VenturyFX 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive VenturyFX review looks at a new trading platform that has gotten attention in forex and multi-asset trading. VenturyFX shows a mixed picture for potential traders based on our analysis of user feedback and platform features. The platform has earned a solid 4 out of 5 rating on Trustpilot from 454 user reviews, which shows generally positive user experiences with both mobile and desktop trading interfaces.

VenturyFX stands out by offering access to multiple asset classes, including forex, stocks, and cryptocurrencies. This setup helps traders who want diversified investment opportunities. The platform provides both mobile and desktop trading experiences, with users reporting similar satisfaction levels across both platforms. However, big concerns come up about the broker's regulatory status, as VenturyFX operates without official regulatory oversight, which raises important questions about transparency and investor protection.

The platform works best for traders interested in participating across various financial markets, especially those who focus on mobile trading capabilities. While user feedback suggests good trading experiences, the lack of regulatory supervision remains a critical consideration for risk-conscious investors.

Important Disclaimer

Regional Entity Differences: VenturyFX operates without official regulatory oversight, which may result in varying levels of legal protection for investors across different jurisdictions. The absence of regulatory supervision means that standard investor protection measures typically provided by regulated brokers may not be available.

Review Methodology: This evaluation is based on comprehensive analysis of user reviews, platform functionality assessments, and available market feedback. Our goal is to provide an unbiased analysis while acknowledging information limitations where specific details were not available in source materials.

Rating Framework

Broker Overview

VenturyFX operates as a multi-asset trading platform based in Mauritius. The platform has made its mark in the competitive online brokerage landscape. While specific founding details were not available in source materials, the platform has built a presence in the trading community through its diverse asset offerings and technology-focused approach. The broker's business model centers on providing comprehensive trading services across multiple financial instruments, which appeals to traders seeking one-stop investment solutions.

The platform's core value proposition revolves around accessibility and variety. It offers traders exposure to forex markets, equity markets, and the growing cryptocurrency sector. According to available information, VenturyFX has developed both mobile and desktop trading capabilities, with user feedback suggesting comparable functionality across platforms. This dual-platform approach shows the broker's recognition of evolving trader preferences and the increasing importance of mobile trading accessibility.

However, a critical aspect of VenturyFX's operational structure is its unregulated status. Unlike many established brokers operating under strict regulatory frameworks, VenturyFX functions without oversight from major financial regulatory bodies. This operational choice significantly impacts the broker's risk profile and may influence trader decisions regarding platform selection and fund safety considerations.

Regulatory Status: VenturyFX operates without official regulatory supervision, which represents a significant consideration for potential clients. This unregulated status means the broker does not fall under the oversight of established financial regulatory authorities. It potentially exposes traders to increased risks regarding fund protection and dispute resolution mechanisms.

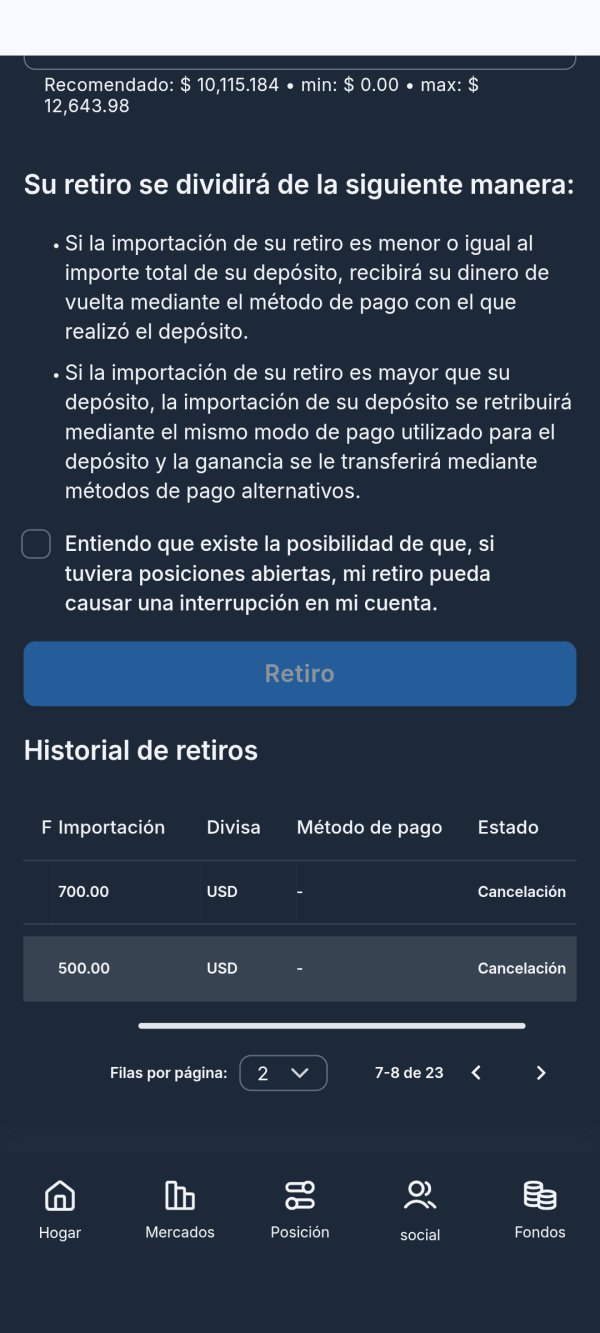

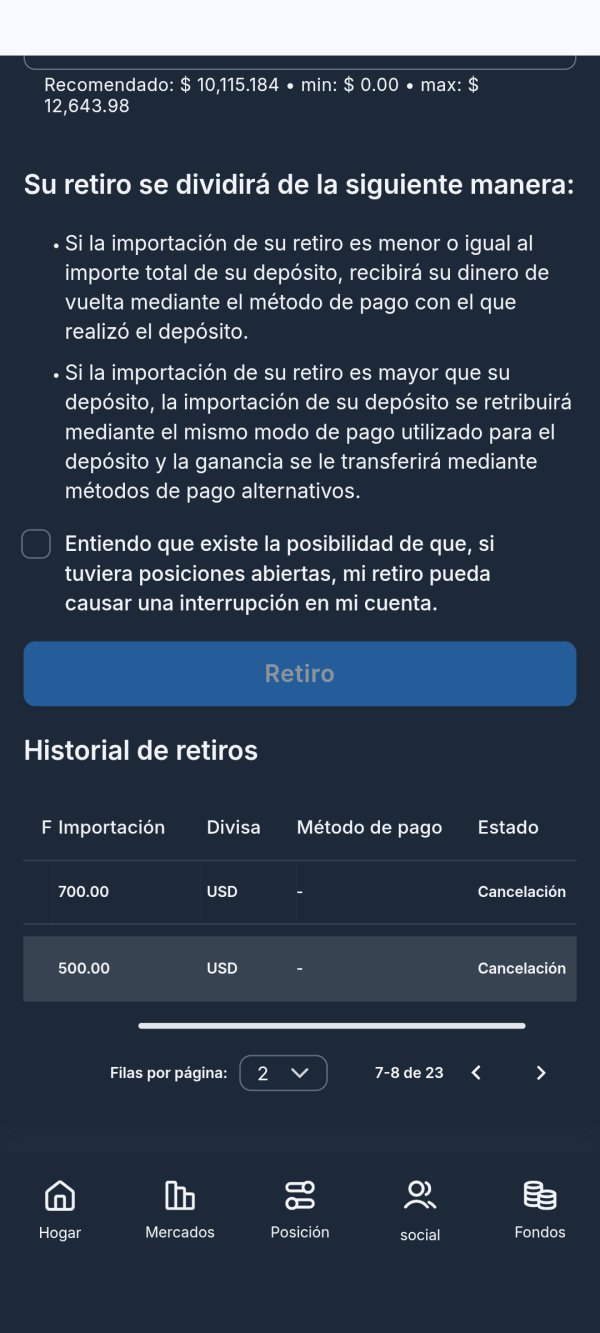

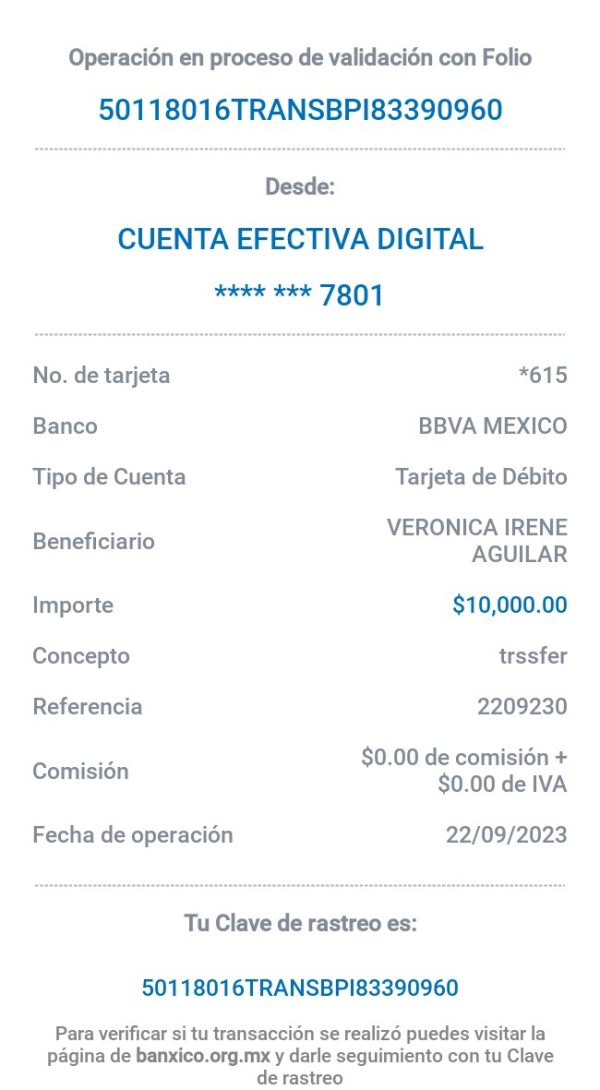

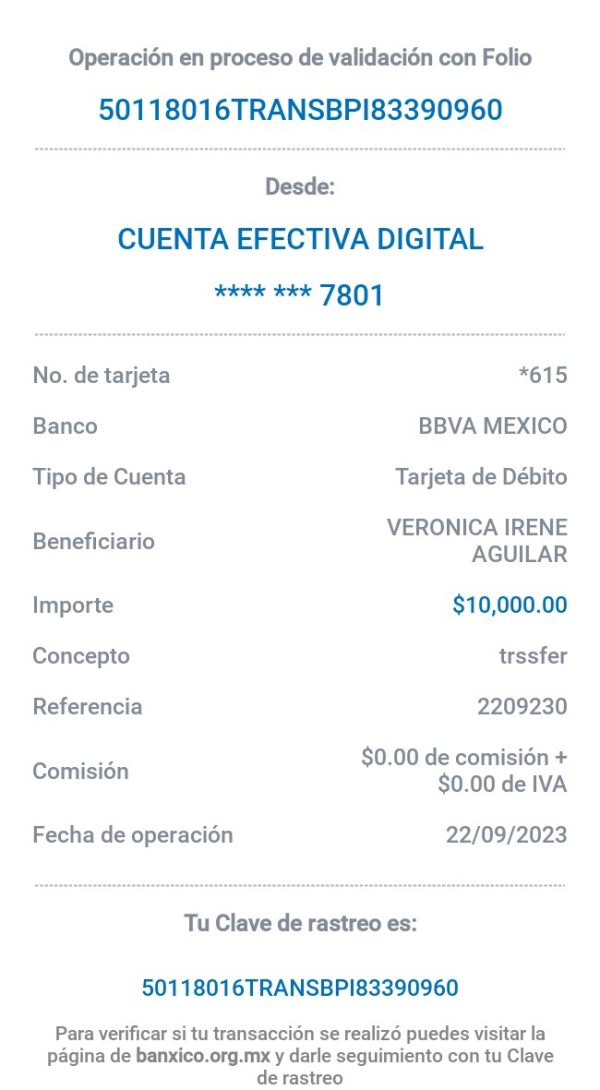

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal options was not detailed in available source materials. This requires potential clients to contact the broker directly for comprehensive payment method information.

Minimum Deposit Requirements: Source materials did not specify minimum deposit thresholds. Interested traders should verify these requirements through direct broker communication.

Bonus and Promotions: Information regarding promotional offers, welcome bonuses, or ongoing trading incentives was not available in reviewed materials.

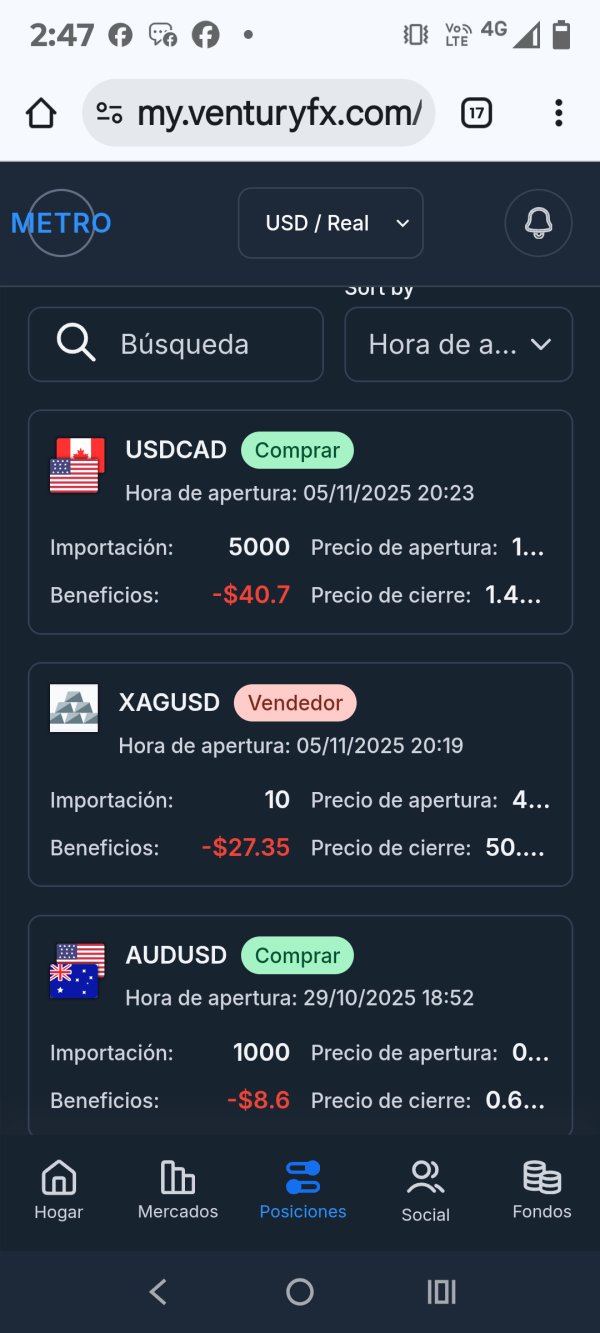

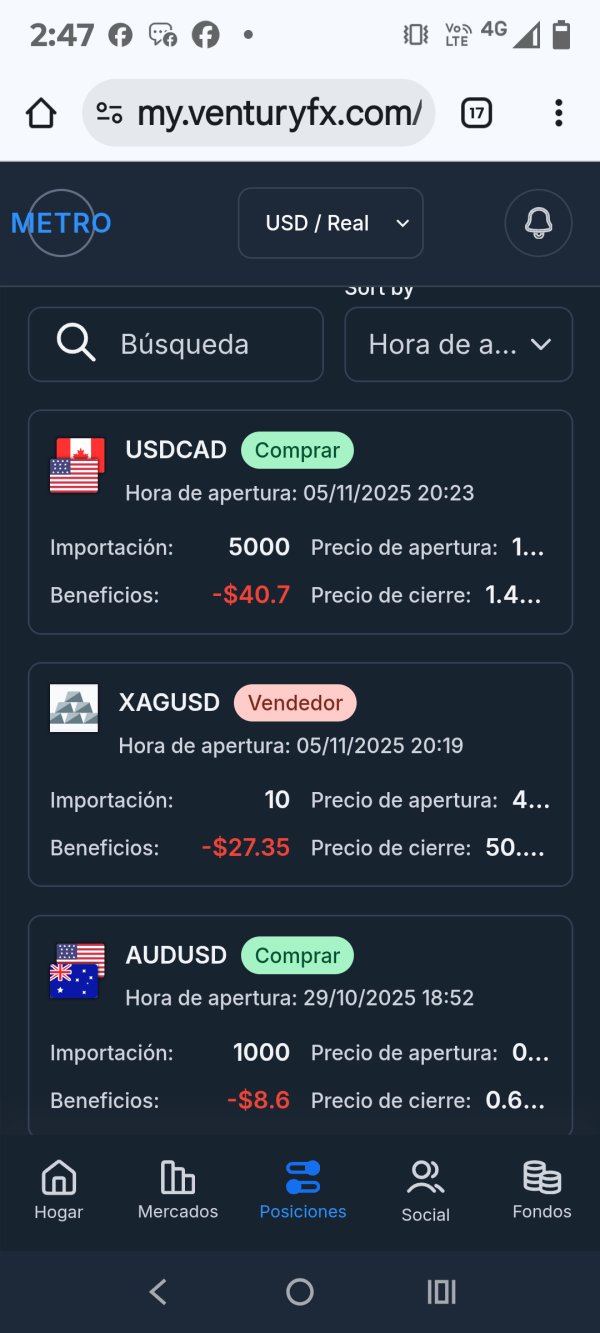

Tradeable Assets: VenturyFX provides access to multiple asset classes, including foreign exchange pairs, stock markets, and cryptocurrency instruments. This offers traders diversified investment opportunities within a single platform environment.

Cost Structure: Detailed information regarding spreads, commission structures, and additional trading costs was not specified in available source materials. This represents an important information gap for cost-conscious traders.

Leverage Ratios: Specific leverage offerings across different asset classes were not detailed in reviewed information.

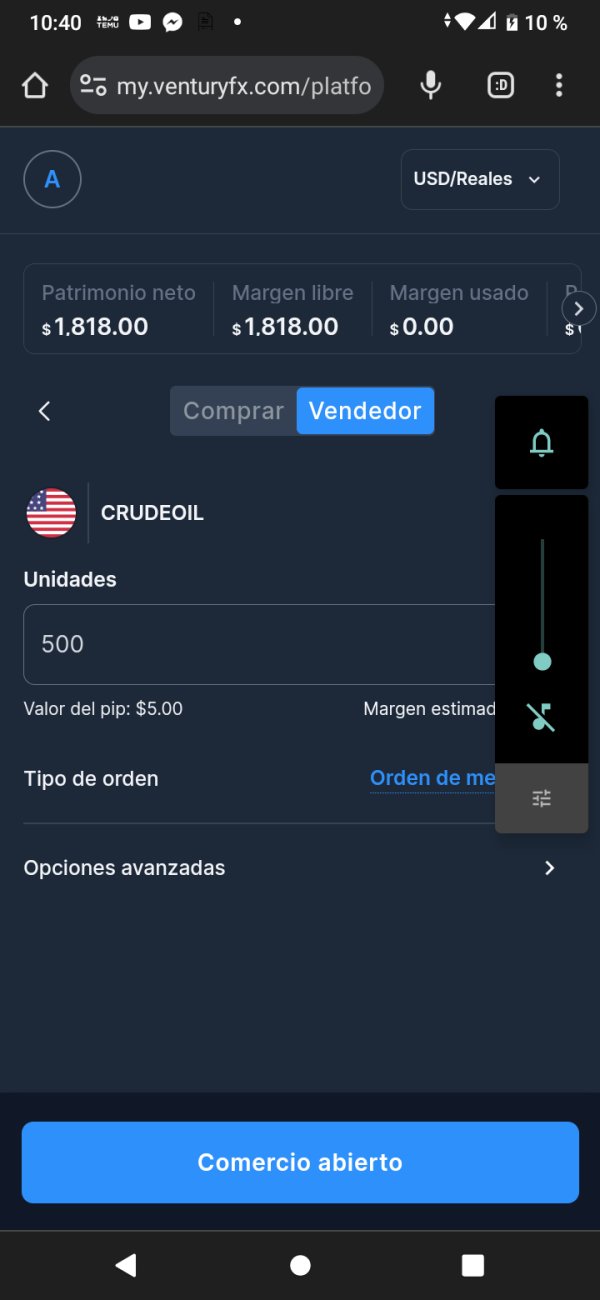

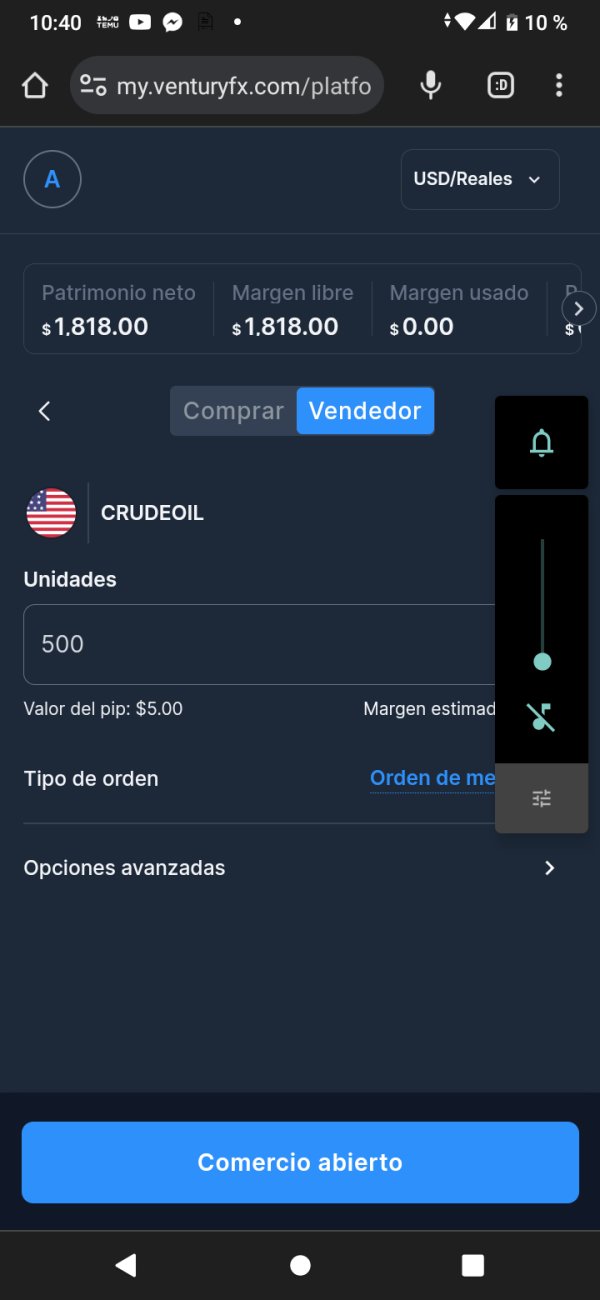

Platform Options: The broker offers both mobile and desktop trading experiences. However, specific platform software details were not comprehensively covered in source materials.

Geographic Restrictions: Information regarding regional trading restrictions was not specified in available documentation.

Customer Support Languages: Details about multilingual support capabilities were not provided in reviewed materials.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of VenturyFX's account conditions faces significant information limitations. Specific details regarding account types, structures, and features were not comprehensively covered in available source materials. This information gap represents a critical consideration for potential traders seeking to understand the broker's account offerings and associated benefits.

Without detailed information about account tiers, minimum deposit requirements, or special account features such as Islamic accounts for Sharia-compliant trading, prospective clients must rely on direct broker communication to understand available options. The absence of readily available account information may indicate limited transparency in the broker's marketing approach or simply reflect the platform's focus on direct client engagement rather than public disclosure.

The lack of specific account opening process details also means that potential traders cannot adequately assess the convenience and efficiency of beginning their trading relationship with VenturyFX. This information deficit becomes particularly significant when compared to more established brokers who typically provide comprehensive account information as part of their transparency commitments.

Given these information limitations, this VenturyFX review cannot provide a definitive rating for account conditions. This highlights the importance of direct broker consultation for interested parties seeking specific account details and requirements.

VenturyFX demonstrates strength in its multi-asset approach, providing traders access to forex, stocks, and cryptocurrencies within a unified trading environment. This diversified offering represents a significant advantage for traders seeking exposure across multiple financial markets without maintaining accounts with different specialized brokers.

The platform's commitment to both mobile and desktop trading experiences suggests recognition of modern trading preferences and the importance of accessibility across different devices and environments. User feedback indicates comparable satisfaction levels between mobile and desktop platforms, which suggests successful implementation of cross-platform functionality.

However, specific information regarding advanced trading tools, research capabilities, analytical resources, and educational materials was not detailed in available source materials. The absence of information about charting capabilities, technical analysis tools, market research provision, or trader education programs represents a significant knowledge gap that potential users must address through direct platform evaluation.

Automated trading support, algorithmic trading capabilities, and API access information were also not specified in reviewed materials. This limits assessment of the platform's appeal to more sophisticated trading strategies and institutional-level functionality requirements.

Customer Service and Support Analysis

The evaluation of VenturyFX's customer service capabilities faces substantial information limitations. Specific details regarding support channels, availability, and service quality were not comprehensively covered in available source materials. This represents a critical information gap, particularly given the broker's unregulated status, which makes reliable customer support even more essential for trader confidence.

Without information about available communication channels such as live chat, telephone support, email responsiveness, or support ticket systems, potential clients cannot adequately assess the broker's commitment to client service. Response time expectations, service quality standards, and problem resolution procedures remain unclear based on reviewed materials.

Multilingual support capabilities, which are increasingly important for international brokers, were not specified in available information. Similarly, customer service operating hours and timezone coverage details were not provided, which limits assessment of support accessibility for traders in different global regions.

The absence of specific user feedback regarding customer service experiences in the reviewed materials means that service quality assessment must rely on general user satisfaction indicators rather than targeted support experience evaluations.

Trading Experience Analysis

User feedback regarding VenturyFX's trading experience appears generally positive, with Trustpilot reviews indicating satisfactory performance across both mobile and desktop platforms. The consistency of user experience between mobile and desktop environments suggests successful platform development and implementation across different device types.

The platform's multi-asset trading capability contributes positively to the overall trading experience. It allows users to diversify their trading activities within a single platform environment. This integrated approach can enhance trading efficiency and portfolio management convenience for users interested in multiple asset classes.

However, specific information regarding platform stability, execution speeds, order fulfillment quality, and trading environment characteristics was not detailed in available source materials. Critical technical aspects such as slippage rates, requote frequency, and platform uptime statistics remain unspecified, which limits comprehensive trading experience assessment.

The absence of detailed information about trading tools, charting capabilities, and platform-specific features means that this VenturyFX review cannot provide comprehensive analysis of the technical trading environment quality that sophisticated traders typically require for optimal performance.

Trust and Reliability Analysis

VenturyFX's trust and reliability assessment reveals significant concerns primarily stemming from its unregulated operational status. Operating without official regulatory oversight means the broker lacks the standard investor protection measures typically provided by regulated financial institutions, which represents a fundamental risk consideration for potential clients.

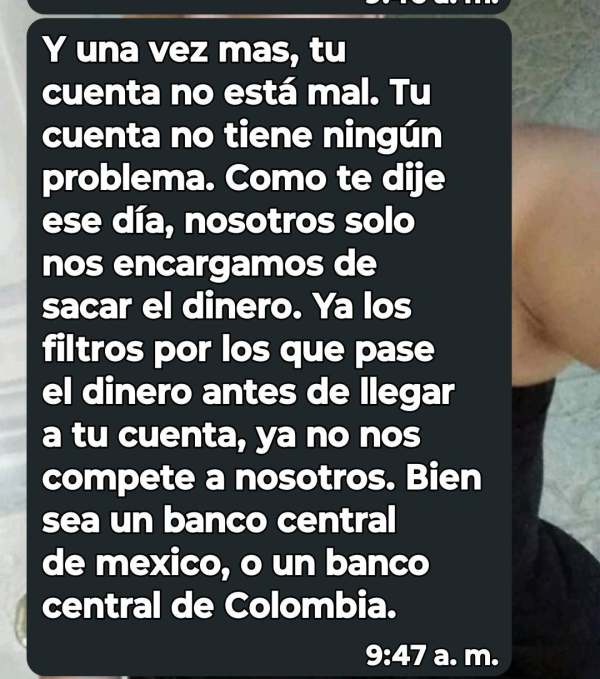

The absence of regulatory supervision raises questions about fund segregation practices, dispute resolution mechanisms, and adherence to industry best practices regarding client fund handling. Without regulatory oversight, traders cannot rely on established regulatory frameworks for protection in case of disputes or operational issues.

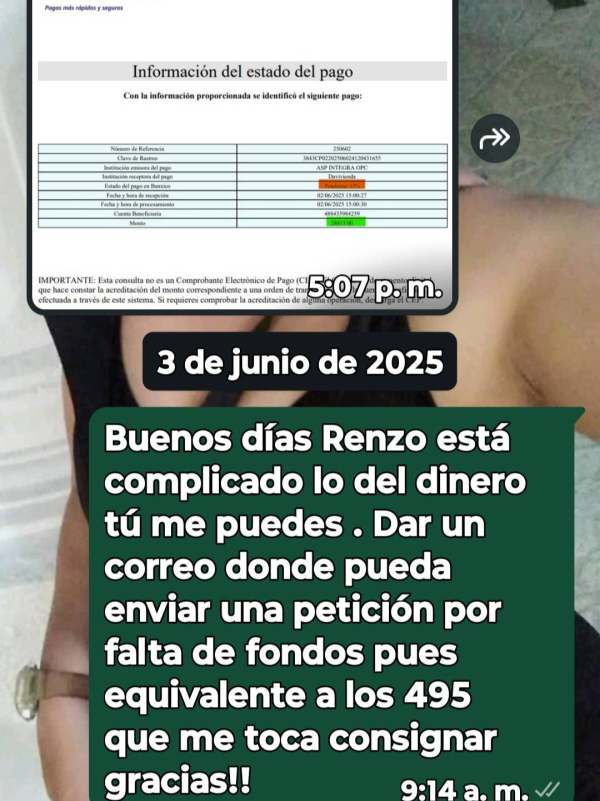

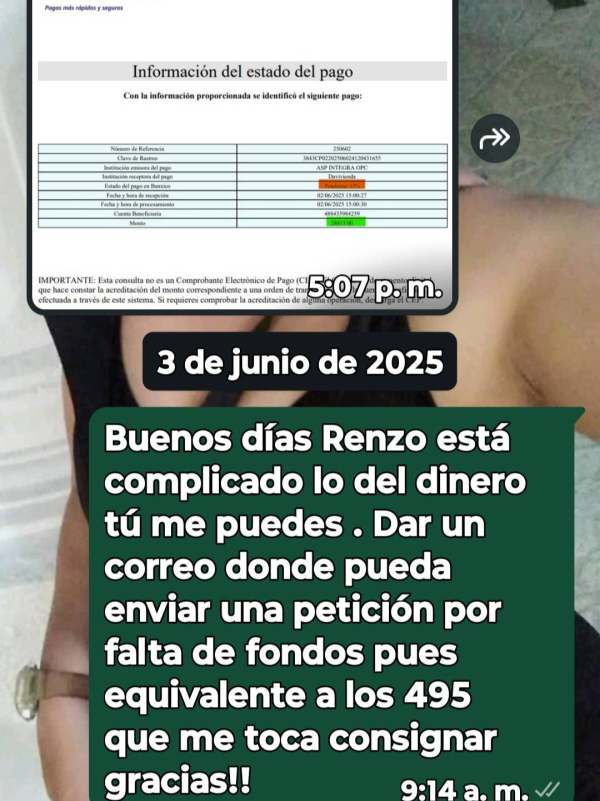

Some market commentary has raised concerns about potential fraudulent characteristics, though specific details regarding these allegations were not comprehensively detailed in available source materials. These concerns underscore the importance of thorough due diligence when considering unregulated trading platforms.

The platform's transparency regarding company information, ownership structure, and operational details appears limited based on available information. This further contributes to trust and reliability concerns that potential clients must carefully consider when evaluating platform suitability.

User Experience Analysis

VenturyFX demonstrates relatively strong user experience metrics, achieving a 4 out of 5 rating on Trustpilot based on 454 user reviews. This rating suggests that users who have engaged with the platform generally report satisfactory experiences, which indicates successful implementation of core platform functionality and user interface design.

The platform's focus on both mobile and desktop trading experiences aligns with modern trader preferences for flexible access to trading capabilities. User feedback suggesting similar satisfaction levels across both platforms indicates successful cross-platform development and consistent user experience delivery.

The broker's target demographic appears to include traders interested in multi-asset exposure, particularly those who value mobile trading capabilities. This positioning reflects understanding of contemporary trading trends and user preferences for comprehensive, accessible trading solutions.

However, specific information regarding user interface design quality, navigation efficiency, registration and verification processes, and fund operation convenience was not detailed in available source materials. This limits comprehensive user experience assessment beyond general satisfaction indicators.

Conclusion

This comprehensive VenturyFX review reveals a trading platform with both appealing features and significant concerns that potential users must carefully weigh. The broker's strengths include generally positive user feedback, multi-asset trading capabilities, and successful implementation of both mobile and desktop trading experiences. The 4 out of 5 Trustpilot rating from 454 users suggests that many traders find the platform satisfactory for their trading needs.

However, the broker's unregulated status represents a fundamental concern that overshadows many positive aspects. Operating without regulatory oversight creates inherent risks regarding fund protection, dispute resolution, and adherence to industry standards that regulated brokers must maintain.

VenturyFX appears most suitable for experienced traders who understand the risks associated with unregulated brokers and prioritize multi-asset trading capabilities and mobile accessibility. However, risk-averse traders or those seeking maximum regulatory protection should carefully consider whether the platform's features justify the increased risk profile associated with unregulated operations.