Is Neuko safe?

Pros

Cons

Is Neuko Safe or Scam?

Introduction

Neuko is a relatively new player in the forex market, having been established in 2021 and operating out of Saint Vincent and the Grenadines. As with any forex broker, traders must exercise caution and conduct thorough due diligence before committing their funds. The forex market is notoriously volatile, and the presence of unregulated or poorly regulated brokers can pose significant risks to traders. This article aims to assess whether Neuko is a safe trading option or if it raises red flags that potential clients should be aware of. Our investigation is based on a review of various credible sources, including regulatory bodies, user feedback, and expert analyses, to provide a comprehensive evaluation of Neuko's operations.

Regulation and Legitimacy

The regulation of a forex broker is one of the most critical aspects that determine its legitimacy and safety. Neuko is currently operating without proper regulation, which raises concerns about its reliability and the safety of client funds. The absence of oversight from reputable regulatory authorities can expose traders to potential fraud, mismanagement, and other risks. Below is a summary of Neuko's regulatory status:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of regulation means that Neuko does not adhere to the strict standards that regulated brokers must follow. This includes transparency in operations, safeguarding client funds, and providing clear recourse in the event of disputes. Additionally, the absence of regulatory history raises questions about the broker's compliance with industry norms. Overall, the unregulated status of Neuko is a significant red flag for potential traders, making it imperative to question Is Neuko safe?

Company Background Investigation

Neuko was founded in 2021 and is headquartered in Saint Vincent and the Grenadines. The company's ownership structure and history are not well-documented, which contributes to the uncertainty surrounding its operations. A review of available information reveals that the management team lacks publicly available credentials, making it challenging to assess their expertise and experience in the forex trading industry.

Transparency is vital for any financial institution, and Neuko's limited disclosure raises concerns. Potential clients should be wary of companies that do not provide clear information about their ownership, management, and operational history. The obscure nature of Neuko's background further complicates the question of whether Is Neuko safe? Traders are encouraged to seek brokers with a well-established history and transparent practices to mitigate risks.

Trading Conditions Analysis

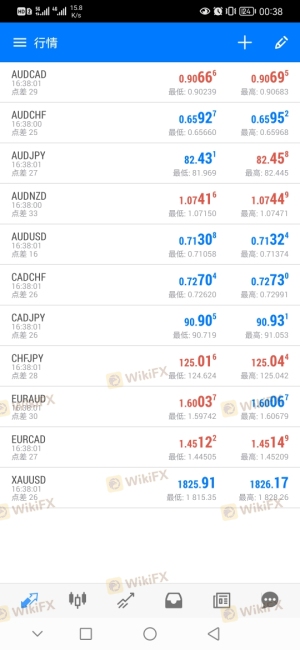

Understanding the trading conditions offered by Neuko is crucial for evaluating its overall appeal and safety. Neuko provides access to various financial instruments, including forex, CFDs, and commodities. However, the cost structure associated with trading on Neuko's platform is a point of concern. The broker's fees and spreads may not be competitive compared to industry standards, which can significantly impact traders' profitability.

| Fee Type | Neuko | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Low to Moderate |

The absence of commissions may seem appealing, but high spreads can make trading costly in the long run. Traders should also be aware of any hidden fees that may not be immediately apparent. This lack of clarity could lead to unexpected costs, raising further questions about the broker's integrity. Therefore, it is essential to consider whether Is Neuko safe? when evaluating its trading conditions.

Client Fund Safety

The safety of client funds is paramount in the forex trading industry. Neuko's unregulated status raises significant concerns regarding its fund protection measures. A reputable broker typically implements strict policies for fund segregation, investor protection, and negative balance protection. However, Neuko does not provide clear information regarding these safety measures, which is alarming for potential clients.

Without robust fund safety protocols, clients risk losing their investments in the event of financial mismanagement or insolvency. Historical issues related to fund security can exacerbate these risks. Given the lack of information on Neuko's fund safety measures, it is crucial for traders to consider if Is Neuko safe? and to weigh the potential risks against their investment goals.

Customer Experience and Complaints

Evaluating customer feedback is essential to understanding a broker's reputation and reliability. Reviews of Neuko indicate a mixed bag of experiences, with some users expressing dissatisfaction over withdrawal processes and customer service. Common complaints include difficulties in accessing funds and inadequate responses from support staff.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Average |

Two notable cases involve clients who reported being unable to withdraw their funds despite having met all requirements. This raises significant concerns about the broker's operational integrity. Such issues could lead traders to question whether Is Neuko safe? given the potential for financial loss and frustration.

Platform and Execution

The trading platform's performance is another critical factor in assessing a broker's reliability. Neuko offers access to popular trading platforms like MetaTrader 4 and 5, which are known for their user-friendly interfaces and robust features. However, the execution quality, including slippage and rejection rates, is crucial for traders relying on timely trades.

Traders have reported varying experiences with execution speed on Neuko, with some noting delays that could affect trade outcomes. Additionally, any signs of platform manipulation should be taken seriously, as they can indicate deeper issues within the brokerage. Thus, it is essential to consider Is Neuko safe? when evaluating the platform's reliability.

Risk Assessment

Using Neuko as a trading platform comes with inherent risks, primarily due to its unregulated status and the associated concerns regarding fund safety and customer support. Below is a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker, high fraud risk |

| Fund Safety Risk | High | Lack of fund segregation policies |

| Customer Service Risk | Medium | Mixed feedback on support quality |

To mitigate these risks, traders should consider using only regulated brokers with robust fund protection measures and responsive customer service. Additionally, thorough research and caution are essential when dealing with any broker, especially one like Neuko.

Conclusion and Recommendations

In summary, the evidence suggests that Neuko presents several red flags that warrant caution. Its unregulated status, lack of transparency, and mixed customer feedback raise significant concerns about its safety and reliability. Therefore, potential traders should carefully consider whether Is Neuko safe? before proceeding.

For traders seeking a more secure trading environment, we recommend exploring options with well-established, regulated brokers that offer transparent operations and robust customer support. Brokers such as Forex.com, OANDA, and IG are examples of companies with strong regulatory oversight and positive user experiences. Ultimately, ensuring the safety of your investments should be the top priority when selecting a forex broker.

Is Neuko a scam, or is it legit?

The latest exposure and evaluation content of Neuko brokers.

Neuko Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Neuko latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.