Is FX Bullion safe?

Business

License

Is FX Bullion A Scam?

Introduction

FX Bullion is an online broker that offers trading services in foreign exchange (forex), contracts for difference (CFDs), and cryptocurrencies. Established in Saint Vincent and the Grenadines, FX Bullion markets itself as a platform for both novice and experienced traders to access a wide array of financial instruments. However, as with any financial service provider, it is crucial for potential investors to conduct thorough due diligence before committing their funds. Why is it important to evaluate forex brokers carefully? The forex market is notorious for its high volatility and potential for fraud, making it essential for traders to ensure they are dealing with reputable and regulated brokers. This article aims to provide an objective analysis of FX Bullion's legitimacy, based on a review of its regulatory status, company background, trading conditions, and customer experiences.

The investigation is based on data gathered from various online sources, including user reviews and expert analyses. The assessment framework includes key factors such as regulatory compliance, company history, trading costs, customer fund security, and user feedback.

Regulation and Legitimacy

One of the most critical aspects of evaluating any forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that the broker adheres to specific standards of conduct and financial accountability. Unfortunately, FX Bullion operates without a license from any recognized financial authority. This lack of regulation raises significant concerns regarding the safety of client funds and the transparency of operations.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulatory oversight from reputable entities such as the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC) is a major red flag. Why is this important? Regulated brokers are required to maintain segregated accounts for client funds, ensuring that traders' money is protected in the event of company insolvency. Furthermore, they must adhere to strict guidelines regarding financial reporting and consumer protection. FX Bullion's unregulated status suggests a higher risk for traders, as there is no authority to turn to in case of disputes or issues with fund withdrawals.

Company Background Investigation

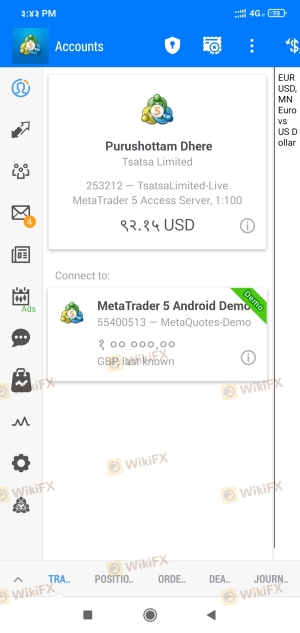

FX Bullion claims to be operated by Tsatsa Limited, with its office located in Beachmont Business Centre, Kingstown, Saint Vincent and the Grenadines. However, the company's history and ownership structure lack transparency. The establishment date is undisclosed, and there is limited information available regarding the management team's qualifications and experience in the financial industry.

This lack of transparency is concerning, as reputable brokers typically provide detailed information about their ownership and management. A well-structured company profile helps build trust with potential clients. In the case of FX Bullion, the absence of such information may lead to skepticism regarding its operations and intentions.

Trading Conditions Analysis

When assessing whether FX Bullion is safe, it's essential to consider the trading conditions it offers. The broker provides a minimum deposit requirement of $100, which is relatively low compared to industry standards. However, the trading costs and fee structure are equally important in determining the overall value of the service.

| Fee Type | FX Bullion | Industry Average |

|---|---|---|

| Spread on Major Pairs | 0.1 - 0.2 pips | 1-2 pips |

| Commission Structure | No commission | Varies |

| Overnight Interest Range | N/A | Varies |

While FX Bullion advertises tight spreads, the lack of transparency regarding commissions and overnight interest rates can be a cause for concern. Traders should be cautious of hidden fees that could significantly impact their profitability. The absence of clear information on these costs raises questions about the broker's commitment to transparency and fairness.

Client Fund Security

The safety of client funds is paramount when evaluating any broker. FX Bullion does not provide adequate information regarding its fund security measures. For instance, there is no mention of segregated accounts, which are crucial for protecting client deposits. Without this safeguard, traders risk losing their funds in the event of the broker's financial difficulties.

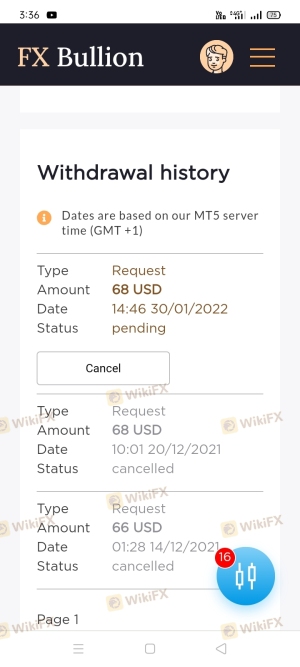

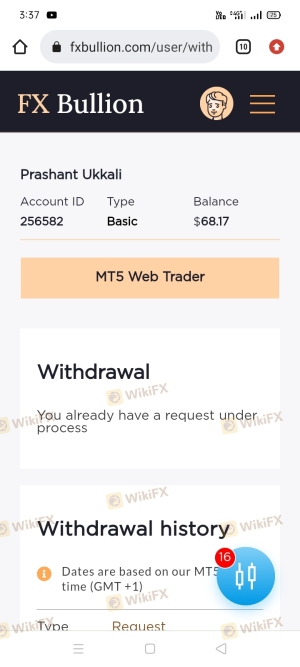

Additionally, FX Bullion does not appear to offer investor protection schemes that are typically available through regulated brokers. This lack of safety measures significantly increases the risk profile of trading with FX Bullion. Historical issues regarding fund security have also been reported, with numerous complaints from users who have faced difficulties in withdrawing their funds.

Customer Experience and Complaints

Customer feedback is a vital component of assessing whether FX Bullion is a scam. A significant number of reviews indicate that clients have experienced problems, particularly concerning fund withdrawals. Common complaints include unresponsive customer service, delayed withdrawal requests, and issues related to account management.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Unresponsive Support | Medium | Poor |

| Account Management | High | Poor |

For example, several users have reported that after requesting withdrawals, their accounts were blocked or went unanswered. Such patterns suggest a troubling trend that could indicate potential fraudulent behavior. The overall sentiment among users points toward a lack of reliability and accountability from FX Bullion.

Platform and Trade Execution

The performance of a trading platform is crucial for any trading experience. FX Bullion offers the MetaTrader 5 (MT5) platform, which is known for its advanced features and user-friendly interface. However, reviews indicate mixed experiences regarding execution speed and order fulfillment.

Traders have reported instances of slippage and order rejections, raising concerns about the platform's reliability. Any signs of manipulation or unfair trading practices can further diminish trust in the broker's operations.

Risk Assessment

Understanding the risks involved in trading with FX Bullion is essential for potential clients. The lack of regulation, combined with negative user feedback and unclear trading conditions, contributes to a high-risk profile.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker |

| Fund Security Risk | High | No segregation of funds |

| Customer Support Risk | Medium | Poor response to complaints |

To mitigate these risks, traders are advised to conduct thorough research, avoid depositing large sums, and consider using regulated brokers with a proven track record.

Conclusion and Recommendations

In conclusion, the evidence suggests that FX Bullion raises significant concerns regarding its legitimacy and safety. The lack of regulation, combined with numerous client complaints and unclear trading conditions, indicates that traders should exercise extreme caution.

For those considering trading in the forex market, it is advisable to opt for regulated brokers that offer transparency, robust customer support, and adequate fund protection. Some recommended alternatives include brokers that are well-regulated and have positive user reviews. Ultimately, while FX Bullion may present an attractive entry point for trading, the associated risks and potential for loss make it a questionable choice for serious investors.

Is FX Bullion a scam, or is it legit?

The latest exposure and evaluation content of FX Bullion brokers.

FX Bullion Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FX Bullion latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.