Is Atlas Forex safe?

Pros

Cons

Is Atlas Forex Safe or a Scam?

Introduction

Atlas Forex is an online forex broker that has emerged on the trading scene, primarily targeting retail traders looking for access to the foreign exchange markets. Established in 2020, Atlas Forex claims to offer a user-friendly trading platform and a range of account types, appealing to both novice and experienced traders. However, as the forex market is rife with scams and unregulated brokers, it is crucial for traders to conduct thorough due diligence before committing their funds. This article aims to evaluate whether Atlas Forex is safe or a potential scam by analyzing its regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and associated risks.

Regulation and Legitimacy

The regulatory environment in which a broker operates is a critical factor in determining its legitimacy and safety. A properly regulated broker is subject to oversight by financial authorities, ensuring compliance with stringent operational standards and providing a level of protection for traders.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| IFSC | Not available | Belize | Not verified |

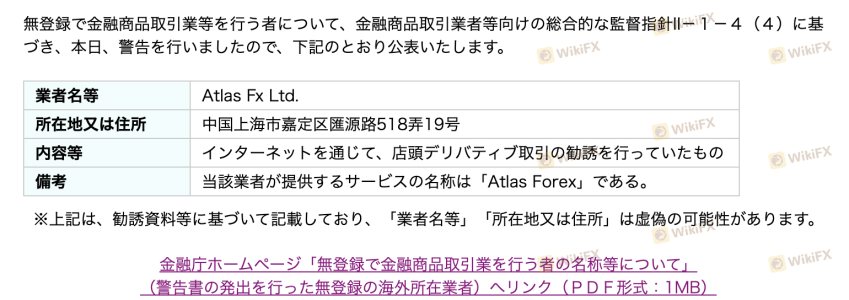

Atlas Forex claims to be regulated by the International Financial Services Commission (IFSC) in Belize. However, multiple sources indicate that there is no verifiable record of Atlas Forex being licensed by this authority. The absence of a legitimate regulatory framework raises significant concerns about the safety of trading with Atlas Forex. Unregulated brokers often operate with minimal oversight, exposing traders to higher risks, including potential fraud and loss of funds. Furthermore, the lack of regulatory compliance can lead to a lack of recourse for traders if disputes arise.

Company Background Investigation

Atlas Forex presents itself as a forex broker based in China, but details about its ownership structure and management team are scant. The broker claims to have been operational since 2020; however, there are no substantial records or verifiable information regarding its establishment or operational history. This lack of transparency is alarming, as it limits traders' ability to assess the broker's credibility.

The management teams background is also unclear, with no available information on their professional experience or qualifications in the financial industry. A reputable broker typically provides insights into its leadership to instill confidence among potential clients. The absence of such information further raises concerns about the broker's legitimacy and whether it is a safe option for traders.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is essential. This includes analyzing the fee structure, spreads, and commissions, which can significantly impact trading profitability.

| Fee Type | Atlas Forex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Moderate |

Atlas Forex offers variable spreads, which can be competitive but are not explicitly listed on their website. The absence of clear information on spreads and commissions can be a red flag, as it suggests a lack of transparency. Additionally, the broker's claim of having no commissions may appear attractive; however, this often translates to wider spreads, which can erode profits over time.

Furthermore, traders should be cautious of any hidden fees or unfavorable terms that could impact their trading experience. The lack of clear information on the fee structure raises questions about whether Atlas Forex is safe for trading.

Client Fund Security

The safety of client funds is paramount when choosing a forex broker. A reputable broker should implement robust security measures to protect client deposits and ensure that funds are managed responsibly.

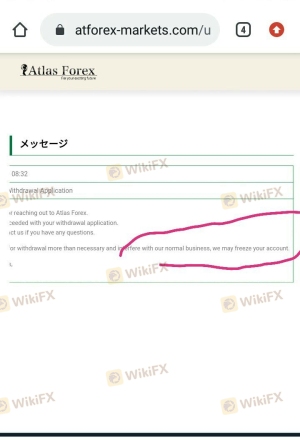

Atlas Forex claims to keep client funds in segregated accounts; however, without regulatory oversight, there is no guarantee that these claims are accurate. The absence of investor protection schemes means that traders may have little recourse in the event of financial mismanagement or insolvency. Moreover, historical complaints from users about withdrawal issues further exacerbate concerns regarding fund security.

Traders should be aware that dealing with an unregulated broker like Atlas Forex can expose them to significant risks, including the potential loss of their entire investment.

Customer Experience and Complaints

Examining customer feedback is crucial in assessing a broker's reliability. Atlas Forex has garnered a range of reviews, with many users expressing dissatisfaction regarding their experiences.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Inadequate |

| Customer Service Delays | Medium | Slow |

Common complaints include difficulties in withdrawing funds, lack of transparency regarding fees, and inadequate customer support. Users have reported being unable to access their funds, which raises serious concerns about the broker's operational integrity. The company's slow response to complaints further indicates a lack of commitment to customer service, which is essential for building trust in the forex trading community.

Platform and Execution

The trading platform is a critical component of any forex broker's offering. Atlas Forex provides access to the MetaTrader 4 (MT4) platform, which is widely recognized for its reliability and user-friendly interface. However, the broker's execution quality, slippage rates, and overall platform performance are less clear.

Traders have reported instances of slippage and delayed order execution, which can significantly impact trading outcomes. The lack of transparency regarding these issues raises questions about whether Atlas Forex is safe for trading, especially for those who rely on timely execution to capitalize on market movements.

Risk Assessment

Trading with Atlas Forex presents several risks that potential clients should consider.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases risk. |

| Fund Security Risk | High | Lack of protection for client funds. |

| Execution Risk | Medium | Reports of slippage and delays. |

| Customer Service Risk | Medium | Poor response to complaints. |

Given these risks, it is crucial for traders to approach Atlas Forex with caution. Implementing risk mitigation strategies, such as only trading with funds they can afford to lose and considering regulated alternatives, can help protect against potential losses.

Conclusion and Recommendations

In conclusion, the evidence suggests that Atlas Forex is not a safe broker for trading. The lack of regulatory oversight, transparency in operations, and numerous customer complaints indicate that traders should exercise extreme caution. While the broker may offer attractive trading conditions, the potential risks far outweigh the benefits.

For traders seeking a reliable and secure trading environment, it is advisable to consider regulated alternatives with established reputations. Brokers regulated by reputable authorities provide greater protection for client funds and offer a more transparent trading experience. Therefore, before engaging with Atlas Forex, traders are urged to conduct thorough research and consider safer options in the forex market.

Is Atlas Forex a scam, or is it legit?

The latest exposure and evaluation content of Atlas Forex brokers.

Atlas Forex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Atlas Forex latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.