FX SmartBull 2025 Review: Everything You Need to Know

Executive Summary

FX SmartBull positions itself as a leading online forex broking platform. The company offers a wide range of markets and attractive spreads to its clients around the world. According to available information, this fx smartbull review reveals that the broker appeals primarily to aspiring forex traders. These traders seek a user-friendly platform with diverse trading opportunities that can help them succeed. The platform's key strength lies in its extensive market selection and competitive spread offerings. This makes it particularly suitable for beginners navigating the complexities of forex trading in today's fast-paced market.

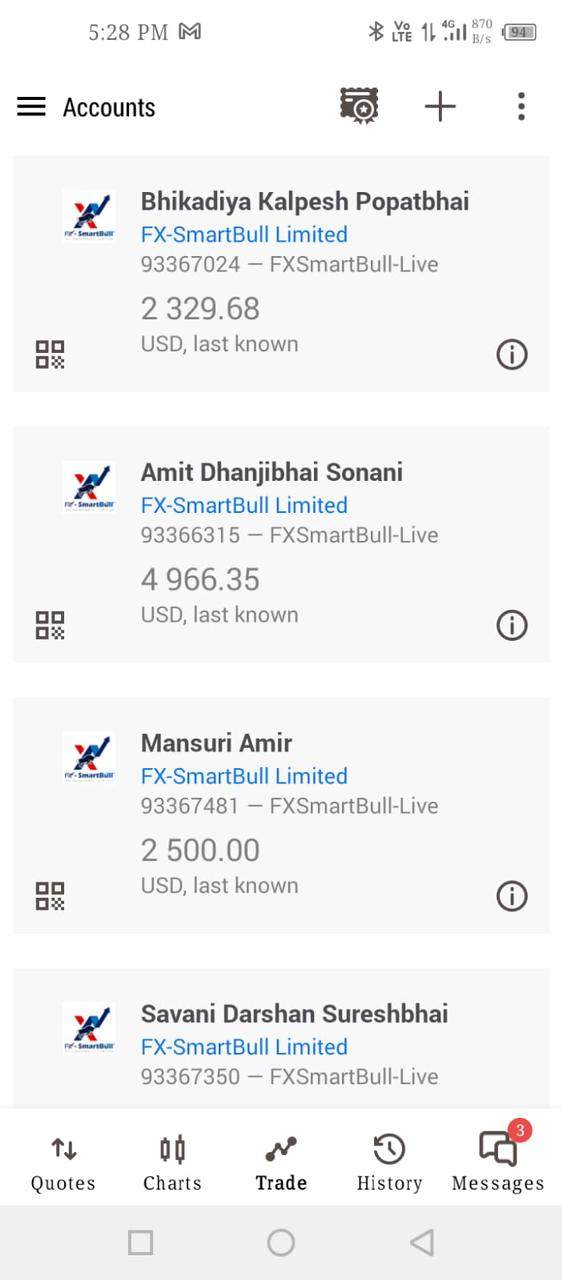

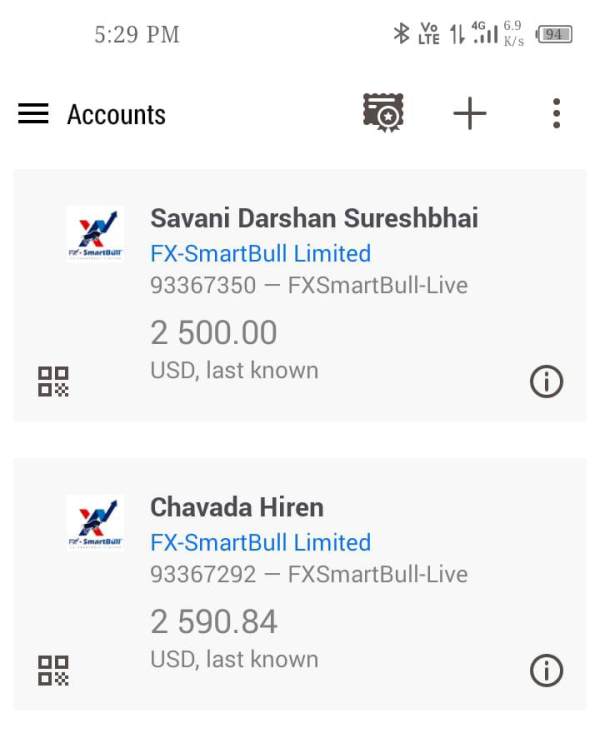

However, our comprehensive analysis reveals significant concerns regarding regulatory transparency and platform information availability. While FX SmartBull promotes itself as offering attractive trading conditions, limited detailed information about the platform's functionalities, regulatory status, and operational framework raises questions about transparency that potential users should consider. User feedback indicates mixed experiences, with some traders appreciating the platform's accessibility. Others express concerns about the lack of comprehensive platform details and regulatory clarity that would help them make informed decisions.

The broker appears to target new forex traders looking for straightforward market access. However, potential users should carefully consider the limited regulatory information available before making trading decisions that could affect their financial future.

Important Notice

This FX SmartBull evaluation is based on publicly available information and user feedback as of 2025. Due to limited regulatory disclosure and platform transparency, potential traders should exercise enhanced due diligence before engaging with this broker to protect their interests. The regulatory status and operational legitimacy may vary across different jurisdictions. Traders should verify local compliance requirements to ensure they meet all necessary legal obligations.

Our assessment methodology incorporates available company statements, user reviews, and industry analysis. We acknowledge information gaps where platform details remain undisclosed and could affect our evaluation. This review aims to provide an objective analysis based on accessible data. We highlight areas where additional transparency would benefit potential clients seeking to make informed trading decisions.

Rating Framework

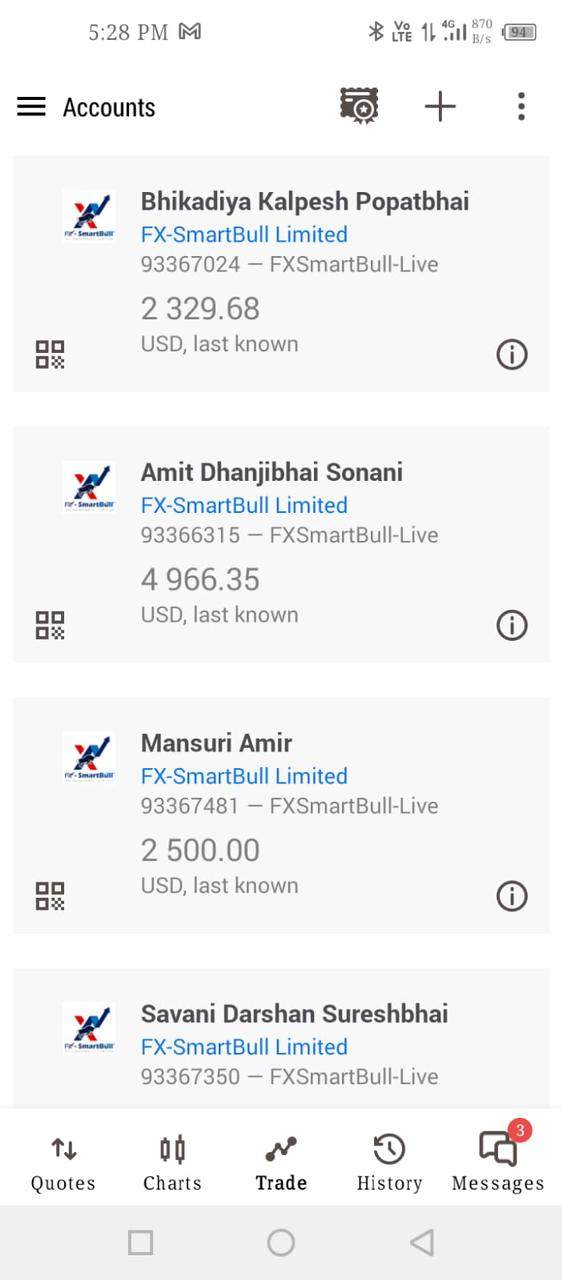

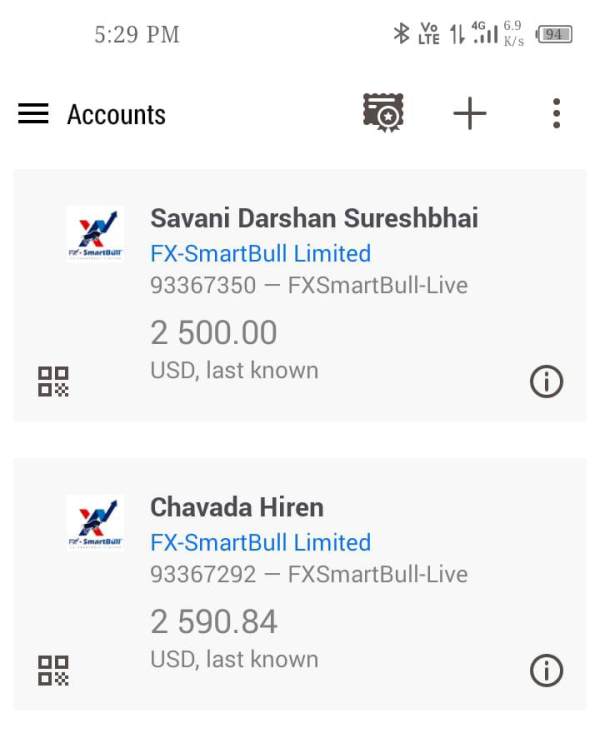

Broker Overview

FX SmartBull operates as an online forex broking platform. The company positions itself within the competitive retail forex market segment where many brokers compete for trader attention. According to company statements, the broker focuses on providing comprehensive market access with competitive pricing structures. These structures are designed to attract both novice and experienced traders who want reliable market access. The platform emphasizes its wide choice of markets as a key differentiator in the crowded broker landscape.

The broker's business model centers on offering direct market access through digital platforms. This approach targets traders seeking streamlined access to global financial markets without unnecessary complications. FX SmartBull's operational approach appears designed to simplify the trading experience while providing exposure to diverse asset classes. These include traditional forex pairs and additional financial instruments that traders commonly use.

However, specific details regarding the company's establishment date, corporate structure, and operational history remain limited in available public information. This fx smartbull review notes that enhanced corporate transparency would significantly benefit potential clients seeking comprehensive broker evaluation criteria that help them make informed decisions. The platform's regulatory framework and compliance structure require further clarification for thorough assessment.

Regulatory Status: Available information does not specify particular regulatory jurisdictions or oversight authorities governing FX SmartBull's operations. This represents a significant transparency concern for potential clients who need regulatory assurance.

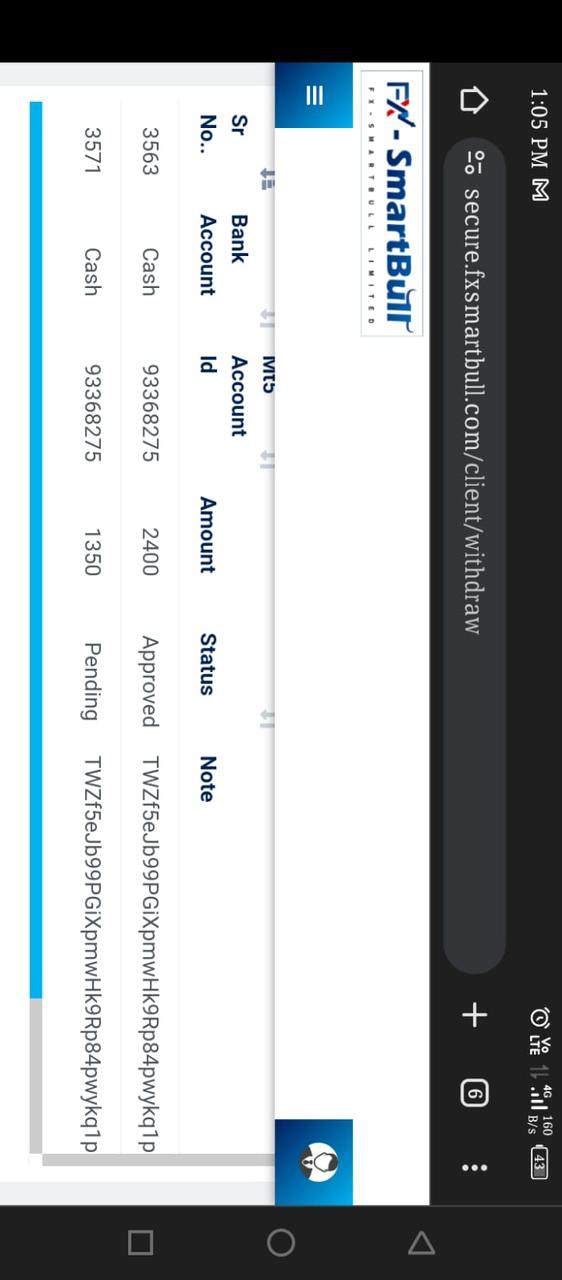

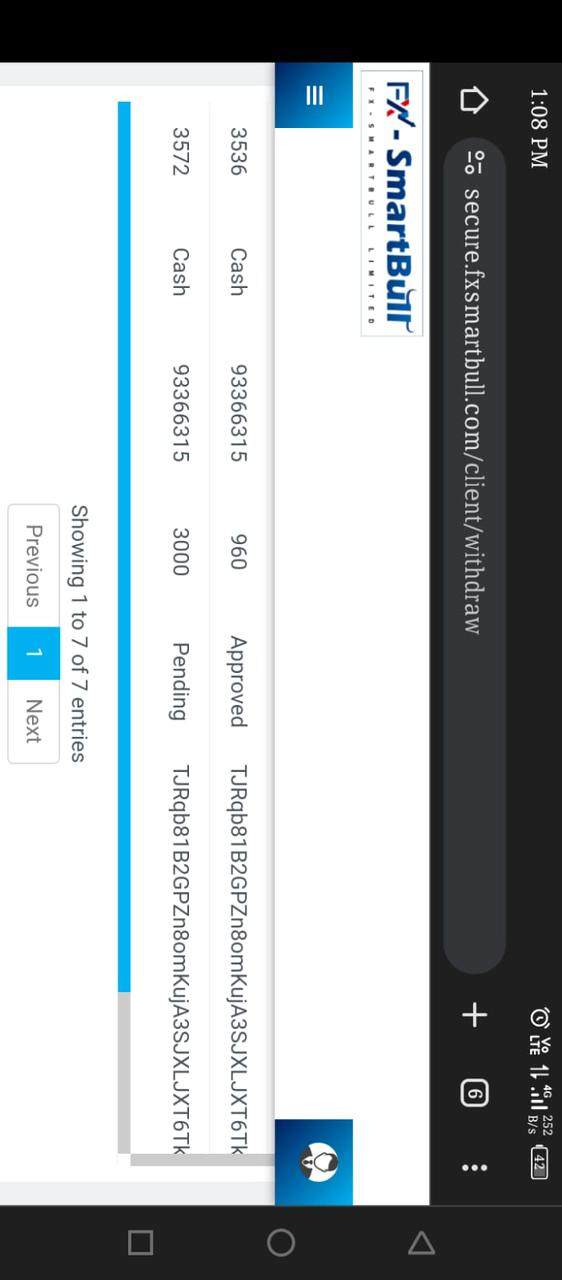

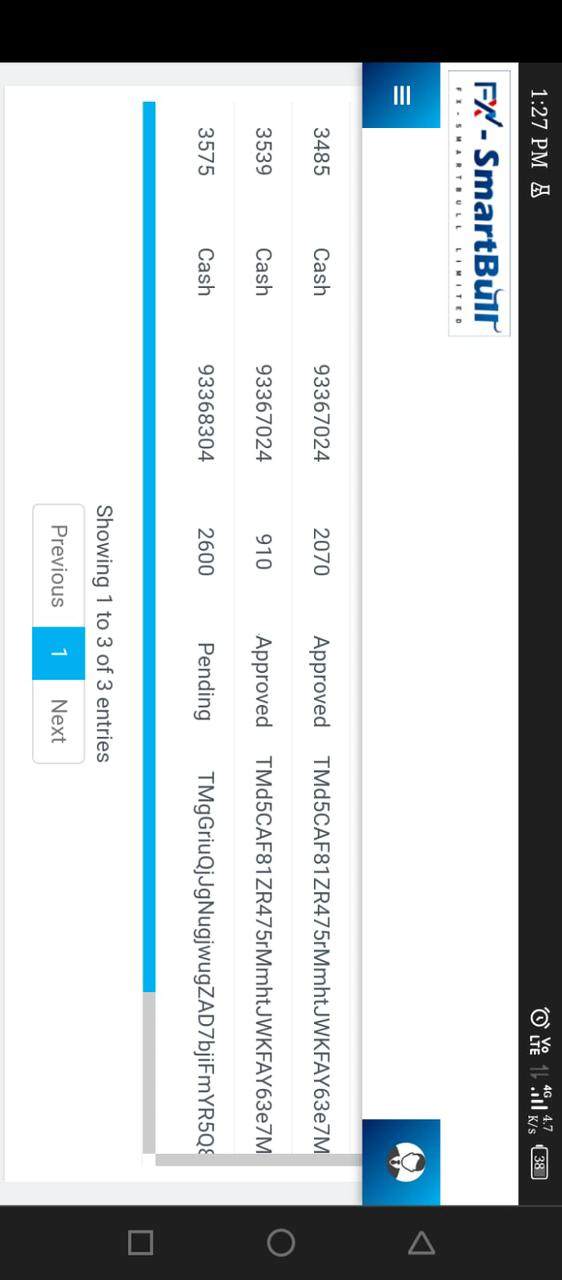

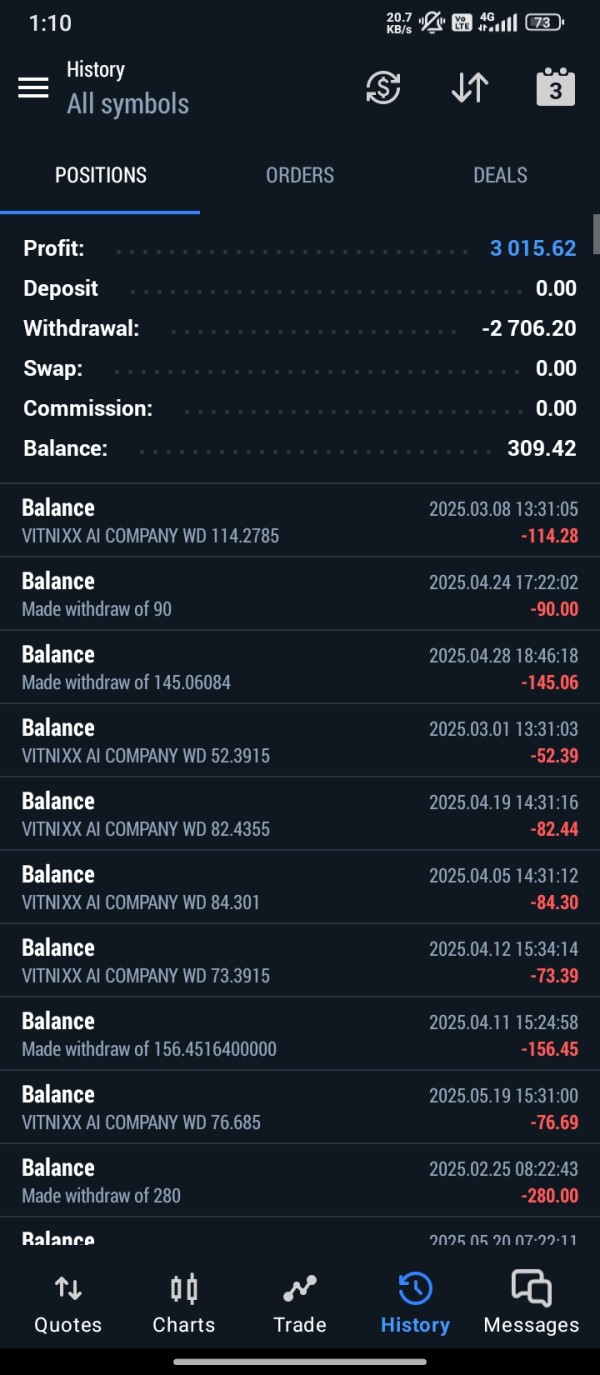

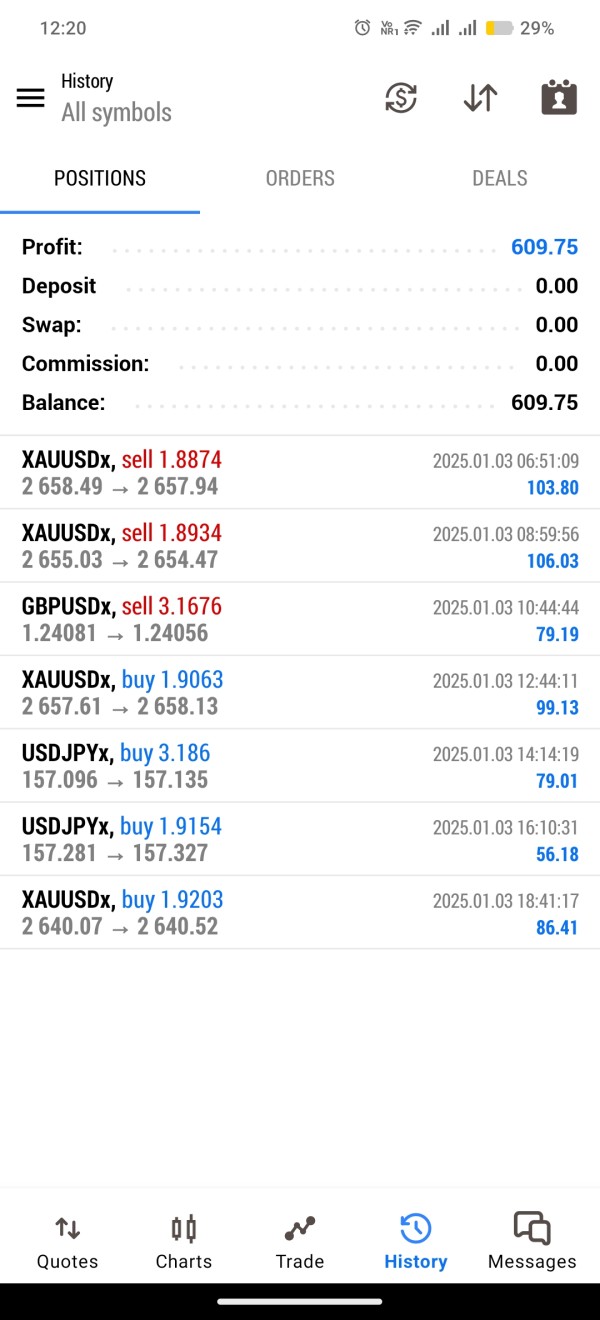

Deposit and Withdrawal Methods: Specific payment processing options and withdrawal procedures are not detailed in accessible platform information. This limits client ability to assess operational convenience and plan their trading activities accordingly.

Minimum Deposit Requirements: Minimum account funding thresholds are not specified in available documentation. This makes it difficult for potential traders to evaluate accessibility and determine if they can afford to start trading.

Promotional Offers: Current bonus structures or promotional campaigns are not detailed in publicly available information that would help traders understand potential benefits.

Tradeable Assets: The platform emphasizes offering a "wide range of markets" for trader convenience. However, specific asset categories and instrument availability require additional clarification to help traders understand their options.

Cost Structure: While the broker mentions "attractive spreads," detailed commission schedules, overnight fees, and comprehensive pricing information remain unspecified. This makes it challenging for traders to calculate their potential trading costs accurately.

Leverage Ratios: Maximum leverage offerings and risk management parameters are not detailed in available fx smartbull review materials that could guide trader decisions.

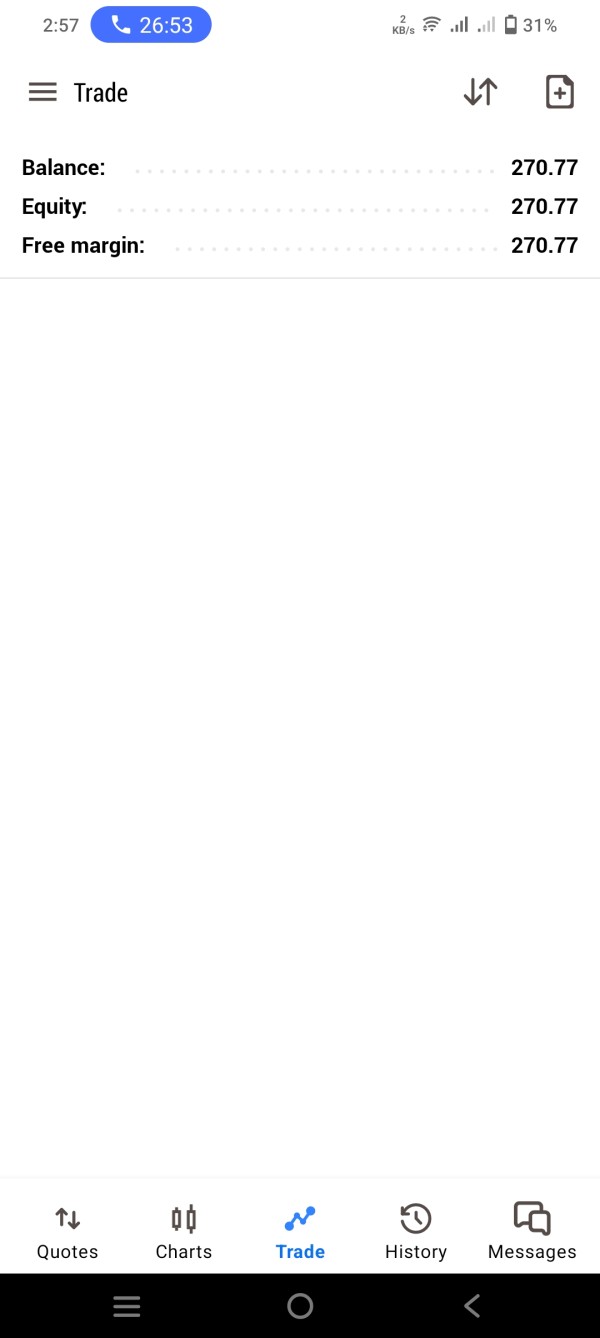

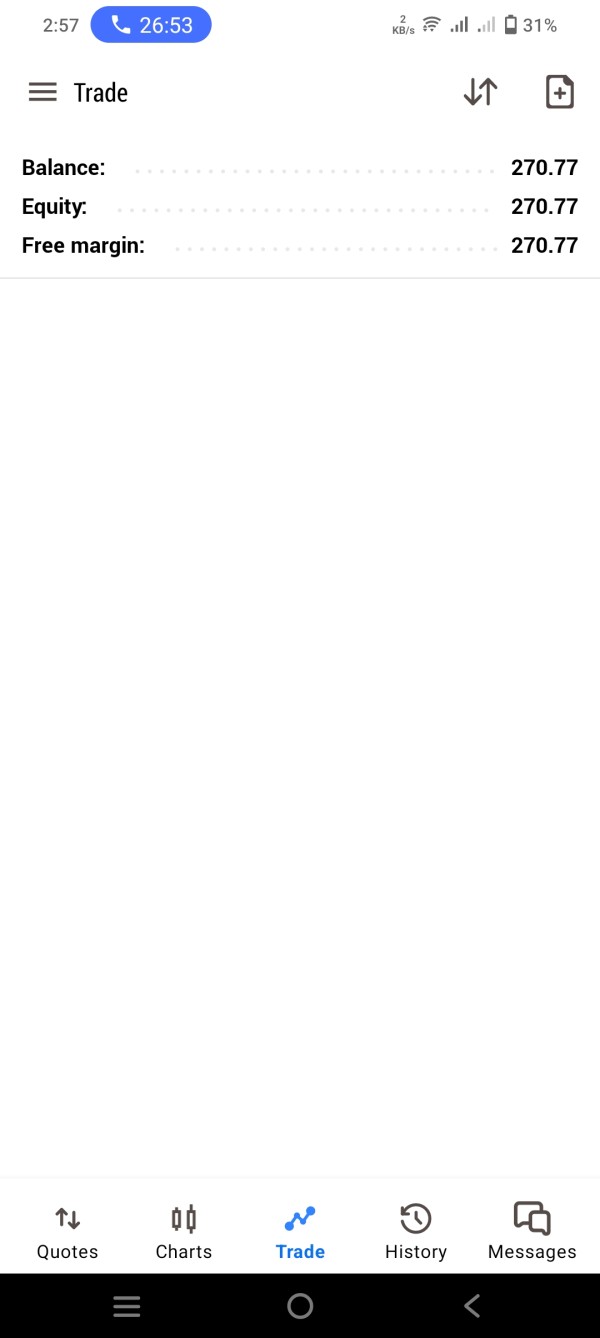

Platform Options: Trading platform specifications and technology infrastructure details require additional disclosure for comprehensive evaluation by potential users.

Geographic Restrictions: Operational jurisdictions and service availability by region are not specified in accessible information. This leaves traders uncertain about whether they can access the platform from their location.

Customer Support Languages: Multilingual support capabilities and communication channels are not detailed in available documentation that would help international traders.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

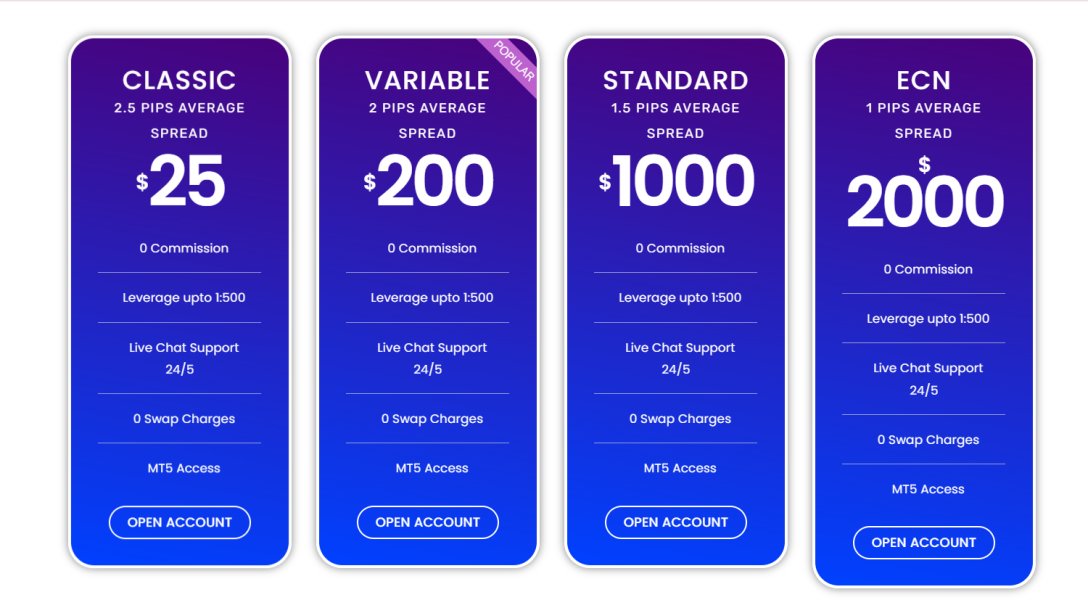

FX SmartBull's account structure lacks the transparency and detailed specification expected from established forex brokers. The absence of clearly defined account types, minimum deposit requirements, and specific account features significantly impacts the platform's appeal to informed traders who need complete information. Without comprehensive account condition disclosure, potential clients cannot adequately assess whether the broker's offerings align with their trading objectives and financial capabilities.

The platform's promotional materials emphasize market access and competitive pricing but fail to provide the granular account details necessary for informed decision-making. Professional traders typically require detailed information about account tiers, associated benefits, and specific trading conditions. This helps them evaluate broker suitability effectively and choose the right platform for their needs.

Industry standards suggest that reputable brokers provide comprehensive account documentation including fee schedules, minimum balance requirements, and account-specific features. FX SmartBull's limited disclosure in this area represents a significant weakness in their client acquisition approach that could deter serious traders. This fx smartbull review identifies account transparency as a critical area requiring improvement. Enhanced transparency would help meet industry expectations and enhance client confidence in the platform.

FX SmartBull's trading tools and resources receive moderate evaluation based on available information. The platform emphasizes providing market access and trading capabilities for users who want reliable trading infrastructure. According to available reviews, some users appreciate the platform's functionality. This suggests adequate basic trading infrastructure that meets minimum requirements for forex trading activities.

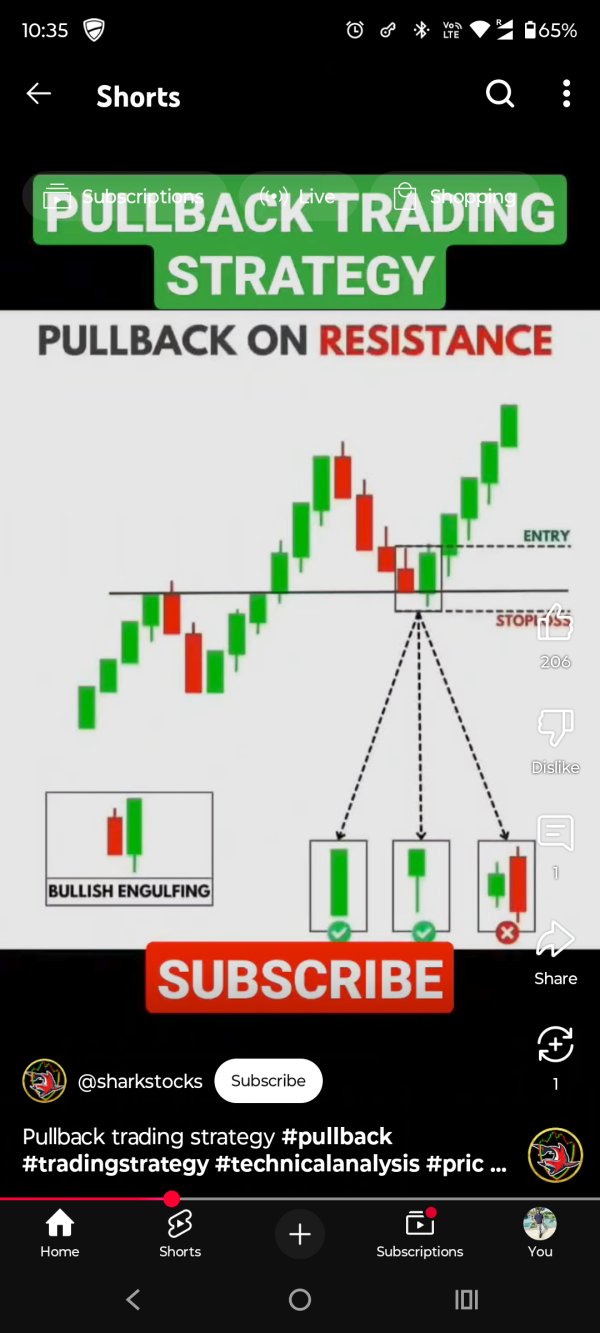

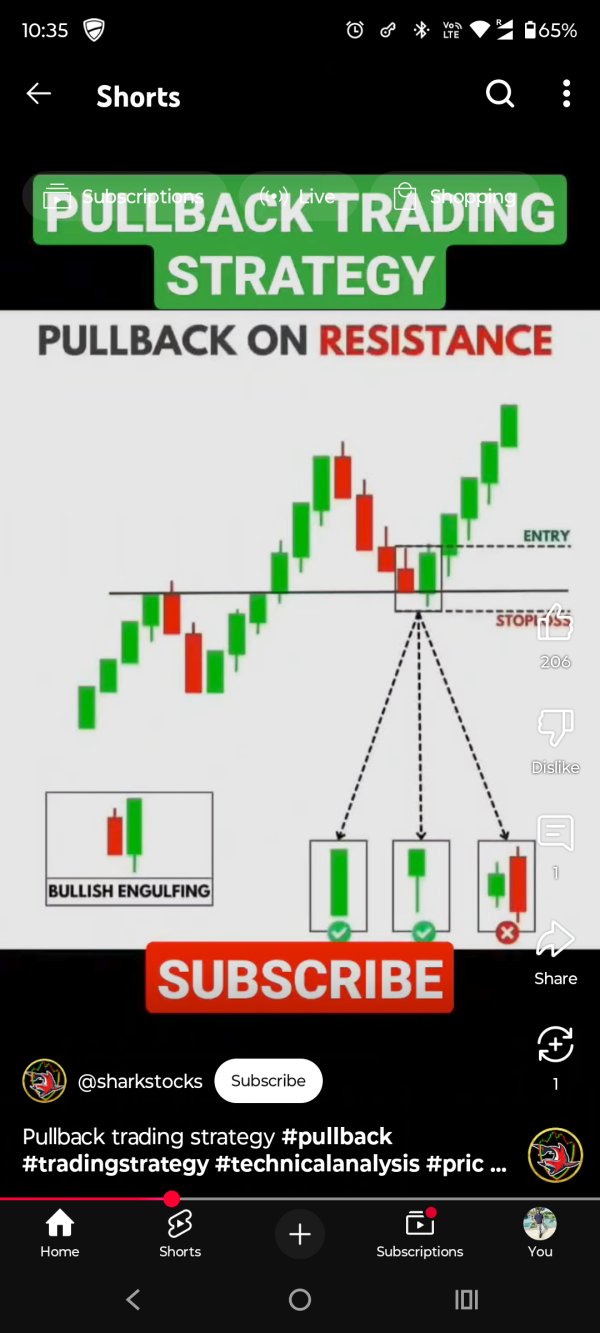

However, comprehensive analysis reveals significant gaps in detailed platform specification that could affect trader success. Professional trading environments typically include advanced charting tools, market analysis resources, economic calendars, and educational materials. The absence of detailed tool descriptions makes it challenging to assess whether FX SmartBull provides the comprehensive trading environment expected by serious forex participants who need sophisticated tools.

The platform would benefit from enhanced disclosure regarding technical analysis tools, fundamental analysis resources, and educational support materials. Modern forex traders expect sophisticated analytical capabilities and comprehensive market research resources. These tools support informed trading decisions that can significantly impact trading success and profitability.

Customer Service and Support Analysis (Score: 5/10)

Customer service evaluation for FX SmartBull remains challenging due to limited specific feedback and support channel documentation. Available information does not detail customer service hours, communication channels, response time expectations, or multilingual support capabilities that traders need to know. This lack of transparency regarding client support infrastructure raises concerns about service quality and accessibility for users who require assistance.

Professional forex brokers typically provide comprehensive customer support including live chat, telephone support, email assistance, and dedicated account management for qualified clients. The absence of detailed support information makes it difficult for potential clients to assess whether FX SmartBull can provide adequate assistance when needed during critical trading situations that require immediate help.

Effective customer service represents a critical component of successful forex broker operations. This is particularly important for novice traders requiring guidance and support as they learn to navigate the forex market. Enhanced disclosure regarding support capabilities and service standards would significantly improve client confidence. Better support documentation would also enhance platform appeal to traders who value reliable customer assistance.

Trading Experience Analysis (Score: 5/10)

The trading experience evaluation for FX SmartBull reflects mixed assessment based on available information and user feedback. While the platform positions itself as user-friendly and accessible to aspiring forex traders, specific details about execution quality, platform stability, and trading environment characteristics remain limited and require further investigation.

Professional trading evaluation typically considers execution speed, order fill quality, platform uptime, and overall trading environment stability. Without comprehensive performance data and detailed user experience documentation, it becomes challenging to assess whether FX SmartBull provides the reliable trading environment necessary for successful forex participation that traders depend on.

The platform's emphasis on user-friendliness suggests design consideration for novice traders who may be intimidated by complex interfaces. However, specific interface features and trading tools require additional documentation for proper evaluation. This fx smartbull review notes that enhanced platform specification and performance disclosure would significantly benefit potential clients. Better documentation would help traders seeking reliable trading infrastructure make informed decisions about platform suitability.

Trust and Regulation Analysis (Score: 3/10)

Trust and regulatory assessment represents the most significant concern in this FX SmartBull evaluation. The absence of clear regulatory disclosure, oversight authority identification, and compliance framework documentation raises substantial questions about platform legitimacy and client protection measures that are essential for trader safety.

Regulatory oversight provides essential client protections including segregated fund requirements, dispute resolution mechanisms, and operational compliance standards. The lack of specific regulatory information makes it impossible to assess whether FX SmartBull operates under appropriate oversight. This also prevents evaluation of whether the platform provides standard client protection measures that traders expect from legitimate brokers.

Professional forex traders typically prioritize regulatory compliance and oversight when selecting brokers. Regulation provides crucial safeguards for client funds and operational integrity that protect trader investments. The absence of regulatory transparency represents a critical weakness that significantly impacts platform credibility. This lack of transparency also reduces client confidence in the broker's legitimacy and safety measures.

User Experience Analysis (Score: 5/10)

User experience evaluation for FX SmartBull indicates moderate satisfaction based on available feedback. However, comprehensive user assessment remains limited due to insufficient detailed reviews and platform documentation that would provide better insight into actual user experiences.

The platform's positioning as suitable for aspiring forex traders suggests design consideration for user-friendliness and accessibility. However, without detailed interface descriptions, navigation assessments, and comprehensive user feedback analysis, it becomes challenging to provide definitive user experience evaluation that accurately reflects the platform's strengths and weaknesses.

Modern forex platforms require intuitive design, responsive performance, and comprehensive functionality to meet user expectations. Enhanced user experience documentation and detailed platform specifications would significantly improve assessment capabilities. Better documentation would also enhance client confidence in the platform's ability to provide a satisfactory trading experience.

Conclusion

This comprehensive fx smartbull review reveals a broker with mixed characteristics that may appeal to specific trader segments. However, the platform raises significant concerns in critical areas that potential users should carefully consider. FX SmartBull's positioning as a user-friendly platform with wide market access has potential appeal for novice traders seeking straightforward forex market entry without complex procedures.

However, substantial transparency and regulatory disclosure gaps significantly impact overall platform assessment. These gaps create uncertainty about the broker's legitimacy and safety measures that protect trader funds and interests.

The broker appears most suitable for beginning traders willing to accept limited regulatory transparency in exchange for simplified market access. However, experienced traders and those prioritizing regulatory oversight and comprehensive platform documentation may find FX SmartBull insufficiently transparent for their requirements and risk tolerance levels.

Key strengths include the platform's focus on user accessibility and market variety that can benefit new traders. Primary weaknesses center on regulatory disclosure limitations and insufficient operational transparency that create uncertainty about platform safety. Potential clients should exercise enhanced due diligence and consider these factors carefully before engaging with the platform to protect their trading capital and interests.