Vector Fin 2025 Review: Everything You Need to Know

Executive Summary

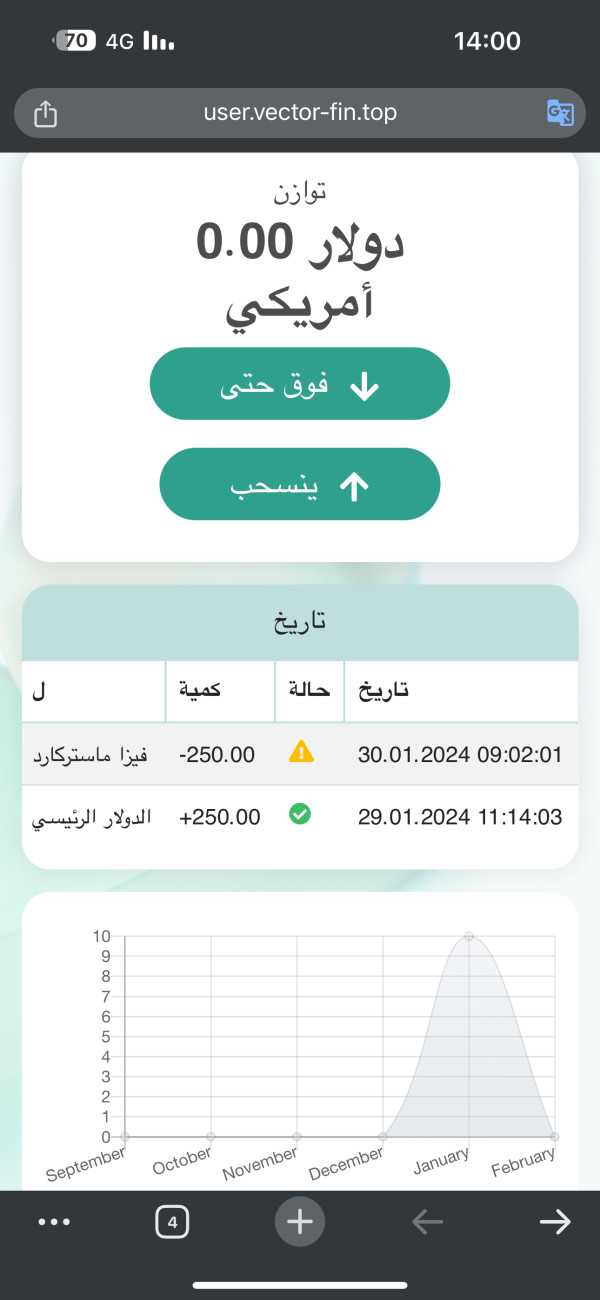

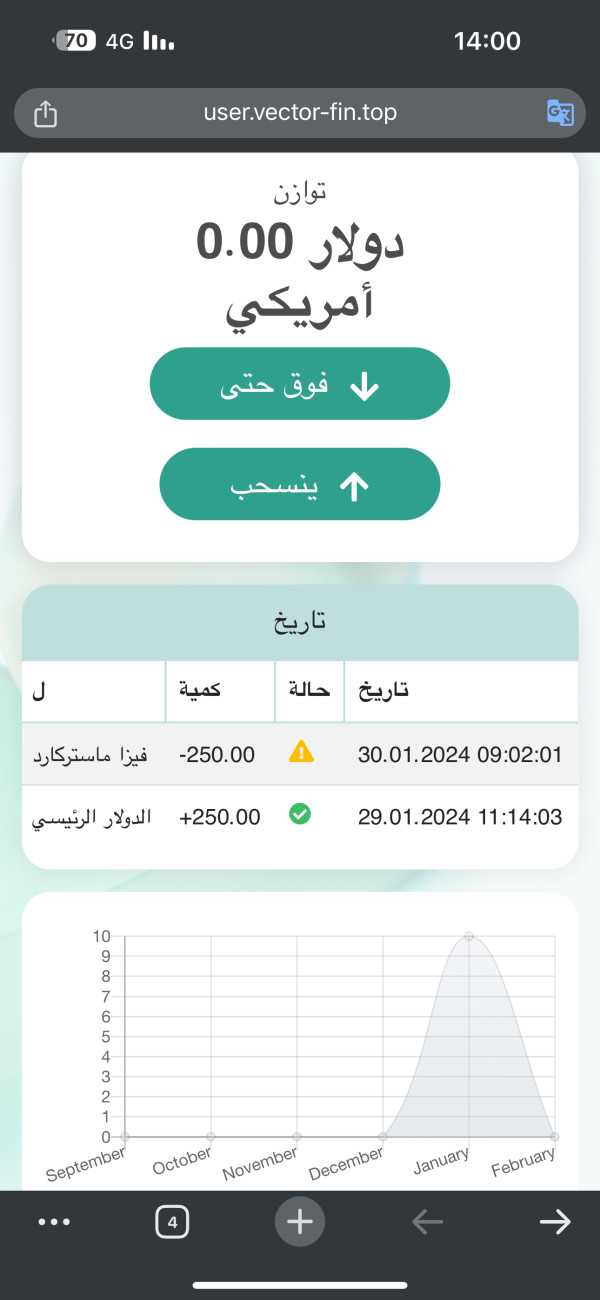

This vector fin review shows worrying facts about a broker that works without proper rules watching over it. Vector Fin says it's an international trading platform that offers forex and CFD services with high leverage up to 1:500, plus what they claim are modern trading platforms. But our full study finds major red flags that possible traders must think about.

The broker has no regulatory permission, which is the biggest worry. Vector Fin has gotten warnings from financial authorities, including BaFin (Germany's Federal Financial Supervisory Authority), based on what we know. This raises serious questions about whether it's real and follows the rules. User feedback on different platforms always shows a bad picture, with many reports calling the company fake.

Vector Fin might interest traders who want high leverage chances and claims to offer learning resources. However, the strong evidence says we should be very careful. The mix of no regulation, bad user experiences, and authority warnings creates a risk level that makes this broker wrong for serious trading work.

Our review targets mainly those looking for high-leverage trading chances. We strongly tell people not to use it because of the big risks involved.

Important Notice

Vector Fin works in multiple areas without a clear regulatory framework. This creates big differences in service quality and legal protection based on where the trader lives. The company has no proper permission, which means traders have limited options if disputes or financial losses happen.

This review uses public information, user feedback from different platforms, regulatory warnings, and the broker's own marketing materials. The limited transparency and lack of regulatory oversight means some information might be incomplete or could change without notice. Potential clients should be very careful and think about the big risks that come with unregulated brokers before making any financial commitments.

Rating Overview

Broker Overview

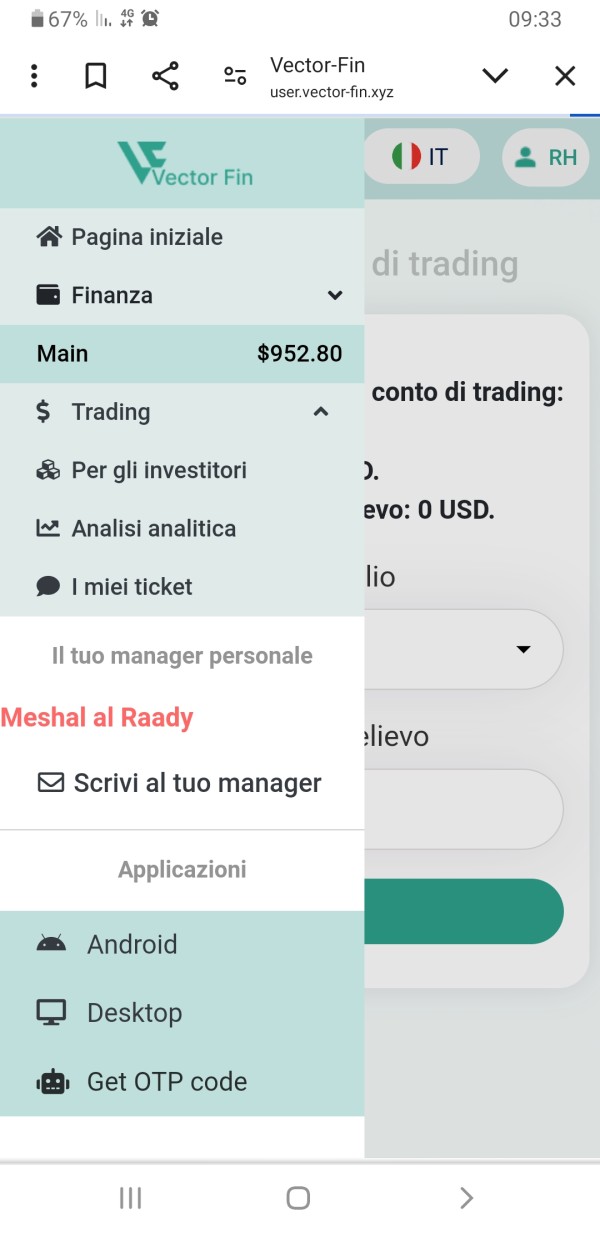

Vector Fin appeared in the trading world around 2019. It says it's an international forex and CFD broker. The company claims it has headquarters in the United Kingdom, though recognized regulatory bodies haven't verified this claim.

The broker's business model focuses on giving retail traders access to foreign exchange markets and contracts for difference across different asset classes. Vector Fin operates without permission from major financial regulators despite its professional look and marketing efforts. This basic problem has led to official warnings from authorities like BaFin, Germany's financial supervisor, which clearly warned investors about the company's unauthorized operations.

The broker gets customers mainly through online marketing and promises of high returns through leveraged trading. The company's trading setup reportedly includes modern platforms designed to help with forex and CFD trading, though specific technical details stay unclear in available documents. Vector Fin targets retail traders who want high leverage opportunities, advertising ratios up to 1:500, which goes way beyond regulatory limits in many areas.

This vector fin review finds that while the broker may attract traders with aggressive marketing and high leverage promises, the lack of regulatory oversight creates big risks that potential clients must carefully consider.

Regulatory Status: Vector Fin works without permission from recognized financial regulators. BaFin has issued specific warnings against the company, telling investors to avoid using their services because of unauthorized operations.

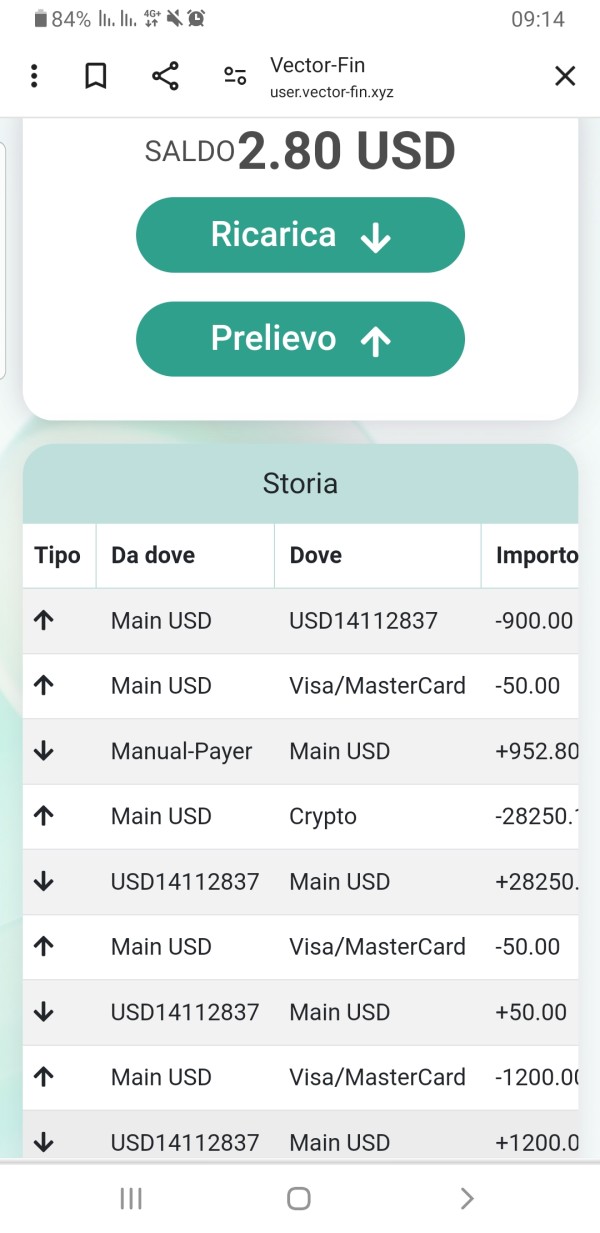

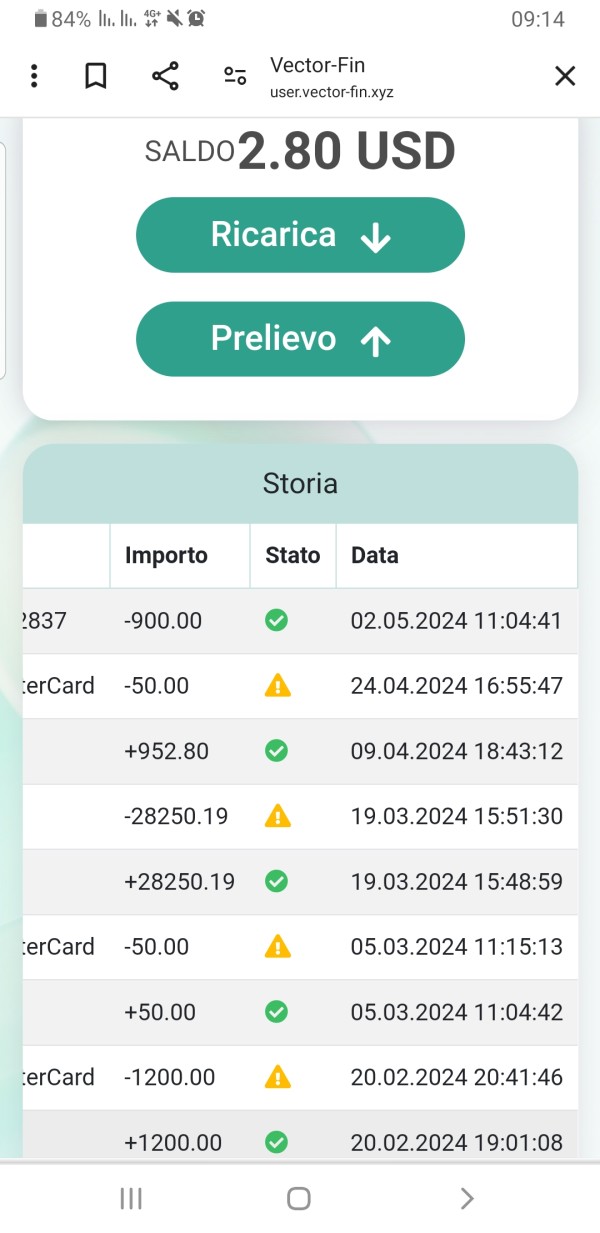

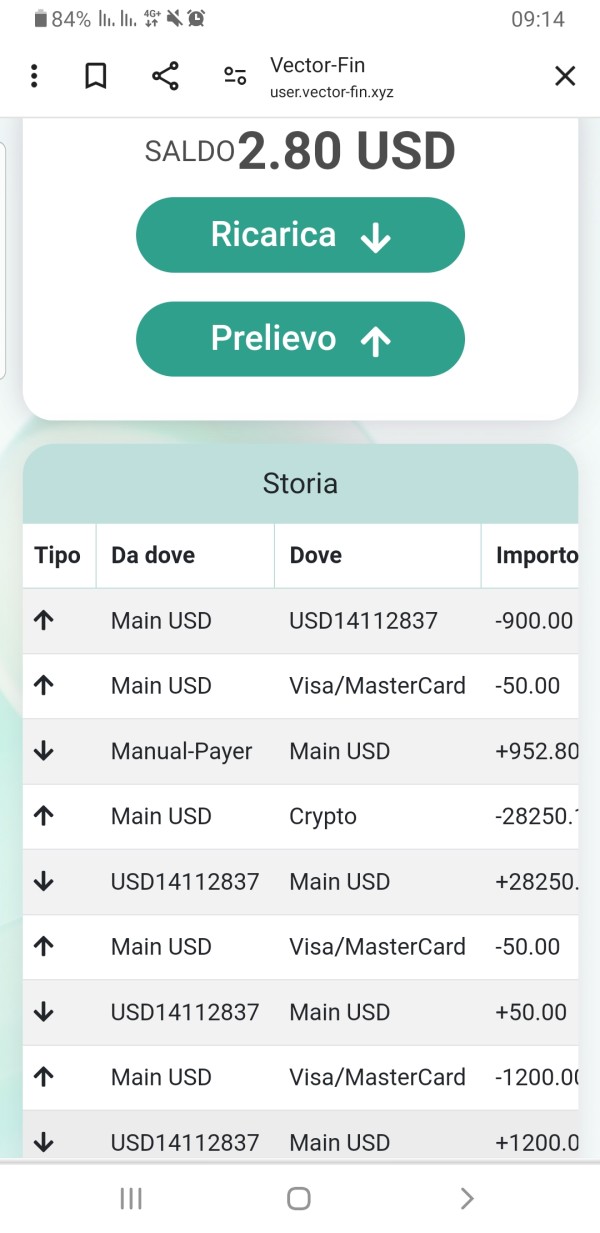

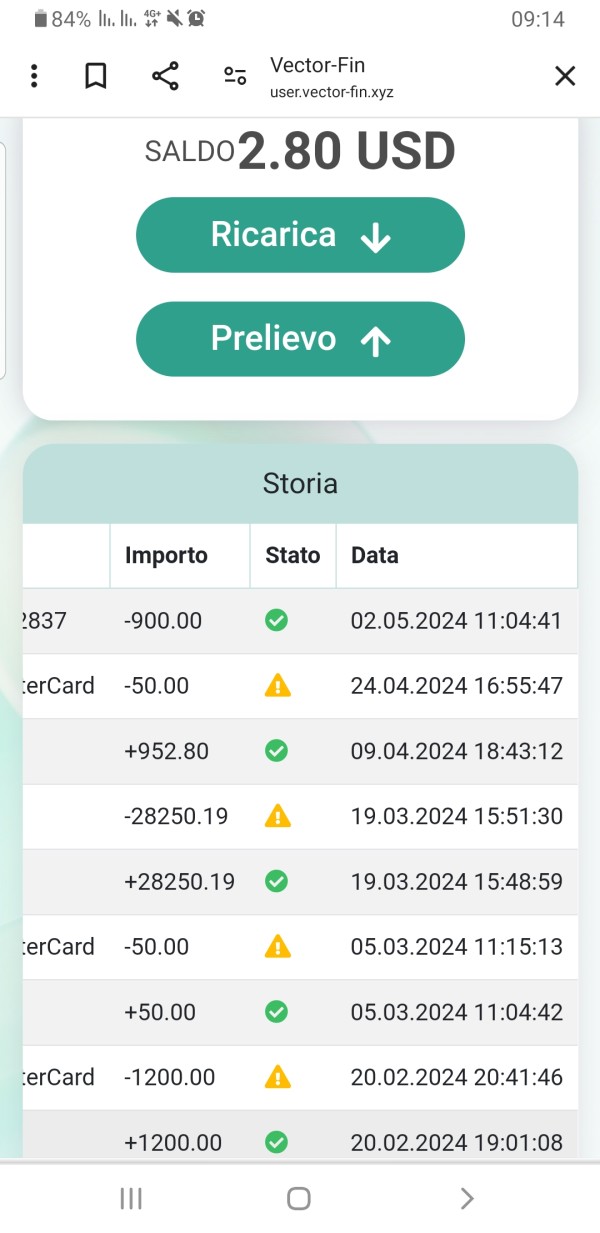

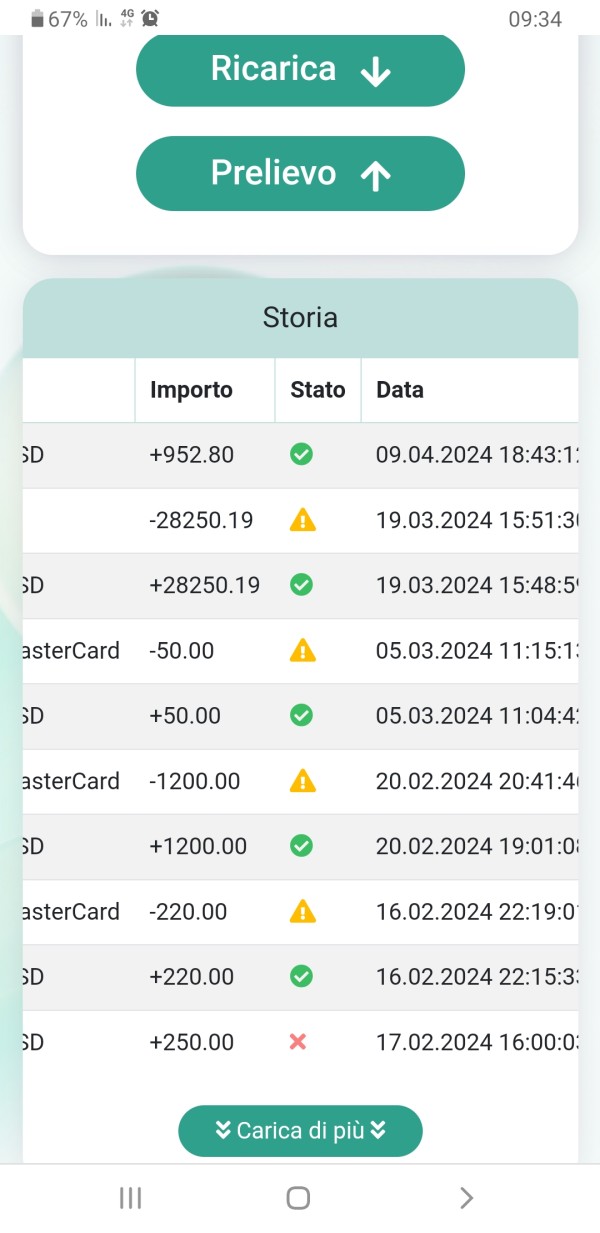

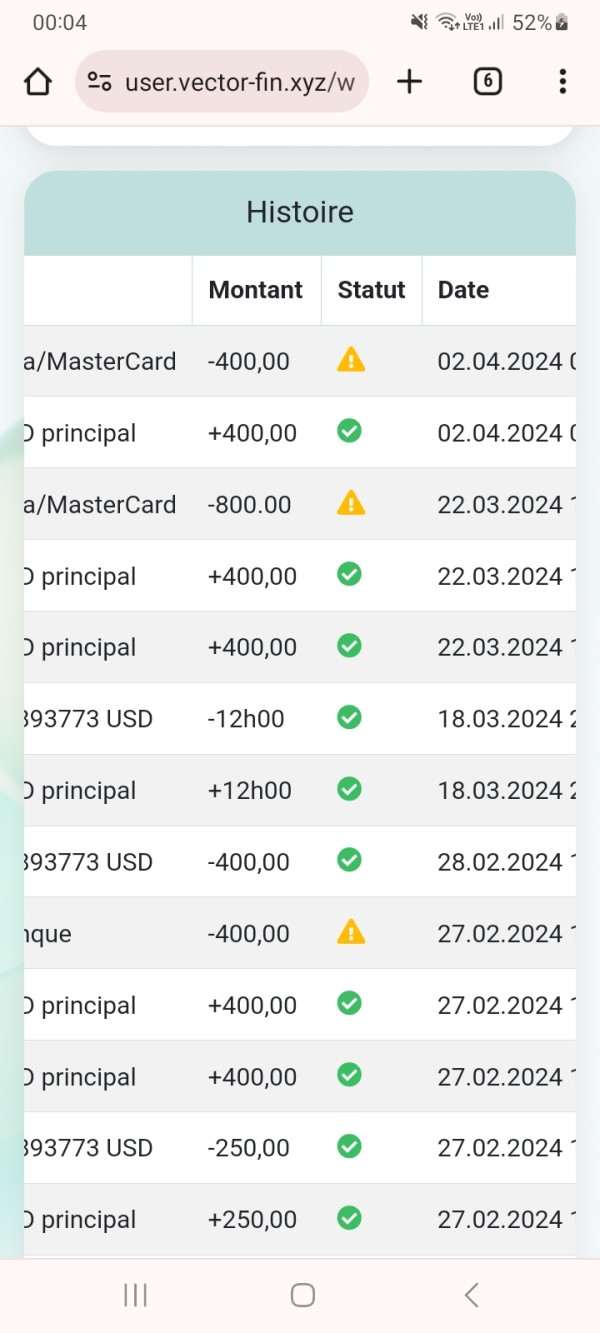

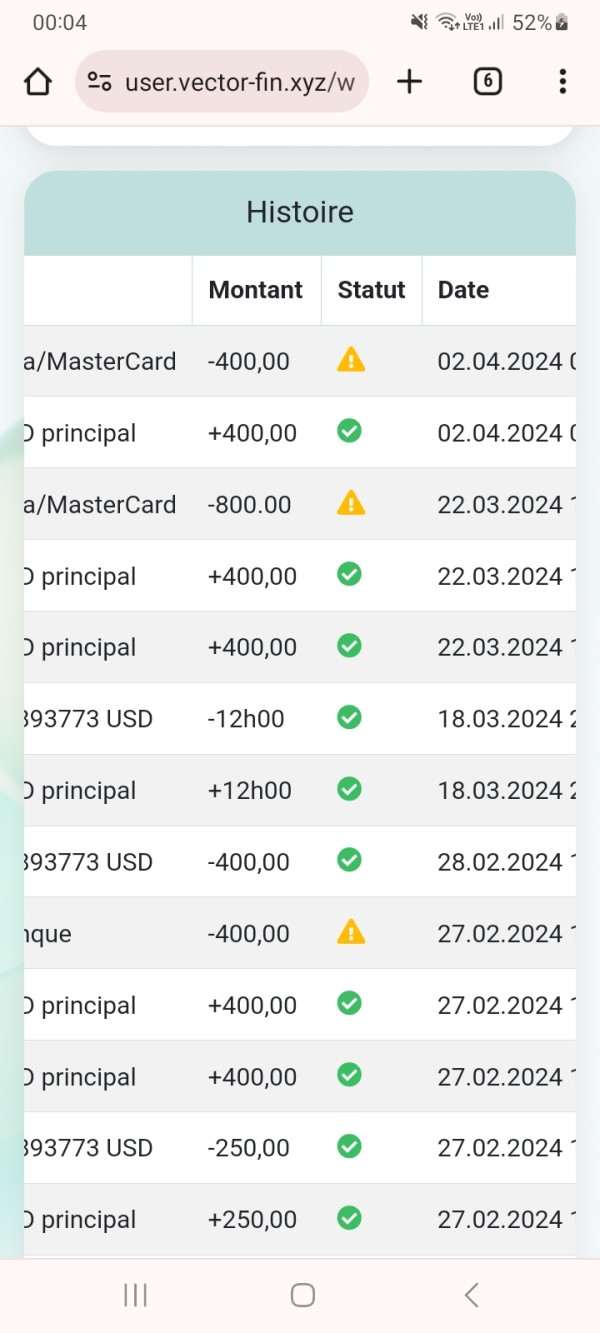

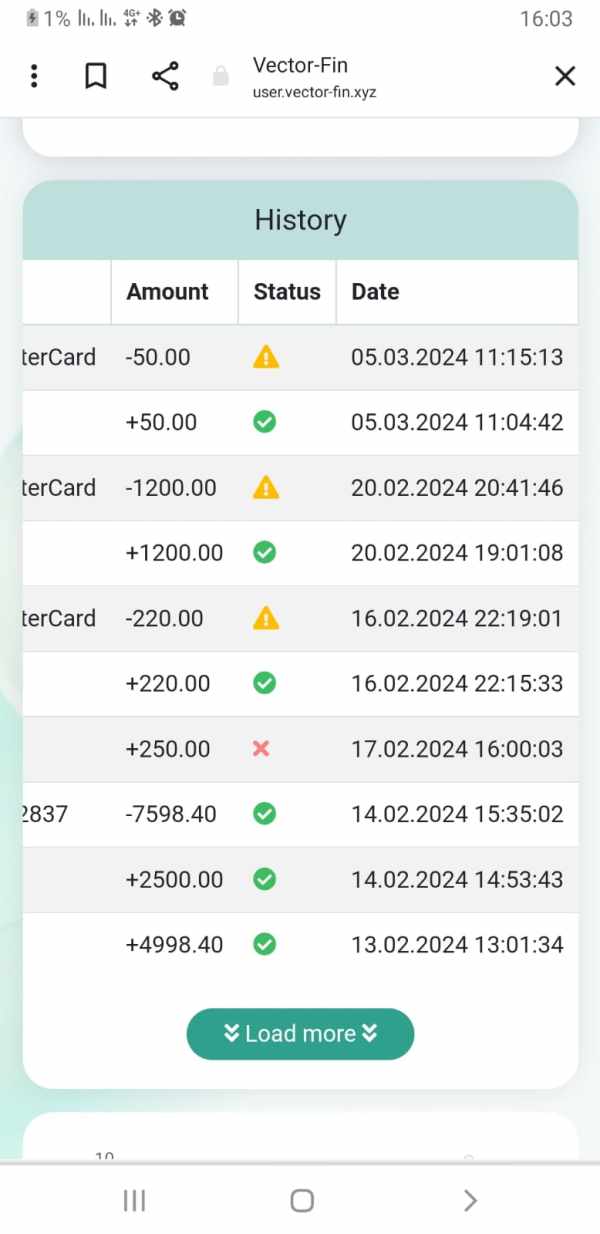

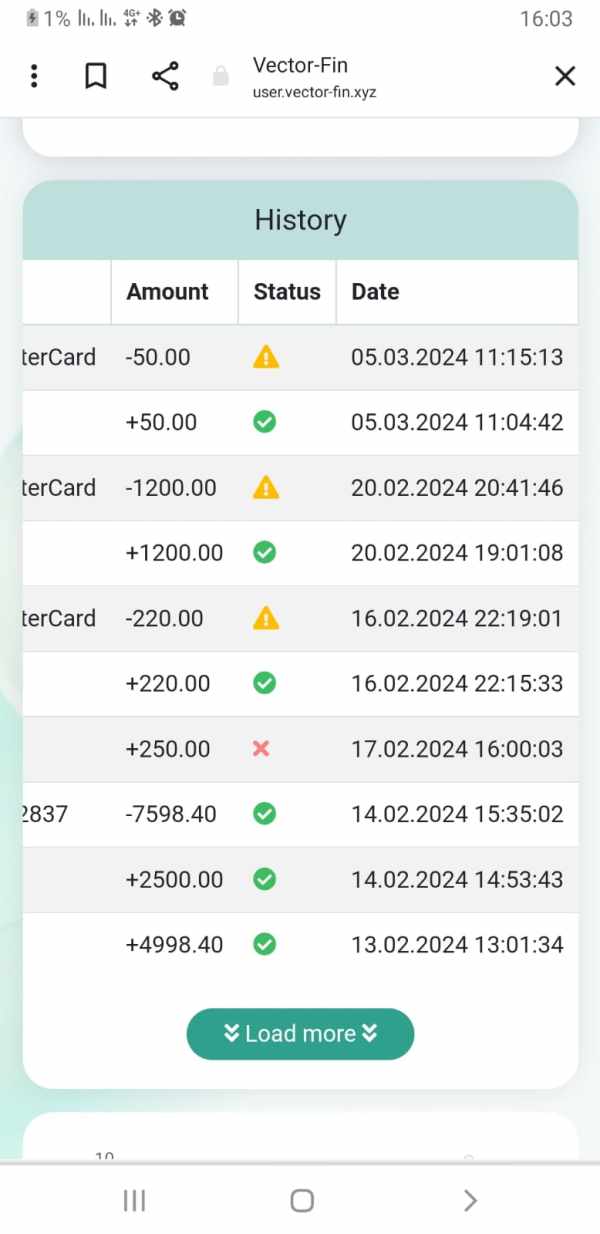

Deposit and Withdrawal Methods: Specific information about funding methods isn't clearly shown in available materials. This raises transparency concerns for potential clients.

Minimum Deposit Requirements: The broker hasn't clearly stated minimum deposit amounts in public information. This makes it hard for traders to assess entry requirements.

Bonus and Promotions: Details about promotional offers or bonus structures aren't easily available in the company's public communications.

Tradeable Assets: Vector Fin claims to offer forex and CFD trading opportunities. However, the specific range of available instruments, currency pairs, and underlying assets lacks detailed documentation.

Cost Structure: Information about spreads, commissions, and other trading costs stays unclear in available materials. This prevents accurate cost comparison with regulated alternatives.

Leverage Options: The broker advertises maximum leverage ratios of 1:500. This is much higher than regulatory limits imposed by major financial authorities in developed markets.

Platform Options: Vector Fin promotes modern trading platforms. However, specific platform names, features, and technical capabilities aren't detailed in accessible information.

Geographic Restrictions: Specific information about regional limitations or restricted areas isn't clearly communicated.

Customer Support Languages: Available support languages aren't specified in reviewed materials.

This vector fin review highlights the worrying lack of transparency across multiple operational aspects. This adds to the risks associated with the broker's unregulated status.

Detailed Rating Analysis

Account Conditions Analysis (Score: 2/10)

Vector Fin's account conditions show big concerns for potential traders. The broker fails to give clear information about account types, tier structures, or specific features that make different account levels stand out. This lack of transparency makes it impossible for traders to make smart decisions about which account might fit their trading style and capital needs.

The absence of detailed minimum deposit information creates uncertainty about entry requirements. The lack of clear documentation about account opening procedures raises questions about the broker's operational standards. Standard features like Islamic accounts, demo account availability, or account upgrade pathways aren't clearly communicated in available materials.

User feedback consistently highlights problems with account management. This includes difficulties accessing funds and unclear terms and conditions. The combination of poor transparency and negative user experiences regarding account operations contributes a lot to the low rating in this category.

Account holders have limited protection and recourse options without regulatory oversight. This makes the already poor account conditions even more problematic. This vector fin review finds that the broker's approach to account management falls well below industry standards expected from legitimate trading platforms.

Vector Fin claims to provide modern trading platforms and educational resources. However, specific details about these offerings remain unclear. The broker's marketing materials suggest access to contemporary trading technology, but lack concrete information about platform features, analytical tools, or research capabilities that traders typically expect.

The educational component is mentioned in promotional materials but lacks detailed curriculum information, learning pathways, or evidence of expert instruction quality. Traders cannot assess the value or relevance of these offerings to their development needs without clear documentation of what educational resources actually include. Trading tools such as technical indicators, charting capabilities, automated trading support, or risk management features aren't specifically detailed in available information.

This absence of technical specifications makes it difficult to evaluate whether the platform can meet serious traders' requirements. The broker receives some credit for claiming to offer educational resources and modern platforms, but the lack of transparency and detailed information significantly limits the practical value of these offerings. The moderate score reflects the potential existence of useful tools while acknowledging the substantial uncertainty about their actual quality and functionality.

Customer Service and Support Analysis (Score: 3/10)

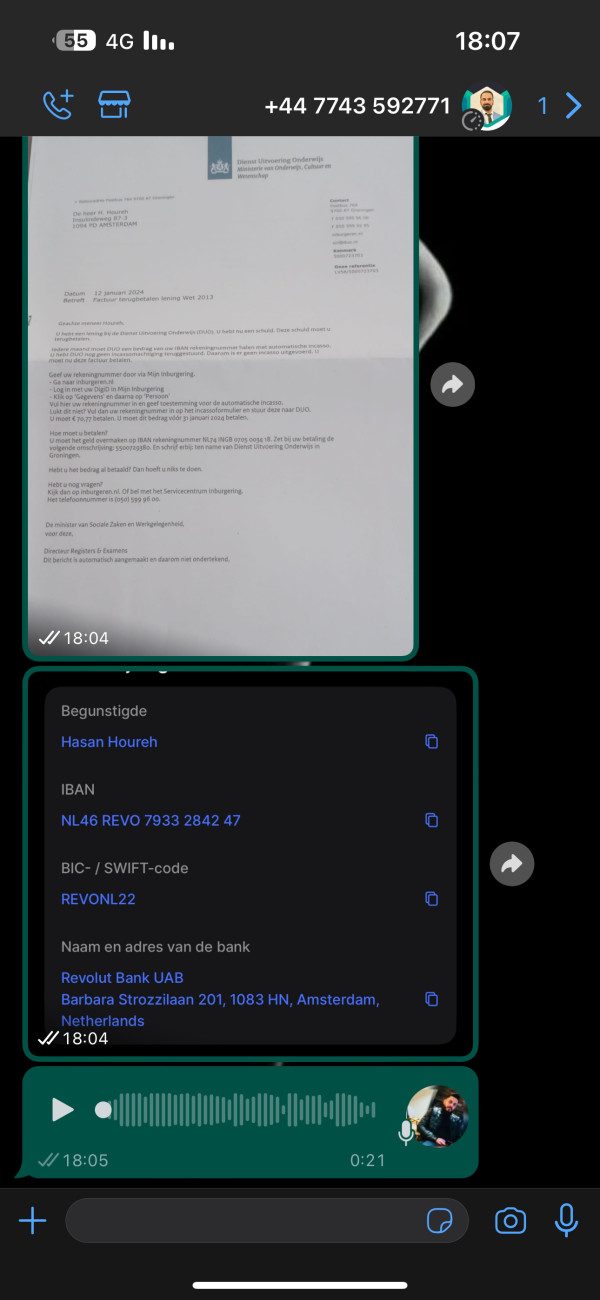

Customer service represents one of Vector Fin's most problematic areas. User feedback consistently reports negative experiences across multiple touchpoints. Available reviews and complaints indicate significant issues with response times, service quality, and problem resolution capabilities.

The broker's customer support structure lacks transparency regarding available contact methods, operating hours, or escalation procedures. Clients face uncertainty when issues arise without clear information about how to reach support teams or what level of assistance traders can expect. User testimonials frequently mention difficulties in getting timely responses to inquiries, particularly regarding account access and withdrawal requests.

The pattern of negative feedback suggests systemic problems with the customer service approach rather than isolated incidents. The absence of regulatory oversight compounds customer service problems, as clients have limited external recourse when internal support fails to resolve issues satisfactorily. This creates an environment where poor service quality can persist without accountability mechanisms that regulated brokers must maintain.

Trading Experience Analysis (Score: 4/10)

The trading experience with Vector Fin appears compromised by several factors that impact overall platform usability and reliability. User feedback suggests issues with platform stability, order execution quality, and overall trading environment that affect the practical trading experience.

The broker advertises modern trading platforms, but actual user experiences indicate potential problems with system reliability and performance during active trading periods. These technical issues can significantly impact trading outcomes and create frustration for active traders. The lack of detailed information about execution quality, slippage rates, or platform uptime statistics makes it difficult to assess the true quality of the trading environment.

Traders must rely on limited user feedback to gauge platform reliability without regulatory oversight requiring performance reporting. Mobile trading capabilities and cross-device synchronization aren't clearly documented, limiting traders' ability to assess whether the platform meets modern mobility requirements. The moderate-low score reflects concerns about platform reliability while acknowledging that some traders may have acceptable experiences.

This vector fin review finds that trading experience concerns, combined with regulatory and transparency issues, create significant obstacles to satisfactory platform usage.

Trustworthiness Analysis (Score: 1/10)

Trustworthiness represents Vector Fin's most critical weakness. Multiple factors contribute to severe concerns about the broker's reliability and legitimacy. The absence of regulatory authorization from recognized financial authorities immediately raises red flags about operational compliance and client protection.

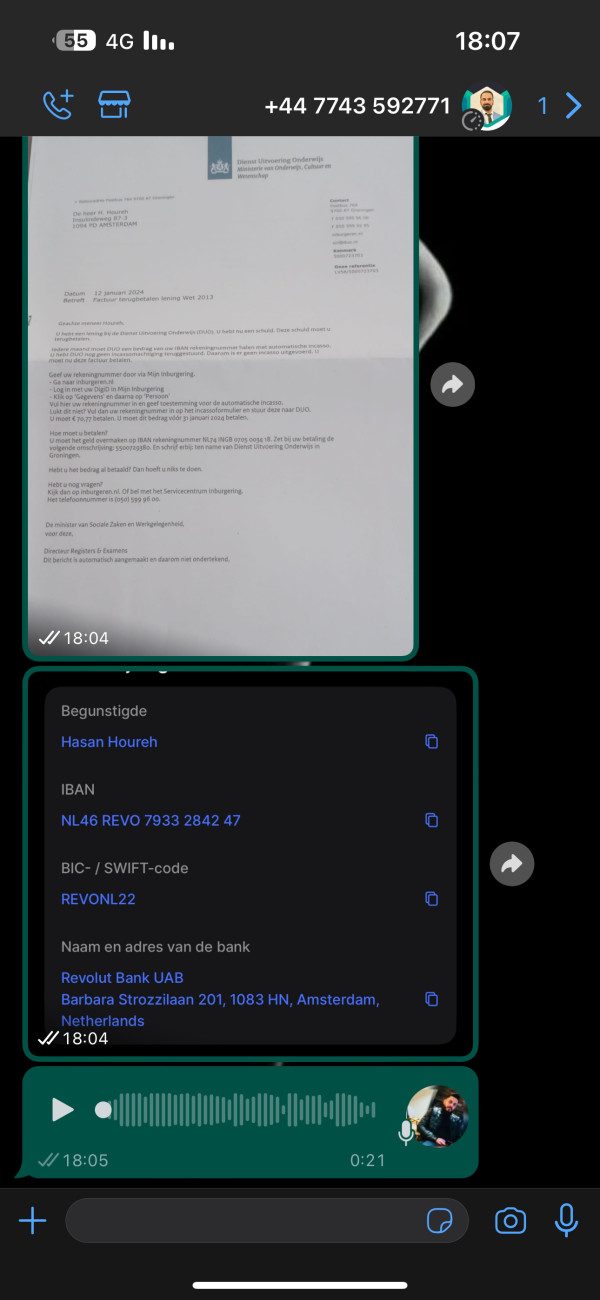

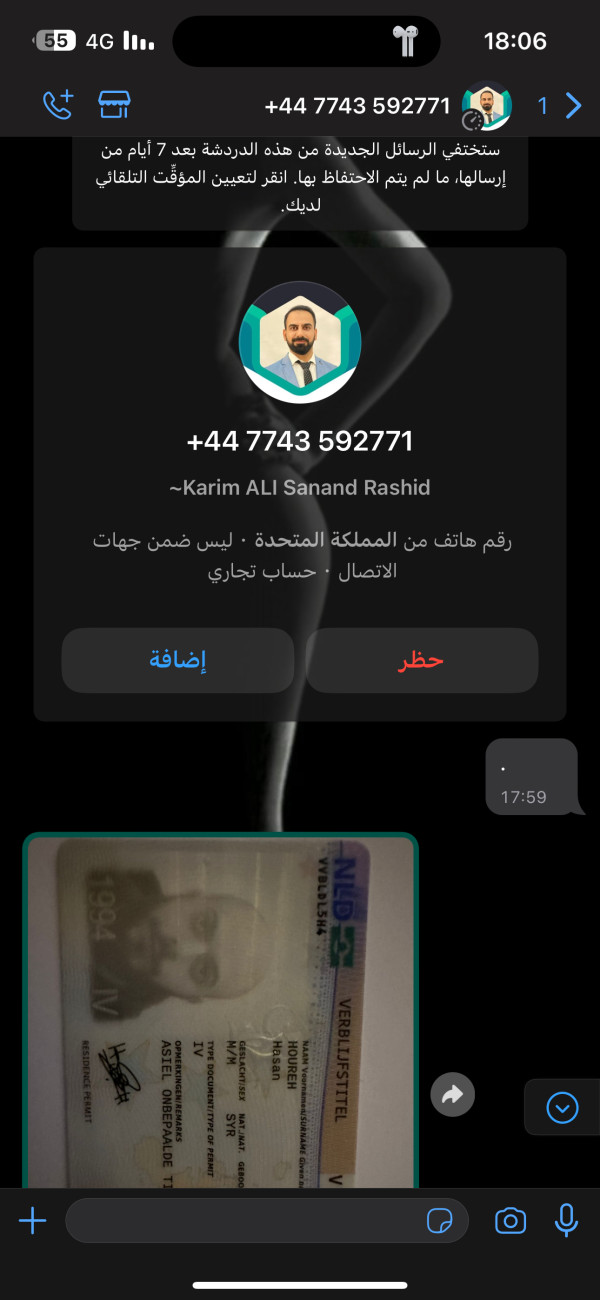

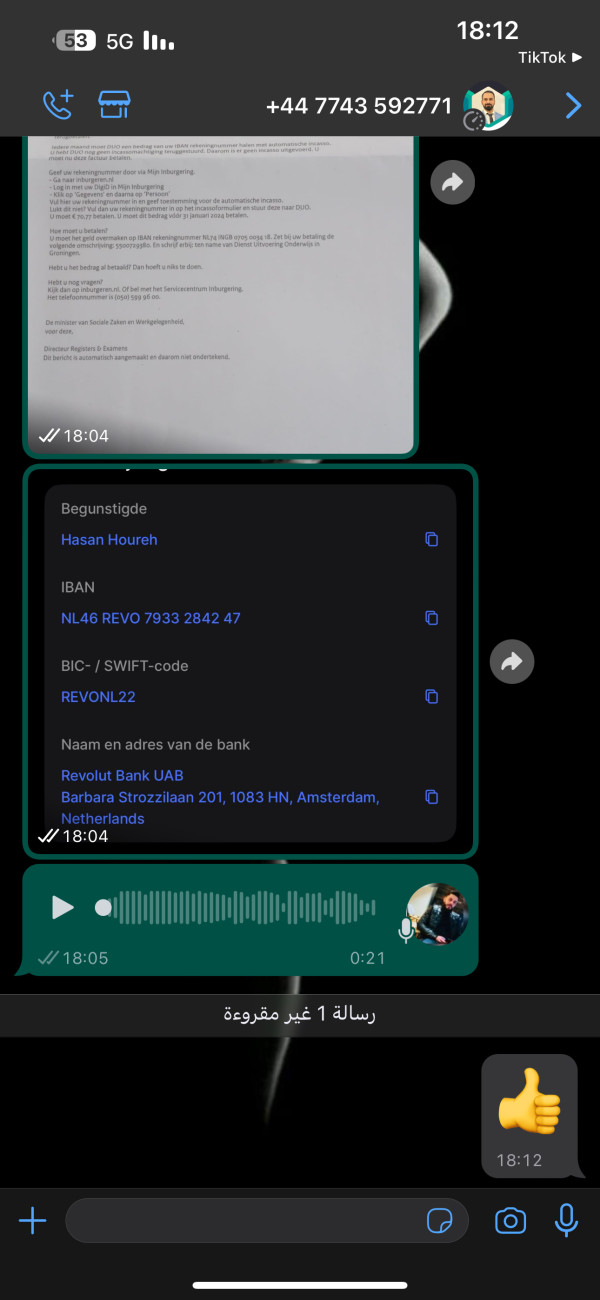

BaFin's explicit warning against Vector Fin demonstrates that established financial regulators have identified problematic practices warranting public advisories. Such warnings typically indicate serious concerns about unauthorized operations and potential investor harm. User feedback consistently describes experiences that align with fraudulent operations, including difficulties withdrawing funds, misleading marketing practices, and poor transparency.

The pattern of negative reviews across multiple platforms suggests systemic problems rather than isolated incidents. The company's lack of transparency regarding corporate structure, beneficial ownership, and operational procedures further undermines trust. Legitimate brokers typically provide clear information about corporate governance, regulatory compliance, and risk management practices.

Clients have minimal protection against potential fraud or operational failures without regulatory oversight. The combination of regulatory warnings, negative user experiences, and operational opacity creates a trust profile that makes Vector Fin unsuitable for serious trading activities.

User Experience Analysis (Score: 2/10)

Overall user experience with Vector Fin reflects the cumulative impact of poor service quality, regulatory concerns, and operational transparency issues. User satisfaction appears consistently low across multiple evaluation criteria, with few positive experiences reported in available feedback.

The registration and verification processes lack clear documentation. This creates uncertainty about account opening procedures and requirements. This opacity extends to ongoing account management, where users report confusion about terms, conditions, and operational procedures.

Interface design and platform usability receive limited positive feedback. However, specific technical complaints about navigation, functionality, or user interface quality aren't detailed in available reviews. The focus of user complaints tends to center on more fundamental issues regarding fund access and service reliability.

The most significant user experience problem involves the broader context of engaging with an unregulated broker. This creates ongoing anxiety about fund security and operational legitimacy. Even users who may not experience immediate technical problems face the underlying stress of uncertain regulatory protection.

Common user complaints focus on withdrawal difficulties, poor customer service responsiveness, and misleading marketing practices. These fundamental operational problems create a user experience that falls well below standards expected from legitimate trading platforms.

Conclusion

This comprehensive vector fin review reveals a broker that presents substantial risks to potential traders despite marketing claims about modern platforms and high leverage opportunities. The combination of regulatory absence, official warnings from financial authorities, and consistently negative user feedback creates a risk profile that makes Vector Fin unsuitable for serious trading activities.

The broker may attract attention through high leverage ratios up to 1:500 and claims of educational resources. However, these potential advantages are overshadowed by fundamental concerns about legitimacy, regulatory compliance, and operational transparency. The lack of clear information about account conditions, costs, and operational procedures further compounds these concerns.

We cannot recommend Vector Fin to any category of traders due to the substantial risks involved. Traders seeking legitimate forex and CFD opportunities should focus on properly regulated brokers that offer transparent operations, regulatory protection, and demonstrable commitment to client service standards. The potential for financial loss and lack of regulatory recourse make Vector Fin an unsuitable choice for both novice and experienced traders.