Is Cointiger safe?

Pros

Cons

Is CoinTiger A Scam?

Introduction

CoinTiger is a cryptocurrency exchange that emerged in 2017, primarily targeting the Southeast Asian market. With a user-friendly interface and a wide range of supported cryptocurrencies, it has attracted a significant user base, boasting over 2 million users. However, as with any trading platform, it is crucial for traders to exercise caution and thoroughly evaluate the legitimacy and reliability of the exchange before investing their hard-earned money. The cryptocurrency market is notorious for its volatility and the presence of scams, making it imperative for traders to conduct due diligence. In this article, we will investigate CoinTiger's regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and overall risks associated with using the exchange. Our analysis is based on a comprehensive review of multiple sources, including user feedback, expert reviews, and regulatory information.

Regulation and Legitimacy

One of the most critical factors in assessing the safety of a trading platform is its regulatory status. A regulated exchange is typically subject to strict oversight, which can provide a layer of security for traders. Unfortunately, CoinTiger operates without regulation from any recognized financial authority, which raises significant concerns about its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of regulation means that CoinTiger does not have to adhere to the same standards as regulated brokers, potentially exposing traders to risks such as fraud, poor customer service, and financial instability. Additionally, the Monetary Authority of Singapore (MAS) has issued warnings against unregulated exchanges, including CoinTiger, advising the public to exercise caution. This absence of regulatory oversight is a red flag for potential users, as it indicates that there is no independent body ensuring the safety and security of user funds.

Company Background Investigation

CoinTiger was founded by Frank Ling in Singapore and has quickly grown to become a notable player in the cryptocurrency exchange landscape. However, the company lacks transparency regarding its operations, ownership structure, and management team. This opacity can be concerning for potential investors, as it raises questions about accountability and trustworthiness.

The management team appears to be composed of individuals with backgrounds in technology and finance, but there is limited publicly available information to assess their experience and qualifications. Furthermore, the company has not made significant efforts to disclose its financial health or operational metrics, which is often a standard practice among reputable exchanges. Such a lack of transparency can lead to skepticism among potential users, as it becomes challenging to ascertain the company's reliability and stability.

Trading Conditions Analysis

CoinTiger offers a trading fee structure that is generally competitive within the cryptocurrency exchange market. However, the absence of a clear and straightforward fee disclosure can lead to confusion among users.

| Fee Type | CoinTiger | Industry Average |

|---|---|---|

| Spread on Major Pairs | 0.15% (Taker) | 0.20% - 0.25% |

| Commission Model | Maker: 0.08% | 0.10% - 0.15% |

| Overnight Interest Range | Varies by Coin | Varies by Coin |

While the trading fees are lower than average, users should be wary of withdrawal fees that can vary significantly depending on the cryptocurrency being withdrawn. For example, the withdrawal fee for Bitcoin is relatively standard, but fees for lesser-known altcoins can be significantly higher, leading to unexpected costs for traders. Furthermore, users have reported issues with delayed withdrawals and unresponsive customer service, which can exacerbate the challenges associated with trading on an unregulated platform.

Client Fund Security

The safety of client funds is paramount when considering a trading platform. CoinTiger employs several security measures, including two-factor authentication (2FA) and encryption protocols to protect user data. However, it does not provide clear information about how client funds are stored, particularly whether they are kept in cold storage or if there are any insurance policies in place to protect against losses.

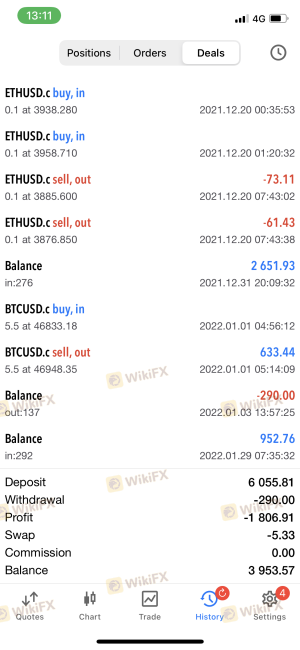

Reports from users indicate that there have been instances of lost funds and difficulties in withdrawing money, which raises concerns about the overall safety of client assets. Additionally, the lack of regulatory oversight means that there is no formal recourse for users in the event of a dispute or loss, further complicating the issue of fund security.

Customer Experience and Complaints

User feedback is a valuable indicator of an exchange's reliability. CoinTiger has received mixed reviews from customers, with many users reporting issues related to delayed withdrawals, unresponsive customer support, and account freezes.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Often Unresponsive |

| Poor Customer Support | Medium | Slow Response Times |

| Account Freezes | High | Limited Communication |

Several users have shared their experiences on forums and review sites, highlighting the challenges they faced when trying to withdraw funds or get support from the company. For instance, one user reported losing a significant amount of money due to withdrawal issues and stated that the customer service team provided inadequate assistance. Such complaints are a significant concern for potential users, as they indicate systemic issues within the platform that could jeopardize user investments.

Platform and Execution Quality

The performance of a trading platform is crucial for a positive user experience. CoinTiger offers a user-friendly interface and a range of trading tools, but there are concerns regarding order execution quality. Users have reported instances of slippage and rejected orders, which can be detrimental to trading strategies.

The platform's stability is also a point of contention, with some users experiencing downtime or connectivity issues during peak trading hours. These performance-related issues can hinder traders' ability to execute their strategies effectively, leading to potential losses.

Risk Assessment

Using CoinTiger presents several risks that potential users should consider. The lack of regulation and transparency, coupled with user complaints about fund security and customer service, contribute to a higher risk profile for this exchange.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated platform with no oversight |

| Fund Security Risk | High | Reports of lost funds and withdrawal issues |

| Customer Service Risk | Medium | Slow response times and inadequate support |

| Execution Risk | Medium | Instances of slippage and rejected orders |

Traders should approach CoinTiger with caution and consider implementing risk management strategies, such as limiting the amount invested and diversifying their trading portfolio.

Conclusion and Recommendations

In conclusion, while CoinTiger offers competitive trading fees and a wide range of cryptocurrencies, the lack of regulation, transparency, and numerous user complaints raise significant concerns about its legitimacy and reliability. The evidence suggests that traders should exercise caution when considering this exchange, as there are indications of potential scams and operational issues.

For traders seeking safer alternatives, it may be beneficial to explore regulated exchanges with proven track records and positive user experiences. Platforms like Binance, Kraken, or Coinbase offer more robust security measures, regulatory oversight, and better customer support, making them more reliable choices for cryptocurrency trading. Ultimately, it is essential for traders to prioritize security and reliability when selecting a trading platform to safeguard their investments.

Is Cointiger a scam, or is it legit?

The latest exposure and evaluation content of Cointiger brokers.

Cointiger Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Cointiger latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.