GalaxyFX 2025 Review: Everything You Need to Know

Executive Summary

GalaxyFX is a new forex broker. It has caught the attention of traders since it started. Professional forex trading experts from the "ForexSQ" FX trading team say this galaxyfx review will give you complete information about what the broker offers and how reliable it is. The broker works as an STP provider, which means Straight Through Processing. It gives traders access to many different types of investments, including over 44 currency pairs and various contracts for differences called CFDs through the well-known MetaTrader 4 platform.

The broker focuses on traders who want many different trading choices. It offers floating spreads that change based on your account type and leverage up to 1:100. However, people who might become clients should know that the STP Basic account charges commissions, which can make your overall trading costs higher. While GalaxyFX says it provides a complete trading solution, different sources show that users have mixed experiences and ongoing talks about whether the broker is legitimate and operates openly in the forex community.

Important Notice

Traders should be careful when looking at GalaxyFX. Different sources have different opinions about how reliable the broker is and how good its service quality is. The rules it follows and how it operates might be different in different countries, which could affect your trading experience and how safe your money is if you live in another country. This review uses information that anyone can find and feedback from users collected from many sources, including professional forex analysis websites and discussions in trader communities. People thinking about becoming clients should strongly do their own research and check all information on their own before making any trading decisions.

Rating Framework

Broker Overview

GalaxyFX says it is a modern forex broker that offers STP execution services to regular people and big institutions who trade. Based on the information we can find, the broker gives access to many financial tools through the MetaTrader 4 platform, which is still one of the most popular trading platforms in the business. The company's business plan focuses on STP execution, which in theory gives direct market access without a dealer getting in the way, possibly offering better pricing that traders can see and understand.

The broker offers over 44 currency pairs, making it good for forex traders who want many different trading choices. GalaxyFX also offers various contracts for differences called CFDs, which let traders bet on price changes across different types of investments. This galaxyfx review shows that the broker targets both new and experienced traders by giving leverage up to 1:100, which follows the rules in many places while offering enough trading power for most regular trading plans.

Regulatory Status: Based on what we can find, GalaxyFX's regulatory standing needs careful thought because specific regulatory details are not completely explained in available sources.

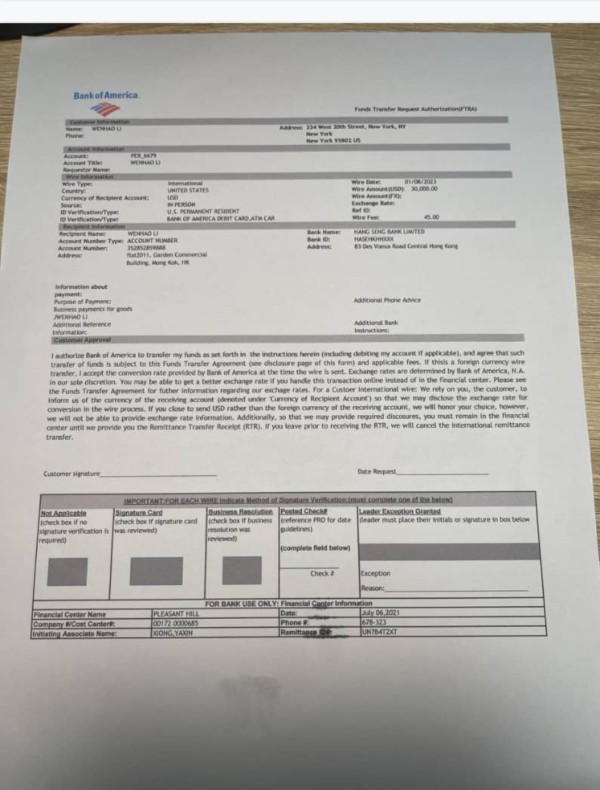

Deposit and Withdrawal Methods: We don't have specific information about how you can put money in or take money out.

Minimum Deposit Requirements: The minimum amount you need to deposit is not clearly explained in the available papers.

Bonus and Promotions: We don't have information about special offers and bonus structures in available sources.

Tradable Assets: GalaxyFX gives access to over 44 currency pairs and various contracts for differences called CFDs. This offers traders a big selection of trading tools across different market areas.

Cost Structure: The broker works with floating spreads that change depending on what type of account you choose. The STP Basic account charges commissions, though we don't know the specific commission rates from available sources.

Leverage Ratios: The highest leverage is set at 1:100. This matches the rules in many places.

Platform Options: The main trading platform is MetaTrader 4, which you can use on desktop computers, mobile phones, and through web browsers.

Geographic Restrictions: We don't have specific information about which countries can't use the service.

Customer Support Languages: We don't know which languages customer service supports from available sources.

This galaxyfx review shows that while the broker offers standard features that most companies in this business have, several important details about how it operates and what services it provides are still unclear in the information anyone can find.

Detailed Rating Analysis

Account Conditions Analysis (6/10)

GalaxyFX offers multiple account types made to work for traders with different experience levels and trading preferences. The ForexSQ team analysis says the broker provides STP execution across all account types, which in theory makes sure you get direct market access without a dealing desk getting in the way. The STP Basic account structure charges commissions, which is normal for STP brokers because they make money through commissions instead of making spreads bigger.

However, this galaxyfx review finds several problems with the available account information. We don't have complete details about how much money you need to start, how account levels differ from each other, and what special features they have in available sources. The leverage offering of up to 1:100 is competitive and follows the rules, but the floating spread structure without detailed spread information makes it hard for traders to correctly figure out trading costs.

The account opening process and what you need to verify your identity are not clearly explained in available materials. This might create uncertainty for people thinking about becoming clients. Also, we don't easily find information about Islamic accounts, VIP services, or institutional account options, which limits how well we can judge if the broker can serve different client needs.

The broker's commitment to providing MetaTrader 4 as the main trading platform is a big strength. MT4 remains the industry standard for forex trading. The platform offers complete charting abilities, technical analysis tools, and support for automated trading through Expert Advisors called EAs. You can use mobile and web-based versions, which means traders can access markets on different devices and operating systems.

GalaxyFX's asset selection of over 44 currency pairs gives substantial trading opportunities across major, minor, and exotic currency combinations. Including CFDs makes trading possibilities bigger beyond traditional forex markets, letting traders diversify their portfolios and take advantage of various market conditions.

However, this analysis shows gaps in educational resources and research materials. Available sources don't explain whether GalaxyFX provides market analysis, trading education, economic calendars, or other extra tools that modern traders expect. We don't have information about special tools they made themselves, trading signals, or advanced analytical resources, which suggests the broker may rely mainly on MT4's built-in abilities rather than offering enhanced trading support.

Customer Service and Support Analysis (5/10)

Customer service quality seems to be a mixed part of GalaxyFX's operations based on available feedback. While we don't have complete details about support channels, response times, and service quality documented, user discussions suggest different experiences with the broker's customer support team.

We don't have detailed information about support availability, abilities to speak multiple languages, and problem-solving processes. This raises concerns about how committed the broker is to excellent customer service. Professional forex trading platforms typically provide 24/5 support during market hours, multiple ways to communicate including live chat, phone, and email support, and special account management for higher-level clients.

Without clear documentation of support procedures, response time promises, or service level agreements, people thinking about becoming clients cannot properly judge whether GalaxyFX's customer service will meet their needs. This uncertainty is especially concerning for traders who may need immediate help during volatile market conditions or technical problems.

Trading Experience Analysis (6/10)

The trading experience with GalaxyFX centers around the MetaTrader 4 platform. This provides a familiar and strong trading environment for most forex traders. MT4's stability, execution speed, and complete functionality help make the overall trading experience better. The STP execution model theoretically provides better order execution with fewer conflicts of interest compared to market maker models.

However, this galaxyfx review finds several areas where trading experience assessment is limited by not having enough information. We don't have specific data about execution speeds, slippage rates, how often requotes happen, and server uptime in public sources. These technical performance numbers are crucial for evaluating the practical trading experience, especially for active traders and scalpers.

The floating spread structure without detailed spread information makes it hard to judge competitiveness during different market conditions. Also, we don't have complete information about what order types are supported, partial fills, and execution policies, which limits traders' ability to evaluate whether the broker's execution practices work with their trading strategies.

Trust and Reliability Analysis (4/10)

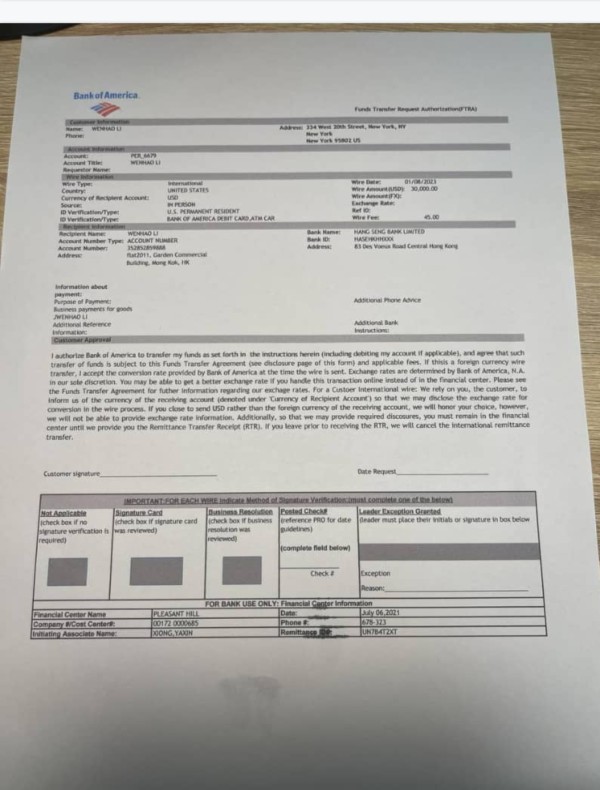

Trust and reliability represent big concerns in this GalaxyFX evaluation. Various sources in the forex community have raised questions about whether the broker is legitimate and operates transparently. Some discussions suggest doubt about whether GalaxyFX operates as a legitimate forex broker or potentially represents fraudulent activity, though definitive conclusions require careful investigation.

The regulatory status remains unclear in available documentation. This is a critical concern for trader fund safety. Legitimate forex brokers typically maintain clear regulatory compliance, separated client accounts, and transparent operational practices. We don't have detailed regulatory information, fund protection measures, and company transparency, which creates uncertainty about client asset security.

Additionally, the broker's relatively recent establishment and limited track record in the industry contribute to trust concerns. Without complete regulatory oversight verification, independent audits, or established industry reputation, traders face higher risks when considering GalaxyFX for their trading activities.

User Experience Analysis (5/10)

User experience with GalaxyFX seems to vary significantly based on available feedback and community discussions. While the MetaTrader 4 platform provides a familiar interface for experienced traders, overall user satisfaction seems inconsistent across different parts of the service.

The registration and account verification processes are not clearly documented. This may create confusion for new clients. Efficient onboarding procedures are essential for positive user experience, and not having clear information suggests potential improvements are needed in this area.

Fund management procedures, including deposit and withdrawal processes, are not completely detailed in available sources. Smooth financial transactions are crucial for trader satisfaction, and uncertainty about these processes may negatively impact user experience. Also, some community discussions suggest concerns about fund withdrawal, though we don't have specific details and resolution outcomes clearly documented.

Conclusion

GalaxyFX presents itself as an STP forex broker offering MetaTrader 4 trading access to over 44 currency pairs and various CFDs. While the broker provides standard industry features including competitive leverage and floating spreads, significant concerns exist regarding transparency, regulatory clarity, and overall reliability. The mixed user feedback and community doubt suggest potential traders should exercise considerable caution.

The broker may be suitable for experienced traders who prioritize MT4 platform access and understand the associated risks. However, it may not be appropriate for new traders or those prioritizing regulatory security and transparent operations. Key advantages include diverse asset selection and popular platform availability, while major disadvantages center on trust concerns and limited operational transparency.