YFX Capital 2025 Review: Everything You Need to Know

Executive Summary

This detailed yfx capital review looks at a broker whose legitimacy faces serious questions in today's forex market. YFX Capital runs as an offshore broker based in the Marshall Islands, creating a complex situation for traders who might want to use their services. The platform does offer some good features like fixed spreads and leverage up to 1:400, but several worrying issues overshadow these benefits.

The broker requires a high minimum deposit of $2,500. This targets traders who have lots of money to invest. YFX Capital gives traders the popular MetaTrader 4 platform and lets them trade forex and CFDs using a market maker system. But the lack of clear regulatory information creates red flags that potential clients should worry about.

This review helps traders with big budgets who might consider YFX Capital. Our analysis shows major concerns that need careful thought before opening an account.

Important Disclaimers

YFX Capital operates as an offshore broker in an unclear regulatory environment. This potentially exposes traders to higher risks than properly regulated alternatives would create. The company's regulatory status stays unclear, with available information failing to show concrete evidence of oversight by recognized financial authorities.

We based this evaluation on available information summaries and public data. The assessment doesn't include direct user trading feedback or real-time platform testing, which may limit how complete our analysis is.

Rating Framework

Broker Overview

YFX Capital works as an offshore forex broker with headquarters in the Marshall Islands. The company uses a market maker business model, which means it becomes the counterparty to client trades. The exact founding date stays unspecified in available documents, but the broker has tried to establish a presence in the competitive forex market through its offshore structure.

The broker focuses mainly on providing forex and CFD trading services to international clients. Specific details about the company's history, leadership, and corporate development remain limited in public information. This lack of transparency about company background adds to concerns about whether the operation is legitimate.

YFX Capital uses the MetaTrader 4 platform as its main trading interface. This is a widely recognized solution in the forex industry. The broker offers access to major currency pairs and contracts for difference across various asset classes, but the absence of detailed information about specific regulatory oversight raises questions about client protection levels. This yfx capital review emphasizes how important it is to understand these limitations before considering the broker for trading activities.

Regulatory Status: Available information doesn't specify concrete regulatory oversight by recognized financial authorities. This raises concerns about client protection and operational standards.

Deposit and Withdrawal Methods: YFX Capital supports limited funding options, accepting credit cards, debit cards, and bank wire transfers. The broker notably doesn't offer electronic wallet solutions, which may inconvenience traders who are used to modern payment methods.

Minimum Deposit Requirements: The broker maintains a high entry barrier with a minimum deposit requirement of $2,500. This positions itself toward traders with substantial capital reserves rather than retail beginners.

Promotional Offers: Current available information doesn't detail specific bonus programs or promotional campaigns that the broker offers.

Available Trading Assets: The platform provides access to forex pairs and contracts for difference (CFDs). It covers major currency combinations and derivative instruments.

Cost Structure: YFX Capital offers fixed spread pricing with zero commission charges. However, accessing floating spreads requires a minimum investment of $2,500, which aligns with their overall high-capital approach to client onboarding.

Leverage Options: The broker provides maximum leverage ratios up to 1:400. This offers significant position sizing flexibility for experienced traders.

Trading Platform: MetaTrader 4 serves as the primary trading interface. It provides standard charting tools and order execution capabilities.

Geographic Restrictions: Specific regional limitations aren't detailed in available documentation.

Customer Support Languages: Information about supported customer service languages isn't specified in current materials. This yfx capital review notes this as another area that lacks transparency.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

YFX Capital's account structure creates significant barriers for many traders through its high minimum deposit requirement of $2,500. This threshold immediately excludes smaller retail traders and targets the broker toward clients with substantial trading capital. The high entry point raises questions about the broker's target market strategy and how accessible it really is.

Available information doesn't provide detailed descriptions of different account tiers or specialized features that might justify such requirements. The absence of information about Islamic accounts, demo account availability, or account upgrade paths further limits the appeal for diverse trading needs.

The account opening process details remain unspecified. This creates uncertainty about verification requirements, documentation needs, and approval timeframes. Without clear information about account features, potential clients can't adequately assess whether the high minimum deposit translates into enhanced services or benefits.

This yfx capital review finds the account conditions restrictive and lacking in transparency. This contributes to concerns about the broker's overall approach to client service and market accessibility.

YFX Capital provides the MetaTrader 4 platform, which is a well-established trading solution that offers standard charting capabilities, technical indicators, and automated trading support. The platform's reliability and feature set represent industry standards, giving traders familiar tools for market analysis and order execution.

The broker supports forex and CFD trading, covering major currency pairs and derivative instruments. However, detailed information about specific asset counts, exotic pairs availability, or specialized trading instruments remains limited in available documentation.

Research and analytical resources aren't detailed in current information sources. This raises questions about the broker's commitment to providing market insights, economic calendars, or trading education materials. The absence of mentioned educational resources suggests limited support for trader development and skill enhancement.

Automated trading capabilities through MetaTrader 4's Expert Advisor functionality appear available. Specific broker policies regarding algorithmic trading, VPS services, or API access aren't clarified though. This represents a missed opportunity for transparency in an increasingly automated trading environment.

Customer Service and Support Analysis (4/10)

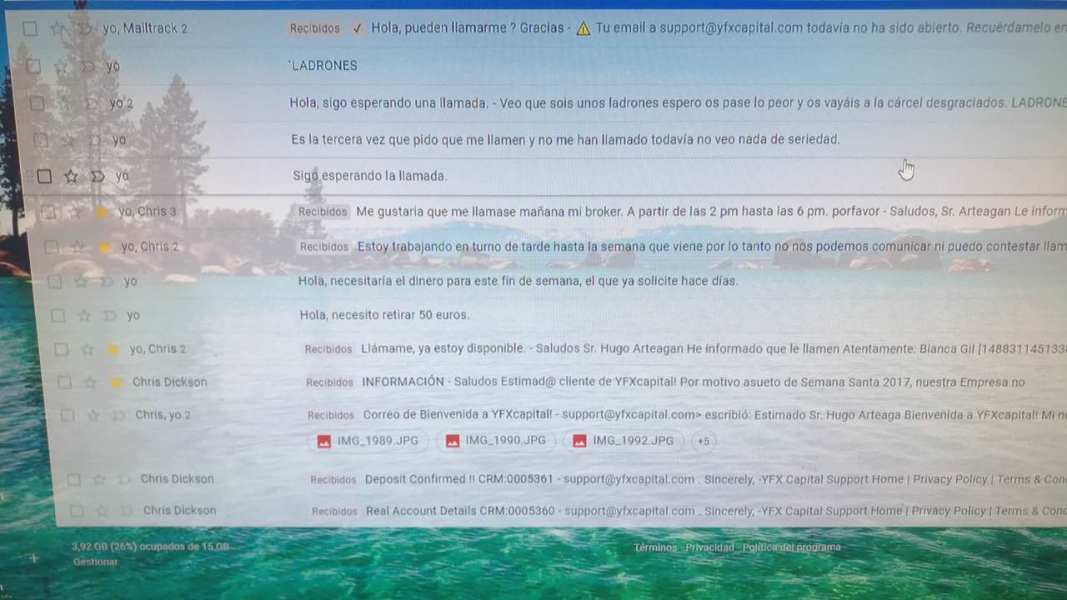

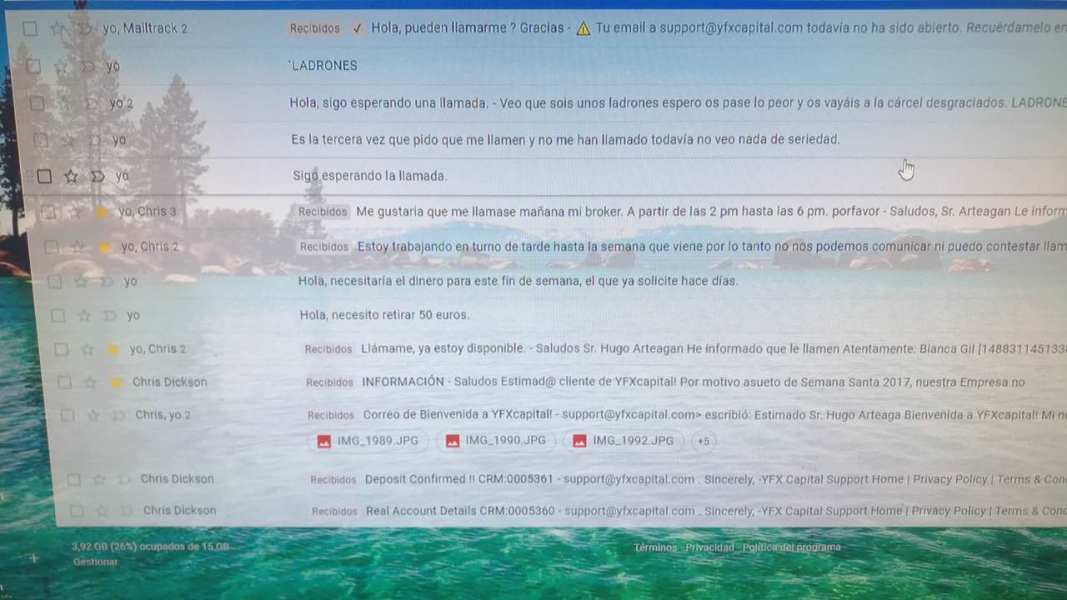

Customer support infrastructure appears limited based on available information, with unclear communication channels and service availability. The broker's support structure lacks detailed description regarding response times, service quality standards, or problem resolution procedures.

Multi-language support capabilities remain unspecified. This potentially limits accessibility for international clients. Given the broker's offshore status and international market targeting, this represents a significant information gap that affects client confidence.

Service hours and availability windows aren't detailed. This creates uncertainty about when clients can expect assistance with account issues, technical problems, or trading inquiries. The absence of live chat options, phone support details, or email response commitments further compounds support concerns.

Without specific user feedback regarding support quality or problem resolution effectiveness, potential clients can't assess the broker's commitment to customer service excellence. This lack of transparency contributes to overall trust concerns identified in this evaluation.

Trading Experience Analysis (5/10)

The trading environment at YFX Capital faces scrutiny due to concerns about website activity and platform reliability. Reports suggest inactive website status, which raises questions about the broker's operational continuity and commitment to maintaining active trading services.

Order execution quality details aren't specified in available information. This creates uncertainty about fill rates, slippage management, and price accuracy during volatile market conditions. These factors significantly impact trading profitability and overall client satisfaction.

MetaTrader 4 functionality typically provides comprehensive trading capabilities, but broker-specific implementations can vary significantly. Without detailed information about server locations, connection stability, or execution speeds, traders can't adequately assess platform performance expectations.

Mobile trading experience details remain unspecified. This limits understanding of on-the-go trading capabilities. The fixed spread structure may provide pricing predictability, but liquidity depth and market access quality aren't detailed. This yfx capital review identifies these gaps as significant concerns for active traders requiring reliable execution environments.

Trust and Security Analysis (3/10)

Trust and security represent the most concerning aspects of YFX Capital's offering. The absence of clear regulatory oversight by recognized financial authorities creates significant uncertainty about client protection standards and operational compliance requirements.

Fund security measures, including segregated account policies, deposit insurance, or client money protection schemes, aren't detailed in available information. This lack of transparency regarding financial safeguards raises serious concerns about capital safety and recovery procedures in adverse scenarios.

Company transparency regarding ownership structure, financial statements, or operational history remains limited. The offshore jurisdiction selection, while common in the industry, requires additional transparency measures to maintain client confidence, which appear lacking in this case.

Industry reputation and third-party assessments aren't readily available. This makes it difficult to verify operational standards or compare performance against established benchmarks. The absence of regulatory reporting or compliance certifications further compounds trust concerns identified throughout this evaluation.

User Experience Analysis (4/10)

Overall user satisfaction metrics aren't available in current information sources. This prevents comprehensive assessment of client contentment levels. The absence of detailed user feedback represents a significant limitation in understanding real-world trading experiences.

Interface design and platform usability details beyond standard MetaTrader 4 functionality aren't specified. Custom broker implementations can significantly impact user experience, but such details remain unclear.

Registration and account verification processes lack detailed description. This creates uncertainty about onboarding efficiency and documentation requirements. Smooth account opening procedures significantly impact initial user impressions and overall satisfaction.

Fund operation experiences, including deposit processing times, withdrawal procedures, and fee transparency, aren't adequately detailed. Common user complaints regarding legitimacy and reliability concerns, as noted in available information, suggest significant user experience challenges that potential clients should carefully consider.

Conclusion

This comprehensive yfx capital review reveals significant concerns about the broker's legitimacy and operational reliability. The combination of unclear regulatory oversight, limited transparency, and questions about website activity creates substantial risks for potential traders.

YFX Capital may appeal to traders with significant capital reserves who are willing to accept elevated risks in exchange for high leverage and fixed spreads. However, the high minimum deposit requirement of $2,500, combined with transparency concerns, makes this broker unsuitable for most retail traders.

The primary advantages include maximum leverage of 1:400 and fixed spread pricing. Significant disadvantages encompass regulatory uncertainty, high entry barriers, and limited operational transparency. Based on this analysis, traders should exercise extreme caution and consider well-regulated alternatives before engaging with YFX Capital.