FairMarkets 2025 Review: Everything You Need to Know

Summary

FairMarkets is an Australian-based forex and CFD broker. It has been operating since 2019 under the regulation of the Australian Securities and Investments Commission. Operated by Fairmarkets Trading Pty Ltd, this fairmarkets review reveals a platform designed to serve both retail and professional traders seeking access to international financial markets. The broker offers a wide range of trading tools including forex pairs, stocks, commodities, indices, and cryptocurrencies. It positions itself as a multi-asset trading destination.

The platform mainly targets traders who want regulated access to global markets with competitive trading conditions. FairMarkets has built its place in the competitive Australian financial services sector, focusing on providing clear trading environments backed by strong regulatory oversight. According to available information, the company has built its reputation on offering diverse trading opportunities while maintaining compliance with ASIC's strict regulatory requirements, which include client fund separation and following professional conduct standards.

Important Notice

This review is based on publicly available information from FairMarkets and user feedback collected from various sources. Trading with FairMarkets involves significant risk. Potential clients should know that regulatory requirements may vary depending on their location. While FairMarkets operates under ASIC regulation in Australia, traders from different regions should verify the applicable legal framework in their respective countries before opening an account. The information presented in this review is current as of 2025 and may be subject to changes in the broker's terms, conditions, or regulatory status.

Rating Framework

Broker Overview

Company Foundation and Structure

FairMarkets was established in 2019 as a subsidiary of Fairmarkets Trading Pty Ltd. Its headquarters are based in Australia. The company entered the competitive forex and CFD market during a period of increased regulatory scrutiny, positioning itself as a compliant and transparent broker from the start. The business model centers around providing retail and professional traders with access to global financial markets through advanced trading platforms. It mainly focuses on the Australian market while maintaining international access.

The broker's operational framework emphasizes regulatory compliance and client protection. It operates under the strict oversight of ASIC. This regulatory foundation has enabled FairMarkets to build trust within the trading community, particularly among Australian traders who prioritize regulatory security. The company's approach combines traditional forex trading with modern multi-asset offerings, reflecting the evolving demands of contemporary traders who seek diversified investment opportunities beyond currency pairs.

Trading Platform and Asset Coverage

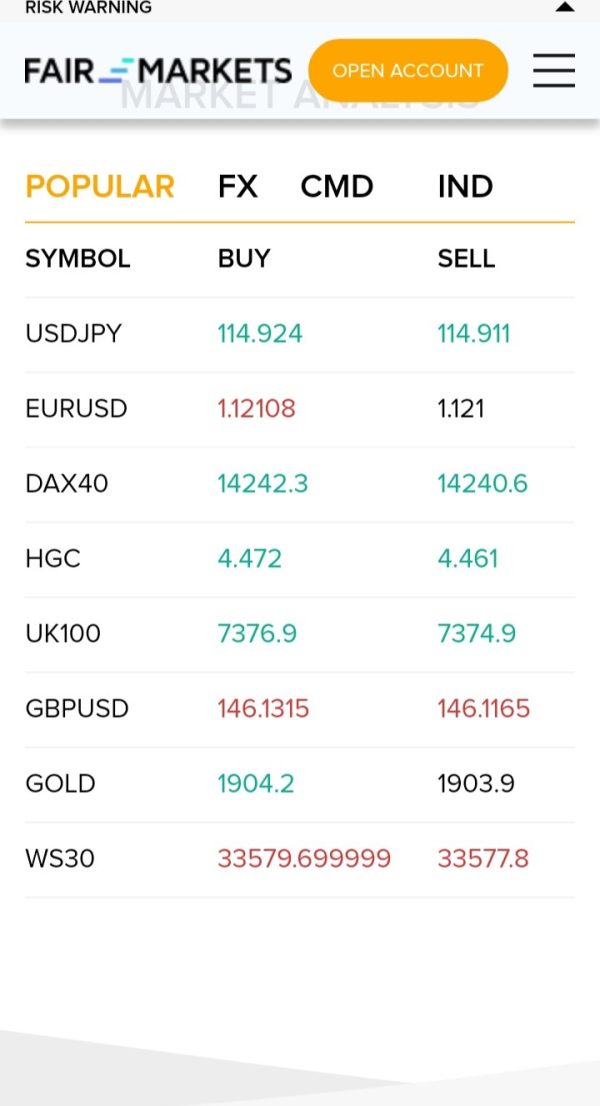

FairMarkets provides access to industry-standard trading platforms, including MetaTrader 4 and MetaTrader 5. These platforms are widely recognized for their reliability and comprehensive trading tools. The broker supports trading across multiple asset classes, offering forex pairs, individual stocks, commodities, major indices, and cryptocurrency instruments. This diverse asset selection positions FairMarkets as a comprehensive trading destination rather than a specialized forex-only provider. It appeals to traders who prefer to manage multiple positions across different markets from a single account.

Regulatory Environment

FairMarkets operates under the supervision of the Australian Securities and Investments Commission. ASIC is one of the most respected regulatory bodies in the global financial services industry. This regulatory framework ensures client fund separation, fair trading practices, and following professional conduct standards.

Deposit and Withdrawal Methods

Specific information regarding deposit and withdrawal methods is not extensively detailed in available public sources. Traders interested in funding options should contact FairMarkets directly for comprehensive information about supported payment methods and processing times.

Minimum Deposit Requirements

The exact minimum deposit requirements for different account types are not clearly specified in publicly available information. Potential clients should verify current minimum deposit standards directly with the broker.

Promotional Offers

Details about current bonus structures or promotional campaigns are not prominently featured in available materials. Traders seeking information about welcome bonuses or ongoing promotions should inquire directly with FairMarkets customer service.

Available Trading Assets

FairMarkets supports trading across forex currency pairs, individual stocks from major exchanges, commodity instruments including precious metals and energy products, global indices, and cryptocurrency assets. This fairmarkets review indicates a comprehensive multi-asset approach to trading.

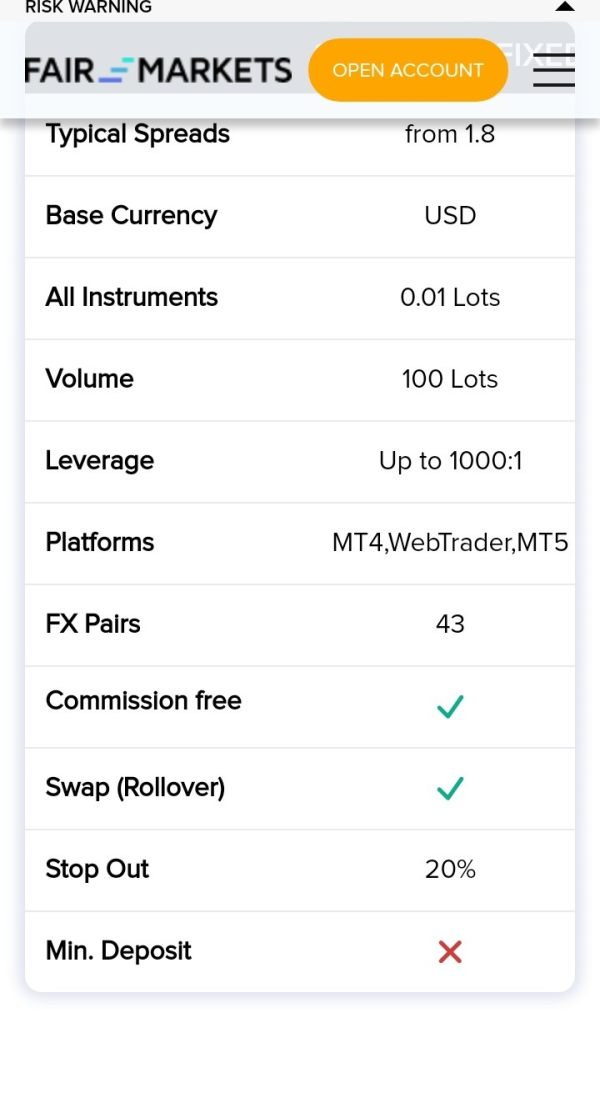

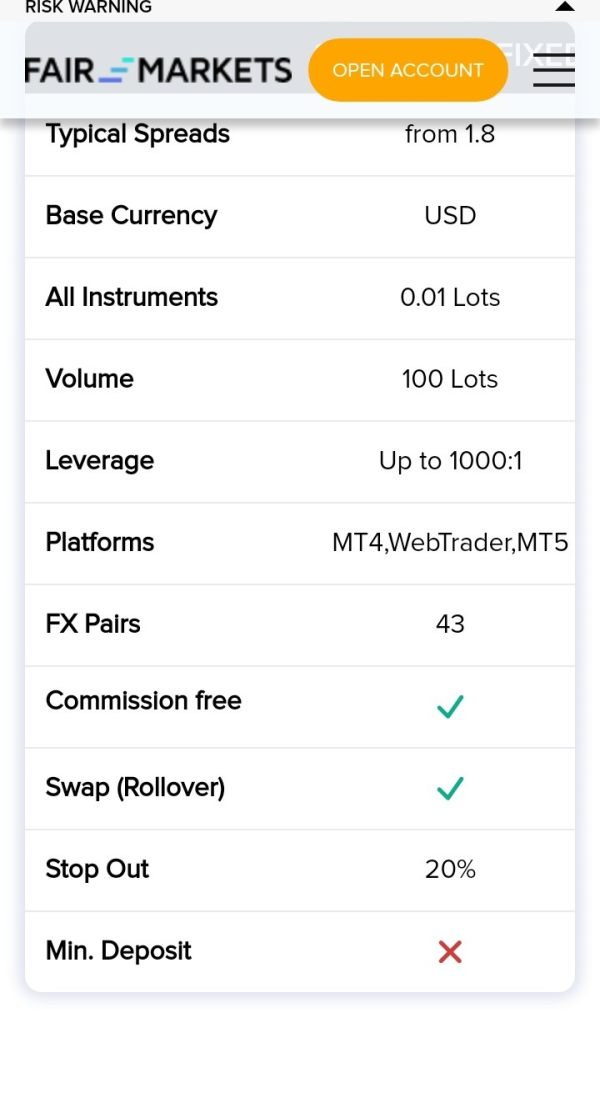

Cost Structure

Specific information about spreads, commissions, and other trading costs is not detailed in readily available sources. Traders should request current pricing information directly from the broker to understand the complete cost structure.

Leverage Ratios

Leverage information for different account types and asset classes is not specifically outlined in available public materials.

Platform Options

The broker supports MetaTrader 4 and MetaTrader 5 platforms. These provide traders with access to advanced charting tools, automated trading capabilities, and comprehensive market analysis features.

Geographic Restrictions

Specific information about geographic restrictions or country limitations is not clearly detailed in available sources.

Customer Support Languages

The range of languages supported by FairMarkets customer service is not extensively documented in publicly available information.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions offered by FairMarkets present a mixed picture based on available information. While the broker operates under ASIC regulation, which typically ensures competitive account structures, specific details about account types, minimum deposits, and account features are not well documented in public sources. This lack of clear information about account conditions represents a significant limitation for potential clients seeking to compare FairMarkets with other brokers in the market.

From a regulatory perspective, ASIC oversight suggests that account conditions likely meet industry standards for client protection and fair trading practices. However, the absence of clear information about different account tiers, their respective benefits, and qualification requirements makes it challenging for traders to assess whether FairMarkets aligns with their specific trading needs. The broker would benefit from providing more transparent account information to help potential clients make informed decisions.

Account Opening Process

Limited information is available regarding the account opening process, verification requirements, and timeframes for account activation. This fairmarkets review suggests that potential clients should contact the broker directly for detailed account opening procedures and requirements.

FairMarkets demonstrates strength in its multi-asset trading approach. It offers access to forex, stocks, commodities, indices, and cryptocurrencies. This diverse asset selection provides traders with opportunities to diversify their portfolios and explore different market sectors from a single trading account. The inclusion of cryptocurrency trading reflects the broker's adaptation to evolving market demands and trader preferences for digital asset exposure.

The platform's support for MetaTrader 4 and MetaTrader 5 ensures that traders have access to professional-grade trading tools. These include advanced charting capabilities, technical analysis indicators, and automated trading through Expert Advisors. These platforms are industry standards that provide reliable execution and comprehensive market analysis tools essential for both novice and experienced traders.

However, specific information about additional research resources, market analysis, educational materials, or proprietary trading tools is not extensively documented. The broker could enhance its value proposition by providing more detailed information about supplementary resources that support trader development and market analysis capabilities beyond the standard platform offerings.

Customer Service and Support Analysis

Information regarding FairMarkets' customer service quality, availability, and support channels is limited in publicly available sources. While ASIC regulation typically requires brokers to maintain professional customer service standards, specific details about response times, support languages, available contact methods, and service hours are not clearly documented.

The absence of comprehensive customer service information represents a transparency gap that potential clients may find concerning when evaluating broker options. Professional customer support is crucial for traders, particularly during market volatility or technical issues, and the lack of detailed support information makes it difficult to assess FairMarkets' commitment to client service.

Effective customer support should include multiple contact channels, reasonable response times, knowledgeable staff, and availability during key market hours. Without specific information about these service aspects, traders cannot adequately evaluate whether FairMarkets meets their support expectations and requirements.

Trading Experience Analysis

The trading experience offered by FairMarkets centers around the MetaTrader 4 and MetaTrader 5 platforms. These are widely recognized for their stability, functionality, and comprehensive trading capabilities. These platforms provide traders with access to advanced order types, real-time market data, technical analysis tools, and automated trading options through Expert Advisors.

The multi-asset trading environment enables traders to access various markets from a single platform. This potentially improves trading efficiency and portfolio management capabilities. The combination of forex, stocks, commodities, indices, and cryptocurrencies provides flexibility for traders who prefer to diversify across different asset classes based on market conditions and opportunities.

However, specific information about execution speeds, platform stability during high-volatility periods, mobile trading capabilities, and any proprietary platform enhancements is not extensively documented. This fairmarkets review indicates that while the foundation for a solid trading experience exists through established platforms, additional details about performance metrics and user experience would strengthen the evaluation.

Trust Factor Analysis

FairMarkets demonstrates strong credentials in terms of regulatory oversight. It operates under ASIC supervision since its establishment in 2019. ASIC regulation provides significant client protections, including mandatory fund separation, compensation schemes, and following strict operational standards. This regulatory framework enhances the broker's trustworthiness and provides clients with recourse mechanisms in case of disputes.

The company's establishment as Fairmarkets Trading Pty Ltd provides corporate transparency. Its operation within Australia's well-developed financial regulatory environment adds credibility. ASIC's reputation as a strict regulator means that FairMarkets must maintain high operational standards and comply with ongoing regulatory requirements.

However, limited information about the company's track record, client testimonials, industry recognition, or third-party evaluations makes it challenging to assess broader market reputation beyond regulatory compliance. Additional transparency about company performance, client satisfaction metrics, and industry standing would further enhance the trust factor evaluation.

User Experience Analysis

User experience evaluation for FairMarkets is limited by the availability of comprehensive user feedback and detailed platform usability information. While the broker offers established trading platforms through MetaTrader 4 and MetaTrader 5, specific insights about user interface design, account management processes, and overall client satisfaction are not extensively documented in available sources.

The multi-asset trading approach potentially enhances user experience by providing diverse trading opportunities within a unified platform environment. However, without detailed user testimonials, usability studies, or comprehensive feedback analysis, it's difficult to assess how well FairMarkets delivers on user expectations regarding platform performance, customer service responsiveness, and overall trading satisfaction.

Areas that typically impact user experience include account opening efficiency, platform reliability, customer support quality, and withdrawal processing times. The limited availability of specific user experience data suggests that potential clients should seek direct feedback from current users or request demo accounts to evaluate the platform's suitability for their trading requirements.

Conclusion

FairMarkets presents itself as a regulated broker with solid regulatory foundations under ASIC oversight. It offers multi-asset trading opportunities through established MetaTrader platforms. The broker's strength lies in its regulatory compliance and diverse asset selection, making it potentially suitable for traders seeking regulated access to international markets with portfolio diversification capabilities.

However, this evaluation reveals significant information gaps regarding specific account conditions, customer service quality, and detailed user experiences. While regulatory oversight provides confidence in operational standards, the limited transparency about trading conditions, costs, and service features presents challenges for potential clients seeking comprehensive broker comparisons. Traders considering FairMarkets should conduct direct inquiries to obtain detailed information about account requirements, trading costs, and service capabilities before making final decisions.