Is CTRL FX safe?

Business

License

Is Ctrl FX A Scam?

Introduction

Ctrl FX is an online forex broker that has garnered attention in the trading community for its promises of competitive trading conditions and a wide array of trading instruments. However, the legitimacy of Ctrl FX has been called into question, prompting traders to exercise caution when considering this broker. As the forex market is rife with potential scams, it is critical for traders to thoroughly evaluate brokers before committing their funds. This article aims to investigate the safety and legitimacy of Ctrl FX through a comprehensive analysis of its regulatory status, company background, trading conditions, customer fund security, client experiences, and overall risk assessment.

Regulation and Legitimacy

The regulatory status of a forex broker is a crucial aspect that determines its credibility and safety for traders. In the case of Ctrl FX, the broker claims to be regulated by the Financial Crimes Enforcement Network (FinCEN) in the United States. However, it is essential to note that FinCEN does not regulate forex trading, which raises significant concerns regarding Ctrl FX's legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FinCEN | MSB Number 31000236051732 | United States | Not a forex regulator |

The lack of a credible regulatory body overseeing Ctrl FX is alarming. The Financial Conduct Authority (FCA) in the UK, which is a reputable regulatory body, does not list Ctrl FX as a licensed broker. This absence of regulation indicates that traders using Ctrl FX do not benefit from the protections that regulated brokers offer, such as segregated accounts and investor compensation schemes. Furthermore, the broker's claims of regulatory compliance appear misleading, as they do not provide evidence of adherence to any stringent regulatory standards. Therefore, it is prudent to conclude that Ctrl FX is not safe, as it operates without adequate regulatory oversight.

Company Background Investigation

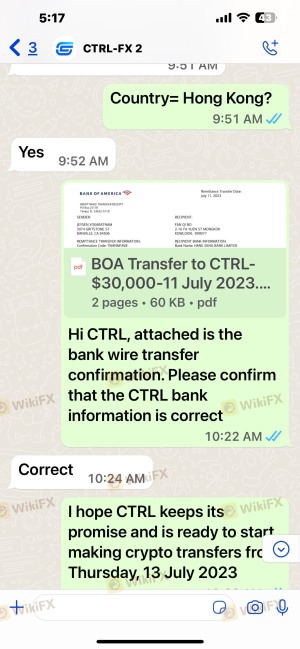

Ctrl FX is operated by Ctrl FX Group Limited, which allegedly has its headquarters in London. However, the broker's website lacks transparency regarding its ownership structure, making it difficult for potential clients to ascertain who is behind the operations. The company has been established recently, raising further suspicions about its credibility.

The management team behind Ctrl FX is not publicly disclosed, which is another red flag for potential investors. A reputable broker typically provides information about its leadership and their professional backgrounds, allowing clients to gauge the experience and expertise of the team managing their funds. The absence of this information on Ctrl FX's platform indicates a lack of transparency and raises questions about the broker's legitimacy.

Overall, the limited information available about Ctrl FX, combined with its recent establishment and lack of transparency, suggests that traders should be wary. The company does not provide sufficient disclosures to instill confidence in its operations, leading to the conclusion that Ctrl FX may not be safe for traders looking for reliable investment opportunities.

Trading Conditions Analysis

When assessing the safety of a forex broker, it is essential to evaluate its trading conditions, including fees and spreads. Ctrl FX claims to offer competitive trading conditions, but the specifics remain vague on their website. The broker does not disclose essential information such as minimum deposit requirements and detailed fee structures, which is not typical for reputable brokers.

| Fee Type | Ctrl FX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2 pips | 1-1.5 pips |

| Commission Model | Not specified | Varies by broker |

| Overnight Interest Range | Not specified | 0.5% - 2% |

The spreads offered by Ctrl FX are relatively high compared to industry averages, which may indicate that traders could incur higher trading costs than anticipated. Additionally, the lack of clarity regarding commission structures and overnight interest rates raises concerns about hidden fees. Such opacity is characteristic of brokers that may engage in deceptive practices, further supporting the notion that Ctrl FX is not a safe choice for traders.

Client Fund Security

The safety of client funds is paramount when considering a forex broker. Ctrl FX's website does not provide detailed information regarding its fund security measures, such as whether client funds are kept in segregated accounts or if there are any investor protection policies in place.

Without proper segregation of funds, traders' money could be at risk in the event of the broker's insolvency. Furthermore, the absence of negative balance protection means that clients could potentially lose more than their initial investment.

Given the lack of transparency and assurances surrounding fund security, it is reasonable to conclude that Ctrl FX does not prioritize client fund safety, making it a risky option for traders.

Customer Experience and Complaints

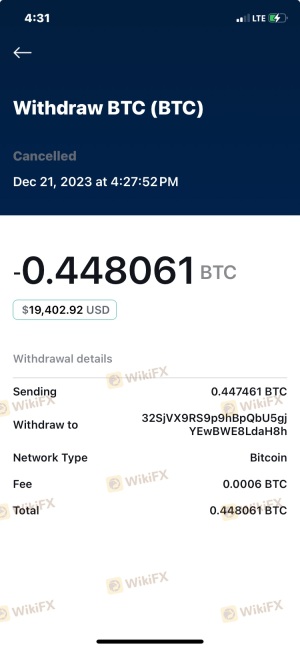

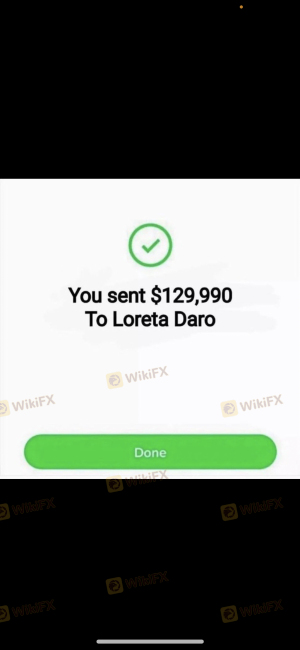

Customer feedback is a vital indicator of a broker's reliability and integrity. Reviews of Ctrl FX reveal numerous complaints from clients, particularly regarding withdrawal issues and unresponsive customer service. Many users report difficulties in accessing their funds, with complaints about being asked to pay additional fees before withdrawals are processed.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Poor |

Typical cases involve clients being unable to withdraw their funds after making substantial deposits, often citing reasons such as "verification fees" or "taxes." Such practices are alarmingly common among fraudulent brokers, further solidifying the claim that Ctrl FX is not a safe broker to engage with.

Platform and Execution

The trading platform offered by Ctrl FX is a proprietary web-based solution that lacks the advanced features found in industry-standard platforms like MetaTrader 4 or 5. This deficiency may hinder traders' ability to execute trades efficiently and access essential trading tools.

Moreover, the quality of order execution is critical in forex trading, and reports suggest that Ctrl FX may experience issues such as slippage and order rejections. Such execution problems can lead to significant financial losses, underscoring the risks associated with trading through this broker.

Risk Assessment

Trading with Ctrl FX presents several risks that potential clients should consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Fund Security Risk | High | Lack of segregation and protection. |

| Trading Condition Risk | Medium | High spreads and unclear fees. |

| Customer Service Risk | High | Poor response to complaints and issues. |

To mitigate these risks, traders should conduct thorough research and consider alternative brokers that offer regulatory protection and transparent trading conditions.

Conclusion and Recommendations

In summary, the investigation into Ctrl FX reveals several red flags that strongly suggest it may operate as a scam. The absence of credible regulation, coupled with a lack of transparency regarding its operations and client fund security, indicates that Ctrl FX is not safe for traders.

For those considering forex trading, it is advisable to seek out regulated brokers with a proven track record of reliability and customer service. Alternatives such as FCA-regulated brokers or those with established reputations in the industry can provide a safer trading environment. Ultimately, exercising caution and conducting due diligence is essential to protect your investments in the forex market.

Is CTRL FX a scam, or is it legit?

The latest exposure and evaluation content of CTRL FX brokers.

CTRL FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CTRL FX latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.