Is Nexus P Capital safe?

Pros

Cons

Is Nexus P Capital A Scam?

Introduction

Nexus P Capital is an online brokerage firm that claims to provide a diverse range of trading options, including forex, commodities, and cryptocurrencies. Positioned as a player in the competitive forex market, Nexus P Capital attracts traders with its promises of high leverage and a user-friendly trading platform. However, potential investors need to exercise caution when evaluating any forex broker, as the industry is rife with scams and unregulated entities. This article aims to provide a comprehensive analysis of Nexus P Capital by examining its regulatory status, company background, trading conditions, customer experiences, and overall safety. Our investigation is based on a review of multiple sources, including user feedback, regulatory warnings, and industry assessments.

Regulation and Legitimacy

One of the primary factors in determining whether a broker like Nexus P Capital is safe to trade with is its regulatory status. Regulatory bodies play a crucial role in ensuring that brokers adhere to strict standards of conduct, protecting investors' funds and interests. Unfortunately, Nexus P Capital lacks regulation from any recognized financial authority, making it a significant risk for traders.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that there are no safeguards in place to protect traders' funds. The broker's operations under the laws of St. Vincent and the Grenadines, a jurisdiction known for its lax regulatory framework, further exacerbate concerns about its legitimacy. As a result, it is essential to approach Nexus P Capital with caution, as the lack of oversight raises red flags regarding its operational integrity and the safety of clients' investments.

Company Background Investigation

Nexus P Capital is operated by GK Marketing Limited, a company that does not provide sufficient information about its ownership or management team. This lack of transparency is concerning, as it prevents potential clients from understanding who is behind the broker and what qualifications they possess. The company's history is relatively short, having been established in 2020, which raises further doubts about its reliability and experience in the industry.

A broker's management team plays a critical role in its operations, and the absence of publicly available information about Nexus P Capital's management is a significant drawback. Without details regarding the professionals running the broker, potential clients cannot assess the team's expertise or track record in the financial markets. Overall, the opacity surrounding Nexus P Capital's corporate structure and management raises questions about its trustworthiness and operational practices.

Trading Conditions Analysis

When evaluating whether Nexus P Capital is safe, examining its trading conditions is vital. The broker offers various account types with different leverage options, but the overall fee structure seems to be less favorable compared to industry standards. Traders should be aware of any unusual fees that could impact their profitability.

| Fee Type | Nexus P Capital | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 2.4 pips | 1.0-1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The spreads offered by Nexus P Capital are notably higher than the industry average, which could significantly affect trading performance. Additionally, the lack of clarity regarding commission structures and overnight interest rates raises further concerns. Traders may find themselves facing unexpected costs that could erode their capital, making it essential to carefully read the terms and conditions before committing any funds.

Customer Fund Safety

The safety of customer funds is a paramount concern when evaluating whether Nexus P Capital is safe. Unfortunately, the broker does not provide adequate measures to protect clients' investments. There are no segregated accounts to ensure that client funds are kept separate from the broker's operating capital, which increases the risk of loss in case of financial instability.

Moreover, Nexus P Capital lacks negative balance protection, meaning that clients could potentially lose more than their initial investment. This poses a significant risk, especially for inexperienced traders who may not fully understand the implications of high leverage and market volatility. The absence of any investor protection schemes further compounds the risk, as clients would have no recourse in the event of a broker insolvency or financial misconduct.

Customer Experience and Complaints

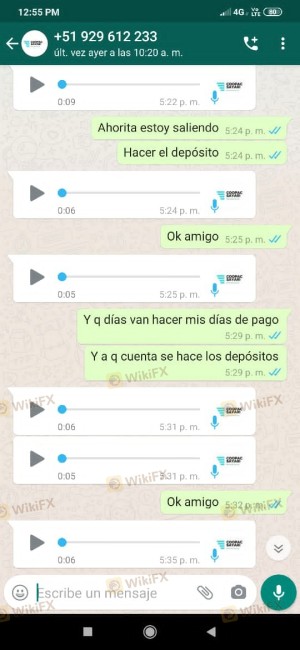

Customer feedback is a valuable resource for assessing the reliability of a broker. Unfortunately, multiple reviews and complaints about Nexus P Capital indicate a pattern of negative experiences among users. Common complaints include difficulties in withdrawing funds, lack of responsive customer support, and issues with account management.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Account Management Issues | Medium | Poor |

| Customer Support Availability | High | Poor |

For instance, several users have reported that their withdrawal requests were either denied or delayed for extended periods, leaving them frustrated and without access to their funds. The company's lack of effective communication and support exacerbates these issues, leading to further dissatisfaction among clients. Such complaints are indicative of deeper operational issues and raise significant concerns about whether Nexus P Capital is safe for trading.

Platform and Trade Execution

The trading platform offered by Nexus P Capital is based on the Sirix web trader, which is known for its user-friendly interface. However, the platform's performance and execution quality are critical factors in determining the overall trading experience. Reports of slippage, order rejections, and platform manipulation have surfaced, leading to further skepticism about the broker's integrity.

Traders have noted that the platform may not always execute orders at the expected prices, which can significantly impact trading outcomes. This type of behavior is often associated with unregulated brokers and raises questions about whether Nexus P Capital can be trusted to provide a fair trading environment.

Risk Assessment

In summary, the overall risk associated with trading with Nexus P Capital is considerable. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation or oversight |

| Fund Safety Risk | High | Lack of segregated accounts and protection |

| Customer Service Risk | Medium | Poor response to complaints |

| Trading Execution Risk | High | Reports of slippage and order rejections |

To mitigate these risks, potential traders should consider using regulated brokers with established reputations. It is advisable to conduct thorough research and ensure that the broker is compliant with industry standards before making any financial commitments.

Conclusion and Recommendations

In conclusion, the analysis of Nexus P Capital raises significant red flags regarding its legitimacy and safety. The broker's lack of regulation, transparency, and poor customer feedback strongly suggest that it may not be a safe option for traders. The absence of investor protection and the high-risk trading environment further compound concerns about potential fraud.

For traders seeking reliable and trustworthy brokers, it is recommended to consider alternatives that are regulated by reputable authorities, such as the FCA or CySEC. These brokers offer greater security and transparency, ensuring that traders' interests are protected. In light of the findings, it is prudent to approach Nexus P Capital with extreme caution, as the risks associated with trading with this broker far outweigh any potential benefits.

Is Nexus P Capital a scam, or is it legit?

The latest exposure and evaluation content of Nexus P Capital brokers.

Nexus P Capital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Nexus P Capital latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.