Is GalaxyFX safe?

Business

License

Is GalaxyFX Safe or Scam?

Introduction

GalaxyFX is a forex broker that has emerged in the competitive landscape of the foreign exchange market, offering a range of trading services and account types to cater to various traders' needs. As with any financial service, it is crucial for traders to evaluate the credibility and safety of brokers like GalaxyFX before committing their funds. The forex market is rife with both legitimate and fraudulent entities, making due diligence essential for protecting investments. This article aims to provide a comprehensive analysis of GalaxyFX's safety, regulatory status, and overall reliability, using a structured evaluation framework based on multiple sources and reviews.

Regulation and Legitimacy

The regulatory status of a broker is a primary indicator of its safety and legitimacy. GalaxyFX claims to be regulated by the Cyprus Securities and Exchange Commission (CySEC), which is a reputable regulatory body within the European Union. However, there are conflicting reports regarding its actual regulatory compliance.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CySEC | Not provided | Cyprus | Claims to be regulated, but lacks verification in major jurisdictions |

The significance of regulation cannot be overstated; it provides a layer of security for traders, ensuring that brokers adhere to strict operational standards. CySEC requires brokers to maintain a minimum capital reserve and segregate client funds, which adds to the overall safety of trading with regulated entities. However, reports indicate that GalaxyFX may not be fully compliant with these regulations, raising concerns about its legitimacy. The absence of a verified license from other important regulatory bodies such as the National Futures Association (NFA) in the U.S. further complicates its standing, leading to questions about whether GalaxyFX is safe for traders.

Company Background Investigation

GalaxyFX operates under the name of K-DNA Financial Services Ltd., and although it claims to have a solid operational history, details about its ownership structure and management team remain sparse. The lack of transparent information raises red flags regarding the company's accountability and operational practices.

The management team's experience and qualifications play a crucial role in establishing trust with clients. A well-experienced team can significantly enhance a broker's credibility. However, the absence of detailed profiles or backgrounds for the management team at GalaxyFX limits the ability of potential clients to assess their expertise. Furthermore, the company's transparency regarding its operations and policies appears to be lacking, which may contribute to the perception that GalaxyFX is not safe.

Trading Conditions Analysis

GalaxyFX presents a diverse array of trading conditions, including multiple account types, varying leverage options, and spreads. However, the overall fee structure raises concerns about its competitiveness in the market.

| Fee Type | GalaxyFX | Industry Average |

|---|---|---|

| Spread on Major Pairs | 1.8 pips | 1.0 pips |

| Commission Model | $14 per lot | $5 per lot |

| Overnight Interest Range | Not disclosed | 0.5% to 2% |

The spreads offered by GalaxyFX are notably higher than the industry average, especially for the basic account. Additionally, the commission structure appears to be less favorable compared to other brokers, which may deter cost-sensitive traders. The lack of clarity regarding overnight interest rates also raises questions about potential hidden costs. These factors contribute to the overall assessment that GalaxyFX may not be a safe choice for traders seeking favorable trading conditions.

Client Fund Security

The security of client funds is paramount in assessing a broker's safety. GalaxyFX claims to implement various measures to protect client deposits, including segregated accounts and participation in investor compensation schemes. However, the actual effectiveness of these measures is questionable given the reports of its unregulated status.

The absence of a clear policy on negative balance protection further complicates the safety of client funds. Traders should be cautious, as any broker without robust safety nets for client funds poses a significant risk, particularly in volatile market conditions. Historical disputes or issues regarding fund security can also serve as indicators of a brokers reliability. In light of these considerations, it is prudent to conclude that GalaxyFX does not guarantee the safety of client funds.

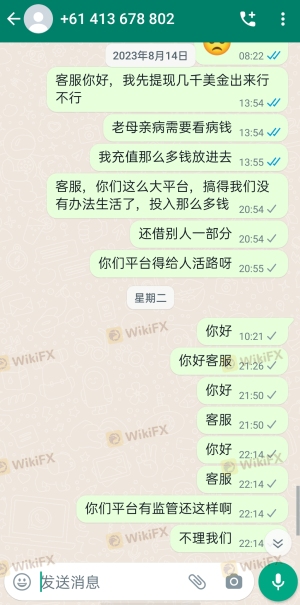

Customer Experience and Complaints

Customer feedback is an essential component in evaluating a broker's reliability. Reviews of GalaxyFX reveal a mixed bag of experiences, with several users reporting difficulties in withdrawing funds and poor customer service responses.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| High Fees | Medium | Limited explanation |

| Poor Customer Service | High | Unresponsive |

Notably, many users have expressed frustration over withdrawal delays, which is a common complaint among traders dealing with less reputable brokers. These issues can be indicative of underlying operational problems and raise further questions about whether GalaxyFX is truly safe for investment.

Platform and Execution

The trading platform provided by GalaxyFX is based on the popular MetaTrader 4 (MT4), which is known for its user-friendly interface and advanced trading tools. However, the overall execution quality and stability of the platform have come under scrutiny. Reports of slippage and order rejections have been noted, which can severely impact trading performance.

The potential for platform manipulation is another concern, particularly if traders experience consistent issues with order execution. These factors collectively suggest that while the platform may be functional, it does not necessarily guarantee a seamless trading experience, further complicating the question of is GalaxyFX safe.

Risk Assessment

The overall risk associated with trading through GalaxyFX can be categorized based on various factors such as regulatory compliance, client fund security, and customer feedback.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Unregulated status raises significant concerns. |

| Fund Security | High | Lack of robust protection measures for client funds. |

| Customer Experience | Medium | Mixed reviews with notable complaints. |

Given the high-risk factors associated with GalaxyFX, it is essential for potential traders to approach with caution. Recommendations for mitigating risks include conducting thorough research, utilizing demo accounts, and only investing amounts that one can afford to lose.

Conclusion and Recommendations

In summary, the evidence suggests that GalaxyFX presents several red flags that warrant caution. The lack of clear regulatory oversight, coupled with mixed customer experiences and high trading costs, raises serious questions about the safety and reliability of this broker.

For traders seeking a secure trading environment, it may be beneficial to explore alternative brokers that are well-regulated and have a proven track record of customer satisfaction. Some reputable alternatives include brokers like XM, eToro, and Forex.com, all of which offer favorable trading conditions and robust regulatory frameworks.

Ultimately, while GalaxyFX may offer attractive features, the potential risks associated with trading through this broker suggest that it may not be the safest option available. Therefore, traders should carefully weigh their options and consider whether GalaxyFX is truly safe for their trading needs.

Is GalaxyFX a scam, or is it legit?

The latest exposure and evaluation content of GalaxyFX brokers.

GalaxyFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GalaxyFX latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.