Is Investments Global safe?

Pros

Cons

Is Investments Global A Scam?

Introduction

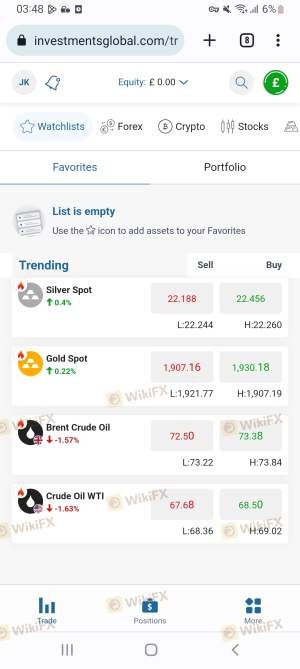

Investments Global is an emerging player in the forex trading market, offering a wide array of financial instruments including forex, cryptocurrencies, stocks, commodities, and indices. Founded in 2022 and operating from Saint Vincent and the Grenadines, the broker positions itself as a versatile trading platform aimed at both novice and experienced traders. However, the lack of regulatory oversight raises significant concerns about its legitimacy and safety. As the forex market is rife with scams and fraudulent brokers, it is crucial for traders to carefully evaluate their options before committing their funds. This article will explore the regulatory status, company background, trading conditions, customer experiences, and overall safety measures of Investments Global to determine whether it is a scam or a legitimate trading platform.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in assessing its legitimacy. Investments Global claims to operate under a license from Saint Vincent and the Grenadines, a jurisdiction known for its lenient regulatory standards. However, many reputable financial authorities do not recognize this as a reliable regulatory framework.

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| Saint Vincent and the Grenadines | N/A | Offshore | Unverified |

The absence of oversight from higher-tier regulatory bodies such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus) raises red flags about the broker's commitment to client protection and financial transparency. Furthermore, historical compliance issues related to offshore brokers indicate that they may not adhere to strict financial regulations, which can put traders' funds at risk. The lack of regulatory protection means that in the event of a dispute, traders may have limited recourse to recover their investments.

Company Background Investigation

Investments Global was established in 2022, and its operational history is relatively short compared to many established brokers in the market. The ownership structure and management team information are notably sparse, which contributes to the overall lack of transparency surrounding the broker. This opacity raises concerns about accountability and trustworthiness.

The management teams professional background is not disclosed, making it difficult to assess their expertise and experience in the financial markets. A transparent broker typically provides information about its leadership, including their qualifications and previous roles in the finance industry. The absence of such information could indicate a lack of professionalism and commitment to ethical trading practices.

The companys transparency in terms of information disclosure is inadequate. A legitimate broker should openly share details about its operations, policies, and management to build trust with its clients. Without this transparency, potential clients may feel apprehensive about associating with Investments Global.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions is essential. Investments Global offers a minimum deposit requirement of $250, which is relatively low compared to many competitors. However, the trading costs associated with the broker are not clearly defined, leading to potential confusion for traders.

| Fee Type | Investments Global | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | From 1.6 pips | 1.0 - 1.5 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The spreads offered by Investments Global start at 1.6 pips for major currency pairs, which can be considered higher than the industry average. Additionally, the lack of a clearly defined commission structure may lead to hidden costs that could affect trading profitability. Traders should be cautious about any unusual fee policies that could be detrimental to their trading experience.

Moreover, the absence of a demo account limits the ability of potential clients to test the platform before committing real funds. This is a significant disadvantage, especially for novice traders who may benefit from practice before engaging in live trading.

Client Fund Security

The safety of client funds is paramount when selecting a trading platform. Investments Global claims to keep clients' funds in segregated accounts, a practice that is intended to protect traders' capital in the event of the broker's insolvency. However, the effectiveness of these measures is questionable given the lack of regulatory oversight.

Additionally, the broker adheres to Anti-Money Laundering (AML) and Know Your Customer (KYC) policies, which are essential for ensuring that the platform is not used for illicit activities. However, the absence of a robust regulatory framework raises concerns about the enforcement of these policies.

Historically, offshore brokers have faced scrutiny regarding their fund security measures, and any past incidents involving Investments Global could further impact its credibility. Traders should remain vigilant and conduct thorough research to ensure their funds are secure when trading with Investments Global.

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability and service quality. Reviews of Investments Global reveal a mixed bag of experiences, with many traders expressing concerns about withdrawal difficulties and unresponsive customer service.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response time |

| Lack of Transparency | Medium | Minimal information provided |

| High Spreads | Medium | No clear justification |

Common complaints include delays in processing withdrawals, which can be a significant issue for traders looking to access their funds promptly. The quality of customer support has also been criticized, with reports of slow response times and inadequate assistance. This could indicate a lack of commitment to customer service and support, which is crucial for building trust with clients.

A few typical cases highlight these issues, where traders have reported waiting weeks for withdrawal approvals, leading to frustration and loss of confidence in the broker.

Platform and Trade Execution

The trading platform offered by Investments Global is web-based and designed to be user-friendly. However, it lacks the advanced features found in more established platforms like MetaTrader 4 or 5, which are widely used by traders for their robustness and functionality.

The order execution quality is also a critical aspect to consider. Reports suggest that some traders have experienced slippage and order rejections, which can negatively impact trading outcomes. Any signs of platform manipulation, such as artificially widening spreads during volatile market conditions, could further erode trust in the broker.

Risk Assessment

Using Investments Global comes with various risks, primarily stemming from its lack of regulation and transparency.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight from reputable authorities |

| Withdrawal Risk | High | Complaints about delays in fund access |

| Transparency Risk | Medium | Lack of clear information about fees and operations |

To mitigate these risks, traders are advised to conduct thorough due diligence before investing. This includes reading reviews, assessing the broker's regulatory status, and considering starting with a small investment to test the waters.

Conclusion and Recommendations

In conclusion, the evidence suggests that Investments Global raises several red flags that warrant caution. The lack of regulatory oversight, combined with negative customer experiences and transparency issues, indicates that traders should approach this broker with care.

For those considering trading with Investments Global, it is crucial to weigh the risks and ensure that you are comfortable with the potential challenges associated with using an unregulated broker. If you are looking for safer alternatives, consider brokers that are regulated by reputable authorities and have a proven track record of reliability and customer satisfaction.

In summary, while Investments Global may offer attractive trading conditions, the concerns regarding its legitimacy make it a platform that traders should carefully evaluate before committing their funds. Always prioritize safety and regulatory compliance when choosing a broker to ensure a secure trading experience.

Is Investments Global a scam, or is it legit?

The latest exposure and evaluation content of Investments Global brokers.

Investments Global Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Investments Global latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.