Is GMZ Global safe?

Pros

Cons

Is GMZ Global Safe or Scam?

Introduction

GMZ Global positions itself as a comprehensive online trading platform, primarily focusing on Contracts for Difference (CFDs) across various asset classes, including forex, commodities, and cryptocurrencies. As the forex market continues to attract traders globally, the need for due diligence when choosing a broker has never been more critical. Traders must navigate a landscape rife with potential scams and unreliable brokers, making it essential to assess the credibility and safety of platforms like GMZ Global. This article aims to provide an objective analysis of GMZ Global, utilizing information gathered from various authoritative sources to evaluate its regulatory status, company background, trading conditions, customer experiences, and overall safety.

Regulation and Legitimacy

One of the most crucial aspects when determining if GMZ Global is safe involves examining its regulatory status. Regulation serves as a protective measure for traders, ensuring that brokers adhere to certain standards of conduct. GMZ Global claims to be regulated by the Anjouan Offshore Finance Authority (AOF), which is essential to understanding its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Anjouan Offshore Finance Authority | L 15739 / XG Ltd | Anjouan, Comoros | Verified |

The Anjouan Offshore Finance Authority is considered a lower-tier regulatory body compared to more stringent regulators like the FCA in the UK or ASIC in Australia. While GMZ Global does hold a license, the quality of oversight and the historical compliance of the broker with regulatory standards remain questionable. Lower-tier regulators often have fewer requirements, which can lead to less protection for traders. Therefore, while GMZ Global is technically regulated, the extent of that regulation may not provide the level of safety that traders expect.

Company Background Investigation

GMZ Global has a relatively short history in the financial services market, having emerged in recent years to cater to the growing demand for online trading. The company is headquartered in London, UK, and claims to have multiple offices worldwide. However, details about its ownership structure and management team remain sparse, which raises questions about transparency.

The management team is reported to have experience in trading and financial services, but specific backgrounds and credentials are not readily available. This lack of information can be a red flag for potential traders who prioritize transparency and a clear understanding of who is managing their funds. A broker's willingness to disclose its management team and corporate structure is often indicative of its overall integrity.

Trading Conditions Analysis

When evaluating whether GMZ Global is safe, analyzing its trading conditions is crucial. The broker offers various account types, each tailored to different trading needs. However, the overall fee structure needs to be scrutinized, as hidden fees can significantly impact a trader's profitability.

| Fee Type | GMZ Global | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1 pip | 1-2 pips |

| Commission Model | Variable | Fixed or Variable |

| Overnight Interest Range | 0.5% - 1.5% | 0.5% - 2% |

While GMZ Global offers competitive spreads, its commission model appears to be variable, which could lead to unexpected costs for traders. Additionally, the overnight interest rates are within the industry average but can vary significantly based on market conditions. Traders should be cautious and read the fine print to avoid unpleasant surprises.

Client Fund Safety

The safety of client funds is paramount when assessing if GMZ Global is safe. The broker claims to implement several protective measures, including segregated accounts for client funds and adherence to anti-money laundering (AML) regulations. These measures are designed to safeguard traders' investments and ensure that funds are not misused.

However, the effectiveness of these measures can only be evaluated through historical performance and any past incidents. Currently, there are no publicly reported cases of significant fund mismanagement or security breaches at GMZ Global, which is a positive sign. Nonetheless, potential traders should remain vigilant and consider the risks associated with trading on platforms that are not regulated by top-tier authorities.

Customer Experience and Complaints

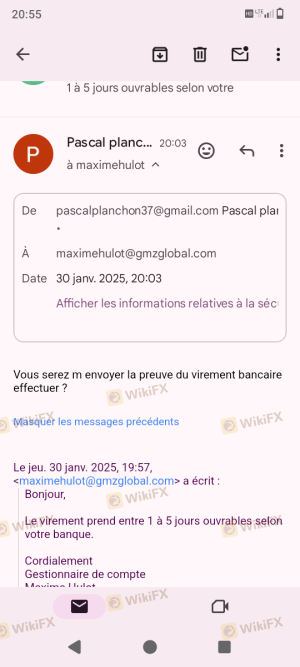

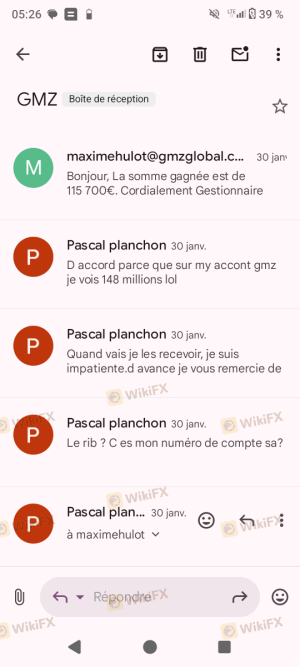

Understanding the customer experience is essential to evaluate GMZ Global's safety. User reviews and testimonials often provide insights into the broker's service quality and responsiveness to complaints. While many users report positive experiences, there are also notable complaints regarding withdrawal processes and customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Mixed |

| Customer Support Quality | Medium | Generally Positive |

Common complaints include delays in processing withdrawals and difficulties in reaching customer support. While GMZ Global's customer service team is available 24/5, the quality of assistance can vary, leading to frustration among traders. Each complaint should be taken seriously, as they can indicate systemic issues within the broker's operations.

Platform and Execution

The trading platform offered by GMZ Global is web-based and designed to be user-friendly. Traders have access to advanced charting tools and real-time market data, which are crucial for making informed decisions. However, the platform's performance can significantly impact trading outcomes.

Issues such as slippage and order rejections can undermine a trader's experience. While there are no widespread reports of platform manipulation, traders should remain cautious and monitor their execution quality closely. A broker's reputation can hinge on the reliability of its trading platform.

Risk Assessment

Using GMZ Global does come with inherent risks, which must be carefully considered before committing funds. While the broker appears to have measures in place to protect traders, the overall regulatory environment and the quality of customer service could pose risks.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Regulated by a lower-tier authority. |

| Fund Security Risk | Low | Segregated accounts and AML compliance. |

| Customer Service Risk | Medium | Mixed reviews on responsiveness and efficiency. |

To mitigate these risks, traders are advised to conduct thorough research, utilize demo accounts, and start with smaller investments to test the waters.

Conclusion and Recommendations

In conclusion, while GMZ Global presents itself as a legitimate trading platform, there are several factors that warrant caution. The broker's regulatory status, while verified, is not backed by a top-tier authority, which raises questions about the level of protection offered. Additionally, the mixed reviews regarding customer service and withdrawal processes suggest that potential users should tread carefully.

For traders who prioritize safety and regulatory oversight, it may be wise to explore alternative brokers that are regulated by higher-tier authorities. Overall, if you are considering GMZ Global, ensure you are fully informed about the risks and prepared to manage them effectively.

Is GMZ Global a scam, or is it legit?

The latest exposure and evaluation content of GMZ Global brokers.

GMZ Global Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GMZ Global latest industry rating score is 1.27, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.27 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.