Is BluechipFx safe?

Business

License

Is BluechipFX Safe or Scam?

Introduction

BluechipFX is a forex broker that positions itself within the competitive landscape of online trading, claiming to offer a range of financial instruments including forex, CFDs, and commodities. Established in 2021, the broker has attracted attention due to its appealing marketing strategies and promises of low spreads and high leverage. However, the forex market is rife with potential pitfalls, making it essential for traders to conduct thorough evaluations of brokers before committing their funds. This article aims to assess the safety and legitimacy of BluechipFX by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. Our investigation is based on a comprehensive review of available data, user feedback, and expert analysis.

Regulation and Legality

One of the most critical factors when evaluating a forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to certain standards and practices. Unfortunately, BluechipFX operates without regulation from any recognized financial authority, which raises significant concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that traders are exposed to higher risks, including potential fraud and the inability to recover funds in case of disputes. Regulatory bodies typically enforce rules that protect clients interests, such as requiring brokers to keep client funds in segregated accounts and to provide negative balance protection. The lack of such safeguards at BluechipFX makes it imperative for potential clients to approach with caution.

Company Background Investigation

BluechipFX is operated by Bluechip Financials Market Limited, which claims to be registered in Saint Vincent and the Grenadines (SVG). This jurisdiction is known for its lax regulatory framework, allowing many unregulated brokers to operate freely. The company has not provided substantial information about its ownership structure or the backgrounds of its management team, which raises transparency concerns.

The lack of detailed disclosures about the team behind BluechipFX adds to the skepticism surrounding its operations. Legitimate brokers often provide information about their executives, including their professional backgrounds and experience in the financial industry. In contrast, BluechipFX appears to maintain a veil of anonymity, which is a red flag for potential investors.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is vital. BluechipFX boasts competitive trading conditions, including low spreads and high leverage. However, the overall fee structure and any hidden costs should also be taken into account.

| Fee Type | BluechipFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2 pips (Standard Account) | 1.0 - 1.5 pips |

| Commission Structure | No commissions | Varies (0 - 5 pips) |

| Overnight Interest Range | Varies | Varies |

While the minimum deposit required to open an account at BluechipFX is $500, which is above the industry average, the broker claims to offer spreads starting from 2 pips. However, such spreads may not be competitive compared to other regulated brokers. Additionally, the absence of a transparent commission structure can lead to unexpected costs for traders.

Customer Funds Security

The safety of client funds is paramount when choosing a forex broker. BluechipFX does not provide adequate information regarding its security measures. One of the most concerning aspects is the lack of segregated accounts, which means that client funds may not be kept separate from the broker's operational funds. This absence of protection can lead to significant risks, especially in the event of financial instability or insolvency.

Furthermore, BluechipFX does not offer any investor protection schemes, which are typically provided by regulated brokers to safeguard client deposits. The absence of these security measures raises questions about the safety of funds deposited with BluechipFX.

Customer Experience and Complaints

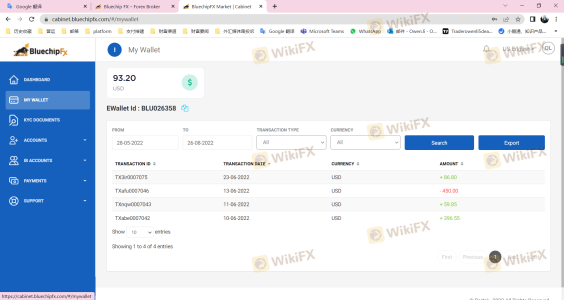

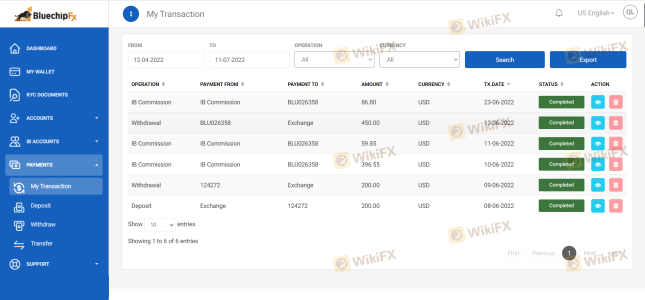

Customer feedback is a crucial element in assessing a broker's reputation. Reviews of BluechipFX reveal a pattern of dissatisfaction among clients, with common complaints including difficulties in withdrawing funds and unresponsive customer service.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Poor Customer Support | Medium | Slow response |

Several users have reported that they were unable to withdraw their funds after depositing, which is a significant warning sign. Additionally, the company's customer support has been criticized for its slow response times and lack of effective solutions to client issues. These complaints suggest that BluechipFX may not prioritize customer service, further casting doubt on its reliability.

Platform and Execution

The trading platform offered by BluechipFX is the widely-used MetaTrader 5 (MT5), which is known for its robust features and user-friendly interface. However, the platform's performance and execution quality have also come under scrutiny. Users have reported instances of slippage and order rejections, which can severely impact trading outcomes.

Traders expect seamless execution and transparency when using a trading platform, and any signs of manipulation or technical issues can erode trust in the broker.

Risk Assessment

Using BluechipFX carries inherent risks that potential clients should carefully consider. The absence of regulation, combined with a lack of transparency and a history of customer complaints, suggests a high-risk environment for traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight. |

| Fund Safety Risk | High | Lack of segregated accounts and investor protection. |

| Customer Service Risk | Medium | Poor response to complaints. |

To mitigate these risks, it is advisable for traders to consider using regulated brokers with established reputations and strong customer protection measures.

Conclusion and Recommendations

In conclusion, the evidence suggests that BluechipFX is not a safe option for traders. The lack of regulation, transparency issues, and a pattern of customer complaints indicate that potential clients should exercise extreme caution. Given the high risks associated with using BluechipFX, it is recommended that traders seek out regulated alternatives that offer better security and customer support.

For those looking to engage in forex trading, consider brokers with solid regulatory frameworks, transparent fee structures, and positive customer feedback. Some reputable options include brokers like FP Markets and OctaFX, which have established themselves as reliable choices in the industry.

In summary, is BluechipFX safe? The overwhelming consensus points to a resounding no, and traders are advised to look elsewhere for their trading needs.

Is BluechipFx a scam, or is it legit?

The latest exposure and evaluation content of BluechipFx brokers.

BluechipFx Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BluechipFx latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.