Is Enterprise London Limited safe?

Business

License

Is Enterprise London Limited Safe or Scam?

Introduction

Enterprise London Limited is an online forex broker that positions itself as a provider of high-level trading services across various financial instruments, including currencies, commodities, stocks, and cryptocurrencies. Operating from London, this broker claims to offer competitive trading conditions and a range of account types to attract both novice and experienced traders. However, the forex market is rife with risks, and it is essential for traders to exercise caution when evaluating brokers. With numerous reports of scams and fraudulent activities in the industry, it becomes crucial for potential investors to conduct thorough due diligence. This article investigates the safety and legitimacy of Enterprise London Limited by analyzing its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

The regulatory status of any broker is a fundamental aspect of its legitimacy. Regulatory bodies serve to protect traders by enforcing compliance with financial laws and ensuring that brokers operate transparently. Unfortunately, Enterprise London Limited is currently not regulated by any recognized financial authority, which raises significant concerns regarding the safety of client funds.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Regulated |

The absence of regulation means that traders have no recourse to regulatory bodies in case of disputes or issues with the broker. This lack of oversight is a major red flag, indicating that the broker might not adhere to industry standards or best practices. According to sources, Enterprise London Limited has received low ratings from various review platforms, further emphasizing concerns about its reliability. The lack of a legitimate license suggests that traders should be very cautious when considering whether Enterprise London Limited is safe for their investments.

Company Background Investigation

Enterprise London Limited was incorporated in December 1998, and its history indicates a long-standing presence in the market. However, recent reports suggest an alarming trend of unregulated practices and potential fraudulent activities. The ownership structure of the company remains unclear, and there is limited information available about its management team. This lack of transparency raises questions about the credibility and accountability of the broker.

Furthermore, the company has been accused of attempting to suppress negative reviews and critical information online, which is often a tactic employed by fraudulent entities. The overall opacity surrounding its operations and the absence of detailed disclosures contribute to the perception that Enterprise London Limited may not be safe for traders looking to invest their hard-earned money.

Trading Conditions Analysis

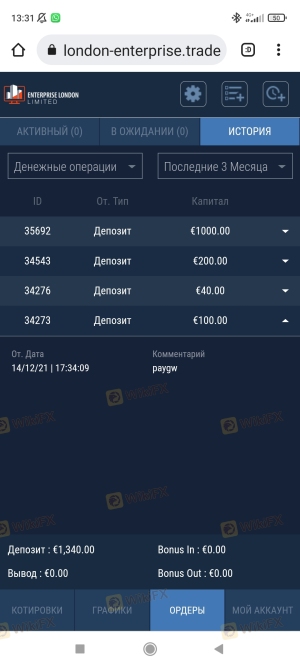

When evaluating a broker, understanding the trading conditions they offer is essential. Enterprise London Limited claims to provide a variety of account types, each with different minimum deposit requirements. However, the minimum deposit for the most basic account is set at €1,000, which is significantly higher than the industry average.

| Fee Type | Enterprise London Limited | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | Not disclosed | 1-2 pips |

| Commission Model | Not disclosed | Varies |

| Overnight Interest Range | Not disclosed | 0-5% |

The lack of transparency in the fee structure is concerning, as traders may encounter hidden fees that could eat into their profits. Additionally, the absence of specific information regarding spreads and commissions suggests that the broker may not be operating in good faith. High costs and unclear fee structures are often associated with untrustworthy brokers, making it imperative for traders to consider whether Enterprise London Limited is safe for their trading activities.

Customer Funds Security

The safety of customer funds is paramount when selecting a forex broker. Unfortunately, Enterprise London Limited does not provide clear information regarding its fund security measures. The absence of segregated accounts, investor protection schemes, and negative balance protection policies raises significant concerns about the safety of client deposits.

Traders have reported difficulties in withdrawing funds, which is a common issue with unregulated brokers. This lack of assurance regarding the safety of funds leads to the conclusion that Enterprise London Limited may not be safe for traders who prioritize the security of their investments.

Customer Experience and Complaints

Customer feedback is a crucial aspect of evaluating any broker. Reviews of Enterprise London Limited reveal a pattern of complaints, particularly regarding withdrawal issues. Many clients have reported being unable to access their funds, with some being pressured to open additional accounts with further deposits before they could withdraw their initial investments.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Poor |

| High Fees | Medium | Average |

One notable case involved a trader who reported being unable to withdraw their funds after multiple requests. The broker allegedly suggested that the trader needed to invest more money to facilitate the withdrawal process. Such experiences indicate a lack of responsiveness and accountability from the broker, leading to the conclusion that Enterprise London Limited might not be safe for potential investors.

Platform and Trade Execution

The trading platform offered by Enterprise London Limited is another critical aspect to consider. While the broker claims to provide a user-friendly web trader and mobile trading options, there have been no independent reviews confirming the platform's stability or execution quality. Traders often report issues such as slippage and rejected orders, which can significantly impact trading performance.

Without access to a reputable platform like MetaTrader 4 or 5, traders may be at a disadvantage. The lack of evidence supporting the platform's reliability raises further concerns about whether Enterprise London Limited is safe for conducting trades.

Risk Assessment

When evaluating the overall risk of trading with Enterprise London Limited, multiple factors come into play. The absence of regulation, coupled with negative customer experiences and a lack of transparency, presents a high-risk environment for traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Difficulty in fund withdrawals |

| Operational Risk | Medium | Unclear trading conditions |

To mitigate these risks, traders should exercise extreme caution and consider alternative, regulated brokers to ensure the safety of their investments.

Conclusion and Recommendations

In conclusion, the investigation into Enterprise London Limited raises significant concerns regarding its safety and legitimacy. The lack of regulation, negative customer feedback, and opaque trading conditions suggest that this broker may not be a safe choice for traders.

For those considering investing with Enterprise London Limited, it is advisable to explore regulated alternatives that offer greater transparency and customer protection. Brokers with established reputations and regulatory oversight can provide a safer trading environment, ensuring that your investments are better protected. Ultimately, while Enterprise London Limited may present itself as a viable trading option, the overwhelming evidence suggests that it is prudent to approach this broker with caution, as it may not be safe for your trading activities.

Is Enterprise London Limited a scam, or is it legit?

The latest exposure and evaluation content of Enterprise London Limited brokers.

Enterprise London Limited Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Enterprise London Limited latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.