Is A3TRADING safe?

Pros

Cons

Is A3Trading A Scam?

Introduction

A3Trading is an online brokerage platform that claims to cater to both novice and experienced traders in the foreign exchange (forex) market. Positioned as a versatile trading hub, A3Trading offers a range of financial instruments, including forex, commodities, stocks, and cryptocurrencies. Given the complexities and risks associated with trading in the forex market, it is crucial for traders to carefully evaluate the credibility and reliability of their chosen brokers. This article aims to assess whether A3Trading is a safe and legitimate trading platform or if it exhibits characteristics of a scam.

To conduct this evaluation, we employed a comprehensive investigative approach, analyzing various aspects of A3Trading, including its regulatory status, company background, trading conditions, customer safety measures, user experiences, and overall risk profile. By synthesizing data from multiple reputable sources, we aim to provide an objective overview of A3Trading's standing in the forex market.

Regulation and Legitimacy

The regulatory environment in which a broker operates is a fundamental aspect that determines its legitimacy and safety. A3Trading claims to be regulated by the Seychelles Financial Services Authority (FSA) and the Cyprus Securities and Exchange Commission (CySEC). However, the credibility of these claims warrants scrutiny.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Seychelles FSA | SD 012 | Seychelles | Active |

| CySEC | N/A | Cyprus | Not Found |

While A3Trading states that it operates under the oversight of the Seychelles FSA, it is essential to note that this regulatory body is classified as Tier-3, which typically involves less stringent requirements compared to Tier-1 regulators like the FCA or ASIC. Moreover, reports indicate that A3Trading has no direct affiliation with CySEC, raising concerns about its claims of regulatory compliance. The lack of a robust regulatory framework and the absence of investor protection mechanisms, such as compensation funds, further complicate the broker's legitimacy.

Company Background Investigation

A3Trading is reportedly operated by Securcap Securities Limited, with its corporate structure indicating ties to offshore jurisdictions. The company claims to have been established to provide a secure trading environment, yet the lack of transparency regarding its history and ownership raises red flags.

The management team behind A3Trading has not been extensively documented, making it difficult to assess their qualifications and experience in the financial services industry. A broker's credibility is often bolstered by a knowledgeable and experienced management team, and the absence of such information may lead potential investors to question the broker's reliability.

Furthermore, A3Trading's website lacks comprehensive information about its operational history and the specific services it offers. This opacity can be a warning sign for potential clients, as transparency is a key factor in establishing trust in the financial services sector.

Trading Conditions Analysis

A3Trading's trading conditions are a vital aspect to consider when assessing its overall appeal. The broker requires a minimum deposit of $200 to open an account, which is relatively standard in the industry. However, the specifics regarding spreads and commissions are not clearly outlined, which may lead to unexpected costs for traders.

| Fee Type | A3Trading | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 3 pips | 1-2 pips |

| Commission Model | Not specified | Varies |

| Overnight Interest Range | 0.02% - 0.1% | Varies |

The fixed spread of 3 pips on major currency pairs is above the industry average, which could affect profitability for traders. Additionally, the lack of clarity regarding commission structures and potential hidden fees is concerning. These factors necessitate careful consideration, as they could significantly impact trading outcomes.

Customer Funds Security

Customer funds' safety is paramount in choosing a forex broker. A3Trading states that it employs various security measures to protect client funds, including segregated accounts and negative balance protection. However, the effectiveness of these measures is questionable given the broker's offshore status.

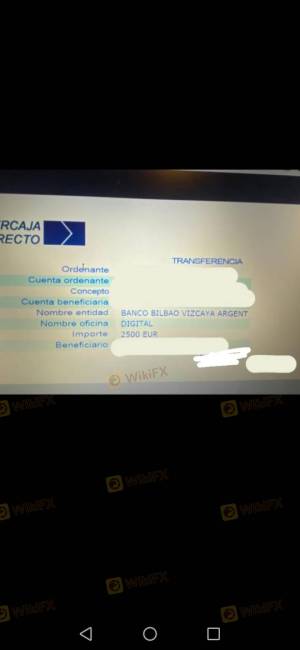

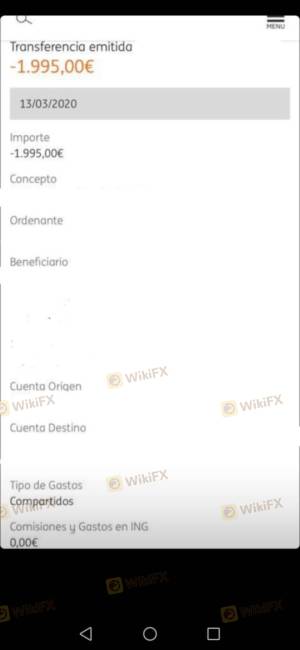

The absence of a credible investor protection scheme, such as those offered by Tier-1 regulators, means that clients may not have recourse in the event of a broker insolvency. Furthermore, historical complaints and warnings from regulatory authorities indicate potential issues regarding fund security and withdrawal processes.

Customer Experience and Complaints

Customer feedback is a crucial indicator of a broker's reliability. A3Trading has received mixed reviews from users, with some praising its user-friendly platform and educational resources, while others report severe issues regarding withdrawals and account management.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Account Management Problems | Medium | Inconsistent support |

| Misleading Information | High | No resolution |

Typical complaints include difficulties in withdrawing funds, with users reporting that they were prompted for additional deposits before being allowed to withdraw their initial investments. Such practices are often indicative of potential scams or at least poorly managed operations.

Platform and Trade Execution

A3Trading offers a proprietary trading platform, which may lack the familiarity and reliability of established platforms like MetaTrader 4 or 5. While the platform claims to provide fast execution and a variety of analytical tools, user reviews suggest that it may not perform consistently under volatile market conditions.

Concerns regarding order execution quality, including slippage and order rejections, have been raised. These issues can significantly impact trading performance, especially for those employing high-frequency or scalping strategies.

Risk Assessment

Engaging with A3Trading presents several risks that potential clients should consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of strong regulation and oversight. |

| Financial Risk | Medium | Potential high spreads and unclear fee structures. |

| Operational Risk | High | Complaints about withdrawal issues and customer support. |

To mitigate these risks, traders should conduct thorough due diligence before investing. This includes seeking out additional reviews, verifying regulatory claims, and considering starting with a smaller investment.

Conclusion and Recommendations

In conclusion, the investigation into A3Trading raises significant concerns regarding its legitimacy and safety. The broker's regulatory status is questionable, with claims that do not align with available information. Additionally, customer feedback indicates potential issues with fund withdrawals and account management.

For traders seeking a reliable forex broker, it may be prudent to consider alternatives that are regulated by Tier-1 authorities, offer transparent fee structures, and have a proven track record of customer satisfaction. Brokers such as IG, OANDA, or Forex.com may provide safer options for traders looking to engage in the forex market.

In summary, while A3Trading may present itself as a viable trading platform, the potential risks and concerns highlighted in this analysis suggest that traders should exercise caution and thoroughly evaluate their options before proceeding.

Is A3TRADING a scam, or is it legit?

The latest exposure and evaluation content of A3TRADING brokers.

A3TRADING Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

A3TRADING latest industry rating score is 1.63, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.63 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.