Is VIG Investment safe?

Pros

Cons

Is VIG Investment A Scam?

Introduction

VIG Investment is a relatively new player in the forex market, claiming to offer a diverse range of trading services, including forex, indices, and commodities. As traders navigate the complexities of online trading, it becomes increasingly crucial to assess the legitimacy and reliability of brokers like VIG Investment. Given the prevalence of scams in the financial sector, traders must conduct thorough due diligence before committing their funds. This article aims to provide a comprehensive evaluation of VIG Investment, focusing on its regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, and associated risks. The analysis is based on a review of various online sources, user feedback, and regulatory databases.

Regulation and Legitimacy

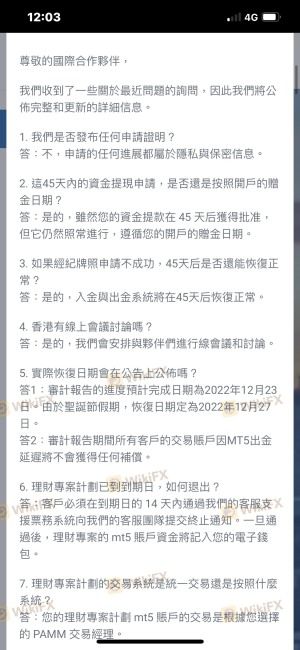

The regulatory status of a trading broker is one of the most critical factors in determining its legitimacy. VIG Investment claims to operate under the auspices of several regulatory bodies, but upon closer inspection, it becomes apparent that it lacks valid licenses. This absence of regulation raises significant concerns about the safety of client funds and the overall integrity of the trading platform.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The lack of regulation means that VIG Investment does not adhere to the stringent standards set by financial authorities, such as fund segregation, transparency, and fair dealing practices. Regulatory bodies like the UK's FCA or the US's NFA impose strict guidelines that protect traders. Without such oversight, VIG Investment operates in a high-risk environment, making it imperative for potential clients to question, "Is VIG Investment safe?"

Historically, unregulated brokers often engage in practices that can jeopardize client funds, such as misappropriation and inadequate risk management. Thus, the absence of a regulatory framework for VIG Investment is a red flag that traders should not ignore.

Company Background Investigation

VIG Investment is owned by Vanguard International Group, which claims to be based in Hong Kong and the British Virgin Islands. However, the lack of transparency regarding its ownership structure and operational history raises further concerns. The company was founded in 2022, making it a relatively new entrant in the forex market. This short operational history can be a significant factor for potential investors, as established brokers typically have a track record that can be scrutinized.

The management team's background is also crucial in assessing the reliability of a trading platform. Unfortunately, VIG Investment does not provide detailed information about its management team, which limits the ability to evaluate their professional experience and expertise in the financial sector. This lack of transparency extends to the company's information disclosure practices, which are vital for building trust with clients.

Given these factors, it is reasonable to ask, "Is VIG Investment safe?" The absence of clear information about the company's leadership and operational history makes it difficult for potential clients to gauge the broker's reliability.

Trading Conditions Analysis

VIG Investment claims to offer competitive trading conditions, including low spreads and high leverage. However, the overall fee structure and potential hidden costs require careful examination. The broker advertises a minimum deposit of $100, which is relatively low compared to industry standards, but this could be a tactic to lure in inexperienced traders.

| Fee Type | VIG Investment | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-3 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

While VIG Investment claims to offer "tight spreads," specific details about these spreads are not readily available. This lack of clarity can be problematic, as traders may encounter unexpected costs that can erode their profits. Additionally, the absence of a comprehensive fee structure raises questions about the broker's transparency.

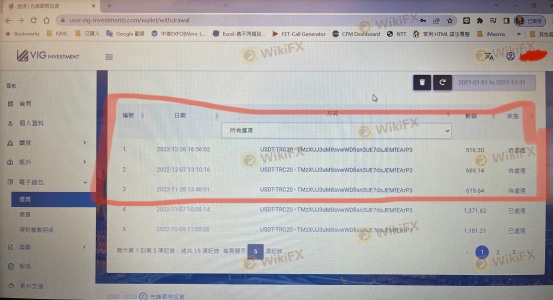

Traders should also be cautious of any unusual or excessive fees that may be imposed, particularly during the withdrawal process. Reports from users indicate that VIG Investment has made it difficult for clients to withdraw their funds, a common tactic employed by fraudulent brokers. Thus, the question remains, "Is VIG Investment safe?" The potential for hidden fees and withdrawal issues casts doubt on the broker's overall reliability.

Client Funds Safety

The safety of client funds is paramount when choosing a forex broker. VIG Investment does not provide sufficient information regarding its fund security measures, which raises significant concerns. The lack of a clear policy on fund segregation and investor protection mechanisms puts clients at risk of losing their investments.

In regulated environments, brokers are required to segregate client funds from their operational funds, ensuring that client money is protected in the event of bankruptcy. However, VIG Investment's unregulated status means that it is not bound by such requirements, leaving clients vulnerable.

Furthermore, the absence of negative balance protection—a feature that prevents clients from losing more than their initial deposit—adds another layer of risk. Historical data on VIG Investment indicates that there have been issues related to fund safety, prompting many to question, "Is VIG Investment safe?" The lack of robust security measures makes investing with this broker particularly risky.

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating any broker. Reviews of VIG Investment reveal a troubling pattern of complaints, primarily related to withdrawal issues and poor customer service. Many users report being unable to access their funds after requesting withdrawals, a common red flag associated with scam brokers.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Quality | Medium | Poor |

| Transparency | High | Poor |

The most severe complaints involve clients being pressured to deposit more funds before they can withdraw their initial investments. This tactic is often indicative of fraudulent practices, as it places undue pressure on traders to invest more money without any guarantee of a return.

One notable case involved a user who attempted to withdraw funds after several months of trading, only to be met with excuses and delays from the broker. This experience highlights the potential risks associated with VIG Investment and raises the critical question, "Is VIG Investment safe?" The overwhelming negative feedback from clients suggests that traders should approach this broker with extreme caution.

Platform and Trade Execution

The trading platform offered by VIG Investment is another area of concern. While the broker claims to use the widely respected MetaTrader 5 (MT5) platform, user reviews indicate that the actual performance may not meet expectations. Reports of slow execution times and issues with slippage suggest that the trading environment may not be as reliable as advertised.

Additionally, the platform's stability and user experience are crucial for traders, particularly those engaged in high-frequency trading. There have been allegations of order manipulation, which raises significant ethical concerns and further questions about the broker's integrity.

Given these issues, potential clients must consider whether they can trust VIG Investment to provide a fair and transparent trading experience. The pervasive issues surrounding platform performance lead to the critical inquiry, "Is VIG Investment safe?" The potential for execution problems and manipulation makes it imperative for traders to tread carefully.

Risk Assessment

Using VIG Investment presents a variety of risks that traders must consider. The lack of regulation, combined with numerous complaints about withdrawal issues and platform performance, contributes to a high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulation, exposing clients to potential fraud. |

| Fund Security Risk | High | Lack of fund segregation and investor protection mechanisms. |

| Withdrawal Risk | High | Numerous complaints about difficulties in accessing funds. |

| Platform Risk | Medium | Allegations of order manipulation and execution issues. |

To mitigate these risks, potential clients should consider using regulated brokers with a proven track record of transparency and reliability. Traders should also ensure that they understand the risks associated with leveraged trading and only invest funds they can afford to lose.

Conclusion and Recommendations

In conclusion, the evidence overwhelmingly suggests that VIG Investment operates in a high-risk environment, raising significant concerns about its legitimacy and safety. The absence of regulation, coupled with numerous client complaints and questionable trading conditions, leads to the conclusion that VIG Investment is not a safe option for traders.

For those considering engaging with VIG Investment, it is crucial to ask, "Is VIG Investment safe?" The overwhelming consensus among users and regulatory bodies indicates that it is not. As a result, traders are advised to seek alternative brokers that are well-regulated and have a proven track record of reliability.

Some recommended alternatives include brokers regulated by reputable authorities such as the FCA, ASIC, or NFA. These brokers not only provide a safer trading environment but also offer robust customer support and transparent trading conditions. Ultimately, conducting thorough research and choosing a reputable broker can significantly enhance the trading experience and protect investors' funds.

Is VIG Investment a scam, or is it legit?

The latest exposure and evaluation content of VIG Investment brokers.

VIG Investment Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

VIG Investment latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.