Is FAIR MARKETS safe?

Pros

Cons

Is Fairmarkets A Scam?

Introduction

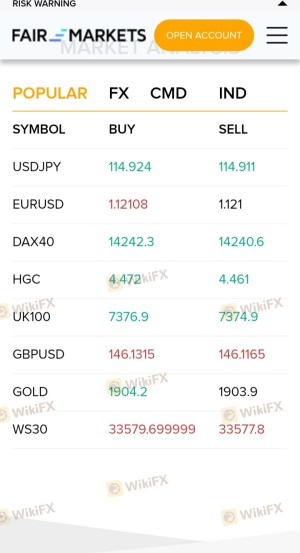

Fairmarkets, a forex and CFD broker, has emerged in recent years as a player in the online trading space. Operating under the banner of Fairmarkets International Ltd, the broker offers a range of trading instruments, including forex, commodities, and cryptocurrencies. However, as with any financial platform, traders must exercise caution and conduct thorough due diligence before investing their hard-earned money. The forex market is rife with unregulated and potentially fraudulent brokers, making it crucial for traders to evaluate the legitimacy of their chosen platforms. This article aims to provide a comprehensive analysis of Fairmarkets, utilizing data from regulatory sources, user reviews, and industry benchmarks to assess its safety and reliability.

Regulation and Legitimacy

Understanding the regulatory framework within which Fairmarkets operates is essential for assessing its legitimacy. Fairmarkets claims to be regulated by the Mauritius Financial Services Commission (FSC) and the Australian Securities and Investments Commission (ASIC). Regulation is a key factor in ensuring that brokers adhere to specific standards of conduct, providing a layer of protection for traders.

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| FSC | GB21026295 | Mauritius | Verified |

| ASIC | Not specified | Australia | Verified |

While Fairmarkets holds a license from the FSC, the quality of this regulation is often questioned. The FSC is not regarded as a top-tier regulatory authority compared to ASIC or the UK's FCA. Traders should be aware that regulation in offshore jurisdictions like Mauritius may not provide the same level of investor protection. Furthermore, there have been no significant compliance issues reported with Fairmarkets, but its relatively short operational history raises concerns about its long-term reliability.

Company Background Investigation

Fairmarkets International Ltd was established in 2021, under the ownership of Trive Investment B.V., a Netherlands-based company. The broker operates from Mauritius, a location known for its favorable tax regulations for financial services. The management team behind Fairmarkets consists of professionals with experience in finance and trading, but specific details about their backgrounds and qualifications remain sparse. This lack of transparency can be a red flag for potential investors.

The company's information disclosure level is somewhat limited, which can hinder investors' ability to make informed decisions. While the broker claims to prioritize customer service and user experience, the absence of comprehensive information about its management and operational practices raises questions about its commitment to transparency.

Trading Conditions Analysis

Fairmarkets offers a variety of trading accounts, each with different fee structures and trading conditions. The broker's overall fee model is designed to attract both novice and experienced traders. However, it is essential to scrutinize any unusual fees that may not be immediately apparent.

| Fee Type | Fairmarkets | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | 1.2 - 1.8 pips | 0.5 - 1.0 pips |

| Commission Model | $10 per lot (Raw Zero account) | Varies by broker |

| Overnight Interest Range | Varies | Varies |

While Fairmarkets advertises competitive spreads, some users have reported discrepancies between the advertised rates and the actual spreads they experienced. Additionally, the $10 per lot commission on the Raw Zero account may deter some traders, especially when compared to other brokers offering commission-free trading options.

Client Fund Security

The safety of client funds is paramount when choosing a broker. Fairmarkets claims to implement several measures to protect client assets, including segregated accounts and negative balance protection. Segregation of client funds is a critical practice that ensures traders' money is kept separate from the broker's operational funds, minimizing the risk of loss in the event of insolvency.

However, the effectiveness of these measures can vary depending on the regulatory environment. While Fairmarkets is regulated by the FSC, it is essential to consider the quality of this oversight. Historical issues with fund security have not been reported, but the broker's offshore status may expose clients to additional risks.

Customer Experience and Complaints

Analyzing customer feedback is crucial for understanding the overall trading experience with Fairmarkets. User reviews present a mixed picture, with some traders praising the platform's ease of use and customer support, while others express dissatisfaction with withdrawal processes and execution speed.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Slow Withdrawal Times | High | Delayed response |

| High Spreads | Medium | Acknowledged but not addressed |

| Customer Service Quality | Medium | Varied responses |

For instance, one user reported significant delays in withdrawing funds, which is a common concern among traders dealing with offshore brokers. Another trader mentioned issues with high spreads during volatile market conditions, which were not aligned with the broker's marketing claims. These complaints highlight the importance of assessing user feedback when determining whether Fairmarkets is safe or a scam.

Platform and Execution

The trading platform offered by Fairmarkets is primarily based on the widely-used MetaTrader 4 and MetaTrader 5, which are known for their reliability and advanced trading features. However, the quality of order execution is a critical aspect that can significantly impact a trader's experience. Reports of slippage and order rejections have surfaced, raising concerns about the platform's performance during high volatility.

Traders have noted instances of significant slippage during critical market events, which can lead to unexpected losses. Such occurrences may indicate potential manipulation or inadequate liquidity, further complicating the assessment of whether Fairmarkets is a trustworthy broker.

Risk Assessment

Engaging with Fairmarkets comes with inherent risks that traders must consider. While the broker offers a range of trading instruments and competitive conditions, the lack of robust regulatory oversight and mixed customer feedback raises concerns.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Offshore regulation may not provide adequate protection. |

| Withdrawal Risk | Medium | Reports of slow withdrawal processing times. |

| Execution Risk | Medium | Instances of slippage and order rejections reported. |

To mitigate these risks, traders should approach Fairmarkets with caution. It is advisable to start with a small investment, utilize demo accounts to test the platform, and always have a clear risk management strategy in place.

Conclusion and Recommendations

In conclusion, the investigation into Fairmarkets reveals a broker that operates in a grey area of the forex market. While it holds regulatory licenses from the FSC and ASIC, the quality of these regulations is questionable, and the broker's offshore status raises concerns about the safety of client funds. Customer feedback is mixed, with significant complaints regarding withdrawal processes and execution quality.

Given these findings, it is prudent for traders to exercise caution when considering Fairmarkets. While the broker may offer attractive trading conditions, the potential risks involved suggest that it may not be the most reliable option for all traders. For those seeking a safer trading environment, it would be advisable to consider alternative brokers with stronger regulatory oversight and a more established reputation in the industry.

Is FAIR MARKETS a scam, or is it legit?

The latest exposure and evaluation content of FAIR MARKETS brokers.

FAIR MARKETS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FAIR MARKETS latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.