Is FOX safe?

Pros

Cons

Is Fox Safe or a Scam?

Introduction

In the ever-evolving landscape of the foreign exchange (forex) market, brokers play a pivotal role in facilitating trades for both novice and seasoned investors. One such broker is Fox, which positions itself as a provider of trading services across various financial instruments. Given the vast number of brokers available today, it is crucial for traders to conduct thorough evaluations before committing their funds. This article aims to assess the legitimacy and safety of Fox as a forex broker, focusing on several key areas, including regulatory standing, company background, trading conditions, and customer experiences. Our investigation relies on a comprehensive review of online resources, regulatory databases, and user feedback to provide an objective analysis of whether Fox is indeed safe or a potential scam.

Regulation and Legitimacy

The regulatory framework surrounding a forex broker is one of the most critical factors in determining its legitimacy. Regulation serves as a safeguard for traders, ensuring that brokers adhere to strict operational standards and ethical practices. In the case of Fox, our research reveals that it operates without oversight from a recognized regulatory authority. This lack of regulation raises significant concerns regarding the safety of client funds and the overall integrity of the broker's operations.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of a valid regulatory license means that Fox is not subject to the rigorous compliance checks that regulated brokers must undergo. This lack of oversight can lead to potential risks, including the possibility of fund mismanagement and fraudulent activities. Furthermore, traders seeking recourse in case of disputes may find themselves with limited options, as unregulated brokers are not bound by the same legal frameworks that protect clients of regulated entities.

Company Background Investigation

Understanding the background of a broker is essential for assessing its reliability. Fox claims to have been established to provide trading solutions to a global audience. However, details regarding its history, ownership structure, and management team remain vague and largely unsubstantiated. The lack of transparency in these areas can be a red flag for potential investors.

In terms of management, there is limited publicly available information about the key personnel at Fox. A strong management team with a proven track record in finance and trading is often indicative of a broker's credibility. However, the absence of such details raises questions about the broker's operational integrity. Furthermore, the lack of clear information on the company's website regarding its physical location and contact details adds to the uncertainty surrounding its legitimacy.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions, including fees and spreads, is crucial. Fox's fee structure appears to be competitive on the surface, but the absence of detailed information on its website leaves many questions unanswered. Traders should be wary of any hidden fees or unfavorable terms that could impact their trading experience.

| Fee Type | Fox | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of clarity regarding spreads and commissions can be a significant concern for traders. In the forex market, spreads can vary widely depending on market conditions and broker policies. Traders should be cautious of brokers that do not provide transparent information regarding their trading costs, as this can lead to unexpected expenses and reduced profitability.

Client Fund Safety

The safety of client funds is paramount when choosing a forex broker. Fox's lack of regulation raises serious concerns about its measures for protecting client deposits. Regulated brokers are typically required to maintain client funds in segregated accounts, ensuring that client money is protected in the event of the broker's insolvency. However, without regulatory oversight, there is no guarantee that Fox adheres to such practices.

Furthermore, the absence of investor protection mechanisms, such as compensation schemes, leaves traders vulnerable to potential losses. Historical incidents involving unregulated brokers often reveal cases of fund misappropriation and difficulties in retrieving funds. This highlights the importance of assessing a broker's fund safety measures before opening an account.

Customer Experience and Complaints

Customer feedback provides valuable insights into a broker's reliability and service quality. Reviews and testimonials about Fox indicate a mixed bag of experiences. While some users report positive experiences, others cite issues related to withdrawals and customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Poor Customer Support | Medium | Inconsistent |

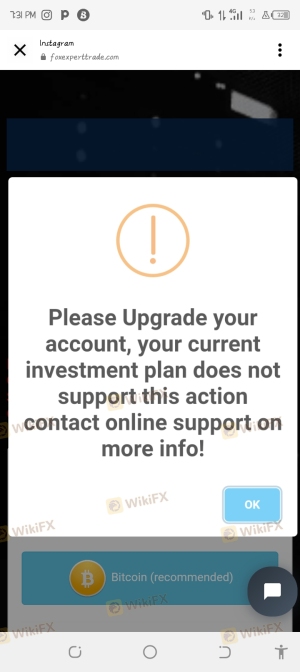

Common complaints include difficulties in withdrawing funds, which is a significant red flag for any broker. Traders should be cautious if they encounter frequent issues with withdrawals, as this can indicate underlying problems with the broker's financial practices. Additionally, the quality of customer support is crucial for resolving issues promptly. Inconsistent responses from the support team can lead to frustration and dissatisfaction among clients.

Platform and Trade Execution

The performance of a trading platform is another critical aspect that traders should consider. Fox claims to offer a user-friendly trading platform; however, there are concerns regarding its stability and execution quality. Traders expect reliable platforms that can handle high volumes of trades without lag or errors. Any signs of slippage or rejected orders can significantly impact trading outcomes, leading to potential losses.

Risk Assessment

Traders must be aware of the risks associated with using an unregulated broker like Fox. The absence of oversight can expose traders to various risks, including financial loss due to mismanagement of funds and limited avenues for recourse in case of disputes.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Safety Risk | High | Lack of investor protection |

| Customer Service Risk | Medium | Inconsistent support responses |

To mitigate these risks, traders are advised to conduct thorough research and consider using regulated brokers that offer better protection for their funds and a more reliable trading environment.

Conclusion and Recommendations

In conclusion, the evidence suggests that Fox may not be a safe option for traders. The absence of regulation, limited transparency, and mixed customer feedback raise significant concerns about its legitimacy. Traders should exercise caution and consider alternative, regulated brokers that provide better security for their investments.

For those considering trading with Fox, it is highly recommended to explore other options that are overseen by reputable regulatory bodies. Brokers such as Interactive Brokers, FCA-regulated brokers, or ASIC-regulated brokers can offer a more secure trading environment with the necessary protections in place.

In summary, while Fox may present itself as a viable trading option, the potential risks and lack of regulatory oversight suggest that it is prudent to look elsewhere for a more secure trading experience. Always prioritize safety and regulatory compliance when selecting a forex broker.

Is FOX a scam, or is it legit?

The latest exposure and evaluation content of FOX brokers.

FOX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FOX latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.