GHC 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

GHC is an unregulated forex broker established in 2020, operating primarily in offshore jurisdictions, such as Saint Vincent and the Grenadines. It presents trading opportunities with high leverage options (up to 1:500) and a constrained selection of asset classes, including forex pairs and commodities. However, GHC poses significant risks for traders, particularly for those who are inexperienced or risk-averse. The lack of credible regulation has led to numerous user complaints regarding fund safety and withdrawal issues, issuing serious warnings about the reliability of this broker. Industry professionals advise caution, suggesting that only experienced traders familiar with high-risk investments consider GHC.

⚠️ Important Risk Advisory & Verification Steps

Warning: Trading with unregulated brokers like GHC carries risks that can severely impact your investment:

- Fund Safety: Your funds may not be protected; unregulated brokers are not held to any financial standards.

- Withdrawal Issues: Users have reported difficulties in withdrawing funds and have expressed concerns over potential scams.

- High Minimum Deposits: GHC requires a minimum deposit of $2,000, which is higher than many regulated brokers.

Self-Verification Guide:

- Check Regulatory Status: Visit official regulatory websites such as the FCA or ASIC to verify broker licenses.

- Read User Reviews: Search for user reviews and complaints about GHC to gauge the broker's reputation.

- Investigate Contact Information: Ensure the broker provides valid communication methods and responsive customer service.

Rating Framework

Broker Overview

Company Background and Positioning

Founded in 2020, GHC operates under the Global Holdings Capital Limited brand. Its headquarters claim location in New Zealand, yet it primarily operates from offshore zones, which raises flags regarding accountability and regulation. While marketed as having ties to regulated bodies, such as ASIC and Fintrac, these claims are questionable and largely unverified. This poses potential risks for investors eager for a transparent trading experience.

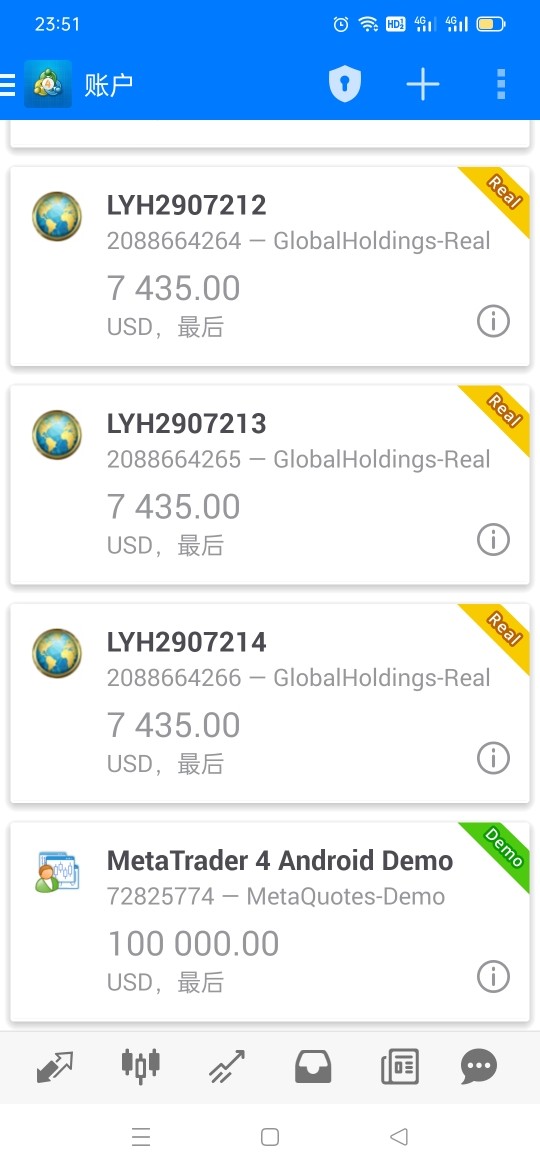

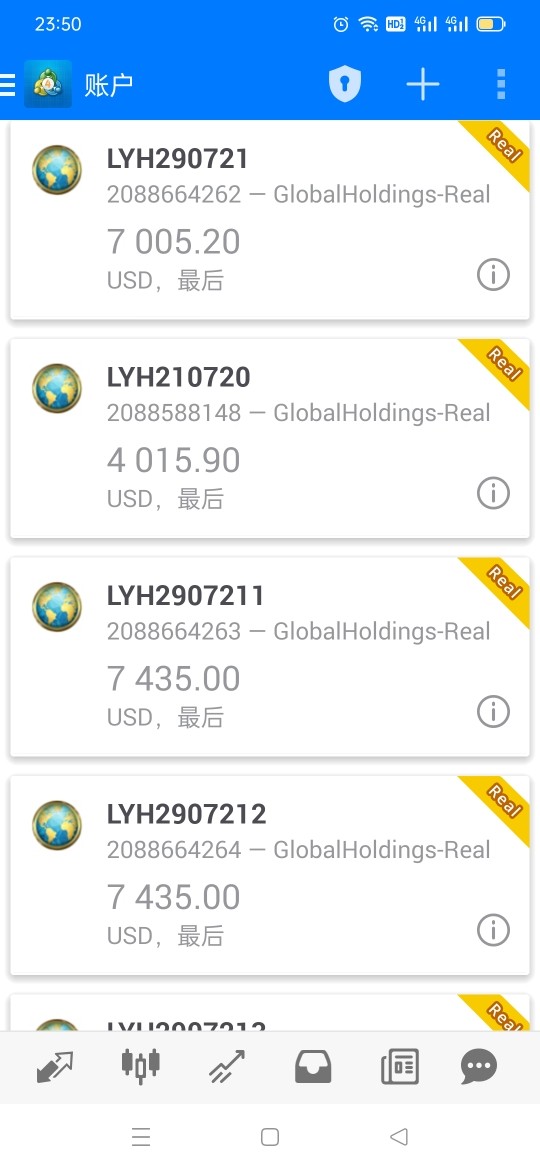

Core Business Overview

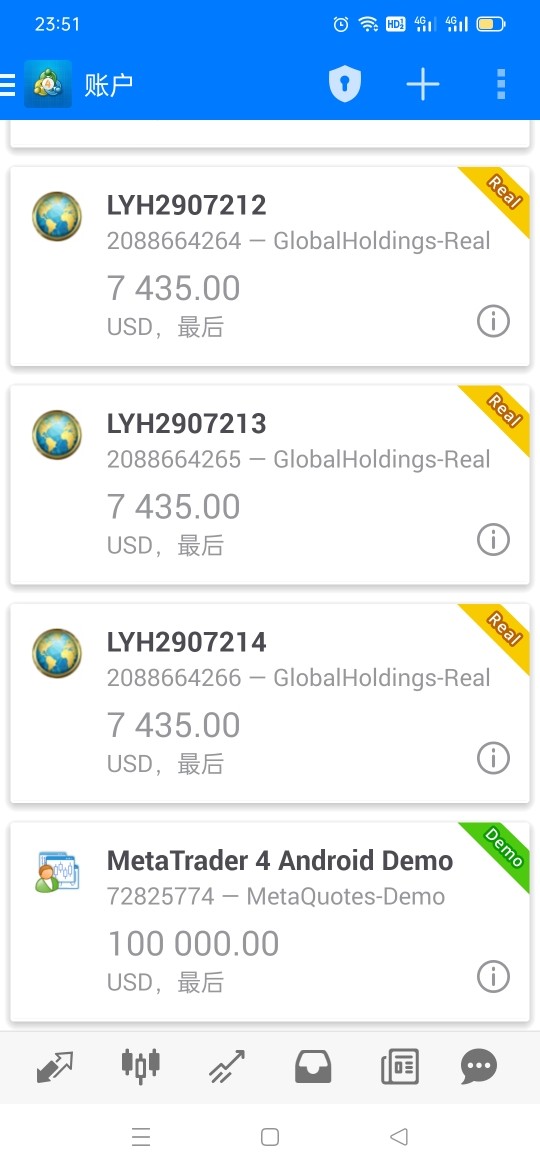

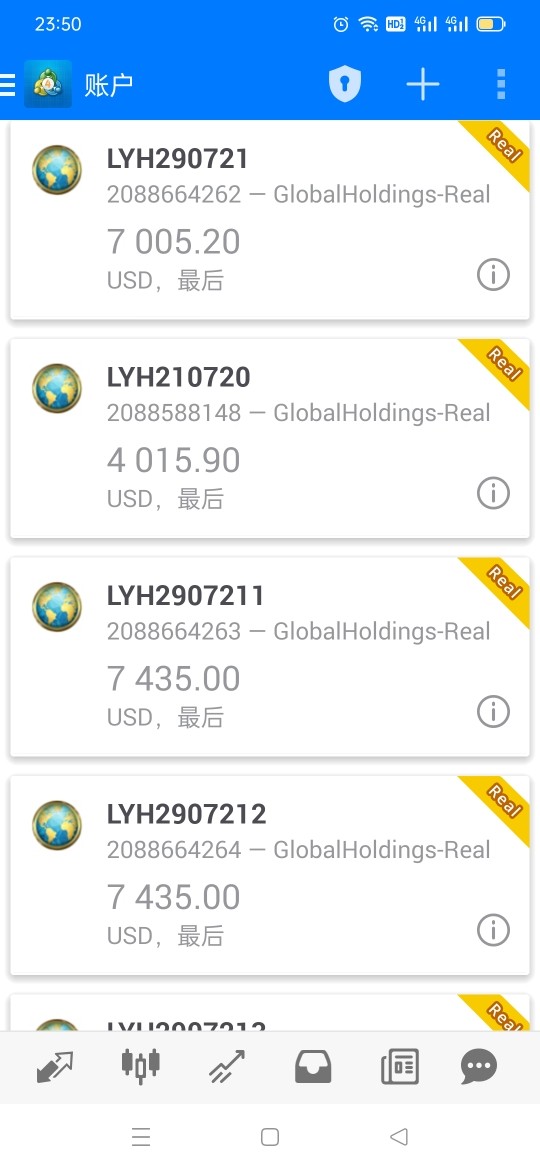

GHC primarily offers forex trading, commodities, and indices to its clients via the MetaTrader 4 (MT4) platform. It allows for a leverage ratio up to 1:500 and requires a significant minimum deposit of $2,000 to start trading. However, the broker's claims about regulation lack credibility, as it operates without valid licenses, exposing traders to heightened risks.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

The foundation of successful trading lies in trustworthiness. GHC's lack of credible regulatory licenses raises significant concerns about fund safety. Numerous user experiences suggest a pattern of withdrawal issues and insufficient communication from customer support.

Regulatory Information Conflicts: GHC claims to operate within the bounds of regulatory authorities, but the reality paints a contradictory picture. The New Zealand FMA has labeled GHC a potential scam, stating there are no legitimate links to the promised regulations. GHC's registration with offshore entities does not provide the necessary oversight.

User Self-Verification Guide:

Visit the FCA or ASIC's official websites.

Search for GHC under their register of regulated entities.

Review any complaints or warnings issued about GHC.

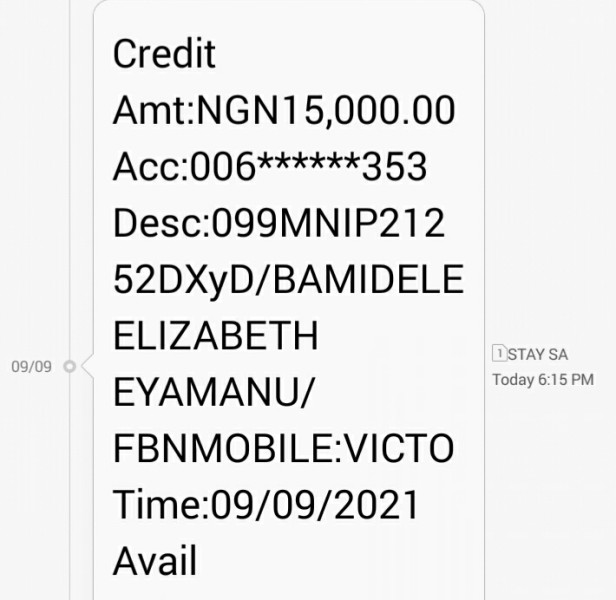

Industry Reputation: The overwhelming feedback from users highlights a broad consensus about the brokers dubious practices surrounding fund withdrawals:

"Keep asking us to deposit. We havent withdrawn all our funds. How dare you to found a new platform cheating us? This is a fraud platform!"

Trading Costs Analysis

While GHC presents a low-cost trading environment with competitive spreads, hidden fees and high minimum deposits present a double-edged sword for traders.

Advantages in Commissions: GHC advertises a commission structure that appears attractive, especially to high-volume traders.

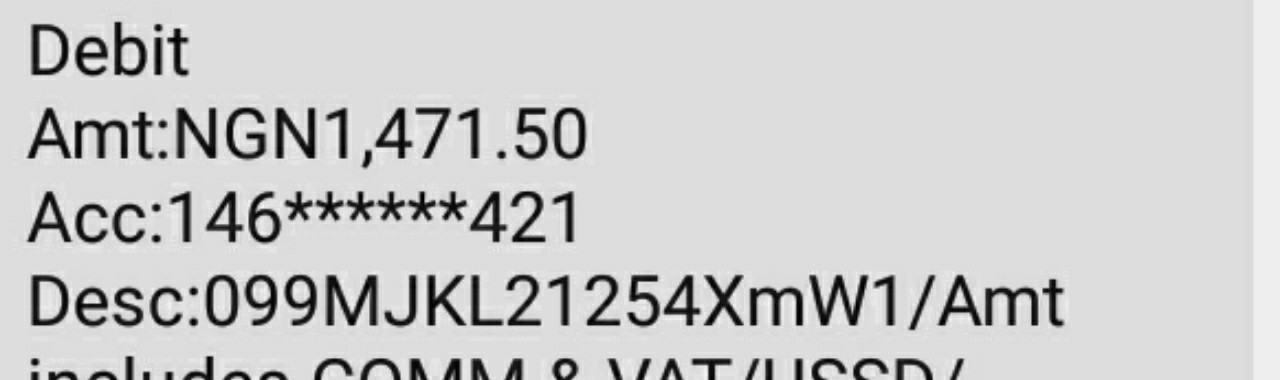

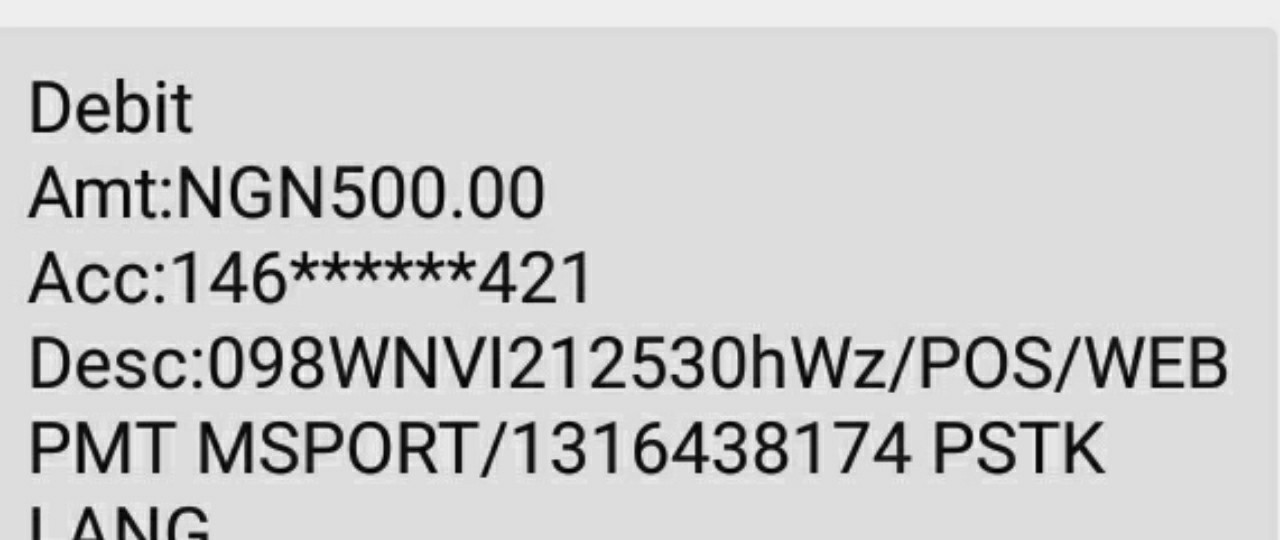

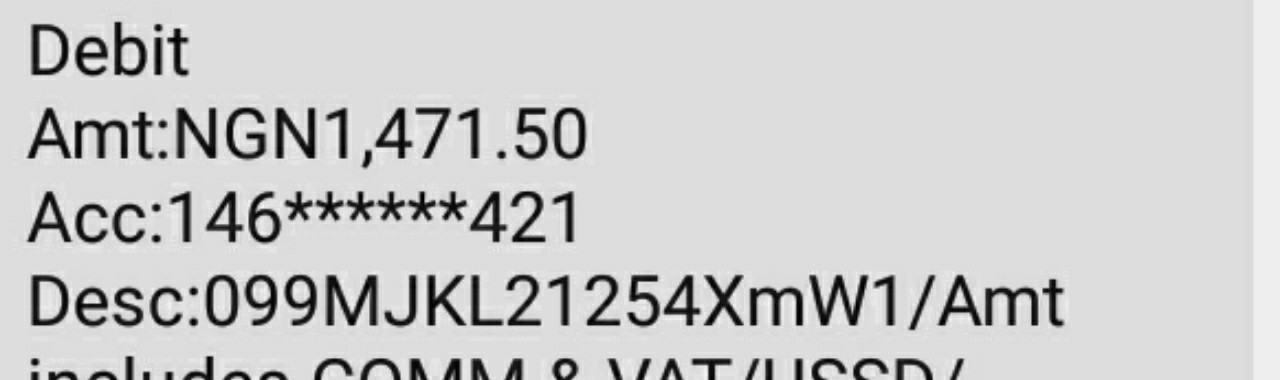

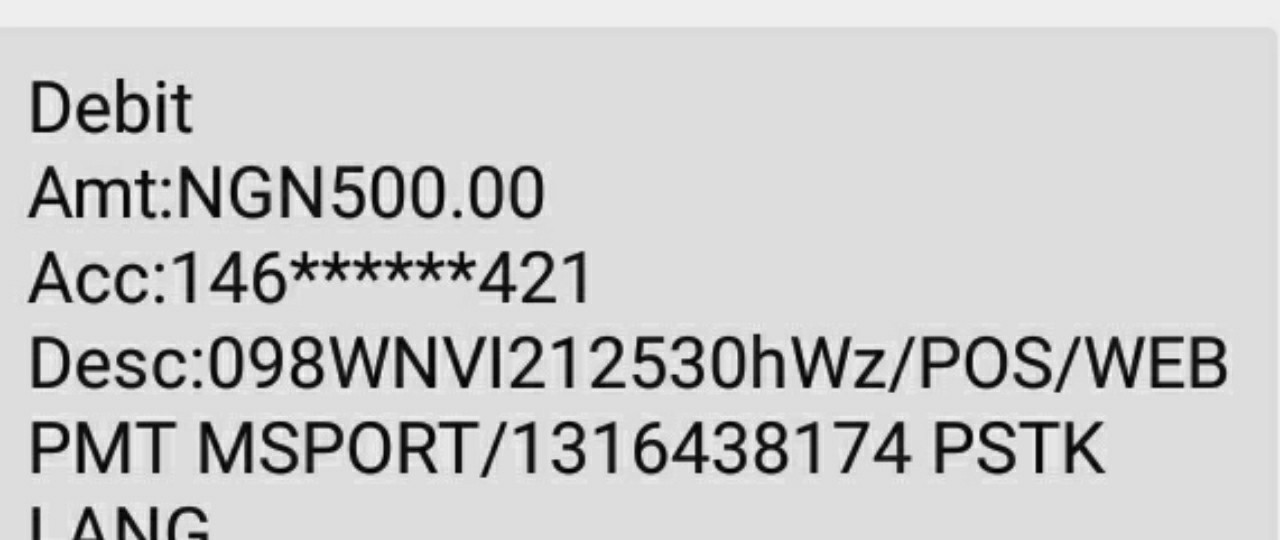

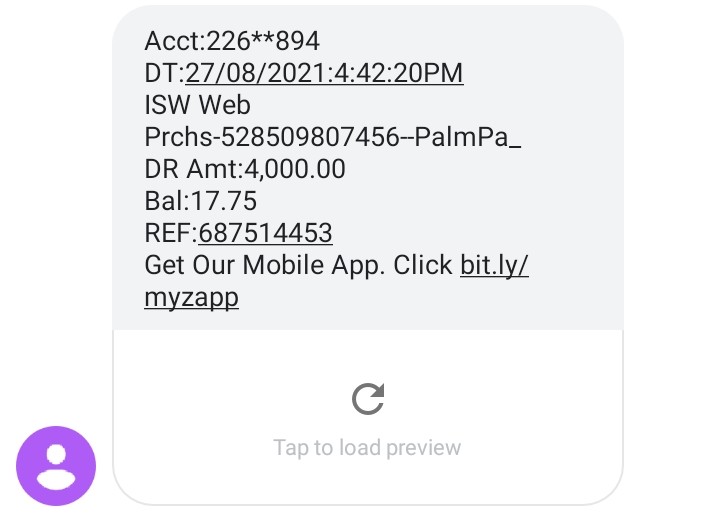

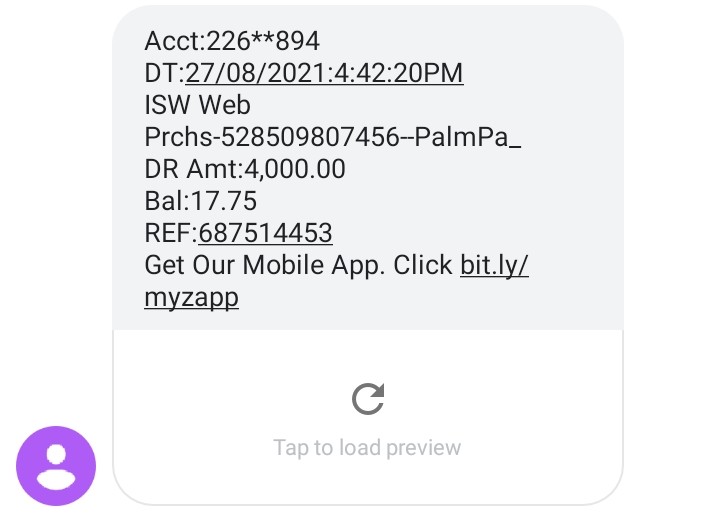

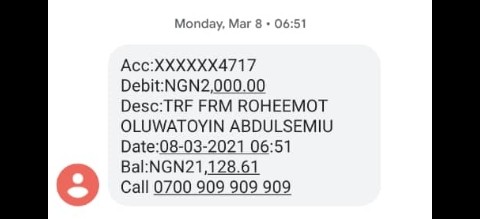

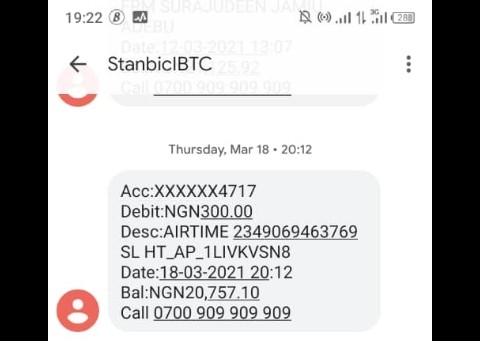

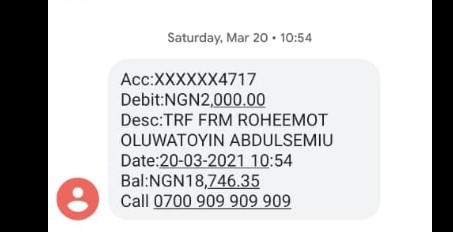

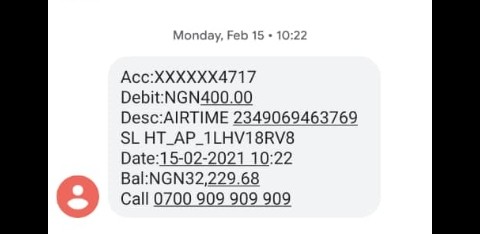

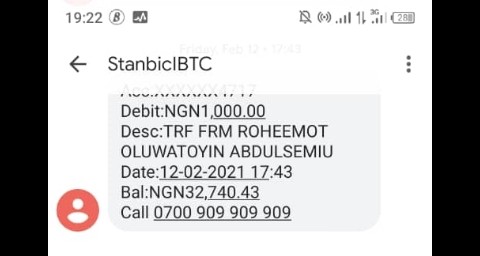

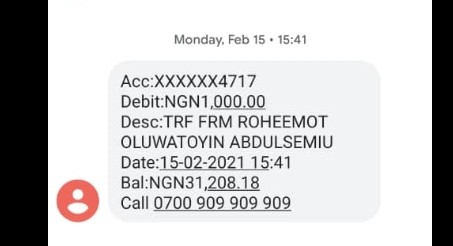

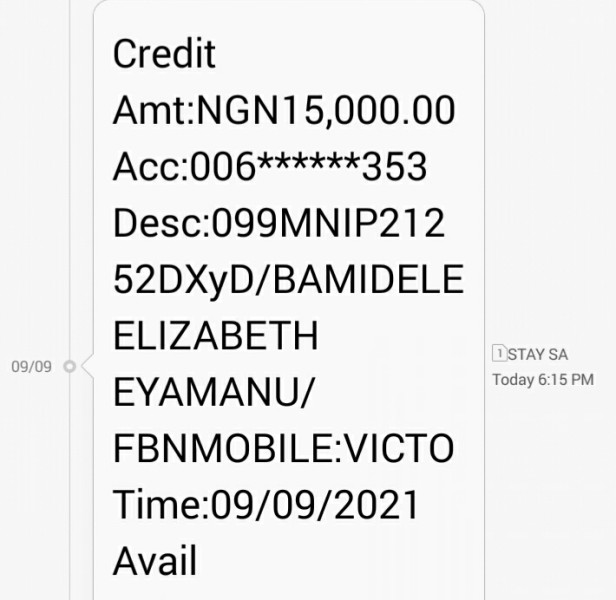

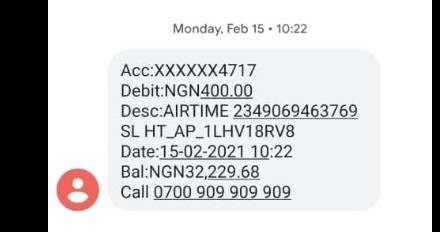

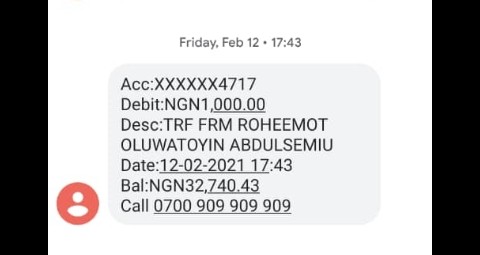

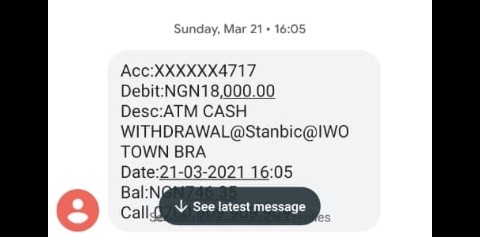

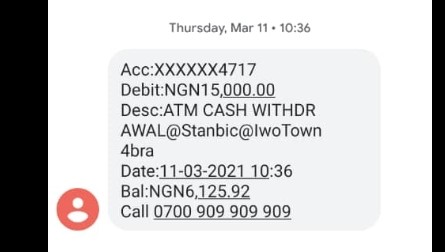

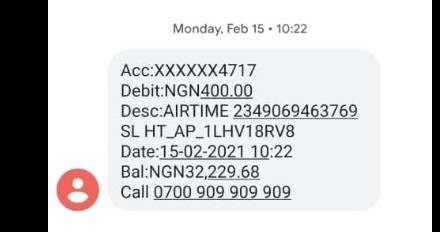

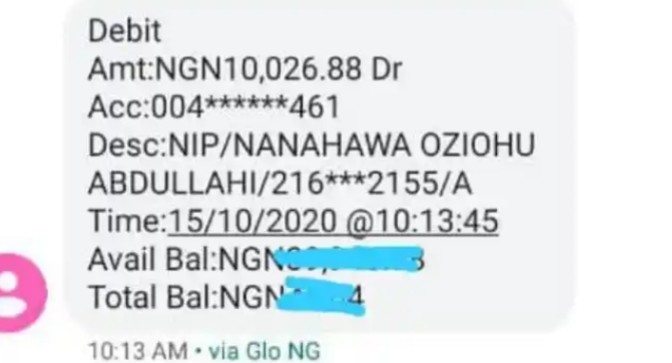

The "Traps" of Non-Trading Fees: However, significant user complaints show withdrawal fees as high as $30, which can become burdensome depending on frequency and amounts being withdrawn.

"I cant withdraw my money! I deposited $300,000 but did not withdraw."

- Cost Structure Summary: Traders should be aware of these charges, as they can undermine the benefits of low commissions.

GHC provides the widely favorited MT4 platform, but additional tools for advanced traders are limited.

Platform Diversity: The availability of MT4 highlights ease of use and functionality; however, there is no mention of newer technologies like MT5, limiting advancement for traders seeking cutting-edge tools.

Quality of Tools and Resources: Users report basic education materials that are insufficient for meaningful learning.

Platform Experience Summary: Feedback indicates a lack of robust user experience, with many citing severe withdrawal frustrations:

"Please focus on GHC which was a scammer. They took so much money and ran away."

User Experience Analysis

The experiences of users interacting with GHC reveal a bleak outlook on trading conditions.

User Reviews Overview: The vast majority of users remain dissatisfied, often reporting unresolved withdrawal issues and ineffective customer service.

Positive Experiences: While a few traders noted ease of setting up accounts, these instances were overshadowed by the multitude of complaints.

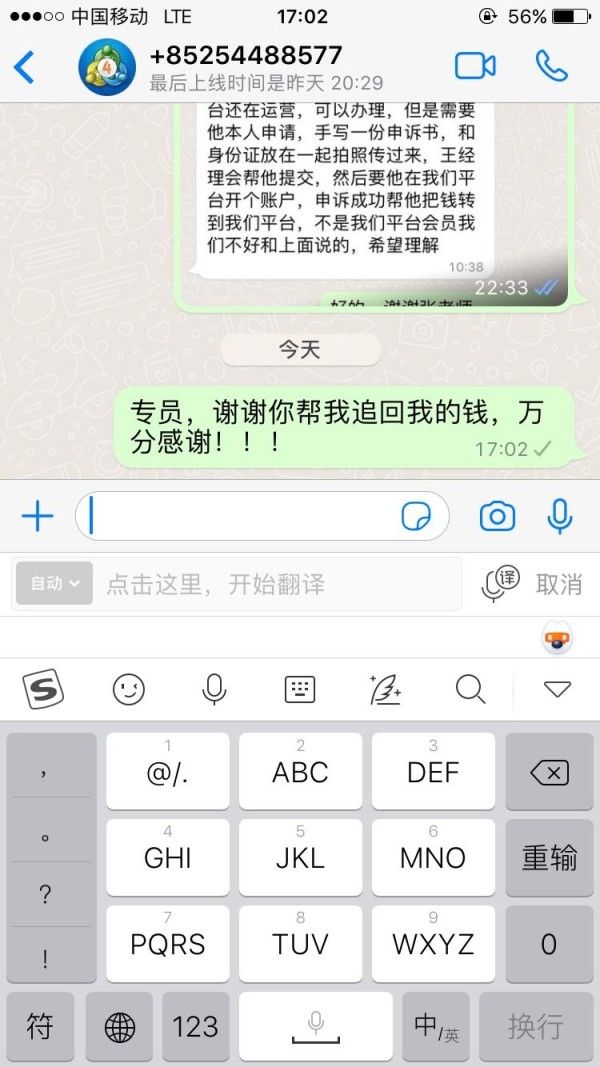

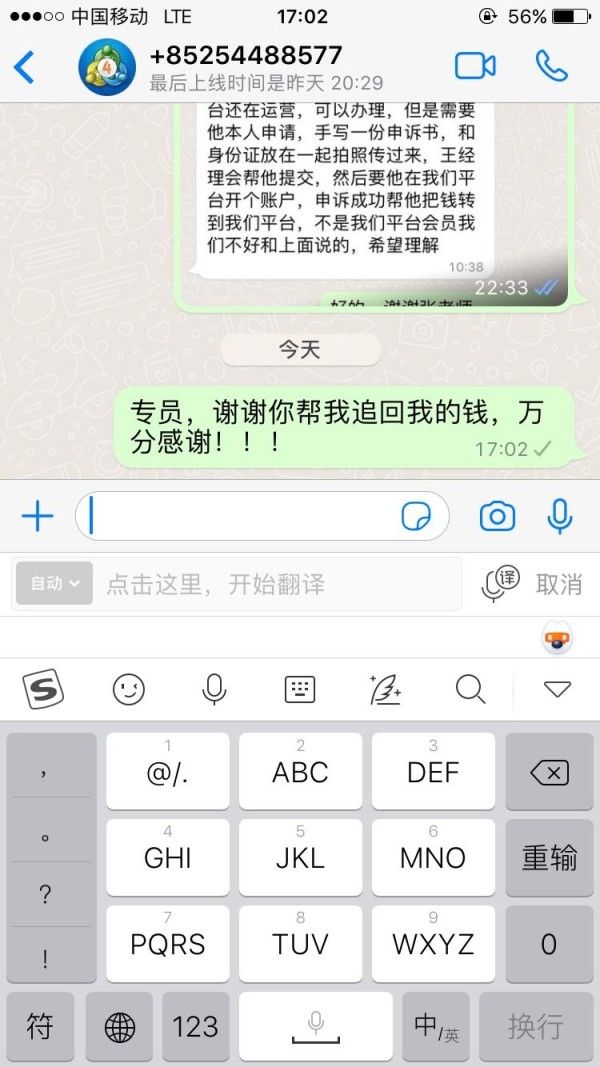

Negative Experiences: The recurrent theme of withdrawal issues paints a dire picture for GHC's clientele, which includes allegations of users being disconnected from their funds:

"Can‘t withdraw because I didn’t pay margin."

Customer Support Analysis

GHC's customer support structure is fraught with issues, making it challenging for users to find help when needed.

Contact Methods: GHC claims to offer email and a contact number; however, many users have found these avenues ineffective or unresponsive.

User Feedback on Support: Many customers report poor experiences, noting slow responses and failure to resolve essential issues.

Support Summary: The quality of customer support is alarmingly low, which compounds the difficulties users face, especially concerning withdrawals.

Account Conditions Analysis

High entry barriers characterize GHC's account conditions.

Minimum Deposit and Account Types: The minimum deposit of $2,000 is significantly above industry standards, which can deter potential traders.

Withdrawal Conditions: Reports of complicated withdrawal processes and excessive fees have left many users frustrated.

Summary of Account Conditions: Overall, GHC's account conditions create an unwelcoming environment for both novice investors and those with experience seeking reliable partners in trading.

Conclusion

In conclusion, GHC presents itself as an enticing option for experienced traders seeking high rewards through high leverage. However, the broker's lack of regulation, compounded by numerous complaints regarding fund safety and withdrawal issues, reveals critical risks that should not be overlooked. Experienced traders aware of the inherent dangers might find a place in GHC, although novice and cautious investors are best advised to steer clear of this broker. The risks of potentially losing funds far outweigh the rewards offered by GHC.

Invest Wisely: Opt for regulated brokers to ensure the safety of your trading funds.