Is Fruitful safe?

Pros

Cons

Is Fruitful A Scam?

Introduction

Fruitful, a financial services platform, has emerged as a player in the forex market, catering to traders seeking a blend of investment management and advisory services. With the proliferation of online trading platforms, traders must exercise caution and diligence when evaluating potential brokers. The forex market, known for its volatility and complexity, can be a breeding ground for scams and unregulated operations. Therefore, it is crucial for traders to assess the legitimacy and safety of a broker before committing their funds. This article employs a multi-faceted evaluation framework, analyzing Fruitful's regulatory status, company background, trading conditions, customer experiences, and overall risk profile to provide a comprehensive assessment of whether Fruitful is a safe trading option or a potential scam.

Regulation and Legitimacy

The regulatory environment is a critical aspect of any brokerage's legitimacy. A broker's adherence to regulatory standards not only ensures compliance with financial laws but also provides a layer of protection for traders. Fruitful claims to operate under a regulated framework, which is essential for building trust with its clients. Below is a summary of the regulatory information pertaining to Fruitful:

| Regulatory Authority | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| SEC | N/A | United States | Verified |

The U.S. Securities and Exchange Commission (SEC) oversees Fruitful's operations, which is a positive indication of its legitimacy. However, it is worth noting that while the SEC provides oversight, the level of consumer protection can vary. Historically, brokers operating under the SEC have faced scrutiny for compliance issues. Therefore, the quality of regulation and historical compliance should be assessed critically.

Company Background Investigation

Understanding the company behind a trading platform is vital for evaluating its trustworthiness. Fruitful was founded with the aim of simplifying financial management for everyday investors. The ownership structure appears to be transparent, with clear information available about its executive team. The management team comprises professionals with backgrounds in finance, investment, and technology, contributing to a robust strategic direction for the company.

However, the company's relatively short history in the financial services industry raises questions about its long-term viability. While it has garnered attention for its innovative approach to financial wellness, the lack of extensive operational history may be a concern for some traders. Transparency in operations and information disclosure is critical; thus, Fruitful's commitment to providing comprehensive information about its services and policies is commendable but requires ongoing scrutiny.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's overall experience. Fruitful's pricing structure is designed to be competitive, with a focus on transparency. However, traders should be aware of any hidden fees that could diminish their profits. Below is a comparison of core trading costs:

| Fee Type | Fruitful | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Structure | No Commission | Varies |

| Overnight Interest Range | 0.5% | 0.5% |

While the spread on major currency pairs at Fruitful may be slightly higher than the industry average, the absence of commission fees can be appealing for frequent traders. Nonetheless, it is essential to scrutinize the overnight interest rates and any other potential costs that could arise, as they may not be immediately apparent.

Customer Fund Safety

The safety of customer funds is paramount for any trading platform. Fruitful claims to implement stringent measures to protect client funds, including segregated accounts and investor protection policies. Segregation of funds is crucial as it ensures that client money is kept separate from the company's operational funds, minimizing the risk of loss in case of insolvency.

Furthermore, the platform reportedly offers negative balance protection, which can safeguard traders from losing more than their initial investment. However, it is vital to investigate any historical incidents of fund security breaches or client complaints regarding fund access. A broker's track record in managing client funds effectively is a key indicator of its reliability.

Customer Experience and Complaints

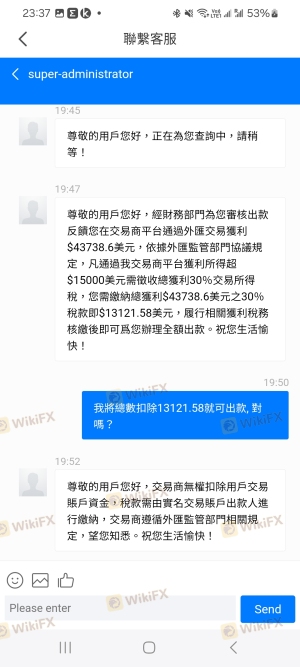

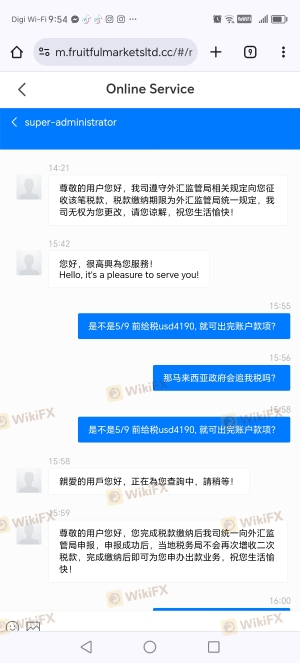

Customer feedback provides valuable insights into a broker's operational effectiveness and service quality. Reviews of Fruitful indicate a mixed bag of experiences. While some users praise the platform for its user-friendly interface and responsive customer service, others express concerns regarding delayed withdrawals and lack of communication.

Common complaint patterns include:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Poor Customer Service | Medium | Adequate response |

| Transparency Issues | High | No clear resolution |

A couple of notable cases highlight these issues. One user reported a significant delay in processing a withdrawal request, leading to frustration and concern over fund safety. Another trader expressed dissatisfaction with the lack of timely responses from customer support, particularly during critical trading periods. These experiences raise red flags about the company's responsiveness and reliability.

Platform and Trade Execution

The performance of a trading platform is critical for traders. Fruitful's platform has been described as stable and intuitive, with a focus on providing a seamless user experience. However, the quality of trade execution is equally important. Reports of slippage and order rejections can significantly impact trading outcomes.

An analysis of execution quality reveals that while most trades are executed promptly, instances of slippage have been noted, particularly during volatile market conditions. This raises concerns about the platform's ability to handle high-frequency trading effectively. Additionally, any indications of potential market manipulation should be closely monitored, as they can signal deeper issues within the brokerage's operational practices.

Risk Assessment

Engaging with any trading platform carries inherent risks. A comprehensive risk assessment of Fruitful reveals several areas of concern that traders should be aware of:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | Potential for compliance issues |

| Fund Safety | Medium | Historical concerns regarding withdrawals |

| Customer Service | High | Frequent complaints about responsiveness |

| Platform Stability | Medium | Occasional slippage reported |

To mitigate these risks, traders are advised to start with smaller investments, utilize demo accounts for practice, and maintain open lines of communication with customer support.

Conclusion and Recommendations

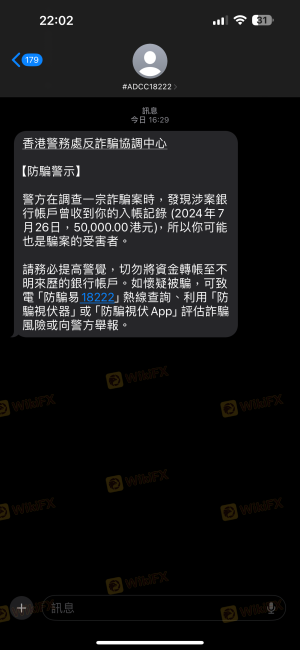

In conclusion, while Fruitful presents itself as a legitimate trading platform, several factors warrant caution. The regulatory oversight by the SEC is a positive sign, but the company's relatively short operational history and mixed customer feedback raise concerns. Traders should be vigilant about the potential for hidden fees, the safety of their funds, and the quality of customer service.

For those considering using Fruitful, it may be wise to approach with caution, particularly if you are a novice trader. Starting with a smaller investment and thoroughly testing the platform's capabilities can help mitigate risks. Additionally, traders seeking more established alternatives may consider brokers with a longer track record of reliability and customer satisfaction.

Is Fruitful a scam, or is it legit?

The latest exposure and evaluation content of Fruitful brokers.

Fruitful Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Fruitful latest industry rating score is 1.29, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.29 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.