Is BKD safe?

Pros

Cons

Is BKD Safe or Scam?

Introduction

BKD, a forex broker primarily catering to the Chinese market, has garnered attention in the trading community. As with any financial service provider, traders must exercise caution when evaluating brokers, especially in the volatile forex market. The potential for scams is high, and traders' hard-earned money can be at risk if they choose an unreliable broker. This article aims to provide a comprehensive analysis of BKD's legitimacy, focusing on its regulatory status, company background, trading conditions, customer experience, and overall safety. The assessment draws from various sources, including user reviews, regulatory databases, and expert analyses.

Regulation and Legitimacy

The regulatory environment is crucial in determining a broker's safety. A well-regulated broker is typically seen as more trustworthy, as they are subject to stringent oversight by financial authorities. Unfortunately, BKD lacks regulation from any recognized financial authority, which raises significant concerns regarding its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulatory oversight means that BKD does not adhere to the same standards of accountability and transparency as regulated brokers. This raises a red flag for potential traders. Without a regulatory body ensuring compliance with industry standards, traders may find it challenging to seek recourse in case of disputes or issues with fund withdrawals. Moreover, the lack of regulation often correlates with a higher risk of fraudulent activities, making it essential for traders to consider these factors seriously when questioning, "Is BKD safe?"

Company Background Investigation

BKD was established in 2021 and claims to operate under a full license for trading on the MetaTrader 4 and 5 platforms. However, detailed information about its ownership structure and management team is scarce. The company's lack of transparency regarding its operational history and management raises concerns about its credibility.

The management teams qualifications and experience play a vital role in a broker's reputation. Unfortunately, without publicly available information on the individuals behind BKD, it is challenging to assess their expertise. This lack of transparency can be a significant deterrent for potential clients, especially those who prioritize working with brokers that have established histories and reliable leadership. Therefore, when asking, "Is BKD safe?" one must consider the implications of such a lack of information.

Trading Conditions Analysis

Understanding the trading conditions offered by BKD is crucial for evaluating its overall safety. A review of BKD's fee structure reveals some concerning elements. While the broker claims to offer competitive spreads, there are reports of hidden fees that can significantly impact traders' profitability.

| Fee Type | BKD | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | N/A | 1.0 - 2.0 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 2% |

The absence of clear information regarding spreads and commissions raises questions about the broker's transparency. Traders may find themselves facing unexpected charges, which could lead to frustration and financial losses. Thus, the lack of clarity in trading conditions serves as another point of concern when evaluating, "Is BKD safe?"

Client Fund Security

The safety of client funds is paramount when choosing a forex broker. BKD's measures for ensuring fund security are unclear, which poses a significant risk to traders. The broker must implement strict policies for fund segregation, investor protection, and negative balance protection to ensure that clients' investments are secure.

The lack of information regarding these safety measures raises questions about how client funds are managed. If funds are not adequately segregated, there is a risk that they could be misused or lost in the event of financial difficulties faced by the broker. Additionally, without investor protection measures, traders may find it challenging to recover their funds in case of a broker's insolvency. Therefore, when considering "Is BKD safe?" the absence of clear security protocols is a significant red flag.

Customer Experience and Complaints

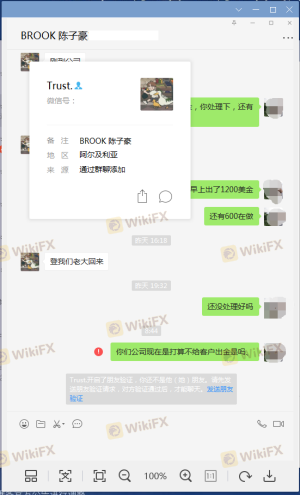

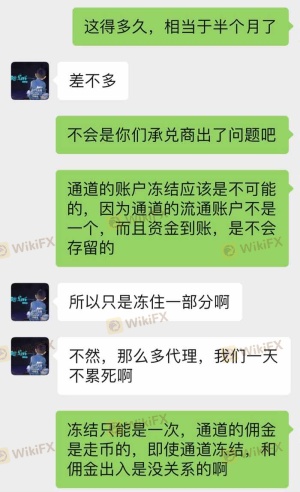

Customer feedback plays a crucial role in assessing a broker's reliability. A review of user experiences with BKD reveals a mixed bag of opinions. While some users report satisfactory trading experiences, others have raised serious concerns regarding withdrawal issues and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Fair |

Common complaints include difficulties in withdrawing funds and a lack of timely responses from customer support. These issues can severely impact a trader's experience and raise concerns about the broker's overall reliability. A notable case involved a trader who reported being unable to access their funds for several weeks, leading to significant frustration. Such experiences contribute to the growing skepticism surrounding BKD's legitimacy, prompting the question, "Is BKD safe?"

Platform and Trade Execution

The performance of a trading platform is vital for a smooth trading experience. BKD utilizes the popular MetaTrader 4 and 5 platforms, which are well-regarded in the industry. However, reports of execution slippage and high rejection rates for trades have emerged, raising concerns about the quality of order execution.

Traders have reported instances where their orders were not executed at the expected prices, leading to unexpected losses. Such issues can significantly affect trading outcomes and contribute to a lack of trust in the broker's operations. Therefore, the question "Is BKD safe?" becomes even more pertinent when considering the execution quality and potential for manipulation.

Risk Assessment

Using BKD as a forex broker entails several risks that traders must be aware of. The lack of regulation, unclear trading conditions, and customer complaints all contribute to a higher risk profile.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Unclear fees and withdrawal issues |

| Operational Risk | Medium | Potential execution problems |

Traders should consider these risks carefully before engaging with BKD. To mitigate these risks, it is advisable to conduct thorough research, start with a small deposit, and monitor trading activities closely.

Conclusion and Recommendations

In conclusion, the analysis of BKD raises significant concerns regarding its safety and legitimacy. The lack of regulatory oversight, unclear trading conditions, and numerous customer complaints suggest that traders should approach this broker with caution. While some traders may have had positive experiences, the potential risks involved cannot be overlooked.

For those considering trading with BKD, it is crucial to weigh the risks carefully. If you prioritize safety and reliability, it may be wise to explore other alternatives that offer robust regulatory protection and transparent trading conditions. Brokers such as OANDA, IG, or Forex.com are examples of well-regulated options that can provide a more secure trading environment.

Ultimately, the question remains: "Is BKD safe?" Based on the evidence, it appears that caution is warranted, and potential traders should proceed with care.

Is BKD a scam, or is it legit?

The latest exposure and evaluation content of BKD brokers.

BKD Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BKD latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.