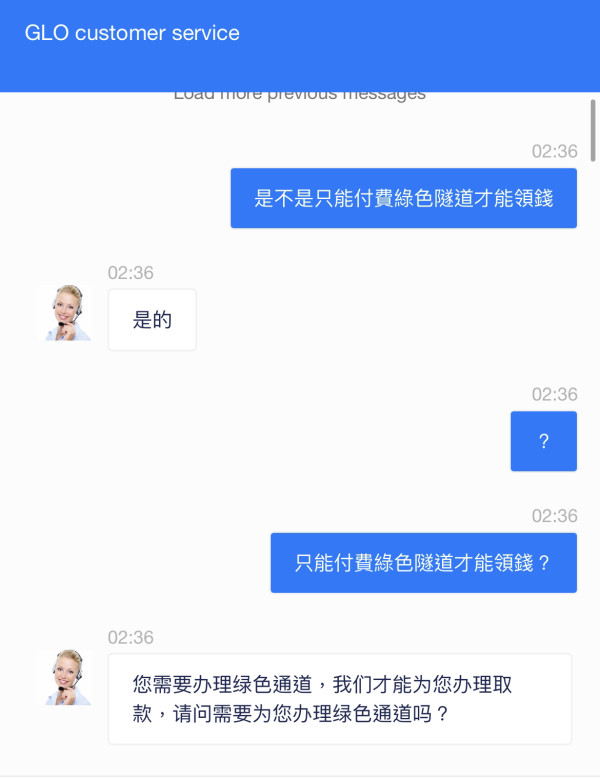

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees for deposits and withdrawals is not detailed in current available materials.

Minimum Deposit Requirements: The broker has not clearly disclosed minimum deposit amounts for different account types. This lack of transparency makes it difficult for potential traders to plan their initial investment.

Bonus and Promotions: Details about welcome bonuses, promotional offers, or incentive programs are not specified in available broker information.

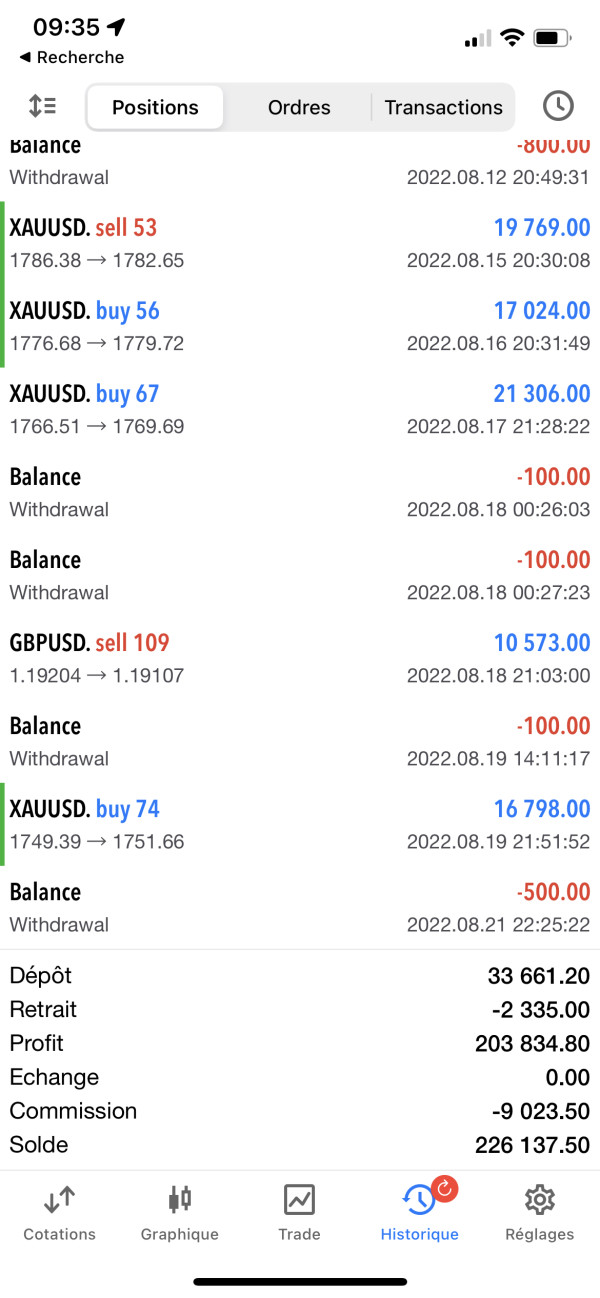

Tradeable Assets: GLO provides access to forex currency pairs, commodities markets, stock indices, and precious metals trading. This offering provides diversification opportunities across multiple asset classes.

Cost Structure: Comprehensive information about spreads, commissions, overnight fees, and other trading costs remains undisclosed. This prevents accurate cost comparison with other brokers.

Leverage Ratios: Maximum leverage offerings and margin requirements for different asset classes are not clearly specified in available documentation.

Platform Options: Details about trading platform availability, whether proprietary or third-party solutions like MetaTrader, are not clearly outlined in current materials.

Geographic Restrictions: Information about service availability in different countries and jurisdictions is not comprehensively detailed.

Customer Support Languages: Available customer service languages and communication channels are not specified in current broker information.

This GLO review highlights significant information gaps that potential traders should address through direct broker contact before making investment decisions.

Account Conditions Analysis

GLO's account structure and conditions present substantial transparency concerns that significantly impact this GLO review assessment. The broker has not provided clear information about different account types, their respective features, or minimum deposit requirements across various trading levels. This lack of transparency makes it extremely difficult for potential traders to understand what they can expect when opening an account with the platform.

The absence of detailed account opening procedures, verification requirements, and documentation needed for different account tiers raises questions about the broker's operational standards. Professional traders typically require comprehensive information about account specifications, including maximum position sizes, available leverage ratios, and any restrictions that might apply to different account categories. GLO fails to provide this essential information to potential clients.

GLO has not disclosed information about special account features such as VIP services, institutional accounts, or Islamic compliant trading options that many modern brokers offer to cater to diverse client needs. The lack of clarity regarding account maintenance fees, inactivity charges, or minimum trading volume requirements adds to the uncertainty surrounding their service offering. Without transparent account condition information, traders cannot make informed decisions about whether GLO's offerings align with their trading strategies and capital requirements, contributing to the low rating in this category.

The trading tools and educational resources offered by GLO remain largely undisclosed, presenting another significant concern in this comprehensive assessment. Modern forex brokers typically provide extensive analytical tools, market research, and educational materials to support trader success. GLO's offerings in these areas are not clearly documented, creating uncertainty about platform capabilities.

Professional trading requires access to advanced charting capabilities, technical analysis tools, economic calendars, and market sentiment indicators. The absence of detailed information about GLO's analytical toolkit makes it impossible to evaluate whether the platform can meet the needs of serious traders who rely on comprehensive market analysis for their decision-making processes. Educational resources represent a crucial component of broker services, particularly for novice traders.

Quality brokers typically offer webinars, tutorials, market analysis, and trading guides to help clients develop their skills. GLO's educational offerings, if any, are not clearly outlined in available materials, suggesting either limited resources or poor communication of available services. The lack of information about automated trading support, expert advisors compatibility, or API access for algorithmic trading further limits the platform's appeal to sophisticated traders. Without comprehensive tool and resource information, GLO fails to demonstrate the value proposition that competitive brokers typically provide to attract and retain clients.

Customer Service and Support Analysis

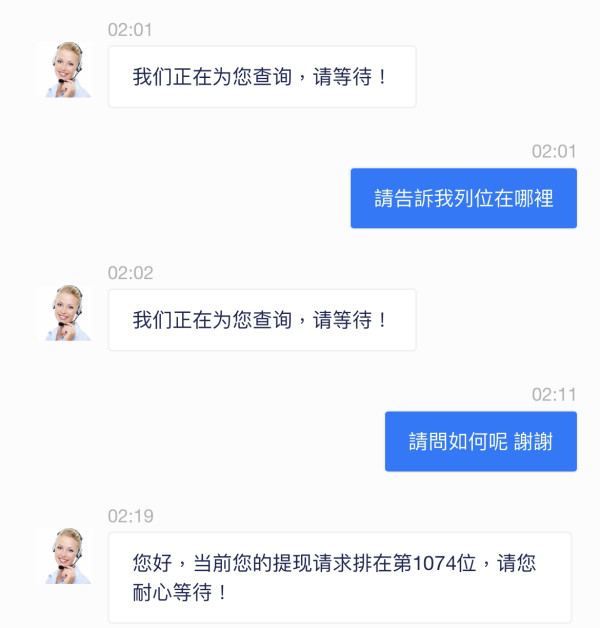

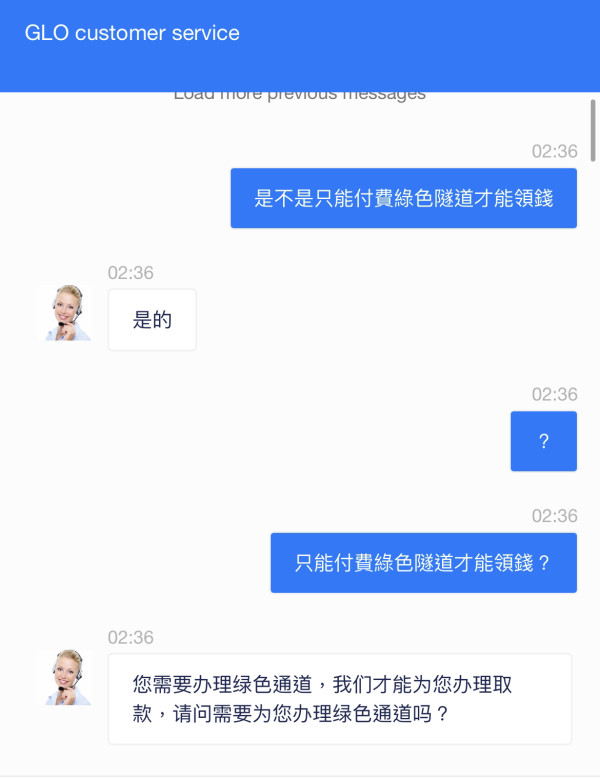

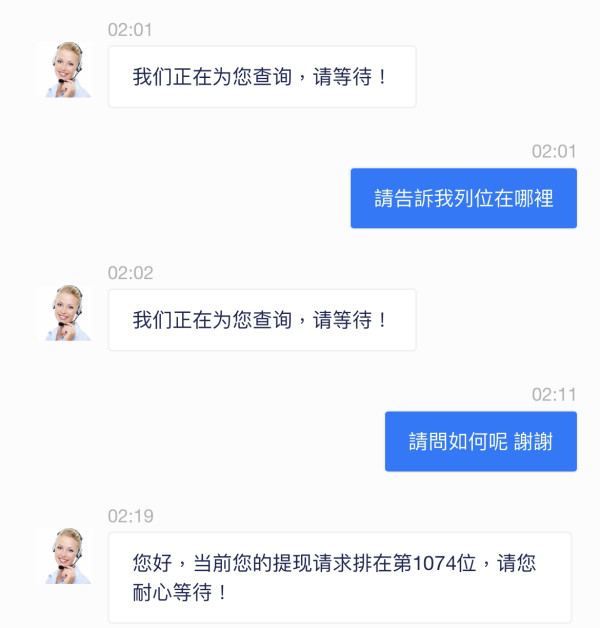

Customer service quality represents a critical factor in broker selection, and GLO's support infrastructure appears inadequately documented based on available information. The absence of clear customer service channels, response time commitments, and support availability hours raises concerns about the broker's commitment to client assistance. Effective forex brokers typically provide multiple communication channels including live chat, telephone support, email assistance, and comprehensive FAQ sections.

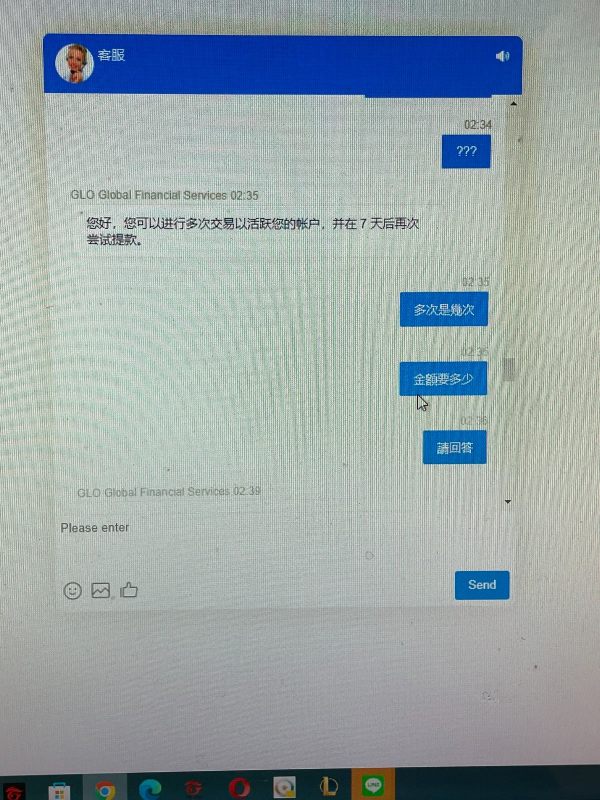

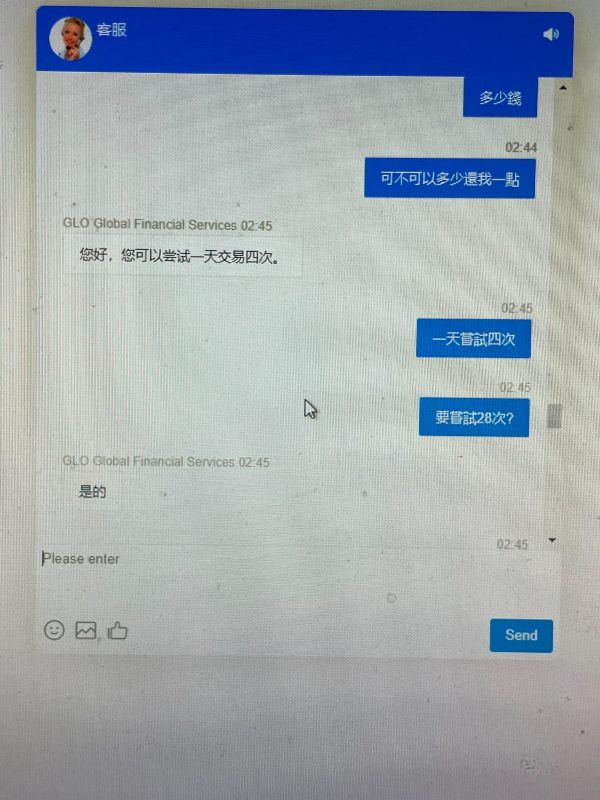

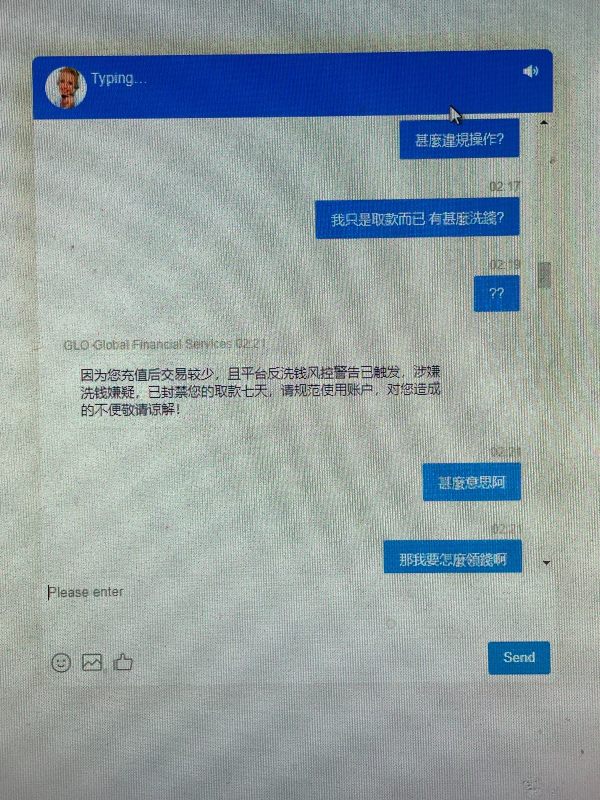

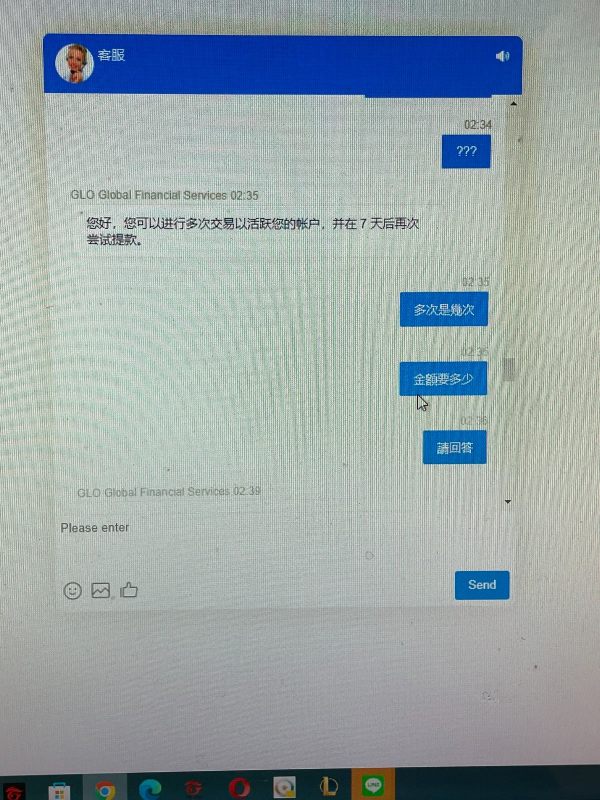

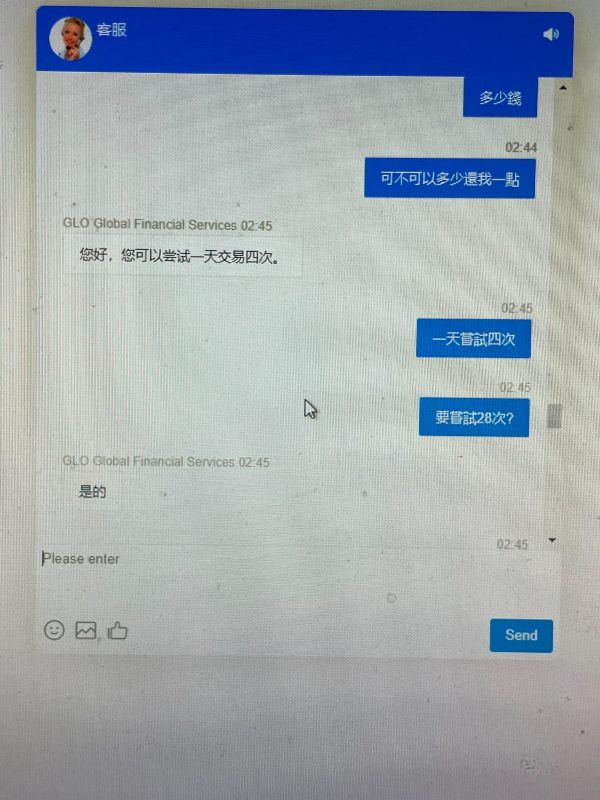

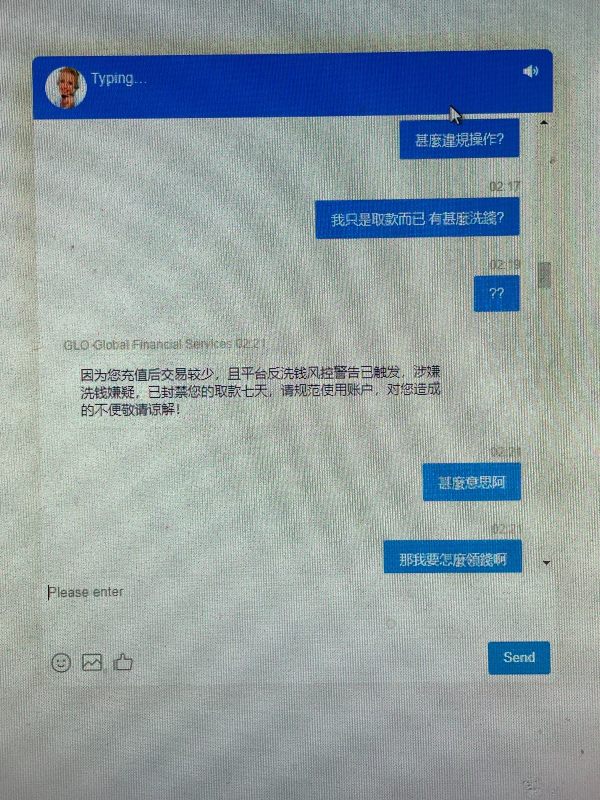

GLO's customer service offerings are not clearly outlined, making it impossible to assess whether traders can receive timely assistance when needed. This becomes particularly crucial during volatile market conditions when immediate support becomes essential for protecting trading positions. The lack of information about multilingual support capabilities also presents concerns for international traders who may require assistance in their native languages.

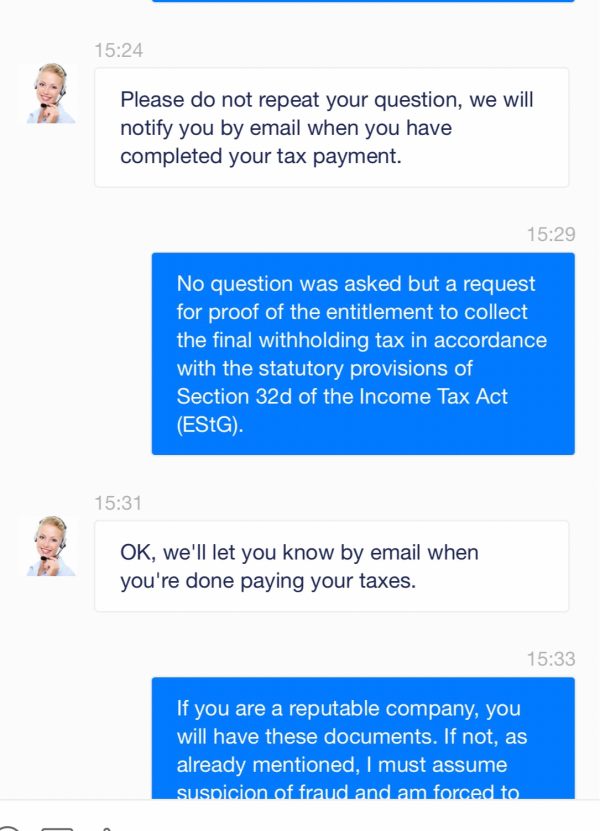

Professional brokers usually specify their supported languages and regional support teams to ensure effective communication with diverse client bases. The absence of documented escalation procedures, complaint handling processes, or dispute resolution mechanisms suggests potential challenges in addressing more complex client issues. Without clear customer service standards and accessibility information, traders cannot confidently rely on GLO for the support they may require throughout their trading journey.

Trading Experience Analysis

The trading experience offered by GLO remains largely unclear due to insufficient information about platform stability, execution quality, and overall trading environment. This GLO review cannot adequately assess the broker's trading infrastructure without comprehensive details about their technology, execution methods, and performance standards. Platform reliability represents a fundamental requirement for successful trading, particularly during high-volatility periods when rapid order execution becomes critical.

GLO has not provided information about their platform uptime statistics, server locations, or redundancy measures that ensure consistent trading access for clients. Order execution quality, including fill rates, slippage statistics, and rejection rates, remains undocumented, preventing traders from evaluating whether GLO can deliver the execution standards required for their trading strategies. Professional traders require transparency about execution methods, whether market maker or ECN, and any potential conflicts of interest in order processing.

The mobile trading experience, which has become essential for modern traders, is not adequately described in available materials. Without information about mobile app features, compatibility, and functionality, traders cannot assess whether GLO supports their on-the-go trading requirements. The absence of information about trading environment features such as one-click trading, advanced order types, or risk management tools further limits the ability to evaluate GLO's suitability for serious trading activities.

Trust Factor Analysis

Trust represents perhaps the most critical concern in this GLO review, as the broker's regulatory status and transparency standards fall significantly short of industry expectations. The absence of clear regulatory authorization from recognized financial authorities raises fundamental questions about client protection and operational oversight. Reputable forex brokers typically maintain licenses from established regulatory bodies such as the FCA, CySEC, or ASIC, which provide client fund protection, operational oversight, and dispute resolution mechanisms.

GLO's regulatory status remains unclear, potentially exposing traders to increased risks regarding fund security and legal recourse options. The broker's transparency regarding company ownership, management team, and operational history is also insufficient. Professional traders typically research broker backgrounds, including company registration details, executive team credentials, and track record information before committing funds.

The absence of information about client fund segregation, insurance coverage, or compensation schemes raises concerns about capital protection in case of broker insolvency or operational issues. Without clear regulatory oversight and transparent operational standards, GLO cannot demonstrate the trustworthiness that serious traders require when selecting a broker partner. The lack of third-party audits, financial reporting, or independent verification of operational claims further undermines confidence in the broker's reliability and professional standards.

User Experience Analysis

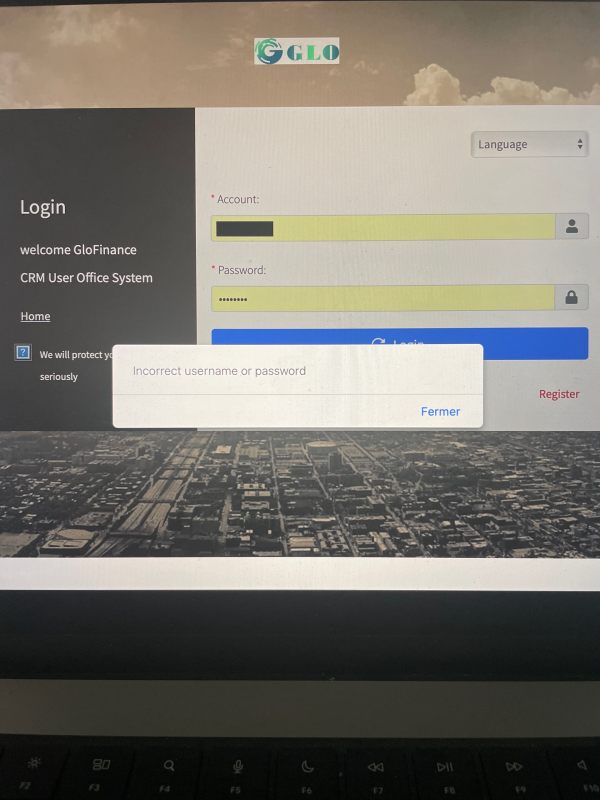

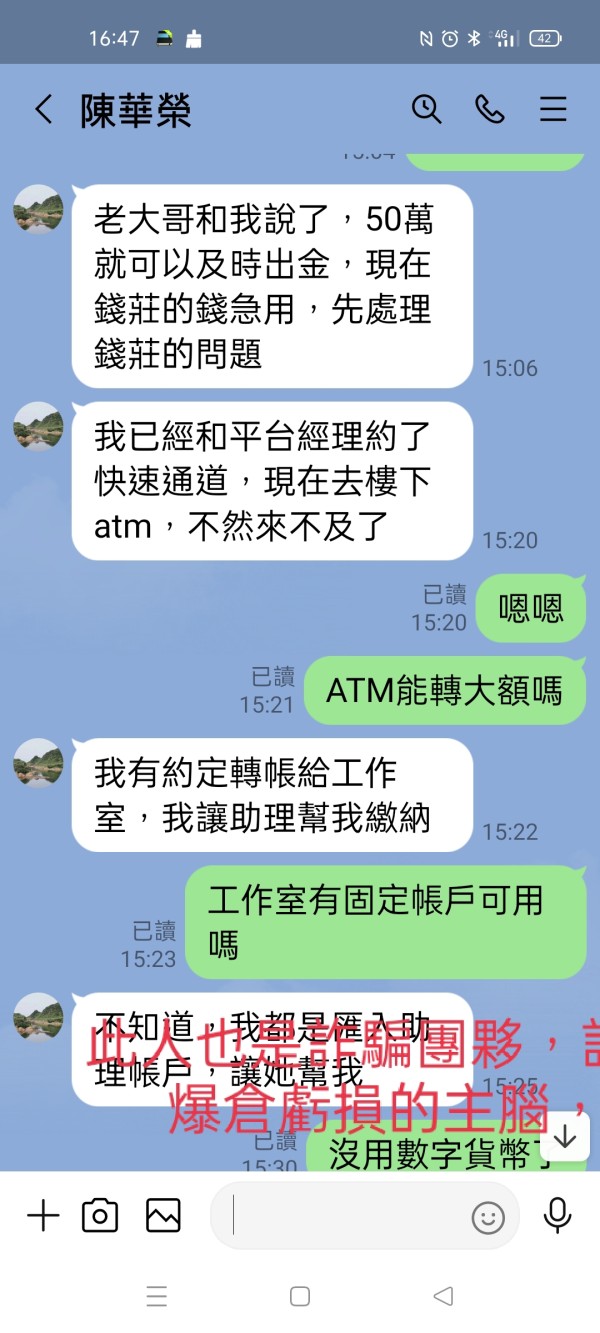

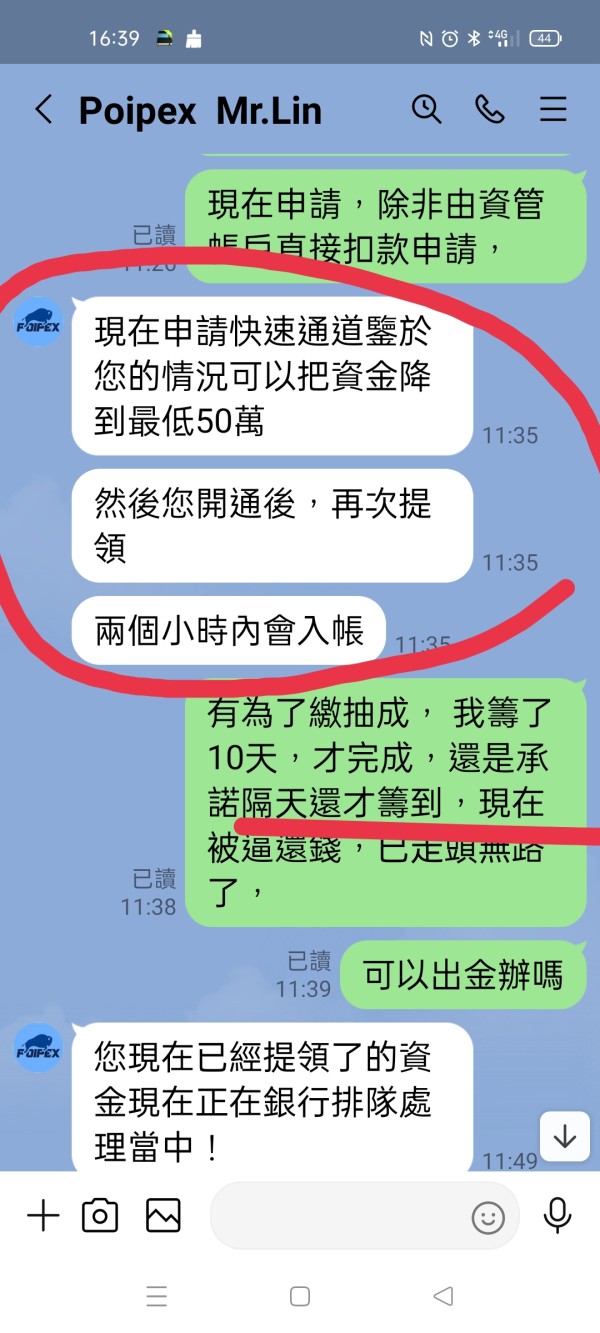

User experience evaluation for GLO reveals significant challenges based on the available TrustScore of 2, indicating substantial user dissatisfaction across various service aspects. This low rating suggests that existing clients have encountered notable issues with the broker's services, though specific user feedback details are limited in available documentation. The overall user satisfaction metrics indicate that GLO has struggled to meet client expectations, though the specific areas of concern require further investigation through direct user testimonials and detailed feedback analysis.

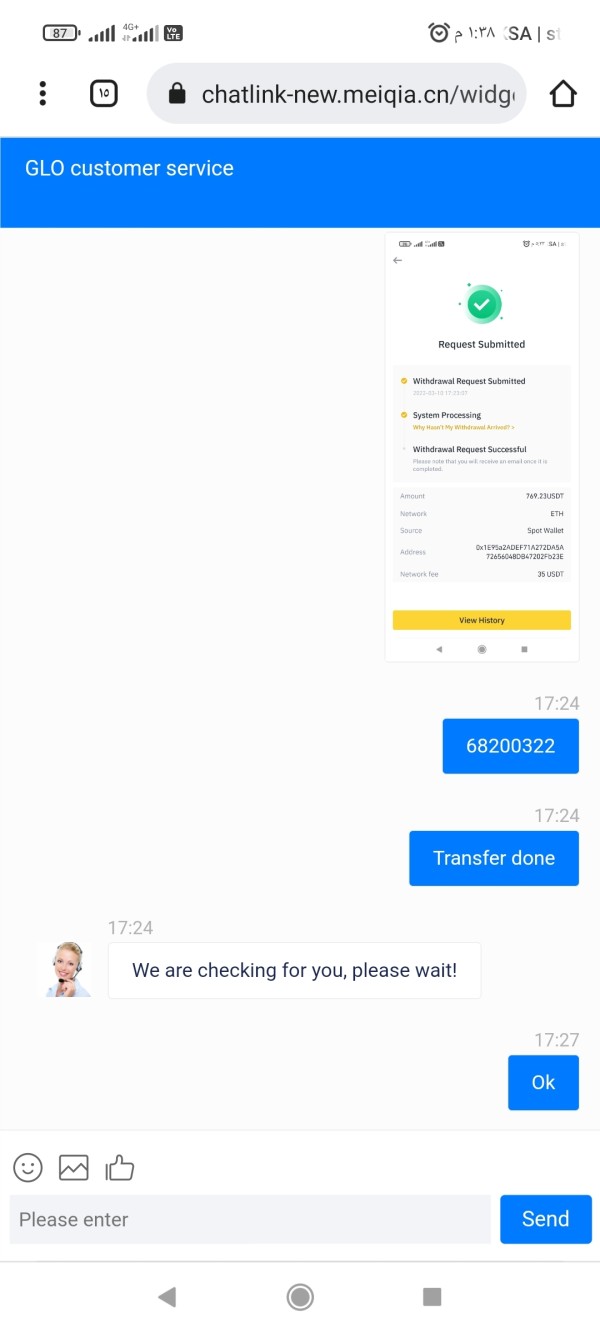

Low user satisfaction scores typically correlate with issues in customer service, platform functionality, or fund withdrawal processes. Interface design and platform usability information is not comprehensively available, preventing assessment of whether GLO provides an intuitive and efficient trading environment. Modern traders expect sophisticated yet user-friendly interfaces that facilitate quick decision-making and seamless order management.

Registration and account verification processes are not clearly outlined, though user feedback suggests potential complications in these areas. Streamlined onboarding processes are essential for positive initial user experiences, and any difficulties in account setup can significantly impact overall satisfaction. The limited positive user feedback available suggests that GLO has considerable room for improvement in delivering satisfactory user experiences across all service touchpoints, from initial registration through ongoing trading activities and support interactions.

Conclusion

This comprehensive GLO review reveals a broker with significant transparency and regulatory concerns that potential traders should carefully consider before opening accounts. While GLO offers access to multiple asset classes including forex, commodities, indices, and precious metals, several critical issues make it difficult to recommend. The lack of clear regulatory oversight and operational transparency presents substantial risks for traders seeking reliable broker partnerships.

GLO may appeal to traders specifically seeking multi-asset trading capabilities, but the absence of comprehensive information about trading conditions, costs, and regulatory protection makes it difficult to recommend for serious trading activities. The broker's low user satisfaction scores and unclear operational standards suggest that alternative, more established brokers may better serve most traders' needs. The primary advantages of GLO appear to be its multi-asset trading offerings and relatively recent market entry, while significant disadvantages include regulatory uncertainty, limited transparency, poor user feedback, and insufficient disclosure of critical trading information that informed traders require for decision-making.