FX Bullion 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive fx bullion review reveals significant concerns about this forex broker. Potential investors must carefully consider these issues before making any decisions. Based on extensive analysis of user feedback and industry reports, FX Bullion has received mostly negative reviews from clients. These clients report serious issues with fund withdrawals and questionable business practices that raise major red flags.

Multiple users across various review platforms have called FX Bullion a fraudulent operation. Their complaints focus on the inability to withdraw invested funds and aggressive tactics to force additional investments. The broker's lack of transparent regulatory information creates additional concerns for potential users.

According to user testimonials found on review sites, investors have reported losing access to their funds after initial deposits. Customer service becomes unresponsive when withdrawal requests are submitted, leaving clients without recourse. This fx bullion review aims to provide potential investors with critical information to make informed decisions about their forex trading choices.

Important Disclaimer

This review is based on publicly available information, user feedback, and analysis of various review platforms. The absence of clear regulatory information from official sources significantly impacts the reliability of available data about FX Bullion's operations. Our evaluation methodology incorporates user testimonials, complaint analysis, and comparison with industry standards to provide a comprehensive assessment.

Potential investors should conduct their own due diligence and consider consulting with financial advisors before making any investment decisions.

Rating Overview

Broker Overview

FX Bullion presents itself as a forex and CFD trading platform. Specific details about its establishment date and corporate background remain unclear in available public information. The broker appears to target retail investors interested in forex trading with promises of competitive rates and earning opportunities.

However, the lack of transparent corporate information and regulatory disclosure raises immediate concerns about the legitimacy of their operations.

The company's business model appears to focus on attracting new investors through online advertising and aggressive sales tactics. According to user reports, FX Bullion employs telemarketers who contact potential clients to encourage larger investments. These representatives often start with smaller amounts before pressuring for substantial additional deposits.

This fx bullion review indicates that the broker's approach differs significantly from established, regulated forex brokers who prioritize transparency and regulatory compliance.

The platform allegedly offers trading in various financial instruments, including forex pairs and CFDs. Specific details about asset availability, trading conditions, and platform features are not clearly documented in reliable sources. The absence of comprehensive information about trading conditions, regulatory status, and corporate structure represents a significant concern for potential investors seeking a trustworthy trading environment.

Regulatory Status: Available information does not clearly indicate regulatory oversight from recognized financial authorities. This represents a major red flag for potential investors.

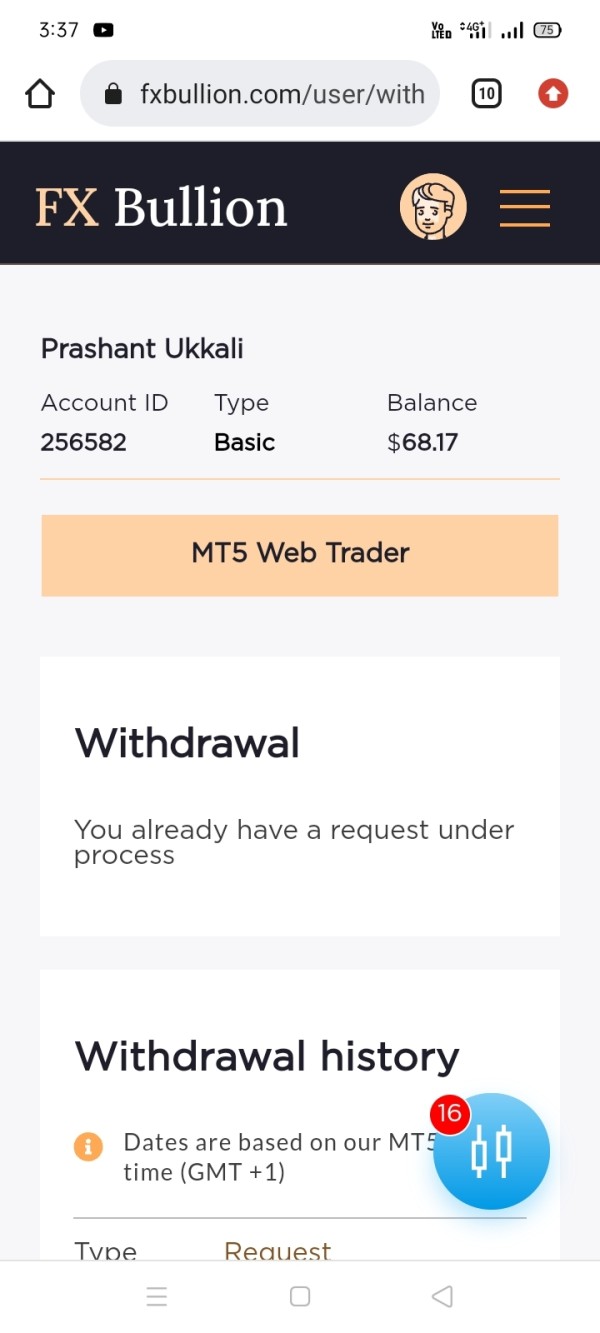

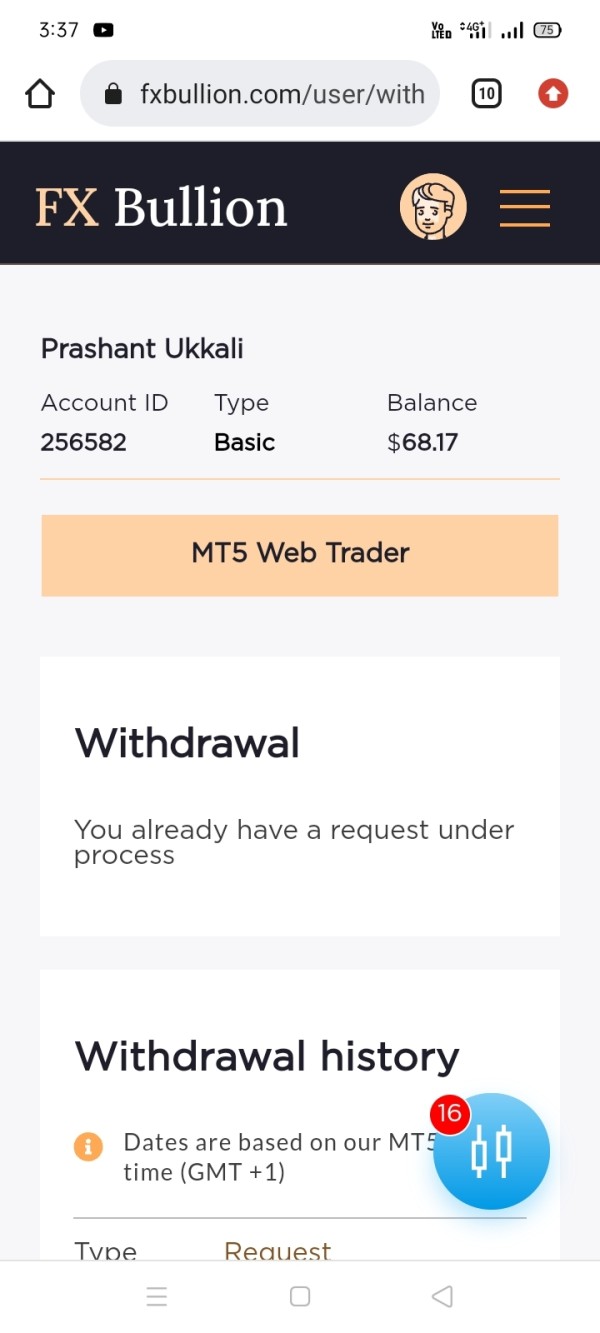

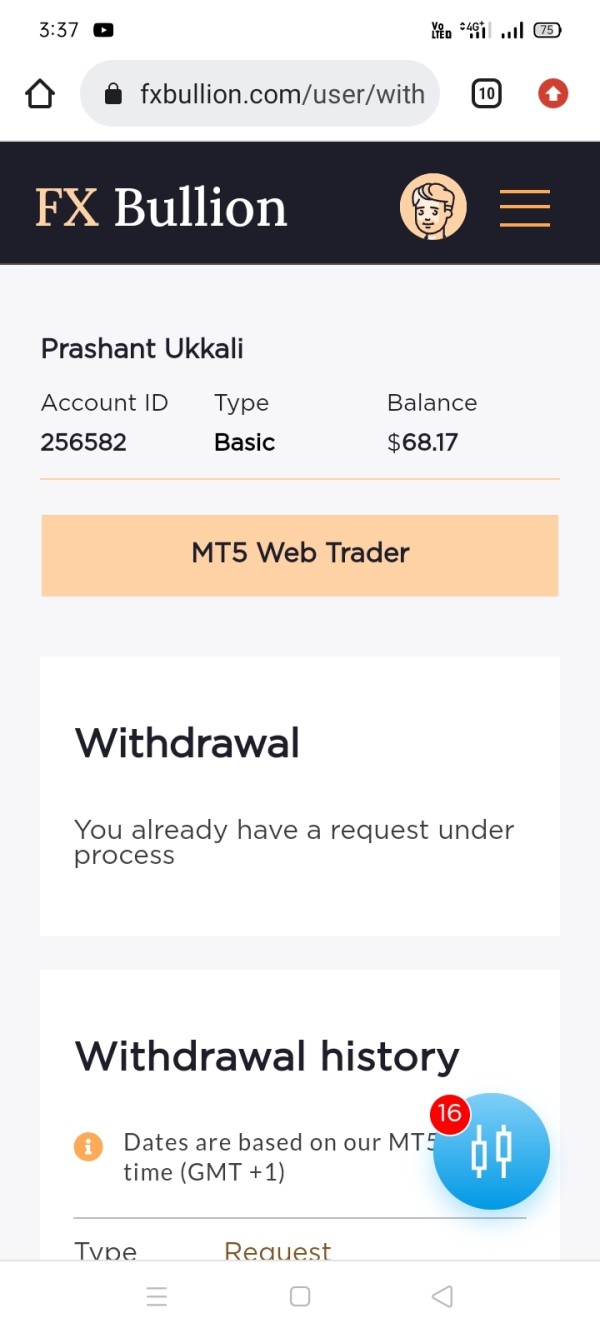

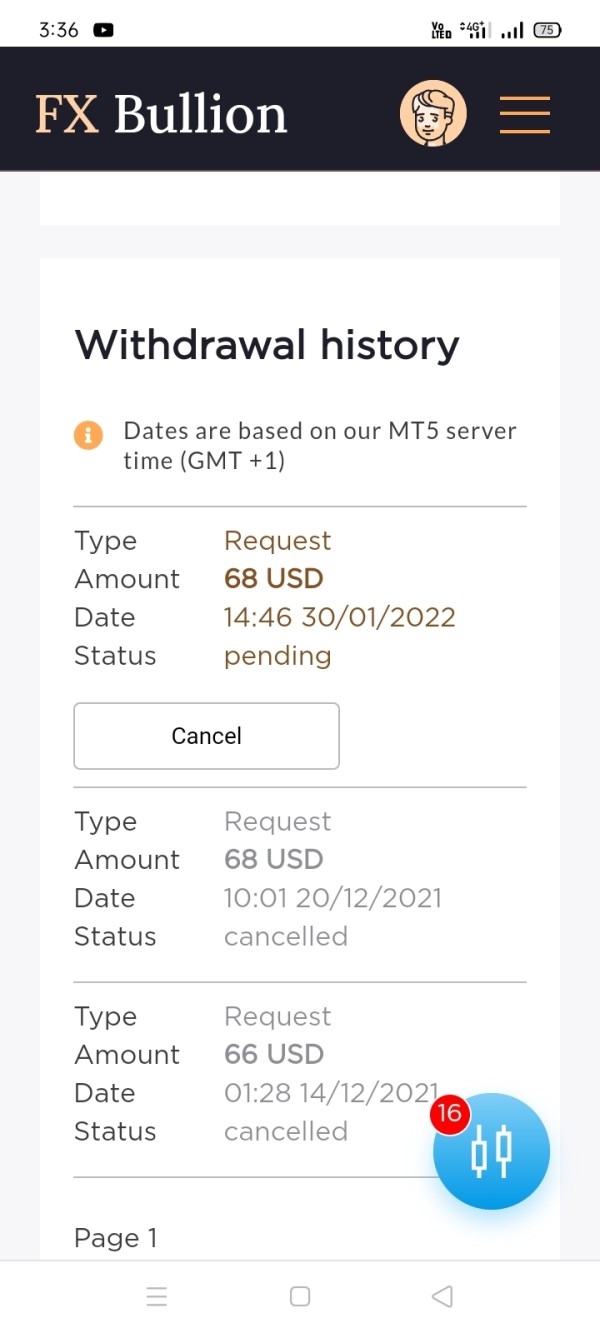

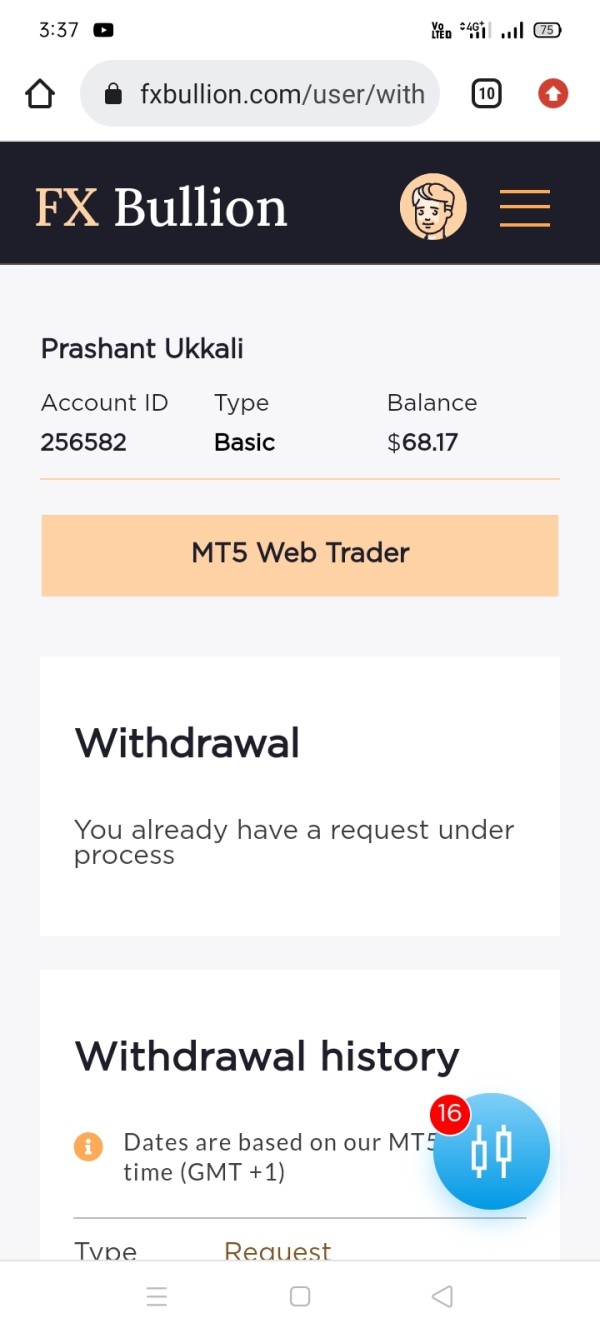

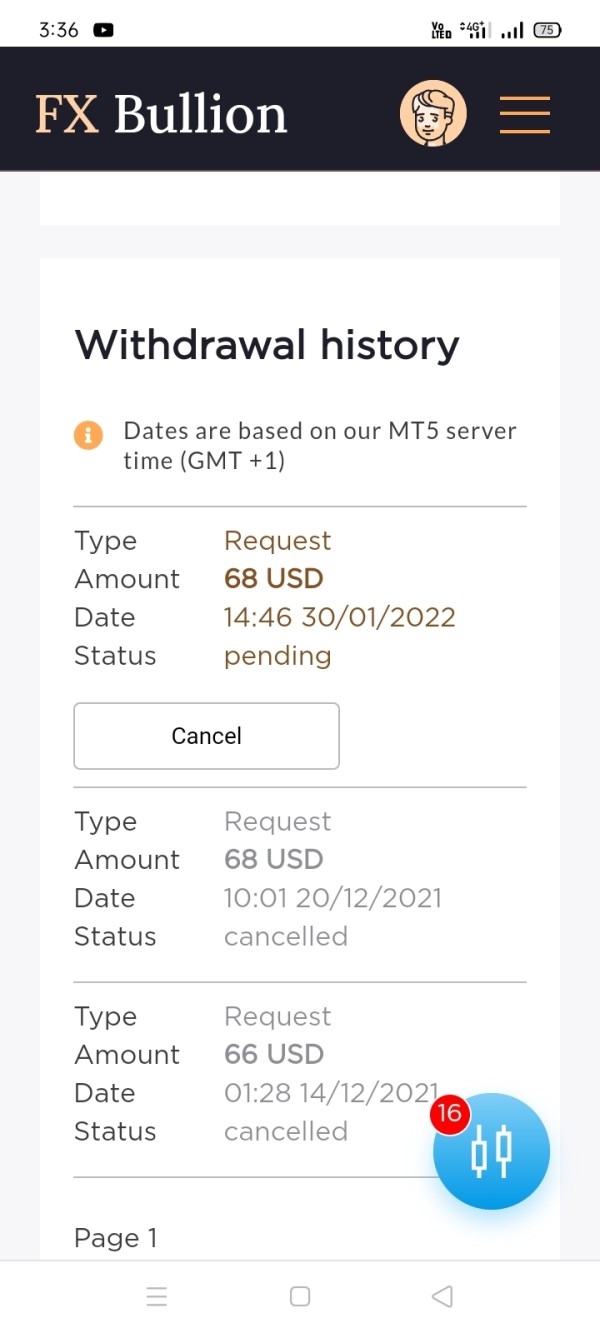

Deposit and Withdrawal Methods: User reports suggest significant issues with withdrawal processes, with multiple complaints about funds being withheld.

Minimum Deposit Requirements: While exact figures are not consistently reported, user testimonials mention initial investments starting from $50. Representatives pressure clients to increase deposits to $200 or more.

Promotional Offers: No reliable information about bonus structures or promotional offerings is available in reviewed sources.

Available Trading Assets: The broker appears to offer forex trading and CFD instruments. The complete range of available assets is not comprehensively documented.

Cost Structure: Specific information about spreads, commissions, and other trading costs is not transparently disclosed in available materials.

Leverage Options: Leverage ratios and margin requirements are not clearly specified in accessible documentation.

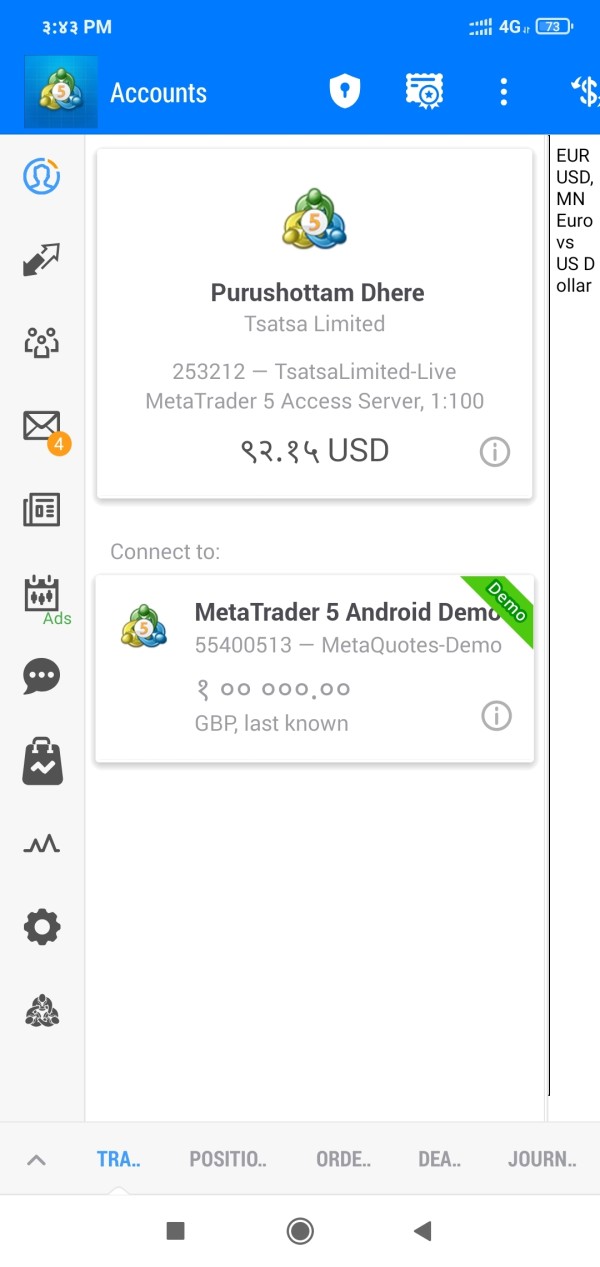

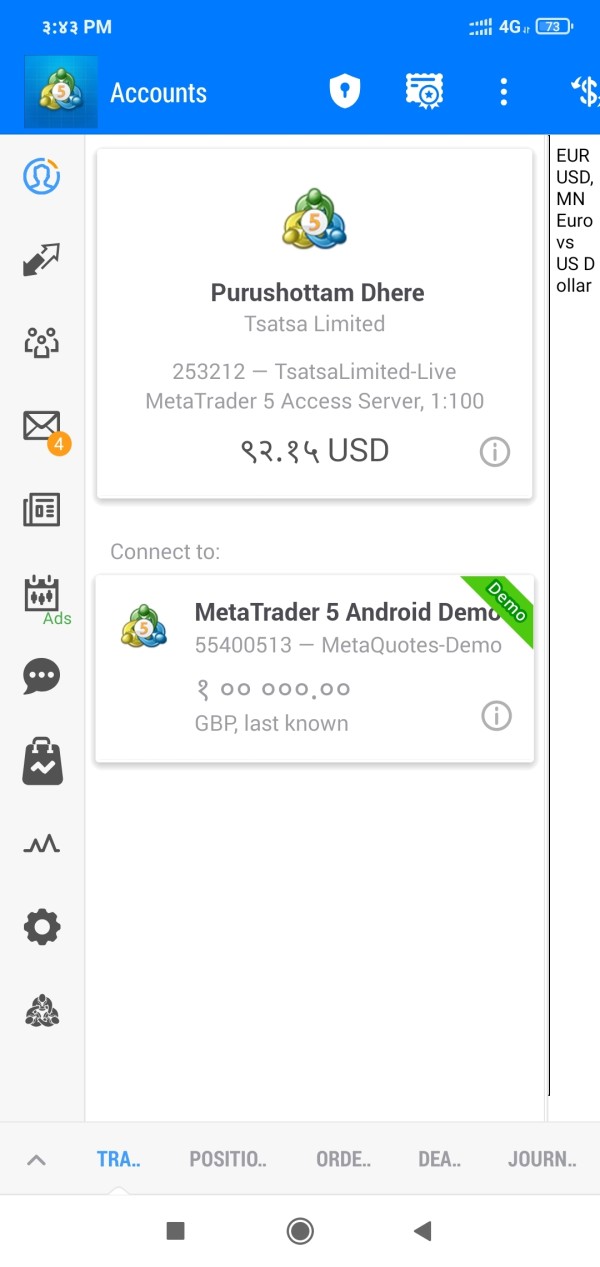

Trading Platform: Details about the trading platform technology, features, and capabilities are not comprehensively available in reviewed sources.

Geographic Restrictions: Information about jurisdictional limitations and service availability by region is not clearly documented.

Customer Support Languages: While user reports mention contact with Indian representatives, comprehensive language support information is not available.

This fx bullion review highlights the concerning lack of transparency in basic operational information. Legitimate brokers typically provide this information clearly to potential clients.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of FX Bullion's account conditions reveals significant deficiencies in transparency and documentation. Available information does not provide clear details about different account types, their respective features, or specific terms and conditions. This lack of transparency contrasts sharply with industry standards where reputable brokers clearly outline various account tiers, minimum deposit requirements, and associated benefits.

User feedback suggests that the account opening process may involve aggressive sales tactics. Representatives pressure clients to increase their initial deposits beyond what they originally intended to invest. According to testimonials found on review platforms, clients report being contacted by telemarketers who encourage larger investments.

The absence of clear account documentation and the reported pressure tactics raise serious concerns about the broker's approach to client onboarding.

The minimum deposit requirements appear to vary, with some users reporting initial investments as low as $50. Others mention pressure to deposit $200 or more after their initial investment. However, the lack of official documentation makes it impossible to verify standard account conditions or compare them with industry benchmarks.

This fx bullion review emphasizes that legitimate brokers typically provide comprehensive account information upfront, including clear terms, conditions, and fee structures.

The assessment of trading tools and educational resources provided by FX Bullion reveals a concerning absence of documented offerings. Established forex brokers typically provide comprehensive trading platforms with advanced charting tools, technical indicators, economic calendars, and educational materials to support trader development. However, available information about FX Bullion does not indicate the presence of such resources.

User reviews and testimonials do not mention access to professional trading tools, market analysis, or educational content. These resources would typically be expected from a legitimate forex broker. The lack of documented trading resources suggests either inadequate platform development or poor transparency in communicating available features to potential clients.

Professional trading platforms usually include features such as real-time market data, advanced order types, risk management tools, and mobile trading capabilities.

The absence of clear information about these essential trading components in FX Bullion's documentation represents a significant deficiency compared to industry standards.

Customer Service and Support Analysis

Customer service evaluation reveals serious concerns based on user feedback and complaint analysis. Multiple users report difficulties in contacting customer support, particularly when attempting to process withdrawal requests. According to testimonials found on review platforms, clients experience unresponsive customer service representatives who fail to address concerns about fund access and account issues.

User reports indicate that while initial contact from sales representatives may be frequent and persistent, support quality diminishes significantly once deposits are made.

Several testimonials mention that customer service becomes unresponsive when clients attempt to withdraw funds or raise concerns about their accounts. This pattern of behavior is consistent across multiple user reviews and represents a serious red flag for potential investors. The reported customer service issues include unreturned phone calls, ignored withdrawal requests, and lack of resolution for client complaints.

These problems suggest systematic issues with customer support rather than isolated incidents, indicating fundamental problems with the broker's client service approach.

Trading Experience Analysis

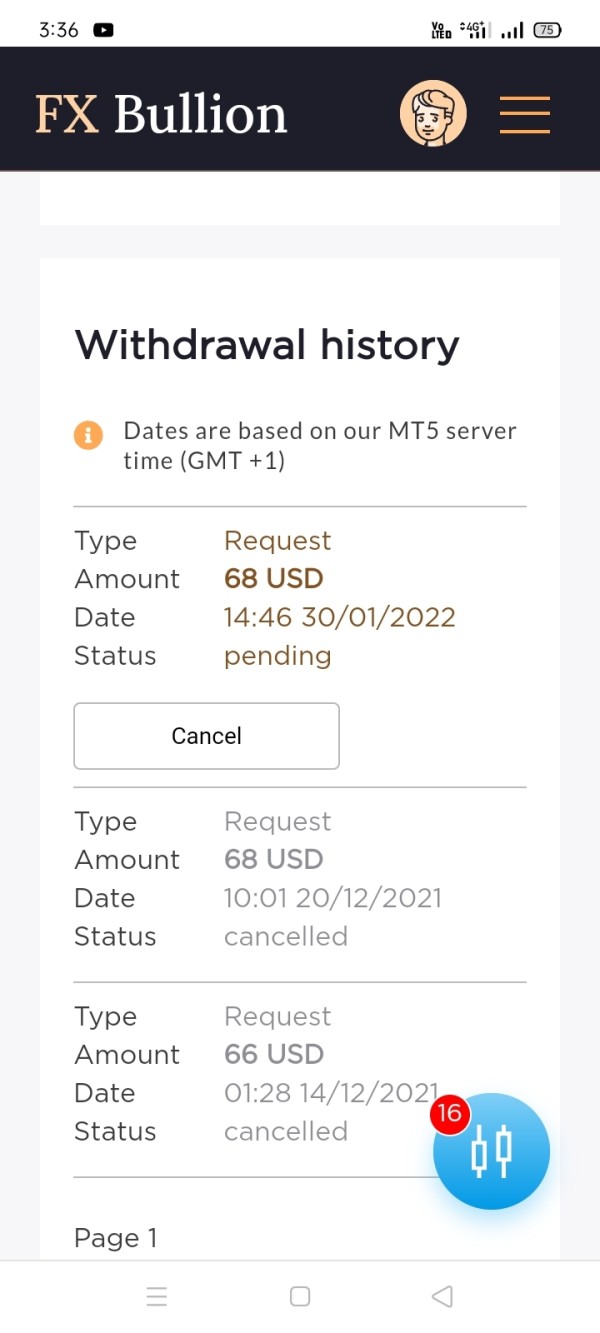

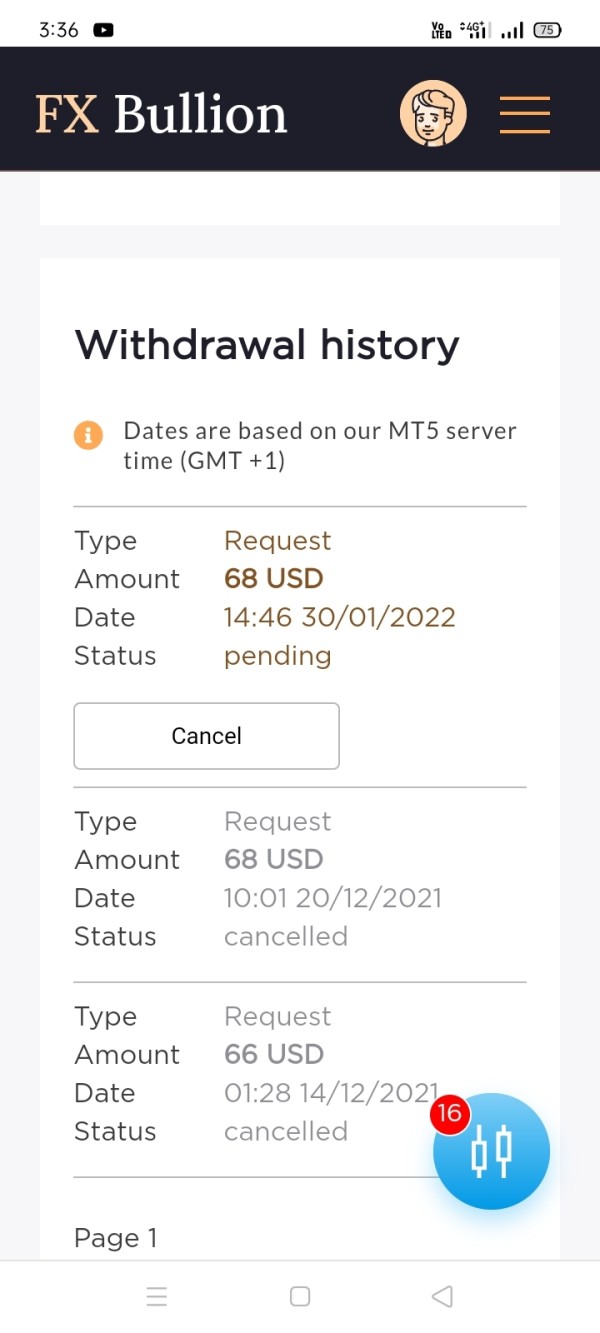

Analysis of the trading experience reveals significant concerns based on user feedback and reported issues. While specific technical performance data is not available, user testimonials suggest problematic experiences with the trading platform and overall service delivery. Multiple users report difficulties accessing their funds and experiencing issues with withdrawal processes, which directly impacts the trading experience.

User feedback indicates that while initial trading activities may proceed normally, problems emerge when clients attempt to withdraw profits or recover their initial investments.

This pattern suggests that the platform may function adequately for deposit acceptance but fails to provide reliable withdrawal services. Reliable withdrawal processing is fundamental to a legitimate trading experience. The reported issues with fund access and withdrawal processing create an environment of uncertainty and risk that undermines trader confidence.

Professional trading environments require reliable deposit and withdrawal processes, transparent pricing, and consistent platform performance.

The documented problems with FX Bullion's service delivery indicate significant deficiencies in providing a trustworthy trading experience. This fx bullion review emphasizes that legitimate trading platforms must provide reliable access to funds and transparent operational processes to maintain trader confidence and regulatory compliance.

Trust and Reliability Analysis

The trust and reliability assessment reveals extremely concerning findings that potential investors must carefully consider. Multiple review platforms and user testimonials characterize FX Bullion as a fraudulent operation, with widespread reports of fund withdrawal issues and questionable business practices. The absence of clear regulatory oversight from recognized financial authorities represents a fundamental trust deficit.

According to user reports found on various review sites, clients consistently experience difficulties withdrawing their invested funds.

Some users describe complete inability to recover their money after making initial deposits. These reports span multiple time periods and involve different users, suggesting systematic rather than isolated problems. The pattern of complaints indicates serious reliability issues that extend beyond typical broker disputes.

The lack of transparent regulatory information compounds trust concerns, as legitimate brokers typically display clear regulatory credentials and compliance information.

Professional forex brokers operate under strict regulatory oversight that provides investor protection and dispute resolution mechanisms. The absence of such regulatory transparency in FX Bullion's documentation represents a significant red flag for potential investors. Industry reputation analysis reveals predominantly negative assessments from multiple sources, with several platforms explicitly warning about potential fraudulent activities.

This consistent pattern of negative evaluation across different review sources indicates serious trust and reliability issues that investors should carefully consider.

User Experience Analysis

Comprehensive user experience analysis reveals consistently negative feedback across multiple platforms and review sources. User satisfaction appears extremely low, with testimonials frequently describing frustrating experiences related to fund access, customer service responsiveness, and overall platform reliability. The documented user complaints suggest systematic issues rather than isolated problems.

Common user complaints include inability to withdraw funds, unresponsive customer service, and pressure to make additional investments beyond initial deposits.

According to user testimonials, clients report being contacted by aggressive sales representatives who encourage larger investments but become unresponsive when withdrawal requests are submitted. This pattern of behavior significantly undermines user confidence and satisfaction. The overall user experience appears characterized by initial engagement followed by difficulties accessing funds and obtaining support.

Multiple users describe feeling misled about the nature of the service and experiencing significant frustration when attempting to recover their investments.

These consistent patterns across different user reports suggest fundamental issues with the broker's service delivery model. User recommendations consistently advise avoiding FX Bullion, with multiple testimonials explicitly warning other potential investors about their negative experiences. This level of user dissatisfaction and explicit warnings represents a serious concern for anyone considering this platform for forex trading activities.

Conclusion

This comprehensive fx bullion review reveals significant concerns that make FX Bullion unsuitable for investors seeking a reliable forex trading platform. The consistent pattern of negative user feedback, reported withdrawal issues, and lack of regulatory transparency creates an environment of substantial risk for potential investors. Multiple users across various platforms have reported serious problems with fund access and customer service responsiveness, suggesting systematic operational issues.

The broker's lack of clear regulatory oversight and transparent operational information fails to meet basic standards expected from legitimate forex brokers.

Combined with widespread user complaints about withdrawal difficulties and unresponsive customer service, these factors indicate that FX Bullion does not provide the trustworthy trading environment necessary for successful forex investment. Potential investors should consider regulated alternatives with established track records and transparent operational practices.