Is Leap Capital Markets safe?

Business

License

Is Leap Capital Markets Safe or a Scam?

Introduction

Leap Capital Markets positions itself as a brokerage firm catering to traders in the foreign exchange market. Founded in 2023 and based in China, it offers a wide range of trading instruments, including forex, indices, stocks, commodities, and cryptocurrencies. However, the lack of regulatory oversight raises significant concerns over its credibility and safety. As the forex market continues to expand, traders must exercise caution when selecting a broker. This article aims to evaluate the safety and legitimacy of Leap Capital Markets by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and overall risk assessment.

Regulatory Status and Legitimacy

The regulatory environment is crucial for any financial institution, particularly in the forex market, where the potential for fraud is high. Leap Capital Markets currently operates without valid regulation from recognized financial authorities. This absence of oversight raises serious questions about its operational integrity and adherence to industry standards. Below is a summary of the regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of regulation means that Leap Capital Markets is not subject to stringent compliance requirements, which can put traders at risk. Without oversight, there is little assurance that the broker will act in the best interests of its clients or that it will adhere to ethical trading practices. The absence of a credible regulatory framework could lead to practices that may jeopardize client funds, making it essential for potential traders to consider this when assessing if Leap Capital Markets is safe.

Company Background Investigation

Leap Capital Markets is a relatively new entrant in the forex brokerage space, having been established in 2023. The company's ownership structure and management team are not well-documented, which raises concerns about transparency. A lack of information regarding the individuals behind the firm can make it difficult for potential clients to gauge the experience and professionalism of the management team. This lack of transparency can be a red flag for traders looking for reliable and trustworthy brokers.

The company claims to have a robust operational framework, but the absence of detailed information about its history and development trajectory further complicates the assessment of its credibility. In an industry where trust is paramount, the opaque nature of Leap Capital Markets' operations contributes to skepticism regarding its safety.

Analysis of Trading Conditions

When evaluating whether Leap Capital Markets is safe, it is essential to consider its trading conditions, including fees and spreads. The broker offers various account types, with some accounts featuring tight spreads starting from 0.0 pips. However, the overall fee structure appears complex, and potential traders should be vigilant regarding any hidden charges that may apply. The following table outlines the core trading costs:

| Fee Type | Leap Capital Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 pips | 1.0 pips |

| Commission Model | $0 | $5 |

| Overnight Interest Range | Variable | Variable |

While the spreads may seem attractive, the lack of clear information on commissions and other potential fees could lead to unexpected costs for traders. This lack of transparency in the fee structure is concerning and may indicate that Leap Capital Markets is not entirely forthcoming about its trading conditions, further raising questions about its safety.

Client Fund Security

The safety of client funds is a critical aspect when determining if Leap Capital Markets is safe. The broker claims to implement several security measures, including segregated accounts for client funds and negative balance protection. Such measures are designed to safeguard traders from incurring debts beyond their initial investments. However, the lack of regulatory oversight means that there is no external verification of these claims.

Additionally, the firm does not provide detailed information about its investor protection policies or any historical issues related to fund security. This omission can be alarming, as the absence of a solid framework for protecting client funds raises concerns about the broker's commitment to safeguarding its clients' investments. Traders must weigh these factors carefully before deciding to engage with Leap Capital Markets.

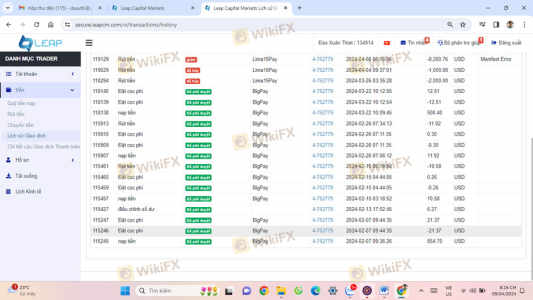

Customer Experience and Complaints

Customer feedback is an essential indicator of a broker's reliability. Reviews and ratings from existing clients can provide insights into the overall experience with Leap Capital Markets. However, the broker has received a mix of reviews, with some users reporting positive experiences while others have expressed dissatisfaction.

Common complaints include difficulties with withdrawals and poor customer service responses. Below is a summary of the primary complaint types encountered:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Service Availability | Medium | Inconsistent |

| Transparency of Fees | High | Lacking Clarity |

For instance, several users have reported challenges in accessing their funds promptly, which raises significant concerns about the broker's operational efficiency and customer service reliability. The inconsistency in addressing complaints further adds to the apprehension surrounding the safety of trading with Leap Capital Markets.

Platform and Trade Execution

The trading platform is a vital component of the trading experience. Leap Capital Markets offers access to the MetaTrader 5 (MT5) platform, which is known for its advanced features and user-friendly interface. However, the performance of the platform, including order execution speed and slippage, is critical for traders. Reports of slippage and rejected orders can be concerning, as they may indicate potential manipulation or inefficiencies in trade execution.

While the broker promotes a seamless trading experience, the lack of independent reviews or performance metrics makes it challenging to ascertain the platform's reliability. Traders should be cautious and consider the potential risks associated with using a platform that may not have a proven track record.

Risk Assessment

The overall risk associated with trading through Leap Capital Markets is high due to several factors, including its unregulated status, opaque fee structure, and mixed customer feedback. The following risk summary provides a concise overview of the key risk areas:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | No valid regulation or oversight |

| Transparency of Fees | Medium | Hidden fees and unclear commission structure |

| Client Fund Security | High | Lack of external verification of security measures |

To mitigate these risks, potential traders should conduct thorough research, consider alternative brokers with established regulatory compliance, and ensure they understand the risks involved in trading with an unregulated broker like Leap Capital Markets.

Conclusion and Recommendations

In conclusion, the evidence suggests that Leap Capital Markets presents several red flags that warrant caution. The absence of regulation, coupled with a lack of transparency in its operations and mixed customer feedback, raises serious concerns about its safety. While the broker offers attractive trading conditions, the potential risks associated with trading on an unregulated platform cannot be overlooked.

For traders seeking a safe and reliable trading environment, it is advisable to consider alternative brokers that are regulated by reputable financial authorities, ensuring a higher level of security and accountability. Overall, while Leap Capital Markets may provide opportunities, the associated risks make it a less favorable choice for traders prioritizing safety and transparency.

Is Leap Capital Markets a scam, or is it legit?

The latest exposure and evaluation content of Leap Capital Markets brokers.

Leap Capital Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Leap Capital Markets latest industry rating score is 1.38, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.38 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.