WINDSORBROKERS Review 1

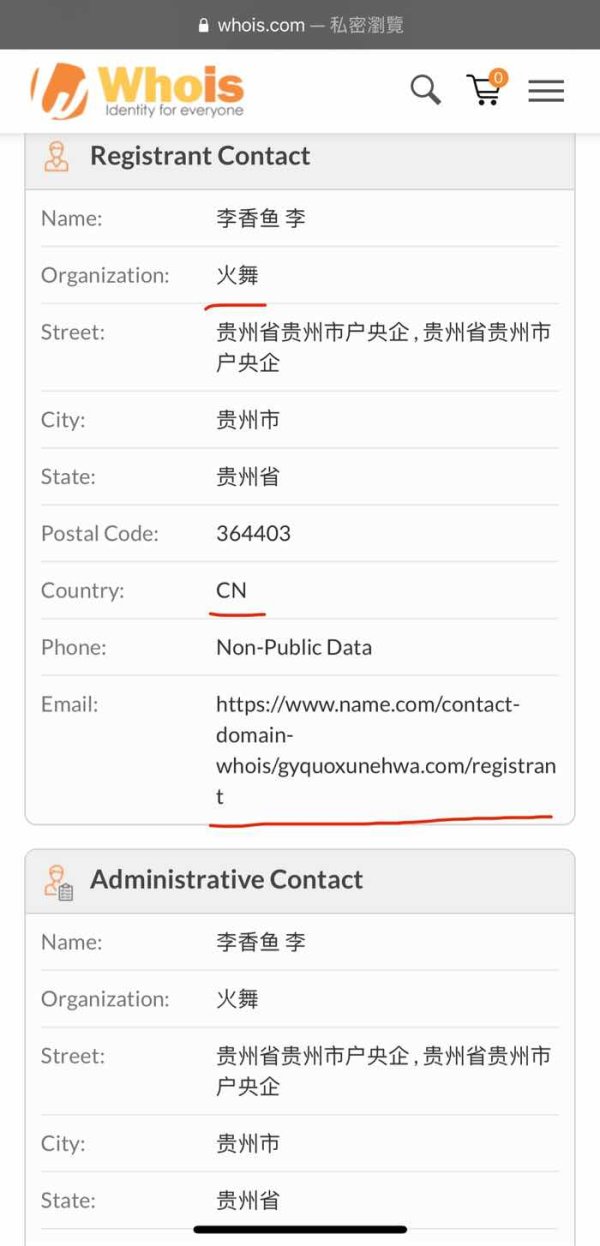

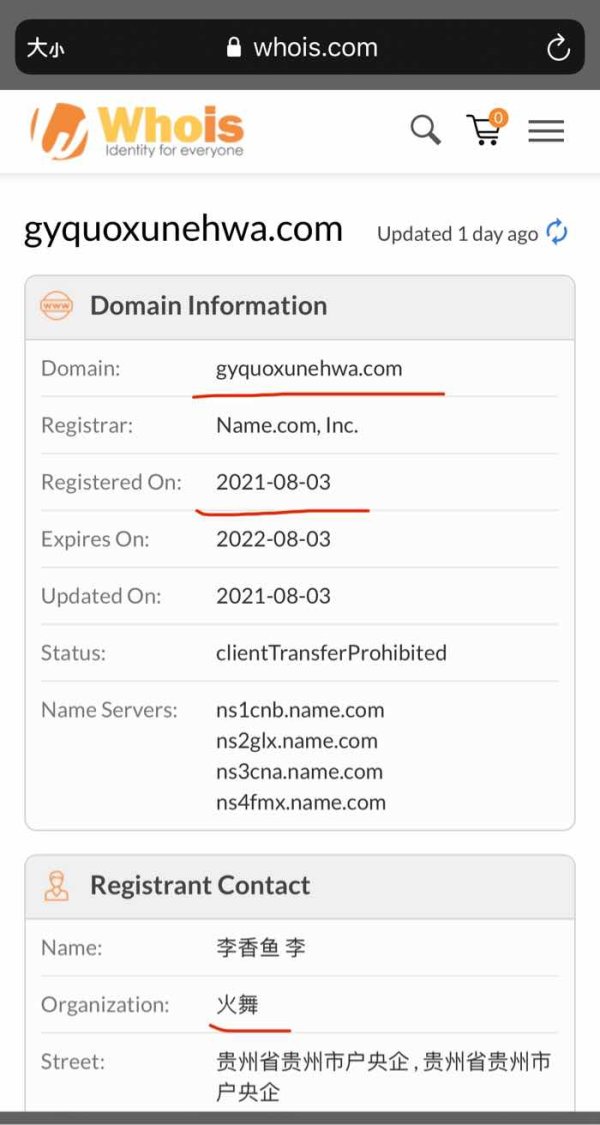

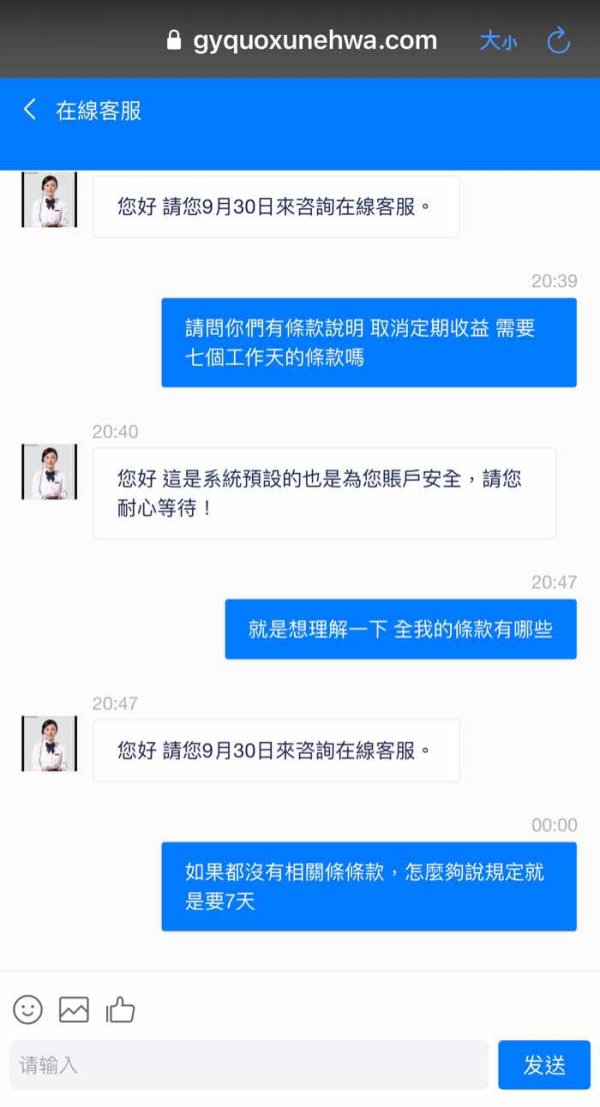

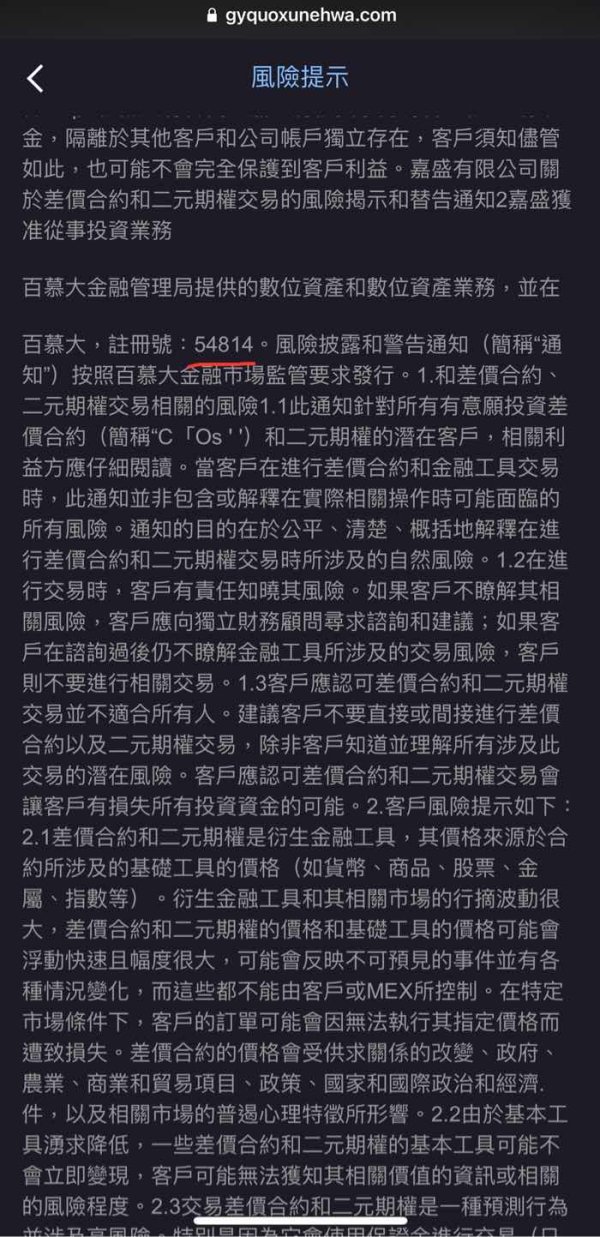

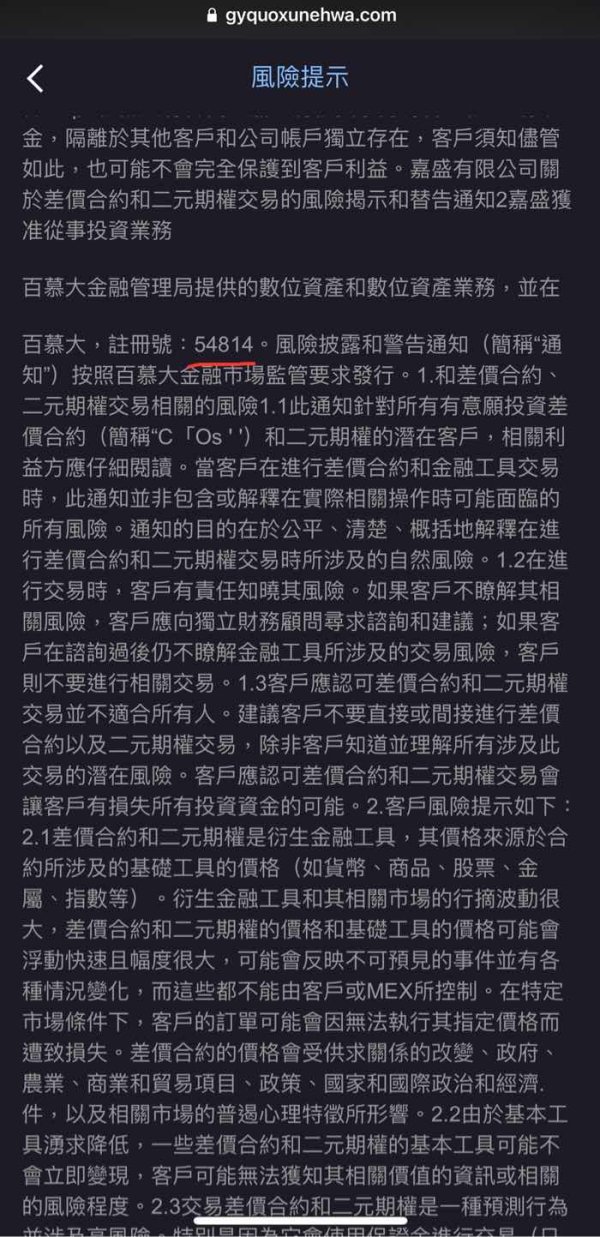

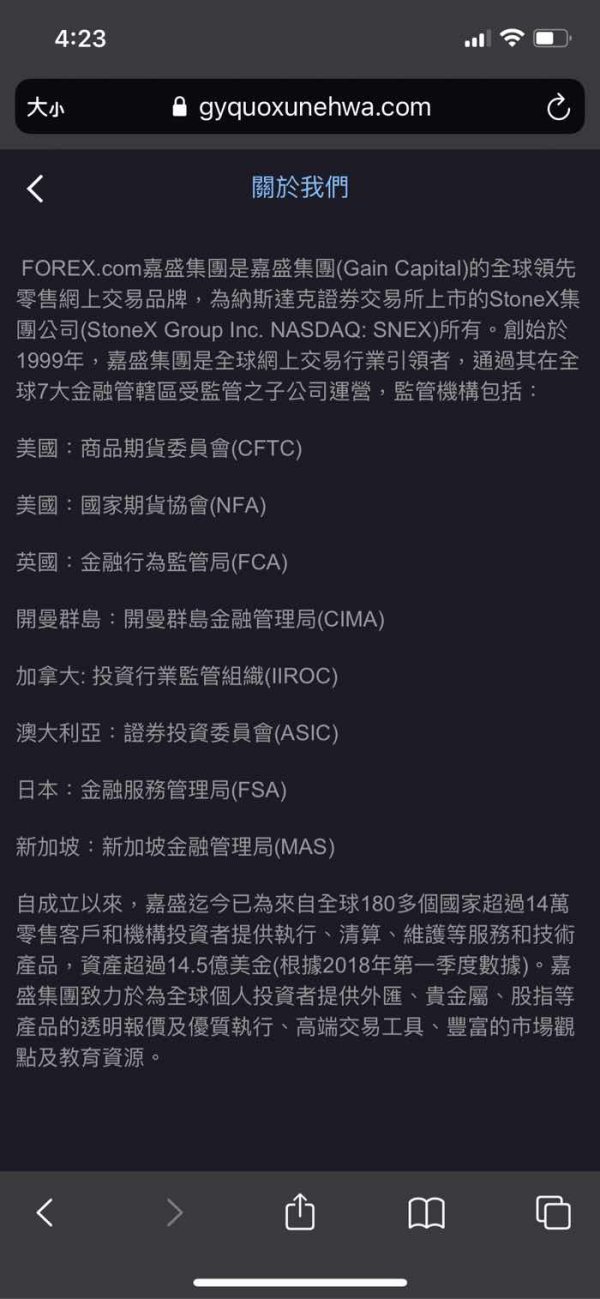

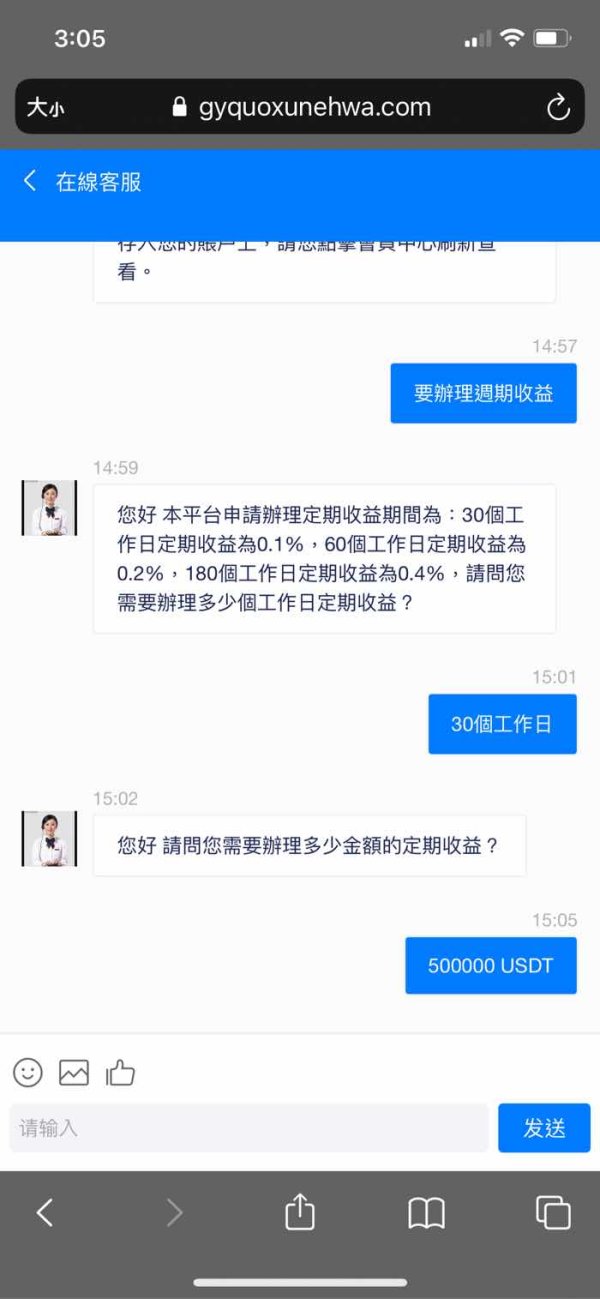

Fraud platform. It was of no regulation after my investigation. They did not approve my withdrawal even if I cancel the profits.

WINDSORBROKERS Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Fraud platform. It was of no regulation after my investigation. They did not approve my withdrawal even if I cancel the profits.

Windsor Brokers has established itself as a prominent player in the online trading landscape, providing a range of financial services since its inception in 1988. This comprehensive review of Windsor Brokers highlights the broker's strengths and weaknesses, drawing insights from user experiences and expert opinions. Key features include competitive spreads, a user-friendly trading platform, and a variety of account types suitable for different trading styles.

Note: It's important to consider that Windsor Brokers operates through multiple entities across different jurisdictions, which may affect the trading conditions and regulatory protections available to clients in various regions.

| Category | Rating (out of 10) |

|---|---|

| Account Conditions | 8.0 |

| Tools and Resources | 7.5 |

| Customer Service | 6.5 |

| Trading Experience | 7.0 |

| Trustworthiness | 7.5 |

| User Experience | 6.0 |

We rated Windsor Brokers based on a thorough analysis of user feedback, expert reviews, and the broker's operational details.

Founded in 1988, Windsor Brokers is headquartered in Limassol, Cyprus, and is regulated by multiple authorities, including the Cyprus Securities and Exchange Commission (CySEC), the Financial Services Commission (FSC) in Belize, and the Jordan Securities Commission (JSC). The broker primarily offers trading through the popular MetaTrader 4 (MT4) platform, which is well-regarded for its extensive features and user-friendly interface. Clients can trade a variety of assets, including forex, commodities, indices, and contracts for difference (CFDs), making it a versatile option for traders of all levels.

Windsor Brokers operates across several jurisdictions, including Cyprus, Belize, Jordan, Kenya, and Seychelles. Each entity is subject to different regulatory requirements, which can impact the trading experience and protections afforded to clients. For instance, EU clients benefit from stringent regulations under CySEC, which includes negative balance protection and participation in an investor compensation fund.

The broker supports various currencies for deposits and withdrawals, including USD, EUR, GBP, and JPY. However, it does not currently offer cryptocurrency trading, which may be a drawback for traders looking to diversify their portfolios with digital assets. Withdrawal methods include credit/debit cards, bank transfers, and e-wallets, with a typical processing time of one to three business days.

Windsor Brokers has a low minimum deposit requirement of $50 for its Prime account, making it accessible for new traders. However, the Zero account, which offers tighter spreads, requires a minimum deposit of $1,000, catering to more experienced traders.

The broker offers various promotions, including a welcome bonus of $30 for new clients and deposit bonuses that can significantly increase trading capital. However, conditions apply, and traders should read the terms carefully to understand the requirements for these bonuses.

Windsor Brokers provides access to over 160 trading instruments, including more than 45 currency pairs, various commodities, indices, and shares. This diverse range allows traders to explore multiple markets and implement various trading strategies.

Windsor Brokers offers competitive spreads starting from 1 pip on the Prime account. For the Zero account, spreads can be as low as 0 pips, but a commission of $8 per round turn applies. The absence of inactivity fees is a positive aspect, although traders should be aware of potential withdrawal fees, particularly for credit card transactions.

The broker offers leverage up to 1:1000, which can amplify potential profits but also increases the risk of significant losses. Traders should use leverage judiciously and be aware of the margin requirements, which are set at 100% for a margin call and 20% for a stop-out.

Windsor Brokers exclusively uses the MT4 platform, which is a well-established choice among traders. While MT4 offers robust features for trading, some users may find the lack of MT5 or other platforms limiting, particularly those looking for advanced trading tools.

Windsor Brokers does not accept clients from certain regions, including the United States, Malaysia, and several other countries due to regulatory restrictions. This limitation may affect potential clients seeking to open an account.

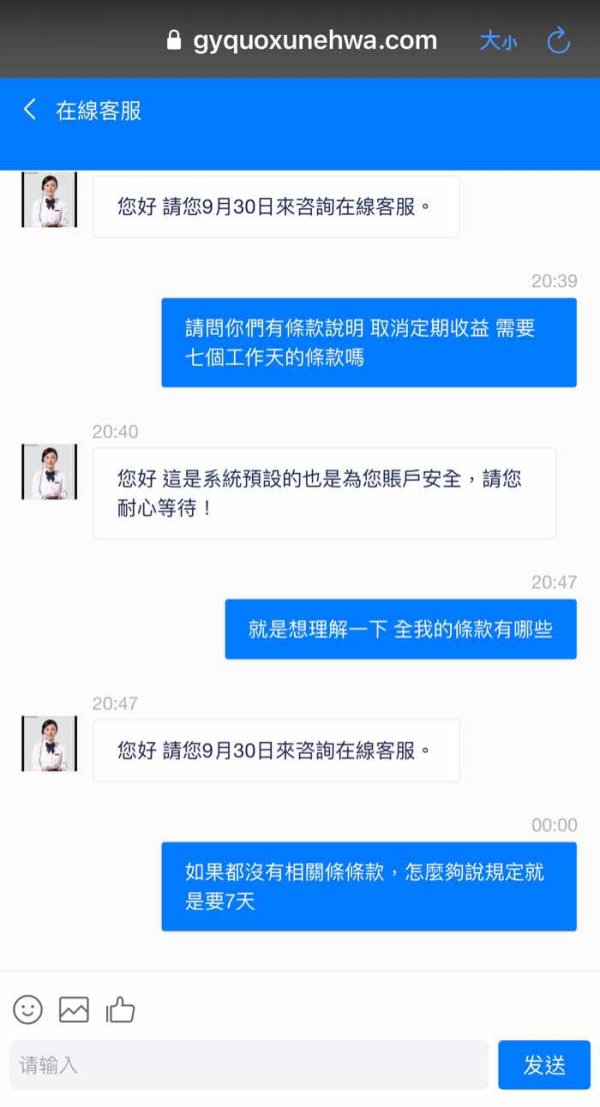

Customer support is available in multiple languages, including English and Chinese. However, some users have reported mixed experiences with response times and the quality of support received, indicating room for improvement in this area.

| Category | Rating (out of 10) |

|---|---|

| Account Conditions | 8.0 |

| Tools and Resources | 7.5 |

| Customer Service | 6.5 |

| Trading Experience | 7.0 |

| Trustworthiness | 7.5 |

| User Experience | 6.0 |

Windsor Brokers offers two primary account types: the Prime account and the Zero account. The Prime account is suitable for beginners, while the Zero account is geared towards experienced traders. Both accounts feature negative balance protection and competitive leverage options.

While the broker provides a solid range of educational resources, including webinars and market analysis, some users have noted a lack of depth in these materials. The MT4 platform is a strong point, offering various tools for technical analysis.

Customer service operates Monday to Friday, with support available via email, phone, and live chat. However, user experiences have been mixed, with some reporting slow response times.

Traders can expect a generally positive experience with Windsor Brokers, but issues such as slippage and requotes have been reported during high volatility periods.

The broker is regulated by multiple authorities, which enhances its credibility. However, some users have raised concerns about withdrawal issues and the responsiveness of customer service.

Overall, users have expressed satisfaction with the trading platform and the variety of instruments available, but there are areas for improvement, particularly in customer support.

In conclusion, Windsor Brokers presents a solid option for traders seeking a regulated broker with a diverse range of trading instruments. However, potential clients should carefully consider the limitations and user feedback before establishing an account.

FX Broker Capital Trading Markets Review