A3Trading 2025 Review: Everything You Need to Know

Executive Summary

A3Trading stands out as a reliable brokerage platform designed to serve both professional and beginner traders in the competitive online trading landscape. This a3trading review reveals a broker that prioritizes user experience through its intuitive interface and comprehensive trading tools, making trading accessible for everyone. The platform offers multiple account types and provides access to over 35 forex currency pairs, CFDs, and commodities including oil. This makes it an attractive option for diverse trading strategies across different markets.

According to Trustpilot data, A3Trading holds a rating of 1.5 out of 5 based on 84 user reviews, which presents a mixed picture of user satisfaction that requires careful consideration. However, multiple sources indicate that the platform delivers excellent customer support and comprehensive educational resources. This positions it as a suitable choice for traders at various experience levels who value learning and support. The broker's commitment to providing both PROfit and WebPROfit trading platforms demonstrates its dedication to meeting different trader preferences and technical requirements.

For traders seeking a platform that combines reliability with user-friendly features, A3Trading presents a compelling option. This is particularly true for those who value educational support and diverse trading instruments in their trading journey.

Important Notice

This review is based on publicly available information, user feedback, and platform-provided data as of 2025. Trading involves substantial risk, and potential traders should conduct their own due diligence before making any investment decisions that could affect their financial future. The information presented here reflects the current state of A3Trading's services and may be subject to change.

Regulatory information and specific terms may vary by region, and traders should verify the broker's compliance status in their jurisdiction before opening an account. This evaluation aims to provide an objective assessment based on available data and user experiences to help traders make informed decisions.

Rating Framework

Broker Overview

A3Trading has established itself as a comprehensive online trading platform that caters to investors seeking a secure and reliable environment for their trading activities. According to multiple industry sources, the platform distinguishes itself through its sleek and intuitive design, making it accessible to both seasoned professionals and newcomers to the trading world who want to start their investment journey. The broker's business model focuses on providing a wide range of financial instruments while maintaining a user-centric approach to service delivery.

The platform's commitment to serving diverse trader needs is evident in its comprehensive offering of trading tools and educational resources. A3Trading positions itself as "one of the best online trading platforms for investors and traders looking for a secure and reliable place to invest their hard-earned money," as noted in industry reviews that evaluate broker performance. This positioning reflects the broker's understanding of the critical factors that traders consider when selecting a trading platform.

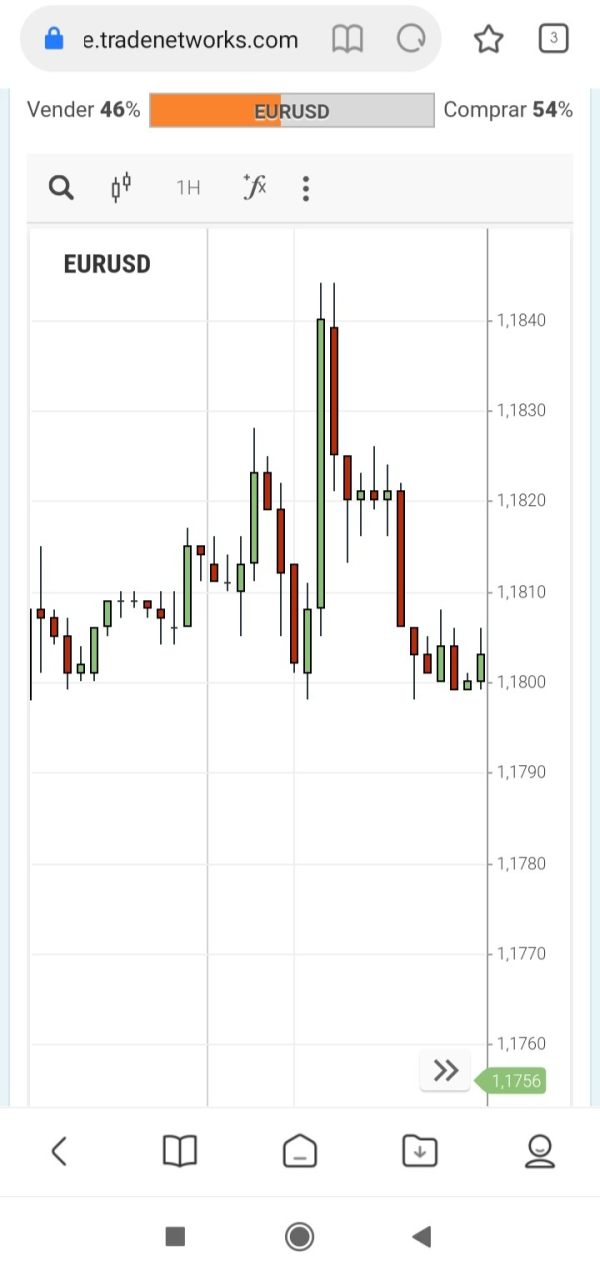

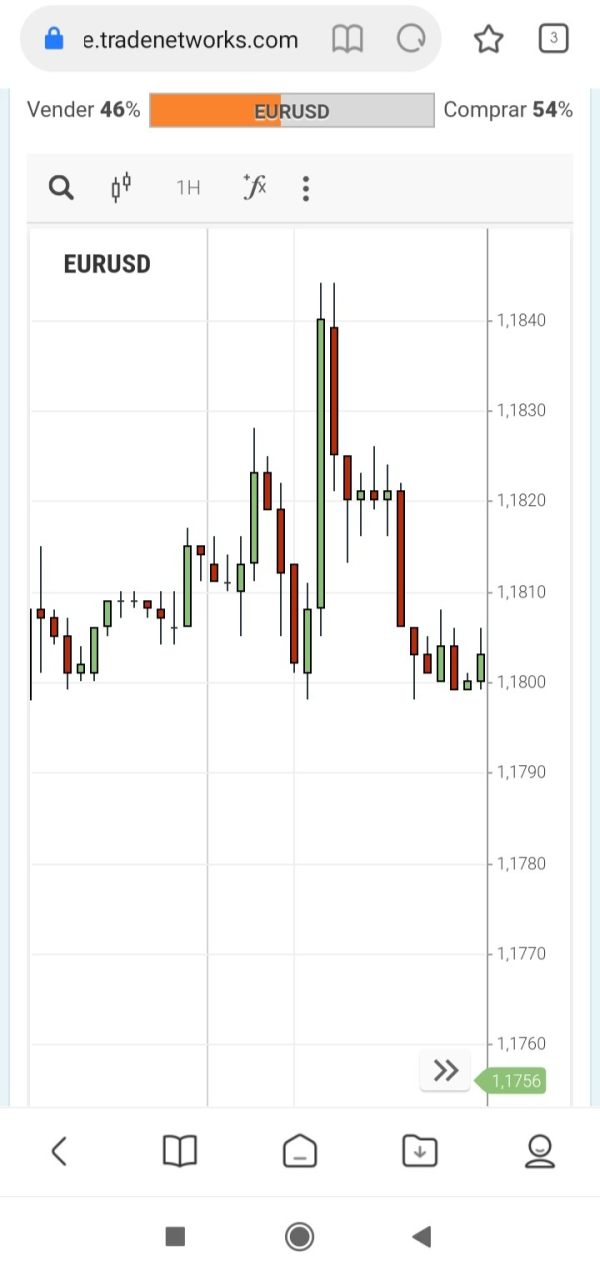

In terms of technical infrastructure, A3Trading operates through two primary trading platforms: PROfit and WebPROfit, providing traders with flexibility in choosing their preferred trading environment. The broker's asset portfolio spans over 35 forex currency pairs, various CFDs, and commodity markets including oil trading, giving traders many options for diversification. While specific regulatory information was not detailed in available sources, the platform maintains its reputation as a trustworthy broker within the online trading community. This makes this a3trading review particularly relevant for traders evaluating their options in today's competitive market.

Regulatory Status: Specific regulatory information was not detailed in available sources, requiring potential traders to verify compliance status directly with the broker.

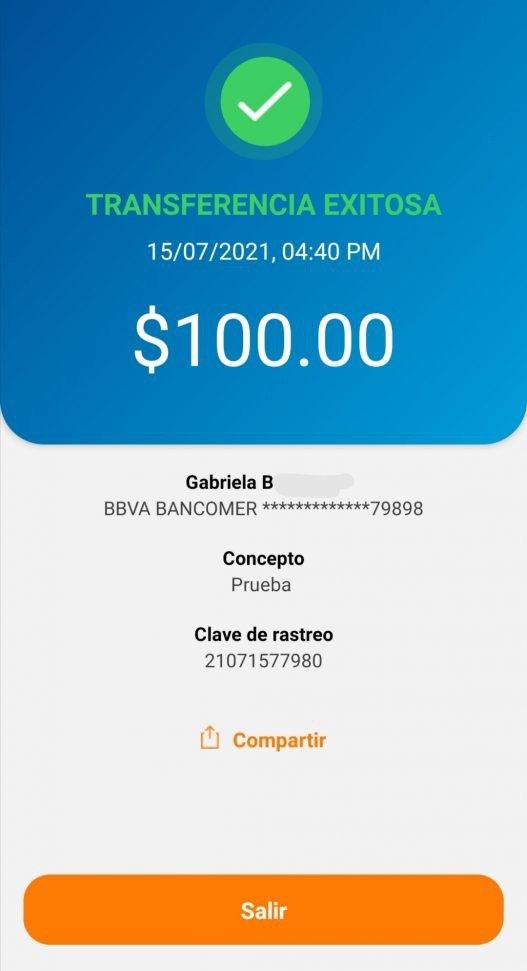

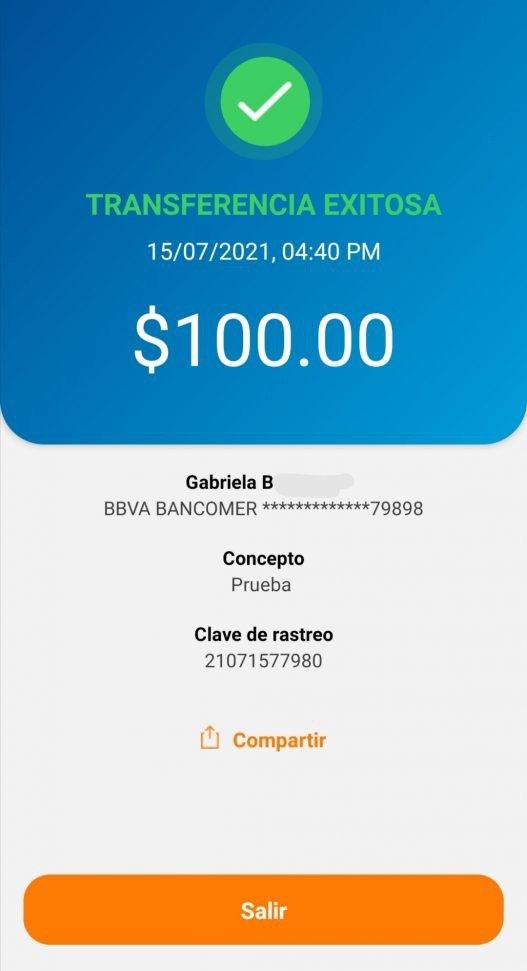

Deposit and Withdrawal Methods: The available sources do not provide comprehensive details about payment methods, processing times, or associated fees for deposits and withdrawals.

Minimum Deposit Requirements: Specific minimum deposit amounts for different account types are not detailed in current available information.

Bonuses and Promotions: Current promotional offers and bonus structures are not specified in the available source materials.

Tradeable Assets: A3Trading provides access to over 35 forex currency pairs, CFDs across various markets, and commodities including oil trading. This diverse range allows traders to implement various strategies across different market sectors and helps them build balanced portfolios.

Cost Structure: Detailed information about spreads, commissions, and other trading costs was not comprehensively covered in available sources, requiring direct inquiry with the broker.

Leverage Options: Specific leverage ratios and their variations across different instruments are not detailed in current source materials.

Platform Options: The broker offers two main trading platforms - PROfit and WebPROfit - designed to accommodate different trader preferences and technical requirements.

Regional Restrictions: Information about geographical limitations and restricted jurisdictions is not specified in available sources.

Customer Service Languages: The range of supported languages for customer service was not detailed in the reviewed materials.

This a3trading review highlights the need for potential traders to seek additional information directly from the broker regarding specific terms and conditions.

Detailed Rating Analysis

Account Conditions Analysis

A3Trading's account structure appears designed to accommodate traders with varying experience levels and capital requirements, though specific details about account types remain limited in available sources. The platform's positioning as suitable for both professional and beginner traders suggests a tiered approach to account offerings, likely featuring different minimum deposits, trading conditions, and access levels to premium features that cater to different trader needs.

The account opening process, while not detailed in current sources, appears to follow industry standards based on user feedback indicating a generally positive onboarding experience. Users have noted the platform's accessibility for beginners, suggesting that the initial setup process is streamlined and user-friendly without unnecessary complications. However, specific information about Islamic accounts, professional trading accounts, or premium service tiers requires direct verification with the broker.

The lack of detailed information about account conditions in public sources presents a limitation for this a3trading review, as traders typically require clear understanding of minimum deposits, account maintenance fees, and specific trading conditions before making decisions. Potential clients are advised to contact A3Trading directly for comprehensive account information and to compare terms with industry standards to ensure they get the best deal.

A3Trading demonstrates strong performance in the tools and resources category, offering traders access to over 35 forex currency pairs alongside CFDs and commodity markets including oil. This diverse instrument selection provides traders with ample opportunities for portfolio diversification and strategy implementation across different market sectors, helping them spread risk effectively.

The platform's educational resources receive particular praise from users and industry observers, with comprehensive learning materials designed to support trader development at all levels. According to available sources, these educational offerings are substantial and well-structured, contributing significantly to the platform's appeal among beginner traders while providing value for more experienced users seeking to expand their knowledge base.

The availability of both PROfit and WebPROfit platforms indicates A3Trading's commitment to providing flexible trading environments. This dual-platform approach allows traders to choose the interface and functionality that best matches their trading style and technical preferences without being locked into a single system. While specific details about analytical tools, charting capabilities, and automated trading support are not extensively covered in available sources, the positive user feedback regarding platform functionality suggests adequate technical resources for effective trading operations.

Customer Service and Support Analysis

Customer service emerges as one of A3Trading's strongest attributes, with user evaluations consistently highlighting excellent support quality. This aspect of the broker's service delivery appears to be a significant differentiator in the competitive online trading landscape, where responsive and knowledgeable customer support can significantly impact trader satisfaction and success over the long term.

The quality of customer support is particularly important for beginner traders who may require more frequent assistance with platform navigation, trading concepts, and account management. User feedback suggests that A3Trading's support team effectively addresses these needs, contributing to the platform's reputation as beginner-friendly while maintaining service standards that satisfy more experienced traders who have complex questions.

However, specific details about support channels, availability hours, response times, and multilingual capabilities are not comprehensively covered in available sources. The absence of detailed information about 24/7 support, live chat availability, or dedicated account management services represents a gap in this evaluation that potential traders should investigate. Despite this limitation, the consistently positive user feedback regarding support quality suggests that A3Trading has invested significantly in building a competent customer service infrastructure.

Trading Experience Analysis

The trading experience on A3Trading receives generally positive feedback from users, with particular emphasis on the platform's user-friendly interface design. This aspect is crucial for trader satisfaction and effectiveness, as intuitive platform navigation directly impacts trading efficiency and decision-making speed during market hours. User testimonials indicate that both PROfit and WebPROfit platforms deliver satisfactory performance in terms of usability and functionality.

Platform stability and execution quality are fundamental elements of trading experience, though specific performance metrics such as execution speeds, slippage rates, or uptime statistics are not detailed in available sources. The positive user feedback suggests adequate performance in these areas, but traders requiring high-frequency trading capabilities or specific technical features should verify platform specifications directly with the broker to ensure compatibility.

Mobile trading capabilities and cross-device synchronization details are not extensively covered in current sources, representing an important consideration for modern traders who require flexible access to their accounts. The overall positive user sentiment regarding trading experience suggests that A3Trading meets basic expectations for platform functionality. This makes this a3trading review favorable in this category despite limited technical specifications being available for detailed analysis.

Trust Factor Analysis

The trust factor evaluation for A3Trading presents a mixed picture that requires careful consideration. While the platform is generally regarded as reliable by industry sources and maintains a reputation for security, the Trustpilot rating of 1.5 out of 5 based on 84 reviews raises some concerns about user satisfaction consistency that cannot be ignored.

This discrepancy between industry perception and user ratings suggests varying experiences among the trader base. Regulatory transparency represents a significant gap in available information, as specific licensing details, regulatory oversight, and compliance measures are not comprehensively documented in current sources that traders can easily access.

For traders prioritizing regulatory security, this lack of detailed regulatory information may impact confidence levels and require direct verification with the broker. The platform's longevity and industry presence contribute positively to its trust profile, with multiple sources recognizing A3Trading as an established player in the online trading space that has maintained operations over time. However, the absence of detailed information about fund segregation, insurance coverage, and dispute resolution mechanisms limits the comprehensive assessment of safety measures.

Potential traders should prioritize obtaining clear regulatory and safety information before committing funds to the platform.

User Experience Analysis

User experience evaluation reveals A3Trading's strength in creating an accessible and intuitive trading environment. The platform's design philosophy appears centered on minimizing complexity while maintaining functionality, resulting in positive feedback from users across different experience levels who appreciate the streamlined approach. The characterization of the interface as "sleek and intuitive" by industry sources aligns with user testimonials praising the platform's usability.

The broker's success in serving both professional and beginner traders suggests effective user interface design that scales appropriately across different user needs and technical proficiency levels. This adaptability is particularly valuable in the diverse online trading market, where platforms must balance sophisticated functionality with accessibility for newcomers who are just learning to trade.

Registration and account verification processes, while not detailed in available sources, appear to meet user expectations based on the positive overall experience feedback. The comprehensive educational resources contribute significantly to user experience, particularly for beginners who benefit from integrated learning materials that help them understand trading concepts and market dynamics. However, specific user journey optimizations, mobile experience details, and advanced customization options require additional investigation for a complete user experience assessment.

Conclusion

This comprehensive a3trading review reveals a broker that demonstrates particular strength in customer support and user experience while offering a solid foundation for both beginner and professional traders. A3Trading's commitment to providing comprehensive educational resources and maintaining user-friendly platforms positions it favorably for traders prioritizing learning and ease of use over complex features. The diverse range of trading instruments, including over 35 forex pairs and various CFDs, provides adequate opportunities for portfolio diversification.

However, potential traders should carefully consider the mixed signals regarding overall satisfaction, as evidenced by the low Trustpilot rating despite generally positive industry recognition. The limited availability of specific information about regulatory status, account conditions, and detailed trading terms represents a significant limitation that requires direct verification with the broker before making any commitments.

A3Trading appears most suitable for beginner to intermediate traders who value educational support and intuitive platform design over advanced trading features or ultra-competitive pricing structures. Professional traders with specific regulatory or technical requirements should conduct additional due diligence to ensure the platform meets their sophisticated needs and trading objectives.