Regarding the legitimacy of HXGJ forex brokers, it provides FCA and WikiBit, .

Is HXGJ safe?

Pros

Cons

Is HXGJ markets regulated?

The regulatory license is the strongest proof.

FCA Derivatives Trading License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

MFM Unit Trust Managers Limited

Effective Date:

2001-12-01Email Address of Licensed Institution:

enquiries@marlboroughfunds.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

2021-07-18Address of Licensed Institution:

MarlborouGh House 59 Chorley New Road BolTon Lancs BL1 4QP UNITED KINGDOMPhone Number of Licensed Institution:

44 01204380060Licensed Institution Certified Documents:

Is Hxgj Safe or Scam?

Introduction

Hxgj, a Hong Kong-based forex broker established in 2018, has garnered attention in the foreign exchange market for its trading services. However, with the rise of online trading platforms, traders are increasingly advised to exercise caution when selecting a broker. The potential for scams in the forex market is significant, making it essential for traders to thoroughly evaluate brokers before committing their funds. This article aims to provide an objective analysis of whether Hxgj is a safe broker or a potential scam, utilizing a comprehensive investigation framework that includes regulatory status, company background, trading conditions, client fund security, customer experiences, and risk assessments.

Regulatory and Legitimacy

The regulatory status of a broker is a critical factor in determining its legitimacy and safety for traders. In the case of Hxgj, it is important to note that it claims to be regulated; however, it has been identified as a "suspicious clone" of other regulated entities. The Financial Conduct Authority (FCA) in the UK has flagged Hxgj, indicating that it operates without proper licensing. Below is a summary of the regulatory information for Hxgj:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | Not Applicable | Hong Kong | Suspicious Clone |

The lack of a legitimate regulatory license raises significant concerns about Hxgj's operations. Regulatory bodies are crucial in ensuring that brokers adhere to strict guidelines designed to protect traders. Hxgj's classification as a suspicious clone suggests that it may not operate with the same oversight as legitimate brokers, which could expose traders to risks such as fraud or mismanagement of funds. Furthermore, while there have been no negative regulatory disclosures found during the evaluation, the overall low score of 1.51 out of 10 from WikiFX underscores the need for caution when considering Hxgj as a trading option.

Company Background Investigation

Understanding the background of Hxgj is essential in assessing its credibility. Established in 2018, Hxgj operates under the name 和讯国际 and is based in Hong Kong. However, the broker's relatively short history raises questions about its stability and track record. The management team behind Hxgj and their professional experience are also crucial components of its operational integrity. Unfortunately, there is limited publicly available information about the management team, which diminishes the transparency of the broker.

Moreover, the ownership structure of Hxgj remains unclear, contributing to an overall lack of transparency. A reputable broker typically provides detailed information about its ownership and management, allowing potential clients to assess their qualifications and experience. The absence of such information about Hxgj is concerning, as it suggests a potential lack of accountability. In the context of assessing whether Hxgj is safe, the transparency and credibility of its company background are critical factors that traders should consider.

Trading Conditions Analysis

When evaluating a forex broker, the trading conditions it offers can significantly impact a trader's experience. Hxgj's overall fee structure and trading conditions require careful examination. Notably, traders have reported issues with withdrawal processes, including complaints about being unable to withdraw funds from their accounts. Such issues raise red flags about the broker's reliability and operational practices.

| Fee Type | Hxgj | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.3 pips | 1.0 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | High | Moderate |

The comparison of Hxgj's trading costs against industry averages indicates that while the spread may be competitive, the potential for hidden fees or unfavorable commission structures could exist. Additionally, traders should be wary of any unusual fee policies that may not align with industry standards. The lack of clarity regarding commission structures and potential hidden fees can create a challenging trading environment, further supporting the notion that traders should approach Hxgj with caution.

Client Fund Security

The safety of client funds is paramount when evaluating a forex broker. Hxgj's measures for ensuring fund security, such as fund segregation and investor protection policies, are critical aspects to consider. However, reviews indicate that Hxgj does not provide adequate information regarding its fund protection measures. Traders should be aware that if a broker lacks transparency about how it safeguards client funds, this could be a significant indicator of potential risks.

In terms of historical issues, there have been reports of clients experiencing difficulties in withdrawing funds, which raises concerns about the broker's financial practices. Effective fund security measures typically include segregated accounts to ensure that client funds are protected in the event of the broker's insolvency. However, without clear policies in place, traders may find themselves vulnerable to financial loss. Overall, the lack of information on fund security measures at Hxgj suggests a need for caution, as it may not provide the necessary protections for traders' investments.

Customer Experience and Complaints

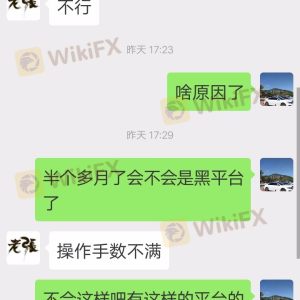

Examining customer feedback is essential in understanding the real-world experiences of traders using Hxgj. Common complaints about the broker include issues with withdrawal processes, unresponsive customer service, and difficulties in executing trades. These complaints highlight potential systemic issues within the broker's operations, which could indicate a lack of commitment to customer satisfaction.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Poor |

| Execution Delays | High | Poor |

Case studies of individual complaints reveal troubling patterns. For instance, one trader reported being urged to enter trades without setting stop losses, ultimately leading to forced liquidations. Such practices not only reflect poorly on the broker's advisory services but also raise ethical questions about its operational integrity. The prevalence of these complaints suggests that Hxgj may not be adequately addressing client concerns, which is a critical factor when determining whether Hxgj is safe for trading.

Platform and Trade Execution

The performance and reliability of a trading platform are crucial for a positive trading experience. Hxgj's platform has been reported to experience issues with stability and execution quality. Traders have noted instances of slippage and order rejections, which can significantly impact trading outcomes. The quality of trade execution is a vital aspect of a broker's service, and any signs of manipulation or poor execution practices can lead to distrust among traders.

Moreover, the absence of robust user feedback regarding the platform's performance raises concerns about its overall reliability. Traders should be wary of platforms that do not provide clear evidence of effective execution and user satisfaction. Given the reported issues with Hxgj's platform, it is important for potential clients to consider these factors carefully when evaluating whether Hxgj is a safe broker to engage with.

Risk Assessment

When assessing the overall risk associated with using Hxgj, several key factors emerge. The broker's regulatory status, client fund security measures, and customer feedback all contribute to its risk profile. Traders should be aware of the potential for significant risks when engaging with unregulated or suspicious brokers.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Lacks legitimate regulatory oversight |

| Fund Security | High | Insufficient information on fund protection |

| Customer Service | Medium | Poor response to client complaints |

To mitigate these risks, traders are advised to conduct thorough research before engaging with Hxgj. It is crucial to remain vigilant and consider alternative brokers that offer better regulatory oversight and proven track records of client satisfaction.

Conclusion and Recommendations

In conclusion, the analysis suggests that Hxgj raises several red flags that warrant caution. The broker's lack of legitimate regulatory oversight, insufficient information on fund security, and numerous customer complaints indicate potential risks that traders should be aware of. While there are no definitive signs of outright fraud, the combination of these factors suggests that traders should exercise extreme caution when considering Hxgj as a trading option.

For traders seeking safer alternatives, it is recommended to explore brokers that are regulated by reputable authorities, have transparent operations, and demonstrate a commitment to customer service. Brokers with a strong track record of client satisfaction and robust security measures are essential for ensuring a safe trading environment. Overall, it is crucial for traders to prioritize their safety and conduct thorough due diligence when selecting a forex broker.

Is HXGJ a scam, or is it legit?

The latest exposure and evaluation content of HXGJ brokers.

HXGJ Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HXGJ latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.