Regarding the legitimacy of STO forex brokers, it provides FCA, CYSEC and WikiBit, (also has a graphic survey regarding security).

Is STO safe?

Pros

Cons

Is STO markets regulated?

The regulatory license is the strongest proof.

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

AFX Markets Limited

Effective Date:

2012-05-15Email Address of Licensed Institution:

mazzaccom@afxgroup.com, complianceuk@afxgroup.comSharing Status:

No SharingWebsite of Licensed Institution:

www.stofs.co.ukExpiration Time:

--Address of Licensed Institution:

33 Sun Street, 2nd Floor London EC2M 2PY UNITED KINGDOMPhone Number of Licensed Institution:

+442077100000Licensed Institution Certified Documents:

CYSEC Market Making License (MM)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

AFX Capital Markets Ltd

Effective Date:

2010-07-09Email Address of Licensed Institution:

info@afxgroup.comSharing Status:

No SharingWebsite of Licensed Institution:

http://www.afxcapital.com/, http://www.stofs.com, http://www.stoaffiliates.com, http://www.afxaffiliates.com, http://www.market-technologies.com, http://www.quanticaffiliates.com, http://www.quantic-am.com, http://www.afxgroup.com, https://www.afxgroup.com/Expiration Time:

--Address of Licensed Institution:

Ascot House 2 Woodberry Grove London N12 0FB United KingdomPhone Number of Licensed Institution:

35725262710Licensed Institution Certified Documents:

Is STO A Scam?

Introduction

STO, a trading name under AFX Group, has been a player in the forex market since its establishment in 2009. With its headquarters in Cyprus and a presence in various financial hubs, including the UK and New York, STO aims to provide traders with optimal trading conditions across a wide range of financial instruments. However, as the forex market continues to attract both seasoned investors and novices, it is crucial for traders to carefully evaluate the reliability of their chosen brokers. This article aims to investigate whether STO is safe or a scam by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, and risk factors.

Regulation and Legitimacy

Understanding a broker's regulatory status is vital for assessing its legitimacy. STO has been regulated by two significant authorities: the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). These regulatory bodies are known for their stringent oversight of financial services, which helps ensure that brokers operate fairly and transparently.

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| FCA | 560872 | UK | Suspended |

| CySEC | 119/10 | Cyprus | Suspended |

Despite its previous regulatory approvals, both the FCA and CySEC have suspended STO's licenses since August 2019 due to compliance issues. This raises significant concerns about the broker's current operational legitimacy and adherence to regulatory standards. While regulation is not a guarantee against fraud, it does provide a level of assurance regarding the safety of client funds and the broker's operational practices. The suspension of STO's licenses indicates potential underlying issues that traders should consider before engaging with the broker.

Company Background Investigation

STO is a trading name for AFX Capital Markets Ltd, which has been operational since 2009. The company has established itself in various international markets, providing a range of financial services. However, the suspension of its licenses raises questions about its operational integrity and transparency. The management team behind STO has a background in finance, but the lack of recent updates or transparency regarding their activities and strategies may be a red flag for potential clients.

The company's transparency and information disclosure levels are critical for building trust with clients. While STO has previously offered educational resources and market analysis, the recent regulatory issues have overshadowed its efforts to maintain a positive image. Traders should be cautious and seek out more information about the company's current status and management practices before deciding to invest.

Trading Conditions Analysis

STO offers various trading accounts with different conditions tailored to meet the needs of various traders. However, the overall cost structure and trading conditions should be closely examined. The broker claims to offer competitive spreads and leverage options, but several reports indicate that the actual trading costs may not align with industry standards.

| Cost Type | STO | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 - 1.6 pips | 0.5 - 1.5 pips |

| Commission Model | Commission-free | Varies |

| Overnight Interest Range | Varies | 0.5% - 2.5% |

While the spreads may appear attractive, the lack of clarity regarding commission structures and overnight interest rates can lead to unexpected costs. Traders should be aware of these factors as they can significantly impact overall profitability. Additionally, the absence of a clear fee schedule raises concerns about potential hidden fees that could affect trading outcomes.

Client Fund Security

The safety of client funds is a paramount concern for any trader. STO claims to implement several measures to ensure the security of client funds, including segregated accounts and negative balance protection. However, the suspension of its regulatory licenses raises questions about the effectiveness of these measures.

STO's policies on fund segregation and investor protection should be critically evaluated. Regulatory bodies typically require brokers to keep client funds in separate accounts to protect them from operational risks. The lack of recent updates or transparency regarding these policies may indicate a risk to client funds. Furthermore, any historical issues related to fund security or disputes should be thoroughly investigated before engaging with the broker.

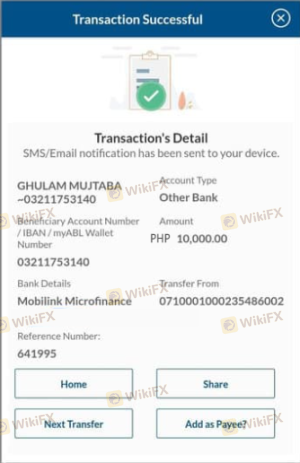

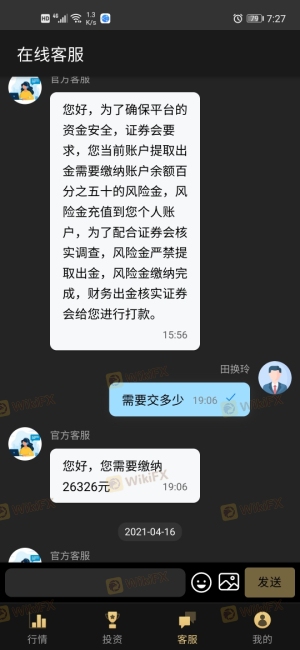

Customer Experience and Complaints

Analyzing customer feedback provides insight into the overall experience traders can expect. Reports indicate a mix of positive and negative experiences with STO. While some users praise the platform's features and educational resources, others have raised concerns about customer support responsiveness and fund withdrawal issues.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Customer Support Issues | Medium | Inconsistent |

| Account Management | Low | Average response |

Common complaints include delayed withdrawals, poor customer support, and account management issues. For instance, several users have reported difficulty accessing their funds after making withdrawal requests, leading to frustration and distrust. The company's response to these complaints has been criticized for being slow and inadequate, further exacerbating customer dissatisfaction.

Platform and Trade Execution

The performance and reliability of the trading platform are crucial for a positive trading experience. STO offers two platforms: MetaTrader 4 (MT4) and its proprietary AFX Fast platform. While MT4 is widely recognized for its robustness and user-friendly interface, the performance of AFX Fast has been questioned by some users.

The quality of order execution, slippage rates, and instances of rejected orders are essential factors to consider. Reports of high slippage and rejected orders during volatile market conditions may indicate issues with the broker's execution quality. Traders should be cautious and consider these factors when assessing whether STO is a safe trading option.

Risk Assessment

Engaging with any broker carries inherent risks, and assessing these risks is essential for informed decision-making. Below is a risk scorecard summarizing key risk areas associated with STO.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Suspended licenses raise concerns. |

| Fund Security | Medium | Issues with transparency and historical disputes. |

| Customer Support | High | Reports of slow response times and unresolved complaints. |

| Execution Quality | Medium | Instances of slippage and order rejections. |

To mitigate these risks, traders should conduct thorough research, consider alternative brokers with better regulatory standing, and remain vigilant regarding their trading activities.

Conclusion and Recommendations

In conclusion, while STO presents itself as a legitimate broker with a wide range of offerings, significant concerns regarding its regulatory status, customer experiences, and fund security raise red flags. The suspension of its licenses by the FCA and CySEC indicates potential operational issues that traders should not overlook.

Is STO safe? Given the evidence presented, it is prudent for traders to approach this broker with caution. For those seeking reliable trading options, it may be advisable to explore alternatives that maintain active regulatory licenses and demonstrate a commitment to client satisfaction and transparency. Brokers such as [insert alternative brokers here] may provide safer environments for trading activities.

Is STO a scam, or is it legit?

The latest exposure and evaluation content of STO brokers.

STO Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

STO latest industry rating score is 6.85, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.85 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.