BKD 2025 Review: Everything You Need to Know

Executive Summary

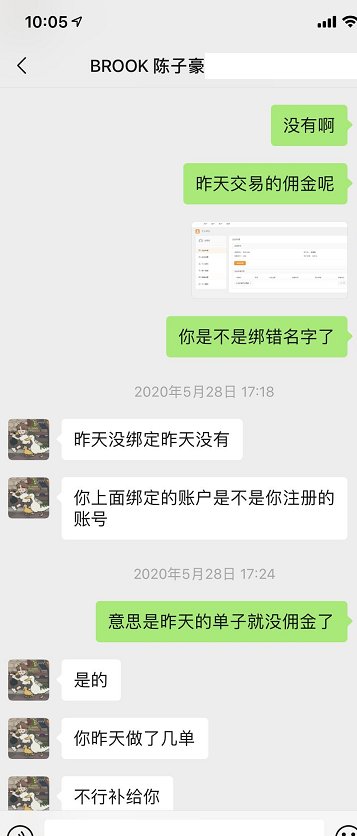

This bkd review gives you a complete look at BKD CPAs & Advisors and their work in financial services. BKD works mainly as an accounting and advisory firm, but we don't have much information about their specific forex trading services. The company seems to stay active in the financial sector, with some mentions of forex activities that target the Chinese market.

Based on information from various sources including employee feedback platforms, BKD shows mixed qualities as a financial services provider. The company's main identity stays rooted in accounting and advisory services. Their forex trading operations represent a secondary business line. Employee reviews suggest a stable working environment. However, specific details about trading conditions, regulatory compliance, and client services remain largely hidden.

The overall assessment of BKD's forex services gives a neutral rating. This happens mainly because we lack complete information about their trading infrastructure, regulatory status, and client offerings. This bkd review aims to give potential traders available insights while acknowledging the limits in publicly accessible data about their forex operations.

Important Notice

This evaluation relies on limited publicly available information about BKD's forex trading services. The company's primary business model centers on accounting and advisory services. Forex trading represents a smaller segment of their operations. Readers should note that specific details about trading conditions, regulatory oversight, and platform specifications are not well documented in available sources.

The assessment method relies on employee feedback, corporate information, and limited market presence data. Potential clients should conduct independent research and directly contact BKD for complete information about their forex trading services, regulatory compliance, and specific terms of service.

Rating Framework

Broker Overview

BKD CPAs & Advisors operates as a professional services firm with primary focus on accounting, tax, and business advisory services. The company has built itself as a traditional CPA firm while keeping some involvement in financial markets, including forex trading services that seem to target specific regional markets, particularly China.

The firm's business model combines traditional accounting services with financial market participation. However, the extent and nature of their forex operations remain unclear from publicly available sources. BKD's approach to financial services seems to use their accounting expertise to provide complete financial solutions to their client base.

According to available information, BKD's forex trading services represent a specialized segment of their broader financial advisory offerings. The company's focus on the Chinese market suggests a targeted approach to international forex trading. However, specific details about their trading infrastructure, platform capabilities, and regulatory compliance remain limited in public documentation.

This bkd review reveals that while the company keeps a presence in forex markets, their primary business identity remains centered on traditional accounting and advisory services. Trading services serve as a complementary offering to their core business model.

Regulatory Status: Available information does not provide specific details about BKD's regulatory oversight for forex trading operations. The company's primary registration appears to be as a CPA firm. However, their forex trading regulatory status remains unclear.

Deposit and Withdrawal Methods: Specific information about funding methods, processing times, and associated fees for forex trading accounts is not detailed in available sources.

Minimum Deposit Requirements: The minimum deposit required to open a forex trading account with BKD is not specified in accessible documentation.

Bonuses and Promotions: No information is available about promotional offers, welcome bonuses, or ongoing incentive programs for forex traders.

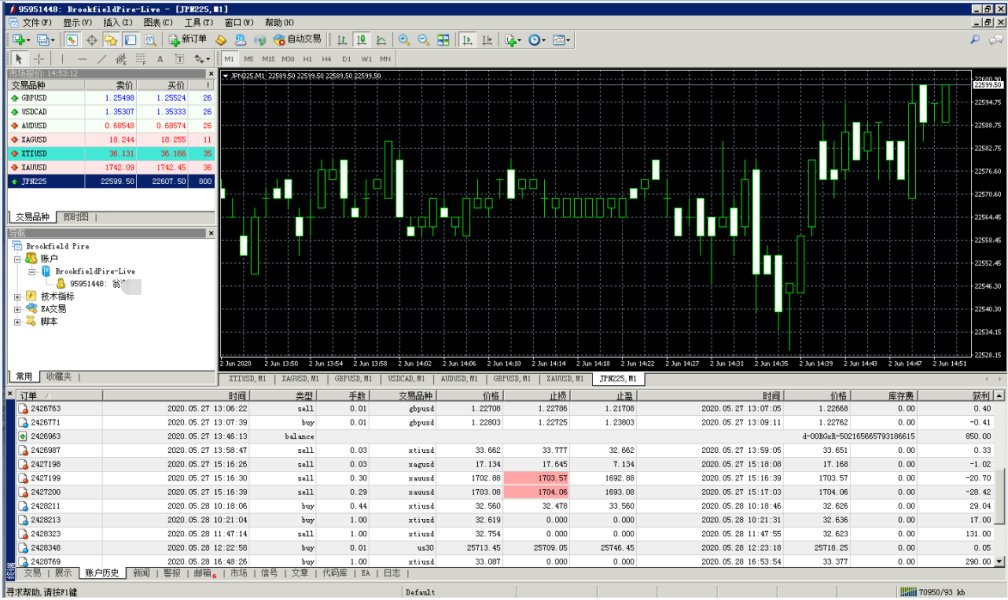

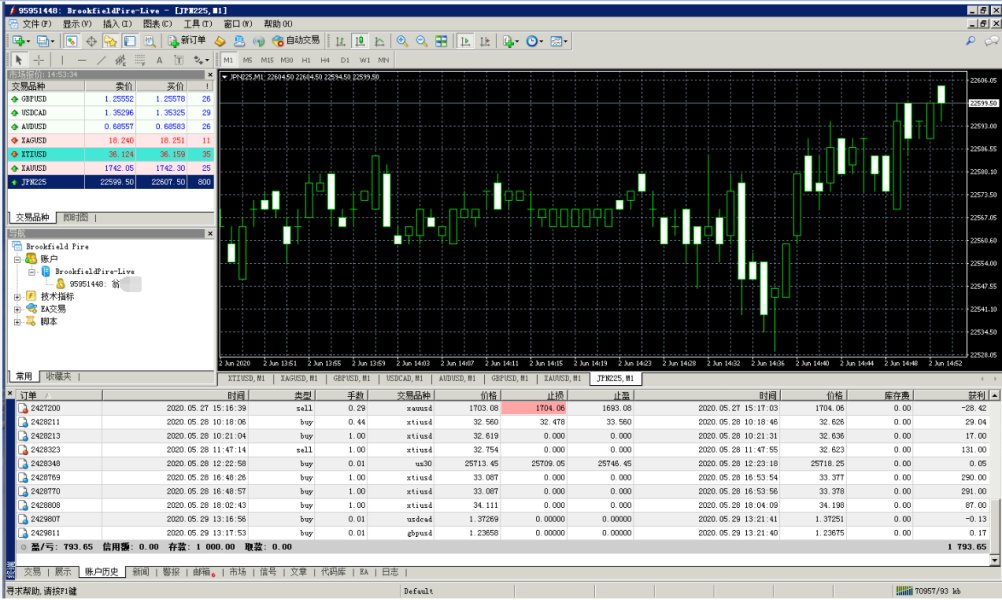

Trading Assets: BKD appears to offer forex trading services with focus on major currency pairs and instruments relevant to the Chinese market. However, the complete range of available assets is not fully documented.

Cost Structure: Specific details about spreads, commissions, overnight fees, and other trading costs are not provided in available sources. This makes it difficult to assess how competitive their pricing structure is.

Leverage Options: Information about maximum leverage ratios and margin requirements is not specified in accessible documentation.

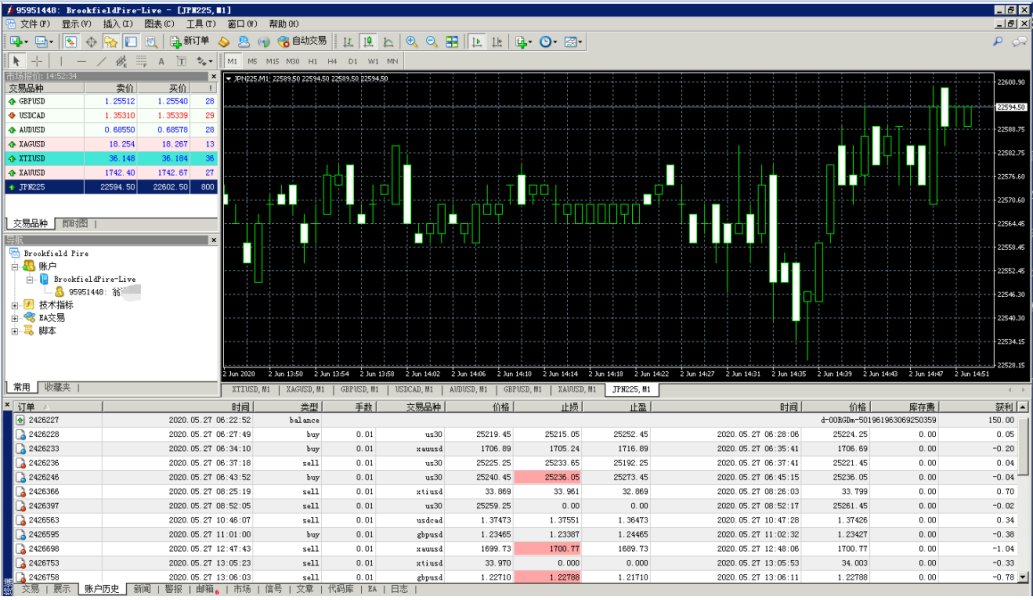

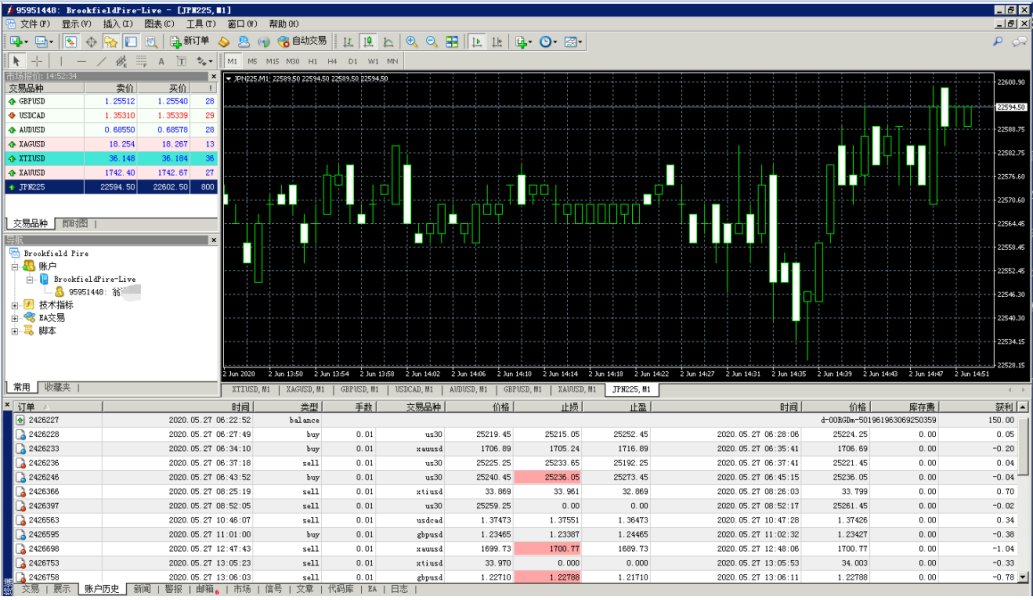

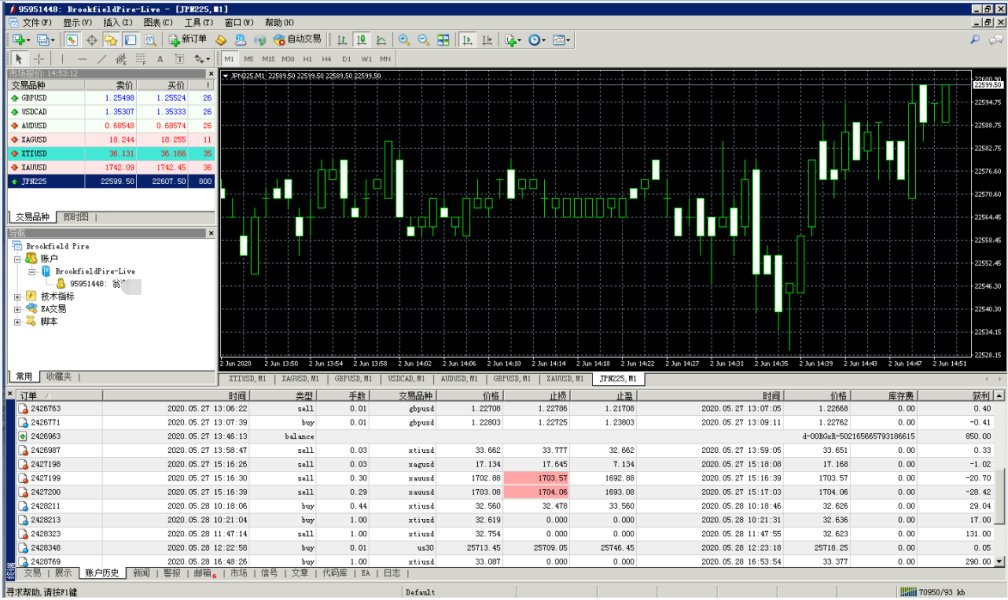

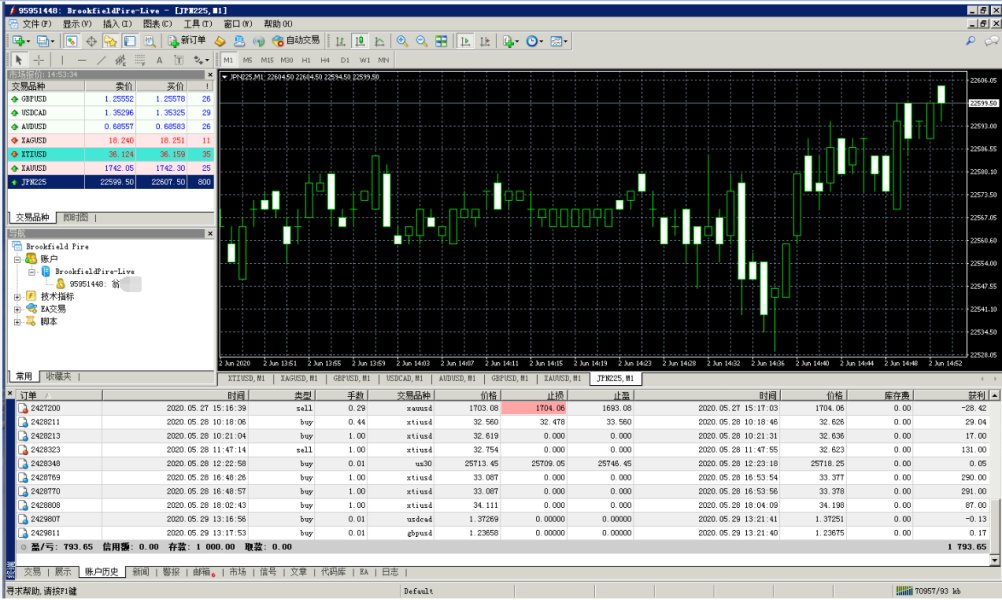

Platform Selection: Details about trading platforms, whether proprietary or third-party solutions like MetaTrader, are not clearly outlined in available sources.

Geographic Restrictions: Specific information about regional limitations and restricted territories is not detailed in accessible documentation.

Customer Support Languages: Available support languages and communication channels are not specified in the reviewed materials.

This bkd review highlights the significant information gaps that potential traders should consider when evaluating BKD's forex services.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions offered by BKD for forex trading remain largely undocumented in publicly available sources. Without specific information about account types, minimum deposit requirements, or special features, it becomes challenging to assess how competitive their offerings are compared to established forex brokers.

Traditional forex brokers typically offer multiple account tiers with varying minimum deposits. These range from micro accounts for beginners to premium accounts for high-volume traders. However, BKD's account structure for forex trading is not clearly outlined. This suggests either a simplified approach or limited public disclosure of their trading terms.

The absence of detailed account information raises questions about how sophisticated BKD's forex trading infrastructure is. Established brokers usually provide complete documentation about account features, including leverage options, minimum trade sizes, and account-specific benefits. This lack of transparency in BKD's account conditions contributes to the neutral rating in this category.

Potential clients interested in BKD's forex services would need to engage directly with the company to get detailed information about account types, opening procedures, and specific terms and conditions. This bkd review emphasizes the importance of thorough research given the limited publicly available information about their account offerings.

The trading tools and educational resources provided by BKD for forex trading are not well documented in available sources. Most competitive forex brokers offer complete suites of analytical tools, market research, and educational materials to support trader development and decision-making.

Standard industry offerings typically include real-time charts, technical indicators, economic calendars, market analysis, and educational webinars. However, BKD's specific provision of these resources for their forex trading clients remains unclear from publicly accessible information.

The company's background in accounting and advisory services could potentially translate into unique analytical perspectives for forex trading. This would be particularly true in fundamental analysis and economic interpretation. However, without specific documentation of their trading tools and resources, it's difficult to assess the value they offer to forex traders.

Educational support is crucial for forex trading success, especially for new traders. The absence of clear information about BKD's educational offerings, research capabilities, and analytical tools contributes to the lower rating in this category. Prospective clients would need to ask directly about available resources and support materials.

Customer Service and Support Analysis

Based on employee feedback available through various platforms, BKD appears to maintain a stable organizational structure with positive management relationships and job security. These factors suggest a foundation for reliable customer support. However, specific information about their forex trading customer service is not detailed.

Employee reviews indicate satisfaction with company culture and management approach. This could translate into quality customer service for trading clients. However, the specific channels, availability, and quality of support for forex trading operations are not clearly documented in available sources.

Professional services firms like BKD typically emphasize client relationships and service quality due to the nature of their core business. This background could provide advantages in customer support for forex trading clients. This would be particularly true in terms of professionalism and attention to detail.

The rating in this category reflects the positive employee feedback about company management and stability. However, it acknowledges the lack of specific information about forex trading customer support. Response times, available communication channels, and support quality for trading-related issues remain undocumented in publicly accessible sources.

Trading Experience Analysis

The trading experience offered by BKD's forex services cannot be fully assessed due to limited information about their platform infrastructure, execution quality, and trading environment. Key factors that typically influence trading experience include platform stability, order execution speed, slippage rates, and overall system reliability.

Most established forex brokers provide detailed specifications about their trading infrastructure. This includes server locations, execution models, and technology partnerships. However, BKD's trading technology and platform capabilities are not clearly outlined in available documentation.

The absence of information about mobile trading capabilities, platform features, and trading tools makes it difficult to evaluate the user experience for active forex traders. Modern forex trading requires sophisticated technology infrastructure to support real-time execution and analysis.

Without specific data about order execution quality, platform uptime, or user interface design, this bkd review cannot provide a complete assessment of the trading experience. The neutral-to-low rating reflects this information gap and the importance of platform quality in forex trading success.

Trust and Reliability Analysis

The trust and reliability assessment for BKD's forex operations is significantly limited by the lack of clear regulatory information and transparency about their trading services. Regulatory oversight is crucial for forex broker evaluation. It provides assurance about fund safety, operational standards, and dispute resolution mechanisms.

Most reputable forex brokers prominently display their regulatory licenses, segregated account policies, and compliance measures. However, BKD's regulatory status for forex trading operations is not clearly documented in available sources. This raises concerns about oversight and protection for trading clients.

The company's established presence as a CPA firm provides some foundation for trust in terms of financial expertise and professional standards. However, accounting services and forex trading operate under different regulatory frameworks. This makes it important to understand their specific compliance status for trading operations.

Without clear information about fund segregation, regulatory oversight, or industry certifications for their forex services, the trust and reliability rating remains low. This assessment reflects the importance of regulatory transparency in forex broker evaluation and the current information gaps in BKD's public disclosure.

User Experience Analysis

The overall user experience for BKD's forex trading services cannot be fully evaluated due to limited feedback and documentation about their trading platform and client interface. User experience includes multiple factors including platform usability, account management, and overall client satisfaction.

Available information suggests that BKD maintains professional standards in their core accounting business. This could translate into attention to detail in their forex services. However, specific user feedback about trading platform functionality, ease of use, and client satisfaction is not available in reviewed sources.

The registration and verification processes, fund management procedures, and ongoing account maintenance experience are not detailed in accessible documentation. These factors significantly impact overall user satisfaction and trading efficiency.

Without specific user testimonials, platform demonstrations, or detailed service descriptions, this assessment remains neutral. The rating reflects the uncertainty about user experience quality while acknowledging the company's professional background in financial services.

Conclusion

This bkd review reveals a forex service provider with limited public transparency about their trading operations and conditions. While BKD maintains credibility as an established accounting and advisory firm, their forex trading services lack the detailed documentation and regulatory clarity typically expected from dedicated forex brokers.

The assessment indicates that BKD may be suitable for traders specifically interested in services targeting the Chinese market. This would be particularly true for those who value the combination of accounting expertise with forex trading capabilities. However, the significant information gaps about trading conditions, regulatory oversight, and platform capabilities present challenges for complete evaluation.

The primary advantages appear to be the company's established professional background and stable organizational structure. However, the main disadvantages include lack of transparency about trading conditions, unclear regulatory status for forex operations, and limited public information about platform capabilities and customer support for trading services.

Potential clients should conduct thorough research and direct communication with BKD to get complete information about their forex trading services before making any commitment.