Regarding the legitimacy of Freeman forex brokers, it provides SFC and WikiBit, (also has a graphic survey regarding security).

Is Freeman safe?

Pros

Cons

Is Freeman markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

Arta Global Futures Limited

Effective Date: Change Record

2004-11-19Email Address of Licensed Institution:

cs@artatechfin.comSharing Status:

No SharingWebsite of Licensed Institution:

www.artagm.comExpiration Time:

--Address of Licensed Institution:

香港鰂魚涌英皇道728 號K11 ATELIER King's Road 9樓901-02室Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Freeman Safe or Scam?

Introduction

Freeman is a broker that has garnered attention in the forex market, but its reputation raises questions about its safety and legitimacy. As the forex market is rife with both legitimate and fraudulent brokers, traders must exercise caution when choosing where to invest their money. This article aims to provide a thorough evaluation of Freeman, focusing on its regulatory status, company background, trading conditions, customer safety, and user experiences. Our investigation is based on a comprehensive review of multiple sources, including broker reviews, regulatory databases, and user feedback.

Regulatory Status and Legitimacy

The regulatory environment is crucial for any forex broker, as it ensures that the broker adheres to industry standards and protects client funds. Unfortunately, Freeman appears to lack proper regulation, which is a significant red flag for potential investors.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of a regulatory license means that Freeman operates without oversight, leaving clients vulnerable to potential fraud. Regulatory agencies, such as the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the USA, provide a level of security for traders by enforcing compliance and offering avenues for complaint resolution. The lack of such oversight raises concerns about the broker's legitimacy and operational practices.

Company Background Investigation

Freeman's history and ownership structure are essential factors to consider when assessing its credibility. The broker does not provide sufficient information regarding its establishment, ownership, or operational history. This lack of transparency is concerning, as reputable brokers typically disclose their corporate structure, including key personnel and their qualifications.

The management team at Freeman is not well-documented, which raises questions about their professional backgrounds and experience in the financial industry. A transparent company usually shares details about its founders and executives, including their qualifications and past experiences. The absence of this information makes it difficult for potential clients to gauge the broker's reliability and expertise.

Trading Conditions Analysis

Understanding the trading conditions offered by Freeman is vital for evaluating its overall value proposition. The broker's fee structure is not explicitly detailed, which can lead to confusion and potential hidden costs for traders.

| Fee Type | Freeman | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Variable |

| Overnight Interest Range | N/A | 1.5% - 3.0% |

The lack of clear information about spreads, commissions, and overnight interest rates can indicate a lack of transparency, which is often a tactic used by unscrupulous brokers. Traders should be wary of brokers that do not provide straightforward information about their fees, as it may lead to unexpected costs and lower profitability.

Customer Fund Safety

The safety of client funds is paramount in the forex trading environment. Freeman's measures for protecting customer funds are unclear, and it does not appear to offer segregated accounts or investor protection schemes, which are standard practices among regulated brokers.

Segregated accounts ensure that client funds are kept separate from the broker's operational funds, providing a layer of security in case of insolvency. Additionally, many regulated brokers offer negative balance protection, which prevents clients from losing more than their initial investment. The absence of these safety measures at Freeman raises serious concerns about the security of client funds.

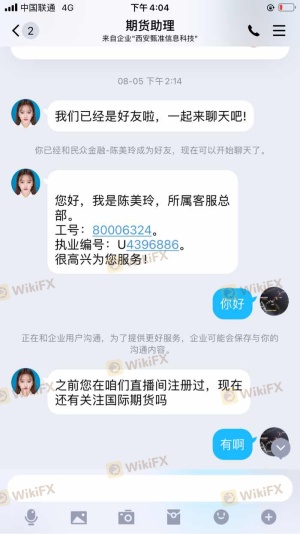

Customer Experience and Complaints

Customer feedback is an essential component in assessing the reliability of a broker. Reviews of Freeman indicate a pattern of dissatisfaction among users, with common complaints including difficulty in withdrawing funds and lack of responsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Poor |

| Account Blocking | High | Unresponsive |

In several instances, users reported being unable to access their funds after making deposits, a common tactic employed by scam brokers to retain client money. The lack of effective communication from the company further exacerbates these issues, leading to a growing number of complaints.

Platform and Execution

The trading platform provided by Freeman is another crucial aspect to evaluate. Users have reported issues with platform stability, including frequent outages and execution delays.

The quality of order execution is vital for traders, as slippage and rejections can significantly impact trading outcomes. Reports of high slippage and rejected orders raise alarms about the broker's operational integrity. Such practices can indicate manipulation or a lack of sufficient liquidity, which are serious concerns for any trader.

Risk Assessment

Using Freeman comes with inherent risks that potential clients should be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight |

| Fund Safety Risk | High | No segregated accounts or protection |

| Execution Risk | Medium | Reports of slippage and rejections |

Traders should approach Freeman with caution, as the absence of regulation, coupled with negative user experiences, presents significant risks. It is advisable to consider alternative brokers with established regulatory oversight and positive user feedback.

Conclusion and Recommendations

In conclusion, the evidence suggests that Freeman is not a safe choice for forex trading. The lack of regulation, transparency issues, and numerous complaints indicate that potential clients could be at risk of fraud. If you are considering trading with Freeman, it is essential to weigh these risks carefully.

For those seeking safer alternatives, brokers with established regulatory frameworks and positive reputations should be prioritized. Always conduct thorough research and consider user reviews before committing to any forex broker. In the ever-evolving landscape of forex trading, ensuring your funds are secure and your broker is legitimate is paramount.

Is Freeman a scam, or is it legit?

The latest exposure and evaluation content of Freeman brokers.

Freeman Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Freeman latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.