Is SDFX Global safe?

Pros

Cons

Is SDFX Global A Scam?

Introduction

SDFX Global is a forex trading platform that has recently gained attention in the financial markets. Established in 2022, it positions itself as a brokerage firm that offers a range of trading services, including forex, commodities, and cryptocurrencies. However, as with any trading platform, potential investors need to exercise caution and thoroughly evaluate the broker's legitimacy before committing their funds. The forex market is rife with both legitimate opportunities and scams, making it essential for traders to conduct due diligence. This article aims to assess the safety and credibility of SDFX Global by examining its regulatory status, company background, trading conditions, customer feedback, and overall risk profile. The evaluation will be based on data collected from various reputable sources, including user reviews, regulatory databases, and financial publications.

Regulation and Legitimacy

Understanding the regulatory environment is crucial when evaluating a forex broker. Regulation serves as a safeguard for traders, ensuring that brokers adhere to certain standards of conduct and financial practices. A lack of regulation can expose traders to higher risks, including potential fraud or mismanagement of funds.

SDFX Global operates without oversight from any recognized regulatory body, which raises significant concerns about its legitimacy. Below is a summary of the regulatory information for SDFX Global:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulatory oversight means that SDFX Global is not bound by the rules and protections that regulated brokers must follow. This lack of accountability is a major red flag, as it leaves traders without recourse if issues arise. Furthermore, the broker's claims of high returns on investments, such as promises of 8% monthly returns, are particularly suspicious. Such claims are often indicative of potential scams, as they significantly exceed average market returns and may be used to lure in unsuspecting investors.

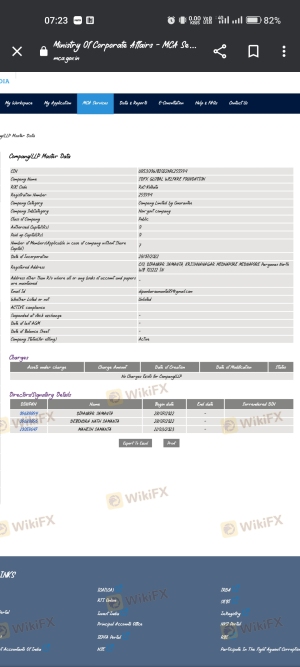

Company Background Investigation

A thorough understanding of a company's history and ownership can provide insights into its credibility. SDFX Global has a relatively short operational history, having been founded in 2022. Its website lacks transparency regarding its ownership structure and management team, which raises further concerns.

The absence of publicly available information about the founders or key personnel involved in SDFX Global is troubling. A reputable broker typically provides detailed information about its management team, including their qualifications and experience in the financial industry. In this case, SDFX Global's lack of transparency may suggest that it is not a legitimate operation.

Moreover, the company's website has been criticized for being poorly constructed, with many users reporting broken links and incomplete information. This lack of professionalism can be a warning sign, as legitimate brokers invest in user-friendly platforms that provide comprehensive information about their services.

Trading Conditions Analysis

When considering a forex broker, it's essential to assess the trading conditions they offer, including fees, spreads, and commissions. SDFX Global claims to provide competitive trading conditions; however, its fee structure appears to be opaque and not clearly defined on its website. Below is a comparison of core trading costs:

| Fee Type | SDFX Global | Industry Average |

|---|---|---|

| Major Currency Pairs Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 2-5% |

The lack of clear information on spreads and commissions is concerning. Traders typically rely on transparent fee structures to calculate potential profits and losses. Moreover, reports indicate that SDFX Global may impose unexpected fees, particularly regarding withdrawals, which can significantly impact a trader's bottom line.

This ambiguity in trading conditions raises questions about the broker's integrity and whether it is attempting to conceal unfavorable terms. In a regulated environment, brokers are required to disclose all fees upfront, ensuring that traders are fully informed before entering into any trading agreements.

Customer Funds Safety

The safety of customer funds is paramount when choosing a forex broker. Traders need to know that their investments are protected against potential fraud or financial mismanagement. SDFX Global's lack of regulation raises significant concerns regarding the safety of client funds.

The broker does not provide clear information about whether client funds are kept in segregated accounts, which is a standard practice among regulated brokers. Segregated accounts ensure that client funds are kept separate from the broker's operational funds, providing an additional layer of protection.

Furthermore, there is no indication that SDFX Global offers any investor protection schemes or negative balance protection. Such safeguards are essential in the volatile forex market, where market fluctuations can lead to significant losses. The absence of these protections increases the risk for traders, making it crucial to consider alternative options that provide better security for client funds.

Customer Experience and Complaints

Customer feedback and experiences are vital indicators of a broker's reliability. Analyzing user reviews for SDFX Global reveals a pattern of complaints and dissatisfaction. Common issues reported by users include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Difficulty with Withdrawals | High | Poor |

| Account Freezing after Deposit | High | Poor |

| Lack of Customer Support | Medium | Moderate |

Many users have expressed frustration over their inability to withdraw funds, with reports of accounts being frozen after deposits. This is a serious issue, as it directly impacts a trader's ability to access their capital. Additionally, the quality of customer support has been criticized, with many users reporting long wait times and unhelpful responses to their inquiries.

One notable case involved a trader who deposited funds only to find their account frozen when attempting to withdraw. Despite multiple attempts to contact customer support, the trader received little assistance, leading to significant financial distress. Such experiences raise serious concerns about the broker's operations and its commitment to customer service.

Platform and Execution

The trading platform's performance is crucial for a positive trading experience. Traders expect reliable execution, minimal slippage, and a user-friendly interface. However, users have reported issues with SDFX Global's platform, including slow performance and frequent outages.

Additionally, there are concerns about order execution quality, with some users alleging instances of slippage and rejected orders. These issues can severely impact a trader's ability to capitalize on market opportunities, leading to potential financial losses.

The lack of transparency regarding the platform's technology and execution processes is concerning. A reputable broker typically provides detailed information about the trading platform, including its features, technology, and performance metrics. The absence of this information raises doubts about SDFX Global's commitment to providing a reliable trading environment.

Risk Assessment

Using SDFX Global presents several risks that potential traders should consider. Below is a summary of the key risk areas associated with this broker:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight increases the likelihood of fraud. |

| Financial Risk | High | Lack of transparency regarding fees and fund safety. |

| Operational Risk | Medium | Reports of platform issues and poor customer support. |

Given these risks, it is advisable for traders to exercise extreme caution when considering SDFX Global as their broker. Potential investors should seek out regulated alternatives that provide better security, transparency, and customer support.

Conclusion and Recommendations

In conclusion, the evidence suggests that SDFX Global raises several red flags that warrant serious consideration. The lack of regulatory oversight, transparency issues, and numerous customer complaints indicate a high risk of potential fraud or mismanagement.

Traders should be particularly wary of the broker's promises of high returns, as these claims are often associated with scams. For those seeking a reliable trading experience, it is recommended to consider regulated brokers that offer clear fee structures, robust customer support, and strong investor protections.

Some reputable alternatives to SDFX Global include Interactive Brokers, Zerodha, and ICICI Direct, all of which are well-regarded in the industry and provide the necessary regulatory oversight to protect traders' interests.

In summary, while SDFX Global may appear to offer attractive trading opportunities, the associated risks far outweigh the potential benefits. It is prudent for traders to prioritize their safety and choose brokers that are transparent, regulated, and committed to their clients' success.

Is SDFX Global a scam, or is it legit?

The latest exposure and evaluation content of SDFX Global brokers.

SDFX Global Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SDFX Global latest industry rating score is 1.40, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.40 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.