Xpoken 2025 Review: Everything You Need to Know

Summary

Xpoken is an unregulated broker with major transparency problems. It has a very poor reputation in the forex trading industry, which creates serious concerns for potential users. According to multiple threat assessment reports, this xpoken review reveals troubling patterns that traders should carefully consider before using this platform. Despite these serious issues, Xpoken offers trading access to over 50 forex currency pairs and multiple cryptocurrency options through their XpTrade WebTrader platform and mobile applications.

The broker's advanced trading systems have received some positive feedback from users. These users appreciate the technological aspects of the platform, which shows some promise for traders who value innovation. However, these limited advantages are overshadowed by the lack of regulatory oversight and numerous red flags identified by industry watchdogs. This platform primarily targets traders with high risk tolerance, particularly those interested in cryptocurrency trading who may be willing to accept the inherent risks associated with unregulated brokers.

Based on available market information and user feedback analysis, Xpoken presents significant concerns regarding fund safety, customer protection, and operational transparency. Potential clients must carefully evaluate these serious issues before making any decisions about using this platform.

Important Notice

Due to Xpoken's lack of regulatory oversight from any financial authority, users must exercise extreme caution when considering this broker. This is especially important given the varying legal frameworks across different jurisdictions, which can create additional complications for traders. The absence of regulatory protection means traders have limited recourse in case of disputes or financial losses.

This evaluation is based on user feedback, industry reports, and available market information. Given the limited transparency from the broker itself, some information may be incomplete or subject to change without notice, which creates additional uncertainty for potential users.

Rating Framework

Broker Overview

Xpoken operates as an online forex and cryptocurrency trading platform. However, specific information regarding its establishment date and corporate background remains undisclosed in available documentation, which raises immediate transparency concerns. The broker's business model focuses on providing access to multiple asset classes through proprietary trading technology, positioning itself particularly toward traders interested in both traditional forex markets and emerging cryptocurrency opportunities.

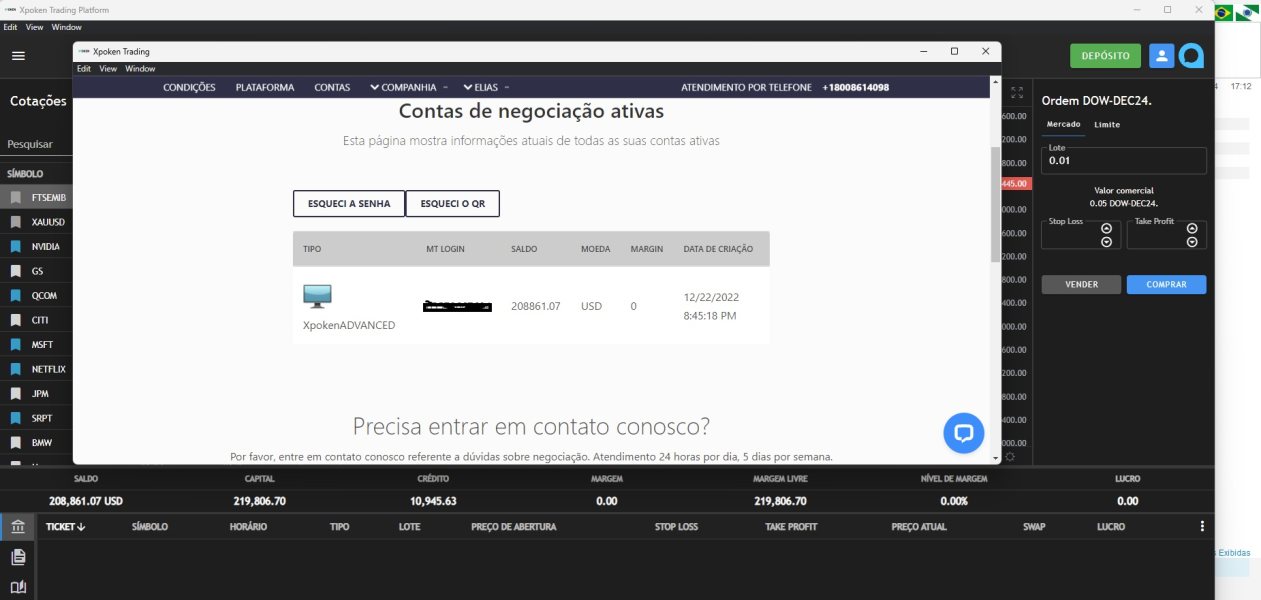

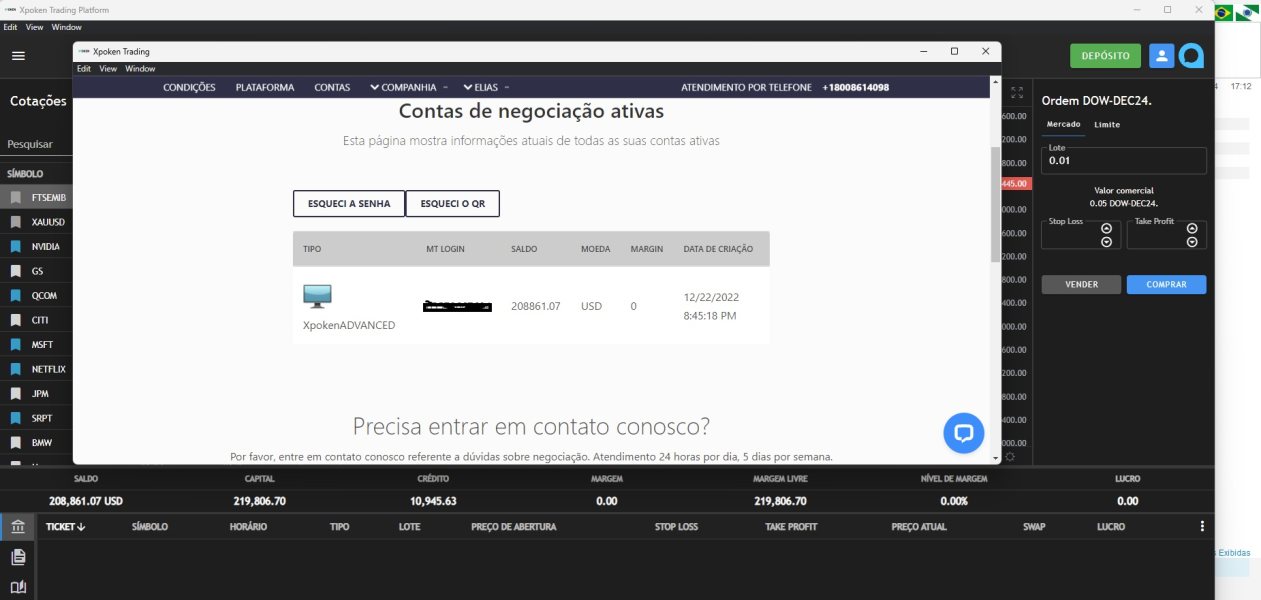

The platform's primary infrastructure centers around the XpTrade WebTrader system and corresponding mobile applications. These systems offer access to more than 50 forex currency pairs alongside various stocks, indices, commodities including gold, silver, and oil, plus Bitcoin and other cryptocurrencies. However, this xpoken review must emphasize that the broker operates without regulatory oversight from any recognized financial institution or government authority. This represents a fundamental concern for trader protection and fund security that cannot be overlooked.

Regulatory Status: Xpoken currently operates without supervision from any established financial regulatory body. This creates significant risks for client fund protection and dispute resolution that traders must understand.

Deposit and Withdrawal Methods: Specific information regarding available payment methods and processing procedures has not been detailed in available documentation.

Minimum Deposit Requirements: The broker has not publicly disclosed minimum deposit thresholds for account opening. This lack of transparency is concerning for potential clients who need to plan their trading budgets.

Bonus and Promotional Offers: No specific promotional programs or bonus structures have been identified in current available information.

Tradeable Assets: The platform provides access to over 50 forex currency pairs, various stock indices, commodities including precious metals and energy products, plus Bitcoin and additional cryptocurrency options. This diverse selection represents one of the platform's few clear advantages for traders seeking variety.

Cost Structure: Detailed information regarding spreads, commissions, and other trading costs remains undisclosed in available materials.

Leverage Options: Specific leverage ratios offered by the platform have not been detailed in accessible documentation. This information gap makes it difficult for traders to assess risk management options.

Platform Options: Trading is conducted through the XpTrade WebTrader interface and mobile applications designed for various devices.

Regional Restrictions: Geographic limitations for service access have not been specified in available information. This creates uncertainty for international traders who need to understand their access rights.

Customer Service Languages: The range of supported languages for customer support has not been documented in current materials.

This xpoken review highlights the concerning lack of transparency regarding fundamental trading conditions and operational details. These information gaps represent major red flags that potential traders should carefully consider.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions offered by Xpoken present significant concerns primarily due to the complete lack of transparency regarding basic account features and requirements. Available documentation does not specify different account types, their respective features, or the benefits associated with various account tiers, which is highly unusual for legitimate brokers. This absence of clear information makes it impossible for potential traders to make informed decisions about account selection.

The minimum deposit requirements remain undisclosed, which is highly unusual for legitimate forex brokers. Most professional brokers typically provide clear fee structures and account opening requirements to help traders make informed decisions. The account opening process details are similarly absent from available materials, raising questions about verification procedures, documentation requirements, and timeline expectations for account activation.

According to user feedback referenced in threat assessment reports, traders have expressed frustration with unclear account terms and conditions. The lack of information about special account features, such as Islamic accounts for traders requiring Sharia-compliant trading conditions, further demonstrates the broker's poor approach to customer service and transparency, which creates additional barriers for diverse trading communities.

This xpoken review emphasizes that the absence of clear account condition information represents a major red flag for potential clients seeking professional trading services. Traders should expect complete transparency about account conditions from any legitimate broker.

Xpoken's trading tools and resources represent one of the few areas where the broker shows some competency. However, significant limitations remain that prevent this area from receiving a higher rating. The platform provides access to a relatively diverse range of trading instruments, with over 50 forex pairs and multiple cryptocurrency options available through their proprietary XpTrade WebTrader system.

User feedback suggests that the trading technology itself demonstrates some advanced features. One trader noted that Xpoken's systems can "elevate your trading experience to the next level," which indicates some positive aspects of the platform's technological capabilities. However, specific details about analytical tools, charting capabilities, technical indicators, and research resources remain undocumented in available materials.

The absence of detailed information about educational resources, market analysis tools, and automated trading support significantly limits the platform's appeal to both novice and experienced traders. Professional traders typically require comprehensive analytical tools, economic calendars, and market research to make informed trading decisions, and the lack of clear information about these features creates uncertainty. While the technological infrastructure may have some merit, the lack of transparency about available tools and resources prevents traders from adequately assessing whether the platform meets their specific trading requirements and analytical needs.

Customer Service and Support Analysis

Customer service represents a significant weakness in Xpoken's operational framework. Multiple indicators suggest inadequate support infrastructure and responsiveness that fall well below industry standards. Available documentation does not specify customer service channels, contact methods, or availability schedules, which immediately raises concerns about accessibility and support quality.

User feedback indicates problems with response times and the overall quality of customer support interactions. The lack of documented multilingual support capabilities suggests limited accessibility for international traders, particularly those requiring assistance in languages other than English, which restricts the platform's global appeal.

Industry reports highlighting Xpoken's involvement in potential cyber crime activities further compromise confidence in the customer service department's ability to address legitimate trader concerns and disputes effectively. The absence of clear escalation procedures or dispute resolution mechanisms leaves traders with limited options when problems arise, creating additional frustration and uncertainty. The combination of poor communication infrastructure, limited accessibility, and concerning industry reputation creates a customer service environment that fails to meet basic professional standards expected from legitimate forex brokers.

Trading Experience Analysis

The trading experience with Xpoken presents a mixed picture. Some technological advantages are offset by significant concerns about platform reliability and execution quality that create uncertainty for traders. User feedback indicates that while some traders appreciate the advanced aspects of the trading system, others have reported concerns about platform stability and order execution consistency.

Reports suggest issues with slippage and requoting, which can significantly impact trading profitability and strategy implementation. The platform's functionality completeness has been questioned by users who express reservations about whether all advertised features operate as expected during live trading conditions, which creates doubt about the platform's reliability.

Mobile trading experience details remain largely undocumented, though the broker claims to offer mobile applications for various devices. The lack of specific information about mobile platform features, synchronization capabilities, and performance metrics makes it difficult to assess the quality of mobile trading services, which is increasingly important for modern traders.

This xpoken review notes that while some users report satisfactory trading experiences, the combination of execution concerns, platform stability questions, and limited transparency about trading environment specifications creates an uncertain trading atmosphere. This uncertainty may not meet professional trader requirements who need consistent and reliable trading conditions.

Trust and Reliability Analysis

Trust and reliability represent Xpoken's most significant deficiencies. Multiple factors contribute to an extremely poor assessment in this critical area that should concern any potential trader. The broker operates without any regulatory oversight from recognized financial authorities, eliminating fundamental protections that traders typically expect from legitimate forex brokers.

Industry threat assessment reports have specifically identified Xpoken in connection with potential cyber crime activities. This represents a severe warning for potential clients that cannot be ignored or understated. The broker's very poor reputation within the financial services industry stems from this lack of regulatory compliance and associated security concerns.

While Xpoken claims to implement various security measures, no specific details about fund segregation, insurance coverage, or client protection protocols have been documented. The absence of regulatory oversight means no independent verification of claimed security measures or operational standards, which leaves traders without protection.

The company's transparency regarding corporate structure, ownership, and operational history remains extremely limited. This prevents traders from conducting proper due diligence that is essential for safe trading decisions. No information about negative event handling procedures or dispute resolution mechanisms has been made available, leaving traders without clear recourse options when problems arise.

User Experience Analysis

Overall user satisfaction with Xpoken shows significant variation. Feedback ranges from limited positive comments about trading technology to serious concerns about safety and transparency that create mixed impressions. The mixed nature of user experiences suggests inconsistent service quality and operational standards.

Interface design and usability information has not been detailed in available documentation. This makes it difficult to assess the platform's accessibility for traders with different experience levels, which is important for user adoption. Registration and verification process details remain undisclosed, creating uncertainty about account opening procedures and timeline expectations.

User feedback regarding fund operation experiences indicates concerns about deposit and withdrawal convenience and reliability. The absence of clear information about processing times, fees, and available payment methods contributes to user uncertainty about financial transactions, which is a critical aspect of any trading platform.

Common user complaints focus primarily on safety concerns and the lack of transparency regarding operational procedures. The platform appears most suitable for traders with very high risk tolerance who prioritize asset variety over regulatory protection and operational transparency, which represents a very limited target market.

Conclusion

This comprehensive xpoken review concludes that Xpoken represents a high-risk, unregulated broker with a very poor industry reputation. It requires extreme caution from potential users who should carefully consider all available alternatives. While the platform offers diverse trading assets including over 50 forex pairs and multiple cryptocurrencies, these advantages are significantly overshadowed by the absence of regulatory oversight and numerous transparency concerns.

The broker may only be suitable for traders with exceptionally high risk tolerance. These traders must fully understand and accept the inherent dangers of trading with unregulated entities before proceeding. The primary advantages include diverse asset selection and reportedly advanced trading technology, while major disadvantages encompass the lack of regulatory protection, poor transparency, and concerning industry reputation.

Potential traders should carefully consider these significant risks and explore regulated alternatives that provide appropriate client protections and operational transparency before making any trading decisions. The risks associated with Xpoken far outweigh the potential benefits for most traders seeking safe and reliable trading environments.