Is OG safe?

Pros

Cons

Is OG Safe or a Scam?

Introduction

Ocean Global Markets Ltd., commonly known as OG, has positioned itself as a player in the forex trading market since its inception in 2009. Based in Australia, the broker offers various trading services, including access to currency pairs, commodities, and CFDs. However, as the forex market continues to grow, so does the number of fraudulent brokers, making it essential for traders to conduct thorough due diligence before engaging with any trading platform. This article aims to provide a comprehensive analysis of OG's legitimacy, focusing on its regulatory status, company background, trading conditions, and customer experiences. The evaluation is based on a review of multiple sources, including regulatory databases, user reviews, and financial reports.

Regulation and Legitimacy

The regulatory framework is a critical aspect of assessing any broker's safety and legitimacy. OG was previously regulated by the Australian Securities and Investments Commission (ASIC), holding an investment advisory license. However, this regulatory status has been revoked, raising significant concerns about the broker's operations and adherence to industry standards.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 332890 | Australia | Revoked |

The revocation of OG's license indicates a lack of oversight from regulatory authorities, which is crucial for ensuring the protection of clients' funds. Without regulatory supervision, there are heightened risks of mismanagement, fraud, and operational irregularities. Additionally, past compliance issues and the absence of a current regulatory framework further cast doubt on the broker's legitimacy. Therefore, the question remains: Is OG safe? The evidence suggests otherwise.

Company Background Investigation

OG was founded in 2009 and initially catered to institutional clients before expanding its services to retail traders in 2017. The company claims to provide a range of trading instruments and educational resources to support its clients. However, the lack of transparency in its ownership structure and management team raises additional concerns.

The management team behind OG has not been prominently featured in public disclosures, making it difficult to assess their experience and qualifications in the financial sector. Transparency in a broker's operations is crucial for building trust, and OG's failure to provide clear information about its leadership can be seen as a red flag. This lack of disclosure only adds to the skepticism surrounding OG's operations, prompting further inquiries into whether OG is safe for traders.

Trading Conditions Analysis

When evaluating a broker, understanding its fee structure and trading conditions is vital. OG imposes a minimum deposit requirement of $1,000, which is significantly higher than many competitors in the market. Additionally, the broker offers high leverage of up to 1:400, which can amplify both potential gains and losses.

| Fee Type | OG | Industry Average |

|---|---|---|

| Spread on Major Pairs | Not disclosed | 1.0 - 1.5 pips |

| Commission Model | Not disclosed | $5 - $10 per lot |

| Overnight Interest Rate | Not disclosed | Varies by broker |

The absence of clear information regarding spreads and commissions raises questions about the overall transparency of OG's trading conditions. High fees can erode profitability, and the lack of clear communication on this front further complicates the decision-making process for potential clients. This uncertainty leads us to wonder again: Is OG safe? The available data suggests that traders should approach OG with caution.

Client Fund Security

The safety of client funds is paramount when considering a broker. OG's previous regulatory status with ASIC would have mandated the segregation of client funds, ensuring that they are kept separate from the broker's operational funds. However, with the revocation of its license, the assurance of fund safety is now questionable.

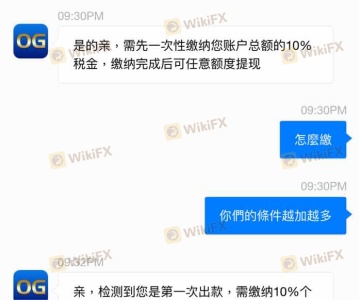

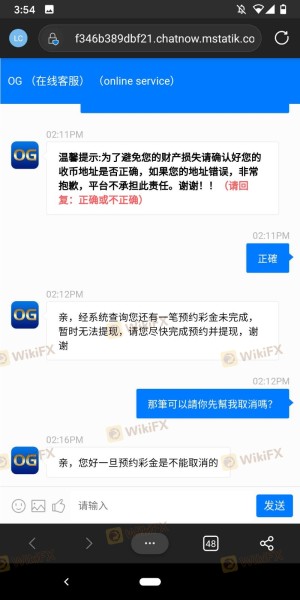

In terms of investor protection, there is no current information available regarding OG's policies on negative balance protection or any compensation schemes. The lack of such measures can put traders at significant risk, especially in volatile market conditions. Historical reports from users indicate difficulties in withdrawing funds, which raises concerns about the broker's financial stability and operational integrity. Given these factors, it is crucial to ask: Is OG safe? The evidence suggests that potential clients should be wary of entrusting their funds to this broker.

Customer Experience and Complaints

Customer feedback is an essential component of evaluating a broker's reliability. Reviews of OG reveal a pattern of complaints, particularly regarding withdrawal issues and the overall responsiveness of customer support. Many users have reported challenges in accessing their funds, which raises serious concerns about the broker's operational practices.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Poor Customer Support | Medium | Inconsistent |

Several users have shared experiences of being unable to withdraw their capital, leading to allegations of fraudulent practices. One case involved a user claiming to have lost significant amounts of money, indicating potential coercion tactics employed by the broker. These complaints suggest a troubling trend, making it imperative to consider whether OG is safe for traders.

Platform and Execution

The trading platform offered by OG is the widely used MetaTrader 4 (MT4), which is known for its user-friendly interface and robust functionality. However, the quality of order execution, including slippage and rejection rates, is crucial for a positive trading experience. Reports from users indicate mixed experiences regarding execution quality, with some claiming delays and issues that could affect trading outcomes.

The absence of clear data on execution performance raises concerns about the broker's operational practices. Traders should be cautious and consider whether OG is safe based on the available evidence regarding platform performance and execution reliability.

Risk Assessment

Overall, the risks associated with trading through OG are significant. The combination of revoked regulatory status, high minimum deposit requirements, and troubling customer feedback creates a precarious environment for traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of oversight and revoked license |

| Financial Risk | High | Withdrawal issues and fund safety concerns |

| Operational Risk | Medium | Mixed reviews on execution and support |

To mitigate these risks, traders are advised to conduct thorough research, consider alternative brokers with robust regulatory oversight, and ensure they fully understand the risks involved in trading.

Conclusion and Recommendations

In conclusion, the evidence suggests that OG is not safe for traders. The revoked regulatory status, coupled with a lack of transparency and troubling customer feedback, raises significant red flags. Traders seeking a reliable and secure trading environment should consider alternative options that are regulated by reputable authorities and have a proven track record of customer satisfaction.

For those interested in forex trading, it is advisable to explore brokers that offer strong regulatory frameworks, transparent fee structures, and positive client reviews. By prioritizing safety and reliability, traders can make informed decisions and protect their investments in the volatile forex market.

Is OG a scam, or is it legit?

The latest exposure and evaluation content of OG brokers.

OG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

OG latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.