Is Bit&Coins safe?

Pros

Cons

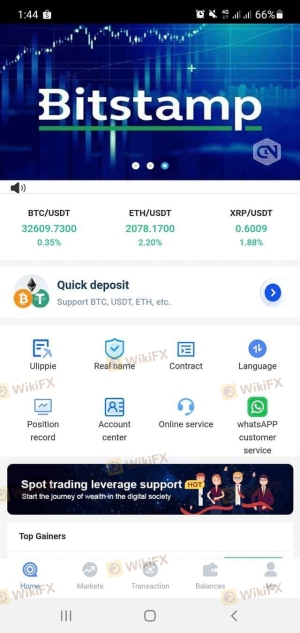

Is Bit Coins A Scam?

Introduction

Bit Coins, a relatively new player in the forex market, has garnered attention from both novice and experienced traders. Positioned as a forex broker that claims to offer a range of trading services, Bit Coins has sparked curiosity and concern regarding its legitimacy. In an industry rife with scams and unregulated entities, it is crucial for traders to exercise caution and thoroughly evaluate any broker before committing their funds. This article aims to provide an objective analysis of Bit Coins, focusing on its regulatory status, company background, trading conditions, customer feedback, and overall safety. The investigation is based on comprehensive research, including user reviews, regulatory databases, and expert analyses, to determine whether Bit Coins is indeed safe or a potential scam.

Regulation and Legitimacy

The regulatory landscape is a critical aspect when assessing the legitimacy of any forex broker. Regulation serves as a safeguard for traders, ensuring that brokers adhere to strict operational standards and protect client funds. In the case of Bit Coins, our investigation reveals that it operates without proper regulatory oversight. The broker claims to be regulated by the Global Financial Authority (GFA); however, this entity is not recognized as a legitimate regulatory body by established financial institutions.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Global Financial Authority | Not Applicable | Not Recognized | Not Verified |

The absence of credible regulation raises significant red flags. Without oversight from a recognized authority, traders are left vulnerable, as there are no legal frameworks to protect their investments or ensure fair trading practices. Historical compliance records for Bit Coins are non-existent, further emphasizing the lack of accountability and transparency. Given these findings, it is vital for potential clients to consider the risks associated with trading through an unregulated broker like Bit Coins.

Company Background Investigation

Understanding the background of a trading company provides insight into its reliability and operational practices. Bit Coins has a limited history, with scant information available regarding its ownership structure and management team. The lack of transparency surrounding the company's origins and leadership raises concerns about its legitimacy.

The management teams qualifications and experience are crucial indicators of a broker's reliability. Unfortunately, Bit Coins does not provide detailed information about its executives or their professional backgrounds. This absence of information can be a warning sign, as reputable brokers typically showcase their team's credentials to instill confidence in potential clients.

In terms of information disclosure, Bit Coins falls short. A legitimate broker should provide comprehensive details about its operations, including its physical address, contact information, and regulatory status. The lack of such transparency can lead to skepticism about the broker's intentions and operational integrity.

Trading Conditions Analysis

An essential aspect of evaluating any forex broker is understanding its trading conditions, including fees and spreads. Bit Coins presents itself as a competitive broker; however, the details regarding its fee structure reveal potential issues. The broker claims to offer low spreads and various account types, but the specifics remain vague and unverified.

| Fee Type | Bit Coins | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Specified | 1-2 pips |

| Commission Structure | Not Transparent | 0-0.5% |

| Overnight Interest Range | Not Disclosed | Varies |

The lack of clarity in Bit Coins' fee structure is concerning. Traders should be wary of brokers that do not transparently disclose their fees, as this can lead to unexpected costs and reduced profitability. Additionally, any unusual fees, such as withdrawal fees or inactivity charges, could further complicate the trading experience. In a competitive market, transparency in pricing is essential for building trust and ensuring a positive trading environment.

Customer Funds Security

The safety of customer funds is paramount when choosing a forex broker. Bit Coins claims to implement various security measures, but the specifics remain unclear. A reputable broker should provide information about fund segregation, investor protection schemes, and negative balance protection policies.

The absence of verified details regarding Bit Coins' security measures raises concerns. Traders must consider the risks associated with entrusting their funds to a broker that lacks transparency in its security protocols. Additionally, any historical incidents of fund mismanagement or security breaches should be thoroughly investigated before proceeding with any investment.

Customer Experience and Complaints

Analyzing customer feedback is crucial in assessing a broker's reliability. Bit Coins has received mixed reviews, with some users expressing dissatisfaction with their trading experience. Common complaints include difficulties in withdrawing funds, lack of customer support, and issues with trade execution.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Customer Support | Medium | Slow |

| Trade Execution | Low | Average |

Several users have reported challenges in withdrawing their funds, a significant red flag that suggests potential liquidity issues. The lack of timely responses from customer support further exacerbates these concerns, as traders rely on efficient communication to resolve issues promptly.

For instance, one user reported being unable to withdraw their funds for weeks, with minimal communication from the Bit Coins support team. Such experiences can lead to frustration and distrust, ultimately impacting the broker's reputation in the market.

Platform and Trade Execution

The performance of the trading platform is another critical factor in evaluating a broker. Bit Coins offers a web-based trading platform, but user reviews indicate mixed experiences regarding its stability and performance. Traders have reported issues with order execution, including slippage and rejected orders, which can significantly impact trading outcomes.

A reliable platform should provide seamless execution and minimal downtime. Any signs of manipulation or irregularities in trade execution could indicate deeper issues within the broker's operations.

Risk Assessment

Using Bit Coins comes with inherent risks that potential traders should carefully consider. The lack of regulation, transparency regarding fees, and customer complaints contribute to an overall risk profile that is concerning.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No credible regulation |

| Financial Risk | Medium | Unclear fee structure |

| Operational Risk | High | Customer complaints about withdrawals |

To mitigate these risks, traders are advised to conduct thorough research before engaging with Bit Coins. Seeking alternative brokers with strong regulatory oversight and positive user feedback can provide a safer trading environment.

Conclusion and Recommendations

In conclusion, the evidence suggests that Bit Coins may pose significant risks to potential traders. The lack of credible regulation, transparency in trading conditions, and negative customer feedback raises red flags about the broker's legitimacy. While it may offer attractive trading features, the potential for fraud and operational issues cannot be overlooked.

For traders seeking safer alternatives, it is advisable to consider well-established brokers with a proven track record and regulatory oversight. Options such as eToro, Coinbase, and Kraken provide more reliable trading environments, ensuring better protection for customer funds and a more transparent trading experience.

Ultimately, traders must exercise caution and conduct thorough due diligence before engaging with any broker, especially one like Bit Coins that raises multiple concerns.

Is Bit&Coins a scam, or is it legit?

The latest exposure and evaluation content of Bit&Coins brokers.

Bit&Coins Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Bit&Coins latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.