GMS 2025 Review: Everything You Need to Know

Executive Summary

GMS is a regulated financial services provider operating within the United States regulatory framework. Our comprehensive gms review gives the company a neutral to positive evaluation. The company maintains registration with the Securities and Exchange Commission and holds membership with both the Financial Industry Regulatory Authority and the Securities Investor Protection Corporation, which establishes a solid regulatory foundation for its operations.

GMS provides comprehensive fixed income and equity products and services, primarily targeting retail investors seeking diversified investment opportunities. The firm maintains applicable registrations and licenses across various states where it conducts business. This demonstrates its dedication to regulatory compliance. Employee satisfaction metrics indicate a strong internal culture, with an overall rating of 4 out of 5 and an impressive 83% of employees willing to recommend GMS as a workplace. This gms review reveals that while GMS operates within a well-regulated environment, detailed information about specific trading conditions and platform features remains limited in publicly available sources.

Important Disclaimers

Traders should be aware that GMS operates as a U.S.-registered entity. Its services may vary significantly across different jurisdictions. The company maintains registrations and licenses as required by various states where it conducts business, but potential clients should verify local regulatory compliance before engaging with the platform.

This evaluation is based on available employee reviews, regulatory registration information, and publicly disclosed company data. Specific trading conditions, platform features, and detailed service offerings are not comprehensively detailed in available sources. Prospective clients should conduct independent research and contact GMS directly for current terms and conditions.

Rating Framework

Broker Overview

GMS Group operates as a comprehensive financial services provider registered with the United States Securities and Exchange Commission. It maintains active memberships with both FINRA and SIPC. The company's business model centers on providing full-service fixed income and equity products to retail investors, positioning itself within the traditional brokerage sector rather than focusing exclusively on forex trading.

The firm's regulatory structure demonstrates commitment to compliance. GMS maintains all applicable registrations and licenses required across various states where it conducts business operations. This multi-state approach suggests a broad operational footprint within the United States market, though specific details about international operations remain unclear from available documentation.

The founding date and detailed company history are not specified in available sources. GMS's established regulatory relationships with major U.S. financial oversight bodies indicate an established presence in the financial services sector. This gms review finds that the company's focus on retail investors and comprehensive product offerings positions it as a traditional brokerage firm rather than a specialized forex platform.

Detailed Specifications

Regulatory Oversight: GMS operates under comprehensive U.S. regulatory supervision through SEC registration and FINRA membership. It has additional investor protection through SIPC coverage.

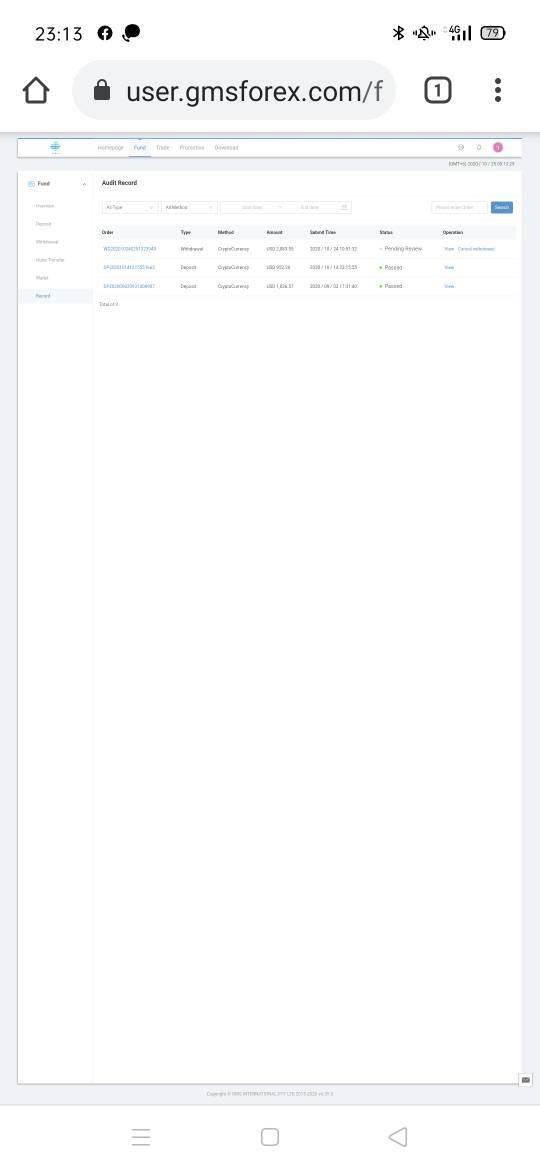

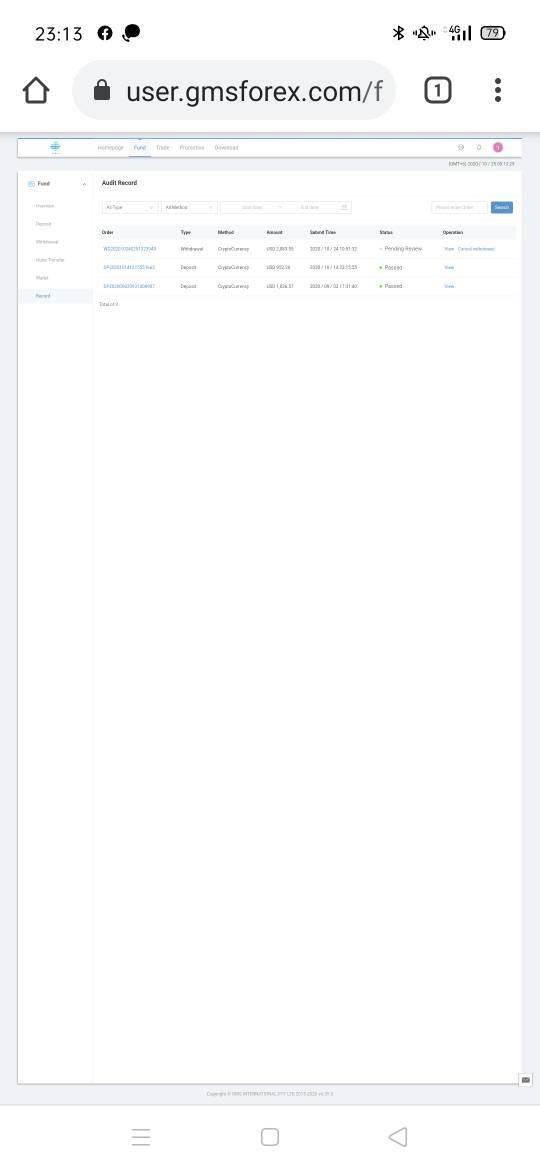

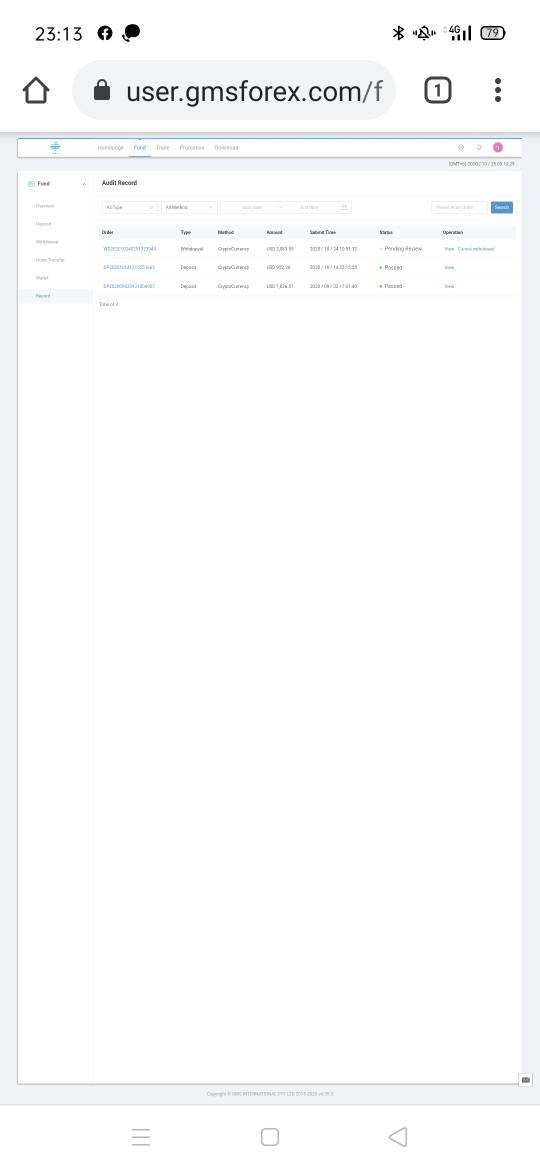

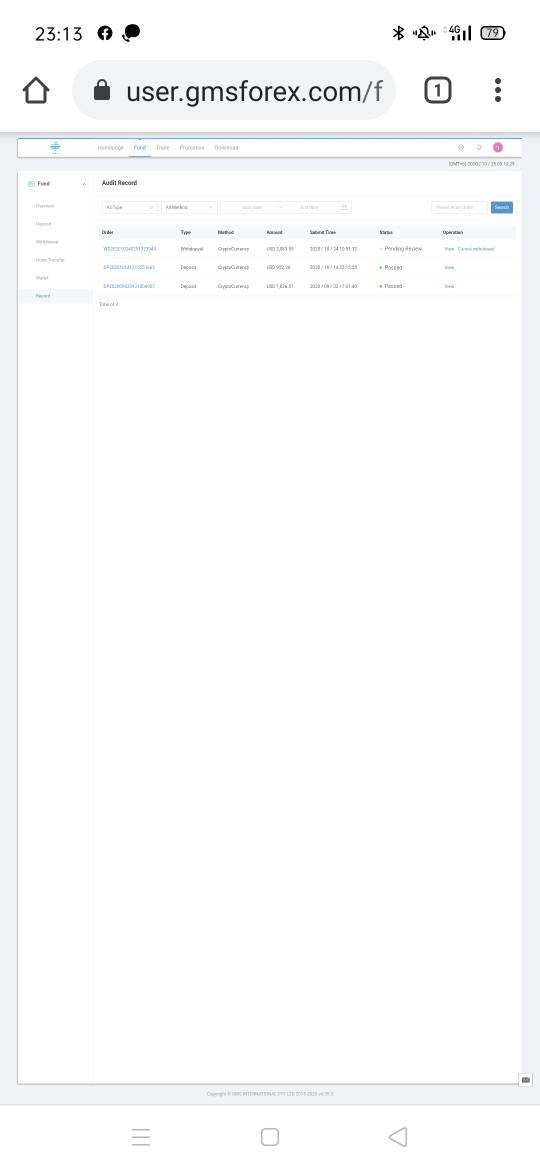

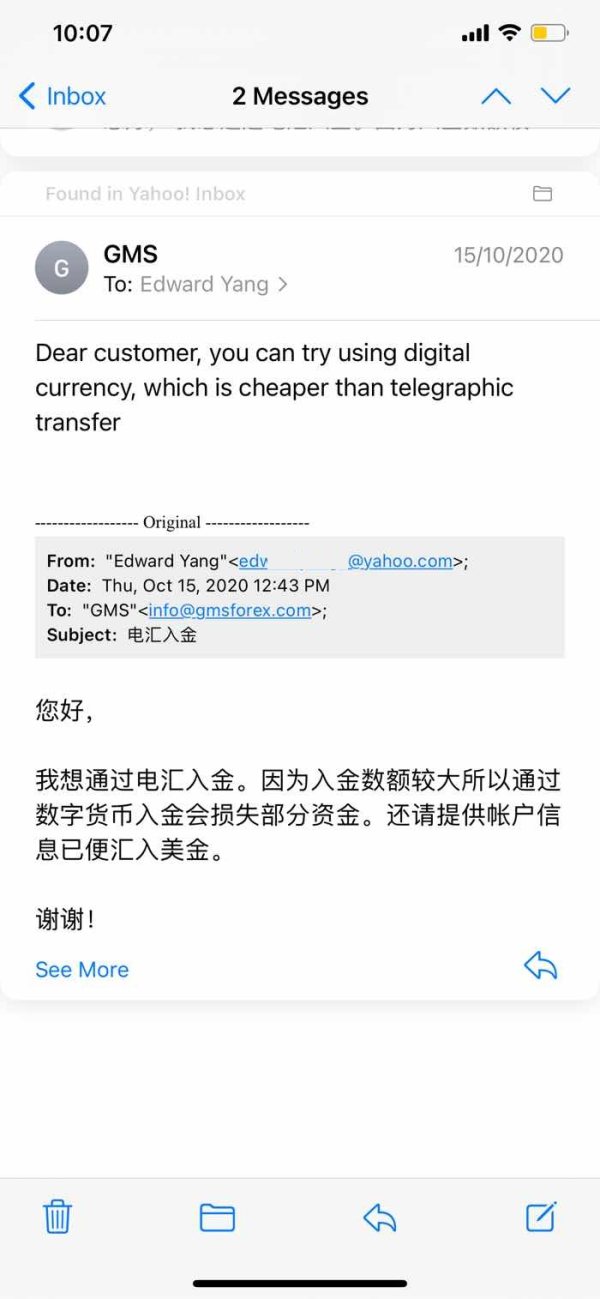

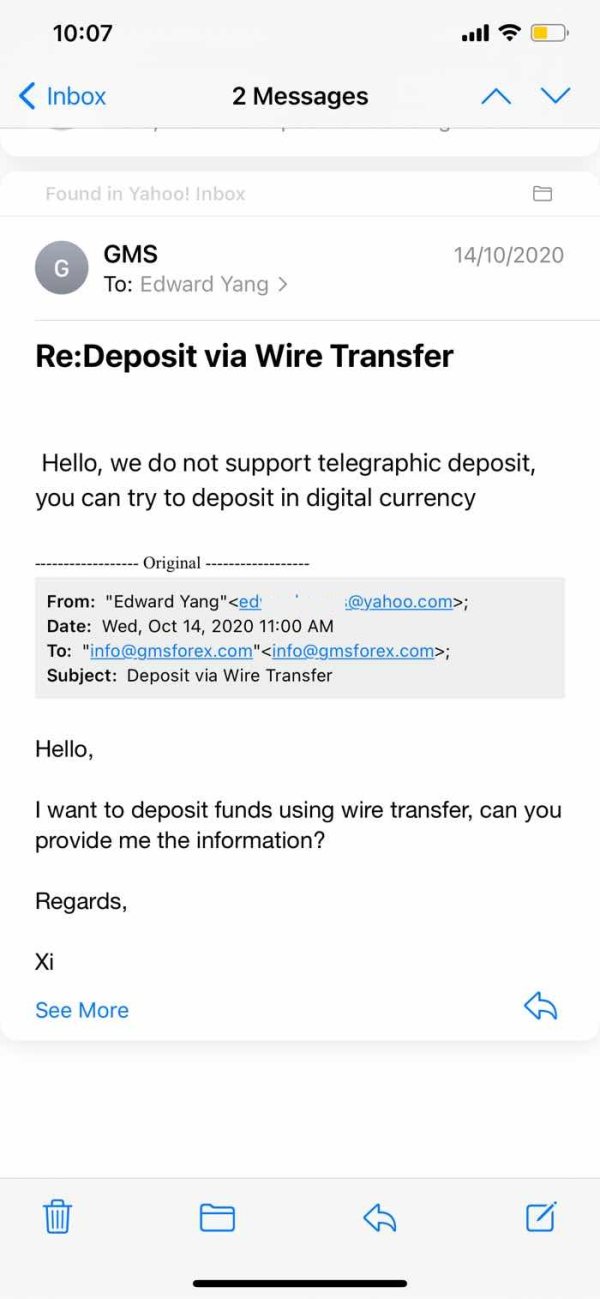

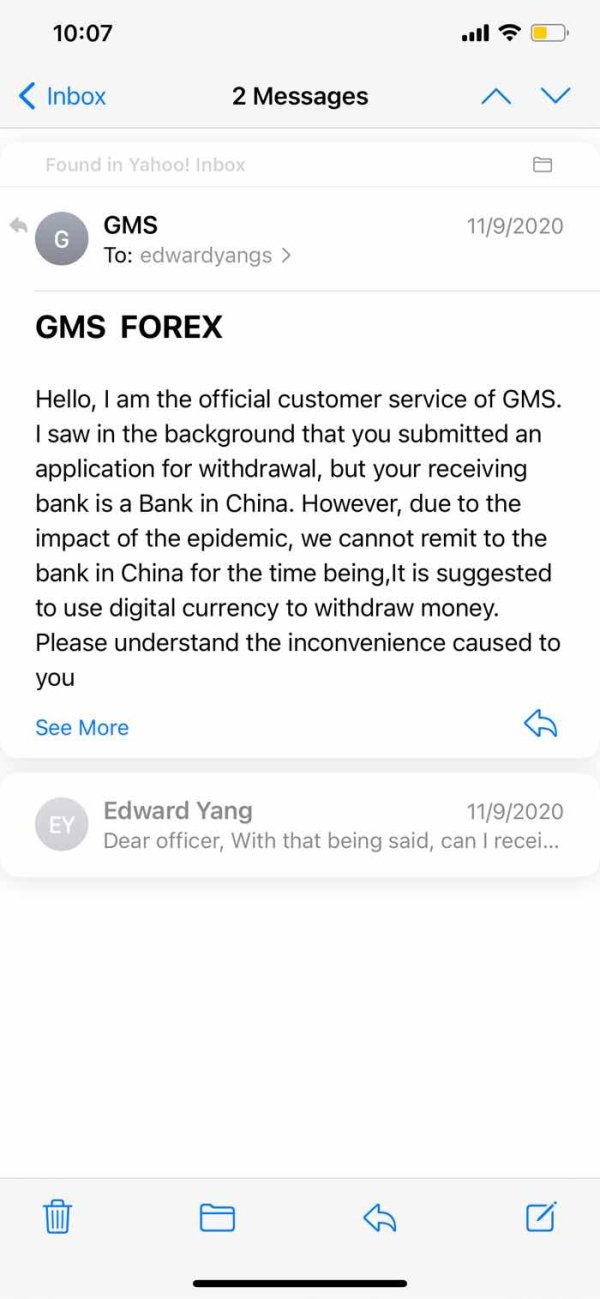

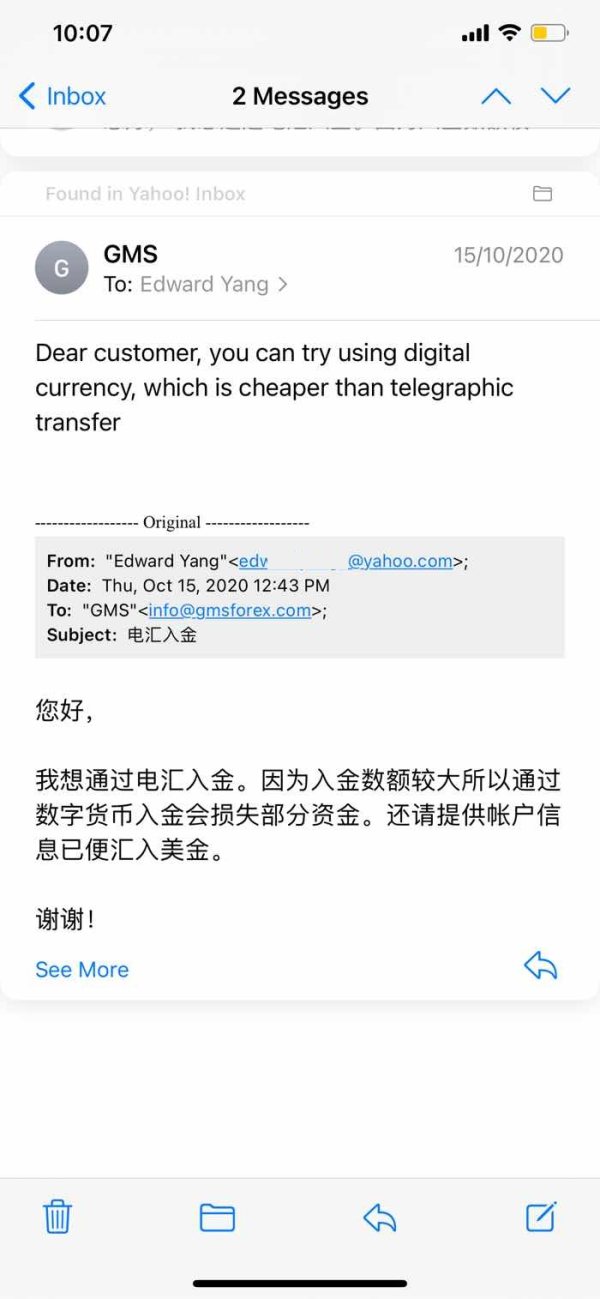

Deposit and Withdrawal Methods: Specific information about funding methods is not detailed in available sources. This requires direct contact with the firm for current options.

Minimum Deposit Requirements: Current minimum deposit thresholds are not specified in publicly available documentation.

Promotional Offers: Details about bonus programs or promotional incentives are not disclosed in available materials.

Tradeable Assets: GMS provides access to fixed income securities and equity products. The complete range of available instruments requires verification through direct contact.

Cost Structure: Specific fee schedules, commission rates, and spread information are not detailed in available sources. This necessitates direct inquiry for current pricing.

Leverage Options: Information about available leverage ratios is not specified in current documentation.

Platform Selection: Details about trading platforms and technological infrastructure are not comprehensively covered in available sources.

Geographic Restrictions: GMS operates across multiple U.S. states. Specific regional limitations are not detailed.

Customer Support Languages: Available support languages are not specified in current documentation. This gms review suggests standard English support given the U.S. focus.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of GMS's account conditions faces significant limitations due to insufficient publicly available information. Traditional brokerage firms typically offer various account types including individual, joint, retirement, and corporate accounts. Specific details about GMS's account structure, minimum balance requirements, and account features are not disclosed in available documentation.

Account opening procedures for SEC-registered firms generally follow standardized KYC and AML protocols. This suggests that GMS likely implements similar verification processes. However, the specific steps, documentation requirements, and timeline for account activation cannot be determined from current sources.

The absence of detailed account condition information represents a significant gap in this gms review. Prospective clients cannot adequately assess whether the firm's offerings align with their trading needs and financial circumstances. Potential clients should contact GMS directly to obtain comprehensive information about account types, features, and requirements before making any commitment.

Assessment of GMS's trading tools and analytical resources cannot be completed based on available information. Modern brokerage platforms typically provide market research, technical analysis tools, fundamental analysis resources, and educational materials. GMS's specific offerings in these areas remain undocumented in publicly accessible sources.

The quality and comprehensiveness of trading tools significantly impact user experience and trading success. This makes the information gap particularly relevant for potential clients. Professional traders and retail investors alike require access to real-time data, charting capabilities, news feeds, and analytical resources to make informed investment decisions.

This review cannot provide meaningful evaluation of the firm's tools and resources dimension without detailed information about GMS's technological infrastructure, research capabilities, or educational resources. Prospective clients should prioritize obtaining detailed information about available platforms, research tools, and educational support before engaging with the firm.

Customer Service and Support Analysis

Evaluation of GMS's customer service capabilities cannot be thoroughly assessed due to limited available information about support channels, response times, and service quality metrics. The employee satisfaction rating of 4 out of 5 suggests positive internal culture. This may correlate with customer service quality, though this connection cannot be definitively established.

Traditional brokerage firms typically provide multiple support channels including phone, email, and online chat. Business hours align to market operations. However, GMS's specific support infrastructure, availability schedules, and service level commitments are not detailed in accessible documentation.

The 83% employee recommendation rate indicates strong internal satisfaction. This potentially suggests a positive service culture that could extend to client interactions. However, without direct customer feedback, response time metrics, or service quality measurements, this review cannot provide substantive evaluation of GMS's customer support capabilities.

Trading Experience Analysis

The trading experience evaluation for GMS cannot be completed due to insufficient information about platform performance, execution quality, and user interface design. Modern trading platforms require assessment across multiple dimensions including order execution speed, platform stability, mobile accessibility, and feature completeness.

Professional trading environments demand reliable order execution, competitive pricing, and sophisticated analytical tools. However, GMS's specific platform capabilities, execution statistics, and technological infrastructure remain undocumented in available sources. This prevents meaningful evaluation of the trading experience dimension.

The absence of detailed trading platform information significantly limits this gms review's ability to guide potential clients regarding execution quality, platform reliability, or overall trading environment. Prospective users should prioritize obtaining platform demonstrations and detailed technical specifications before committing to the service.

Trust and Safety Analysis

GMS demonstrates strong regulatory compliance through its registration with the SEC and memberships with FINRA and SIPC. This earns a high trust rating of 9 out of 10. This regulatory framework provides multiple layers of oversight and investor protection, with SEC registration ensuring compliance with federal securities laws and FINRA membership adding industry-specific regulatory supervision.

SIPC membership provides crucial investor protection. It offers coverage for client assets in the event of broker-dealer failure. This protection typically covers up to $500,000 per customer, including $250,000 for cash claims, providing significant security for retail investors.

The firm maintains applicable registrations and licenses across various states. This demonstrates ongoing regulatory compliance efforts. This multi-jurisdictional approach requires continuous monitoring of changing regulatory requirements and suggests robust compliance infrastructure.

No negative regulatory actions or significant compliance issues are evident in available documentation. The limited public information prevents comprehensive assessment of the firm's complete regulatory history and risk management practices.

User Experience Analysis

User experience evaluation for GMS relies primarily on employee satisfaction metrics. Direct customer feedback is not available in current sources. The overall employee rating of 4 out of 5 and 83% recommendation rate suggest positive internal culture, though correlation between employee satisfaction and customer experience cannot be definitively established.

The firm focuses on retail investors. This indicates orientation toward user-friendly services and accessible investment solutions. However, specific information about user interface design, account management processes, and overall client experience remains unavailable for comprehensive evaluation.

Modern brokerage services require seamless integration across multiple touchpoints including account opening, funding, trading, and ongoing support. This review cannot provide substantive user experience assessment without detailed information about GMS's client onboarding processes, platform usability, or customer journey optimization.

The absence of customer testimonials, satisfaction surveys, or user feedback data represents a significant limitation. This prevents evaluating GMS's user experience capabilities and overall client satisfaction levels.

Conclusion

This gms review reveals GMS as a properly regulated financial services provider operating within the established U.S. regulatory framework. Comprehensive evaluation is limited by insufficient publicly available information. The firm's strong regulatory standing through SEC registration and FINRA/SIPC memberships provides solid foundation for investor confidence, particularly for retail investors seeking traditional brokerage services.

GMS appears most suitable for investors prioritizing regulatory compliance and investor protection over cutting-edge trading technology or specialized forex features. The positive employee satisfaction metrics suggest potentially strong service culture. Direct customer experience validation remains unavailable.

The primary limitation of this evaluation stems from limited disclosure of specific trading conditions, platform features, and service details. This requires prospective clients to conduct direct research before making informed decisions about engaging with GMS's services.