Regarding the legitimacy of Ava Trade MT5 forex brokers, it provides ASIC, FSA and WikiBit, .

Is Ava Trade MT5 safe?

Business

License

Is Ava Trade MT5 markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

AVA CAPITAL MARKETS AUSTRALIA PTY LTD

Effective Date: Change Record

2011-11-09Email Address of Licensed Institution:

D.Ferguson@avatrade.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

AVA CAPITAL MARKETS AUSTRALIA C/- WEWORK G 320 PITT ST SYDNEY NSW 2000Phone Number of Licensed Institution:

1800206496Licensed Institution Certified Documents:

FSA Market Making License (MM)

Financial Services Agency

Financial Services Agency

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

アヴァトレード・ジャパン株式会社

Effective Date:

2007-09-30Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

東京都港区赤坂2-18-1 赤坂ヒルサイドビル4階Phone Number of Licensed Institution:

03-4577-8900Licensed Institution Certified Documents:

Is AvaTrade MT5 Safe or a Scam?

Introduction

AvaTrade, established in 2006 and headquartered in Dublin, Ireland, has positioned itself as a prominent player in the online trading market, particularly in forex and CFDs. As a broker that offers access to multiple trading platforms, including MetaTrader 5 (MT5), it caters to both novice and experienced traders. However, with the proliferation of online trading platforms, it is essential for traders to exercise caution and thoroughly evaluate the legitimacy and reliability of their chosen broker. This article aims to provide a comprehensive analysis of AvaTrade MT5, focusing on its regulatory status, company background, trading conditions, client fund safety, user experiences, platform performance, and overall risk assessment. The evaluation is based on a review of multiple sources, including regulatory information, customer feedback, and expert analyses.

Regulation and Legitimacy

AvaTrade operates under several regulatory authorities, which is a critical aspect of its credibility. Regulatory oversight is essential in the financial sector as it ensures that brokers adhere to strict standards, protecting traders' interests. AvaTrade is regulated by the following entities:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Central Bank of Ireland (CBI) | C53877 | Ireland | Verified |

| Australian Securities and Investments Commission (ASIC) | 406684 | Australia | Verified |

| Financial Services Agency (FSA) | 1662 | Japan | Verified |

| Financial Sector Conduct Authority (FSCA) | 45984 | South Africa | Verified |

| British Virgin Islands Financial Services Commission (BVI FSC) | SIBA/L/13/1049 | British Virgin Islands | Verified |

The presence of multiple tier-1 regulatory licenses indicates a strong commitment to compliance and customer protection. AvaTrade's regulation by the CBI and ASIC, both of which are known for their stringent regulatory frameworks, enhances its credibility. Furthermore, AvaTrade's compliance with the MiFID II directive in the European Union provides additional layers of protection for its clients. Historically, AvaTrade has maintained a solid reputation without significant regulatory infractions, making it a broker that traders can generally trust.

Company Background Investigation

AvaTrade has a rich history that spans over 17 years in the online trading industry. Founded by financial experts, the company has grown significantly, serving over 400,000 registered clients and executing millions of trades monthly. The ownership structure of AvaTrade is primarily private, which allows for flexibility in operations and decision-making.

The management team comprises seasoned professionals with extensive experience in finance and trading. This expertise contributes to AvaTrade's strategic direction and operational efficiency. Transparency is a hallmark of AvaTrade, as it provides detailed information about its services, fees, and trading conditions on its website. This level of disclosure is crucial for building trust with clients, as it allows them to make informed decisions regarding their trading activities.

Trading Conditions Analysis

AvaTrade offers competitive trading conditions that appeal to a wide range of traders. The overall fee structure is relatively straightforward, with no commissions on trades, which is a significant advantage for active traders. However, it is essential to examine the potential hidden costs associated with trading on the platform.

| Fee Type | AvaTrade MT5 | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.9 pips | 1.0 pips |

| Commission Model | 0% | 0% |

| Overnight Interest Range | Varies | Varies |

The spreads offered by AvaTrade are competitive, particularly for major currency pairs. However, traders should be aware of the inactivity fee of $50 after three months of no trading activity, which could deter less active traders. Additionally, while AvaTrade does not charge withdrawal fees for most methods, some payment options may incur charges, which is a common practice in the industry. Understanding these costs is crucial for traders to manage their expenses effectively.

Client Fund Safety

AvaTrade prioritizes the safety of client funds through several robust measures. All client funds are held in segregated accounts, which means that they are kept separate from the company's operational funds. This practice ensures that client deposits are protected in the event of the company's insolvency. Furthermore, AvaTrade provides negative balance protection, which prevents clients from losing more than their initial investment.

The broker is also a member of the Investor Compensation Company (ICCL), which offers additional protection of up to €20,000 for eligible clients in the event of insolvency. This multi-tiered approach to fund safety significantly enhances the security of client investments. Nevertheless, it is important to note that while AvaTrade has not faced significant fund security issues historically, traders should remain vigilant and informed about potential risks associated with online trading.

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability and service quality. AvaTrade generally receives positive reviews for its customer support and trading conditions. However, like any broker, it is not without its share of complaints.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Moderate | Addressed |

| Platform Stability | High | Ongoing Issues |

| Customer Service Response | Moderate | Generally Positive |

Common complaints include delays in withdrawals and occasional platform stability issues. Some users have reported difficulties in withdrawing funds promptly, citing extended processing times. However, AvaTrade's customer service team has been noted for their responsiveness and willingness to assist clients in resolving issues.

For example, one trader reported frustration with the withdrawal process, but after contacting customer support, they received timely assistance and clarification on the steps needed to complete their withdrawal. This highlights the importance of effective customer support in mitigating client concerns.

Platform and Trade Execution

AvaTrade's trading platform, particularly the MT5, is known for its advanced features and user-friendly interface. The platform provides a seamless trading experience with robust analytical tools and support for automated trading through Expert Advisors (EAs).

Order execution quality is generally high, with minimal slippage reported on major currency pairs. However, some traders have experienced occasional requotes during volatile market conditions, which can impact trading outcomes. AvaTrade's commitment to transparency in execution practices is commendable, as it allows traders to understand potential risks associated with order execution.

Risk Assessment

Using AvaTrade involves several risks that traders should be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Low | Strong regulatory oversight. |

| Market Risk | High | Volatile market conditions can lead to significant losses. |

| Operational Risk | Medium | Occasional platform issues may affect trading. |

To mitigate these risks, traders are advised to engage in thorough risk management practices, such as setting appropriate stop-loss orders and diversifying their trading portfolio. Additionally, utilizing the demo account feature can help traders familiarize themselves with the platform and develop strategies without risking real capital.

Conclusion and Recommendations

In summary, AvaTrade MT5 appears to be a reliable broker with a strong regulatory framework, solid company background, and competitive trading conditions. While there are some concerns regarding withdrawal delays and platform stability, the overall customer experience is generally positive, supported by responsive customer service.

Traders should remain vigilant and conduct thorough research before engaging with any broker. For those considering AvaTrade, it is recommended to start with a demo account to gain familiarity with the platform and its features. Additionally, traders should be aware of the potential risks involved and employ effective risk management strategies.

If you are seeking alternatives, brokers like IG, OANDA, or Forex.com may offer similar services with varying features and conditions. Ultimately, the choice of broker should align with individual trading goals and risk tolerance.

In conclusion, AvaTrade MT5 is generally considered safe, but as with any trading platform, caution is advised.

Is Ava Trade MT5 a scam, or is it legit?

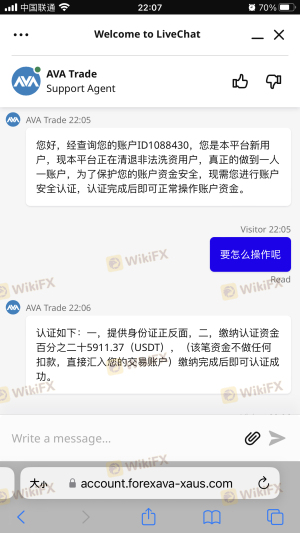

The latest exposure and evaluation content of Ava Trade MT5 brokers.

Ava Trade MT5 Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Ava Trade MT5 latest industry rating score is 1.43, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.43 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.