Is Fun Managers safe?

Business

License

Is Fun Managers A Scam?

Introduction

Fun Managers, operating under the domain fmswa.com, positions itself as a forex broker catering to traders seeking opportunities in the foreign exchange market. However, with the increasing prevalence of scams in the financial sector, it is crucial for traders to conduct thorough evaluations before committing their funds. The forex market is rife with unregulated entities, and the stakes are high; a lack of due diligence can lead to significant financial losses. This article aims to provide an objective analysis of Fun Managers, focusing on its regulatory status, company background, trading conditions, fund security, customer experiences, platform performance, and overall risks. Our investigation is based on a review of available online resources, including customer feedback and expert evaluations, to determine whether Fun Managers is a safe trading option or a potential scam.

Regulation and Legitimacy

The regulatory status of a forex broker is paramount in determining its legitimacy and safety for traders. Fun Managers claims to be regulated by the National Futures Association (NFA) in the United States. However, upon investigation, it becomes evident that this claim is misleading. Fun Managers does not appear in the NFA's registry, indicating a lack of regulatory oversight. This raises substantial concerns about the safety of funds deposited with this broker.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| National Futures Association (NFA) | 0524539 | United States | Not Found |

The absence of regulatory oversight means that Fun Managers does not adhere to the strict compliance requirements set forth by recognized authorities. This includes essential protections such as segregated accounts, which are crucial for safeguarding client funds. Without regulation, traders are exposed to higher risks, including potential fraud and mismanagement of funds. The lack of a credible regulatory framework is a significant red flag, leading us to question whether Fun Managers is truly safe for traders.

Company Background Investigation

Fun Managers is operated by Fund Managers Central Limited, a company that claims to be based in London, UK. However, the lack of transparency regarding its ownership and management structure raises concerns. The company does not provide sufficient information about its history, development, or the backgrounds of its management team. This opacity is problematic, as reputable brokers typically disclose information about their founders and executives, showcasing their experience and qualifications in the financial industry.

Furthermore, the absence of a clear operational history and the inability to verify the company's claims of regulation contribute to a perception of unreliability. Traders are advised to be cautious when dealing with companies that lack transparency and do not provide adequate information about their operations. The combination of these factors casts doubt on the legitimacy of Fun Managers and whether it operates in the best interests of its clients.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for assessing its overall value proposition. Fun Managers requires a minimum deposit of $1,000, which is significantly higher than the industry average. This high entry barrier can deter novice traders who typically prefer to start with smaller amounts. Additionally, the trading costs associated with Fun Managers are concerning. The spreads offered are reportedly as high as 8 pips for major currency pairs, which is well above the average in the forex industry.

| Fee Type | Fun Managers | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 8 pips | 1-2 pips |

| Commission Model | $50 per lot | Varies |

| Overnight Interest Range | Not disclosed | Varies |

The elevated trading costs and lack of transparency regarding commission structures suggest that trading with Fun Managers could be less favorable for clients. High spreads can significantly erode potential profits, making it challenging for traders to achieve success. In the context of evaluating whether Fun Managers is safe, these unfavorable trading conditions raise further concerns about the broker's commitment to providing a fair and competitive trading environment.

Client Fund Safety

The safety of client funds is a critical aspect of any forex broker's operations. Fun Managers does not appear to implement robust measures to protect client funds. There is no indication that client funds are held in segregated accounts, which is a standard practice among regulated brokers to ensure that client money is kept separate from the broker's operational funds. Additionally, Fun Managers does not offer negative balance protection, which means clients could potentially lose more than their initial investment.

The lack of investor protection schemes is another significant concern. Reputable brokers often participate in compensation schemes that provide clients with recourse in the event of fraud or bankruptcy. Fun Managers, however, does not appear to offer any such protections. This absence of safety measures raises alarms about the potential risks associated with trading through this broker, leading us to question whether Fun Managers is indeed a safe option for traders.

Customer Experience and Complaints

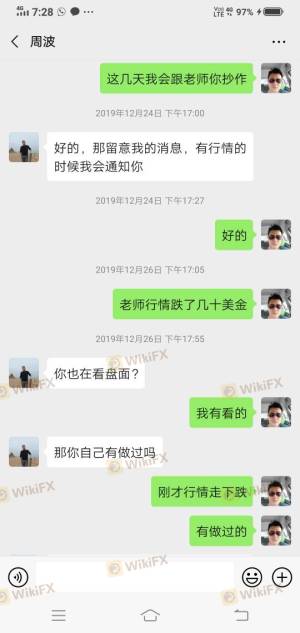

Customer feedback is a valuable resource for assessing a broker's reliability and service quality. Reviews of Fun Managers reveal a troubling pattern of complaints, primarily centered around withdrawal issues and unresponsive customer service. Many users report difficulties in accessing their funds, with some stating that their withdrawal requests have been ignored or delayed for extended periods. This pattern of complaints is indicative of a potentially problematic broker.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Customer Service | Medium | Slow Response |

| Account Blocking | High | No Resolution |

Typical case scenarios include clients who have requested withdrawals only to find their accounts blocked or their requests ignored. Such experiences are alarming and suggest a lack of accountability on the part of Fun Managers. The recurring theme of withdrawal difficulties raises significant concerns about the broker's practices and whether it is operating in good faith.

Platform and Trade Execution

The trading platform is a critical component of the trading experience. Fun Managers claims to offer the widely used MetaTrader 4 (MT4) platform, which is known for its robust features and user-friendly interface. However, user experiences with the platform have been mixed. Reports of slow execution times, slippage, and occasional disconnections have surfaced, leading to frustration among traders.

The quality of order execution is paramount, as delays or rejections can result in missed trading opportunities. Instances of slippage, particularly during volatile market conditions, can further exacerbate traders' challenges. While MT4 is a reputable platform, the reported issues with Fun Managers raise doubts about the reliability of its trading environment.

Risk Assessment

Engaging with Fun Managers carries several risks that potential traders should consider. The lack of regulation, high trading costs, and troubling customer feedback contribute to a high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Lack of fund protection measures |

| Operational Risk | Medium | Complaints about service quality |

To mitigate these risks, traders should approach Fun Managers with caution. It is advisable to start with a minimal deposit, if at all, and to thoroughly research alternative brokers that offer better regulatory protections and trading conditions.

Conclusion and Recommendations

In conclusion, the evidence suggests that Fun Managers is not a safe trading option for forex traders. The lack of regulatory oversight, high trading costs, and numerous customer complaints indicate potential fraud and operational issues. Traders should be wary of engaging with this broker, as the risks associated with their operations appear substantial.

For those seeking reliable alternatives, it is recommended to consider brokers regulated by reputable authorities such as the FCA in the UK, CySEC in Cyprus, or ASIC in Australia. These brokers typically offer better protections for client funds, more favorable trading conditions, and a commitment to transparency and accountability. Ultimately, conducting thorough research and selecting a well-regulated broker is essential for safeguarding investments in the forex market.

Is Fun Managers a scam, or is it legit?

The latest exposure and evaluation content of Fun Managers brokers.

Fun Managers Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Fun Managers latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.