Is GHC safe?

Pros

Cons

Is GHC Safe or a Scam?

Introduction

GHC, also known as Global Holdings Capital, is a forex broker that emerged in the market in 2020. It positions itself as a platform for traders seeking access to various financial instruments, including forex, commodities, and indices. However, the rapid growth of online trading has led to an influx of brokers, making it crucial for traders to carefully evaluate their options before investing. This article aims to provide an objective assessment of GHC by analyzing its regulatory standing, company background, trading conditions, customer experiences, and overall safety. The investigation is based on a thorough review of multiple credible sources, including user reviews, regulatory information, and expert analyses.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its legitimacy and safety. GHC claims to operate under the auspices of various regulatory bodies, including the Financial Service Providers Register (FSPR) in New Zealand and the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). However, the lack of a robust regulatory framework raises red flags.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSPR | 591349 | New Zealand | Not Valid |

| FINTRAC | N/A | Canada | Not a Forex License |

The FSPR does not provide the same level of oversight as more recognized authorities like the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC). Additionally, FINTRAC is a registration body, not a regulatory authority, which means that GHC lacks a credible forex broker license. The Financial Markets Authority (FMA) of New Zealand has issued warnings about GHC, suggesting that it may not be operating legally. This lack of regulation significantly compromises the safety of funds deposited with GHC.

Company Background Investigation

GHC was established in 2020, and its ownership structure is somewhat opaque. The broker is reportedly registered in Saint Vincent and the Grenadines, a common location for many offshore brokers, which often raises concerns regarding transparency and accountability. The management team behind GHC has not been prominently featured in available information, leading to questions about their qualifications and experience in the financial sector.

The company's website lacks comprehensive details about its operational history, which is another indicator of potential issues. Transparency in a brokers operations is vital for building trust with clients. The absence of clear information about the management team and the company's history can be seen as a significant drawback, raising concerns about its legitimacy and reliability. Given these factors, it is prudent for traders to consider whether GHC is safe for their investments.

Trading Conditions Analysis

GHC offers a single trading account type with a minimum deposit requirement of $2,000, which is considerably higher than the industry average. The broker provides leverage of up to 1:400, which can be appealing to traders but also increases risk exposure.

| Fee Type | GHC | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.4 pips | 1.0-1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Moderate |

The absence of a commission model could initially seem beneficial, but it often leads to wider spreads, which can erode profits. Moreover, the high overnight interest rates can be a hidden cost that traders may overlook. The overall fee structure lacks clarity, making it difficult for potential clients to assess the true cost of trading with GHC. This opacity raises questions about whether GHC is safe for traders looking for transparent trading conditions.

Customer Funds Safety

The safety of customer funds is paramount when evaluating a broker. GHC claims to implement various measures to secure client funds, but the lack of regulation significantly undermines these assurances. The absence of segregated accounts and investor protection policies raises concerns about the safety of deposited funds.

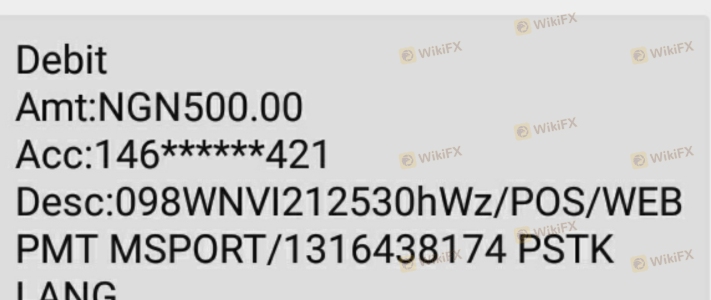

Historically, GHC has faced numerous complaints from users regarding withdrawal issues. Many clients have reported being unable to access their funds, which is a significant red flag. The lack of a robust regulatory framework means that there is no recourse for clients who experience difficulties in withdrawing their funds. This situation poses a serious risk for traders considering GHC, leading many to question whether GHC is safe for their investments.

Customer Experience and Complaints

Customer feedback is a crucial aspect of evaluating a broker's reliability. A review of GHC reveals a plethora of negative user experiences, with many clients expressing frustration over withdrawal issues and poor customer service. Common complaints include:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/No Response |

| Lack of Transparency | Medium | Inadequate |

| High Minimum Deposit | Medium | No Justification |

Many users report that once they deposited funds, communication from GHC ceased, and requests for withdrawals were met with delays or outright refusals. These patterns indicate a troubling trend that suggests a lack of accountability and responsiveness from the broker. Given the severity of these issues, it is reasonable to conclude that GHC is not safe for traders who value reliable customer support and transparent operations.

Platform and Execution

The trading platform offered by GHC is the widely-used MetaTrader 4 (MT4), which is known for its user-friendly interface and robust features. However, the performance of the platform has been called into question, with reports of poor order execution, high slippage, and instances of order rejections. These issues can significantly impact trading outcomes, especially for those employing high-frequency trading strategies.

The overall user experience on the platform has been mixed, with many clients expressing dissatisfaction with the execution quality. This raises concerns about whether GHC is capable of providing a reliable trading environment, further contributing to the perception that GHC is not safe for potential investors.

Risk Assessment

Using GHC comes with a range of risks that potential traders must consider. The lack of regulation, combined with numerous complaints about withdrawal issues and poor customer service, paints a concerning picture.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated operations |

| Fund Safety Risk | High | No investor protection |

| Execution Risk | Medium | Poor order execution |

Given these risk factors, traders are advised to approach GHC with extreme caution. It is essential to weigh the potential for high returns against the significant risks involved. To mitigate these risks, it is recommended that traders seek out well-regulated brokers with transparent operations and robust customer support.

Conclusion and Recommendations

After a comprehensive review of GHC, it is clear that the broker presents numerous red flags that suggest it may not be a safe option for traders. The lack of regulation, combined with a history of customer complaints and questionable business practices, raises significant concerns about the safety of funds and the overall trading experience.

For traders seeking to invest in the forex market, it is advisable to consider alternative brokers that are well-regulated and have established reputations for reliability and transparency. Brokers that are licensed by recognized authorities such as the FCA or ASIC provide a higher level of security and customer protection.

In conclusion, potential clients should exercise extreme caution when considering GHC, as the evidence strongly suggests that GHC is not safe for trading.

Is GHC a scam, or is it legit?

The latest exposure and evaluation content of GHC brokers.

GHC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GHC latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.