Regarding the legitimacy of FXOpen forex brokers, it provides ASIC and WikiBit, .

Is FXOpen safe?

Pros

Cons

Is FXOpen markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

FXOpen AU Pty Ltd

Effective Date: Change Record

2011-12-12Email Address of Licensed Institution:

jafar.calley@fxopen.orgSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

2024-08-30Address of Licensed Institution:

--Phone Number of Licensed Institution:

08 6557 8587Licensed Institution Certified Documents:

Is FXOpen A Scam?

Introduction

FXOpen is a well-known forex broker that has established itself in the online trading market since its inception in 2005. With its headquarters in the United Kingdom, FXOpen provides trading services across various financial instruments, including forex, commodities, cryptocurrencies, and CFDs. As the forex market continues to grow rapidly, traders must exercise caution when selecting a broker, as the potential for scams and fraudulent activities is significant. This article aims to provide an objective analysis of FXOpen's credibility by examining its regulatory status, company background, trading conditions, customer fund safety, and user experiences. The investigation is based on comprehensive research from various online sources and reviews from existing users.

Regulation and Legitimacy

A broker's regulatory status is a crucial factor in determining its safety and legitimacy. FXOpen operates under several regulatory bodies, which adds a layer of security for traders. The following table summarizes FXOpen's core regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 579202 | United Kingdom | Verified |

| ASIC | 412871 | Australia | Verified |

| CySEC | 194/13 | Cyprus | Verified |

| Financial Commission | N/A | International | Verified |

FXOpen is regulated by the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC). These regulatory bodies are known for their stringent requirements and oversight, which significantly enhances the credibility of FXOpen. The broker has maintained a history of compliance with regulatory standards, ensuring that client funds are kept in segregated accounts and that there are measures in place for investor protection.

Company Background Investigation

FXOpen was founded in 2005, originally as an educational center that provided courses on technical analysis and financial markets. Over the years, it has evolved into a full-fledged brokerage firm, gaining recognition for its innovative approach to trading. The company operates under various entities, including FXOpen Ltd in the UK and FXOpen AU Pty Ltd in Australia. The ownership structure is transparent, with information readily available on their official website.

The management team at FXOpen comprises experienced professionals with extensive backgrounds in finance and trading. This expertise is crucial in ensuring the broker adheres to industry standards and provides quality services to its clients. Furthermore, FXOpen's commitment to transparency is evident in its regular updates and disclosures regarding trading conditions and company performance.

Trading Conditions Analysis

FXOpen offers competitive trading conditions, including low spreads and various account types tailored to meet the needs of different traders. The overall fee structure is designed to be transparent, with no hidden fees. The following table outlines the core trading costs associated with FXOpen:

| Fee Type | FXOpen | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | From 0.0 pips | From 0.1 pips |

| Commission Model | $1.50 per lot (ECN) | $3.00 per lot |

| Overnight Interest Range | Varies | Varies |

FXOpen's ECN accounts offer spreads starting from 0.0 pips, making it an attractive option for traders who prioritize low trading costs. However, it is essential to note that the commission structure can vary based on the account type and trading volume. While the broker's fees are competitive, it is crucial for traders to understand the potential costs associated with overnight positions and withdrawals, as these can impact overall profitability.

Customer Funds Safety

The safety of customer funds is a paramount concern for traders, and FXOpen takes this issue seriously. The broker implements several safety measures, including segregated accounts to protect client funds. This means that client money is held separately from the broker's operational funds, reducing the risk of loss in case of insolvency. Additionally, FXOpen offers negative balance protection, ensuring that traders cannot lose more than their account balance.

While FXOpen has a solid reputation for fund safety, it is essential to remain vigilant. Historical issues related to fund security can arise, particularly with offshore entities. Therefore, traders should thoroughly research the broker's track record regarding fund safety and any past disputes or complaints.

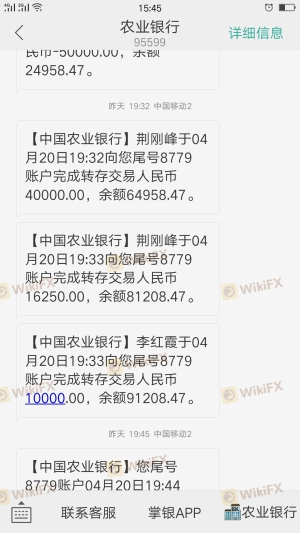

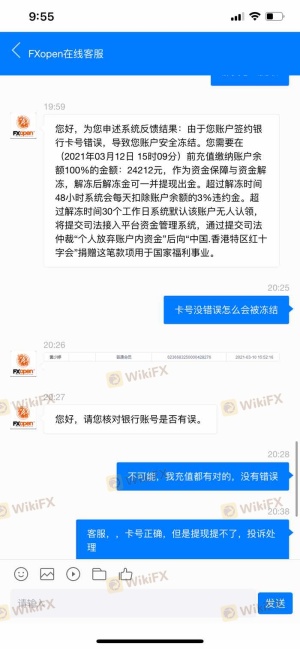

Customer Experience and Complaints

Customer feedback plays a crucial role in assessing a broker's reliability. Overall, FXOpen has received mixed reviews from users. Many traders praise the broker for its low spreads and efficient trading conditions, while others have raised concerns about withdrawal delays and customer service responsiveness. The following table summarizes common complaint types and their severity assessments:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response time |

| Customer Support Issues | Medium | Generally responsive |

| Platform Stability | Medium | Occasional reports of freezing |

One notable case involved a trader who experienced delays in withdrawing funds. While the broker eventually processed the withdrawal, the trader expressed frustration over the lack of timely communication. Such incidents highlight the importance of evaluating customer service quality and responsiveness when choosing a broker.

Platform and Trade Execution

FXOpen offers multiple trading platforms, including MetaTrader 4, MetaTrader 5, and its proprietary Tick Trader platform. These platforms are known for their stability and user-friendly interfaces, providing traders with the necessary tools for effective trading. However, some users have reported instances of slippage and order rejections during high volatility periods.

The execution quality at FXOpen is generally regarded as reliable, with many traders noting the broker's swift order processing times. Nonetheless, it is essential for traders to remain cautious and monitor their execution experiences, as any signs of manipulation or unfair practices could indicate underlying issues.

Risk Assessment

Using FXOpen comes with its own set of risks that traders should carefully consider. The following risk assessment summarizes key risk areas associated with the broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Low | Strong regulatory oversight from reputable bodies |

| Fund Security | Medium | Segregated accounts and negative balance protection |

| Customer Support | Medium | Mixed feedback on responsiveness and issue resolution |

| Trading Conditions | Low | Competitive fees and favorable trading conditions |

To mitigate risks when trading with FXOpen, it is advisable for traders to maintain a diversified portfolio, utilize risk management strategies, and remain informed about market conditions.

Conclusion and Recommendations

In conclusion, FXOpen is a regulated broker that offers a range of trading conditions and instruments. While it has established a solid reputation in the forex market, potential traders should remain cautious and conduct thorough research before opening an account. The broker's regulatory status, commitment to fund safety, and competitive trading conditions contribute to its credibility. However, occasional complaints regarding withdrawal processes and customer service responsiveness warrant attention.

For traders seeking a reliable broker, FXOpen presents a viable option, particularly for those comfortable with its trading conditions and willing to navigate its customer service landscape. For those who prioritize a broker with a more extensive educational offering or superior customer support, it may be beneficial to consider alternatives such as IG or OANDA, which have consistently received positive reviews in these areas. Ultimately, the decision to trade with FXOpen should be based on individual preferences and risk tolerance.

Is FXOpen a scam, or is it legit?

The latest exposure and evaluation content of FXOpen brokers.

FXOpen Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXOpen latest industry rating score is 1.64, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.64 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.