Is HengChang safe?

Business

License

Is Hengchang A Scam?

Introduction

Hengchang, officially known as Hengchang Foreign Exchange Finance Co., Ltd., positions itself as a forex brokerage firm in the competitive landscape of online trading. Established in 2016 and operating primarily out of New Zealand, Hengchang claims to offer a diverse range of trading instruments, including forex, CFDs, commodities, and indices. However, the lack of substantial regulatory oversight raises significant concerns about its credibility and safety for traders. Given the increasing prevalence of scams in the forex market, it is crucial for traders to thoroughly evaluate the legitimacy of brokers before committing their funds. This article aims to investigate Hengchang's safety and reliability using a comprehensive assessment framework that includes regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and risk evaluation.

Regulation and Legitimacy

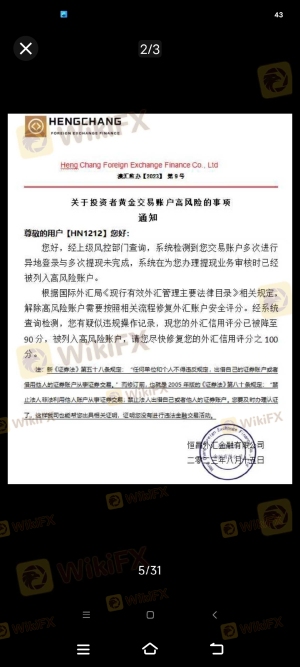

One of the most critical factors in determining the safety of a forex broker is its regulatory status. Regulation serves as a form of oversight that ensures brokers adhere to specific standards, providing a level of protection for traders. Unfortunately, Hengchang currently operates without any valid regulatory oversight, which poses inherent risks for potential investors. The absence of regulation means that there is no external authority monitoring Hengchang's operations, leading to concerns about transparency and fairness.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of a credible regulatory body raises alarms, as traders are left vulnerable to potential misconduct or fraudulent activities. Reports suggest that Hengchang has been associated with withdrawal issues and allegations of scams, further emphasizing the importance of regulatory compliance. The historical compliance record of a broker is also vital; in this case, Hengchang's unregulated status and the absence of any history of compliance indicate a high-risk environment for traders.

Company Background Investigation

Hengchang was founded in 2016 and claims to have established itself as a major player in the forex trading sector. However, the details regarding its ownership structure and operational history are somewhat opaque. The company's management team, while presented as experienced, lacks publicly available credentials or a transparent history that would instill confidence in potential clients. Without clear information about the individuals behind the brokerage, it becomes challenging to ascertain their qualifications or intentions.

Moreover, the company has not provided sufficient transparency in its operations or disclosures, which is a red flag for potential investors. Brokerages that operate with high levels of transparency often provide detailed information about their management team, financial audits, and operational practices, which is crucial for building trust. In the case of Hengchang, the lack of such disclosures raises questions about its legitimacy and operational integrity.

Trading Conditions Analysis

An essential aspect of evaluating a forex broker is understanding its trading conditions, including fees, spreads, and commission structures. Hengchang offers a variety of account types, but the lack of regulation raises questions about the fairness of its fee structures. It is crucial to analyze whether the trading costs align with industry standards or if there are any hidden fees that could adversely affect traders.

| Fee Type | Hengchang | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.1 pips | 1.0 - 2.0 pips |

| Commission Model | From $5 per lot | $5 - $10 per lot |

| Overnight Interest Range | Varies | Varies |

While Hengchang advertises competitive spreads starting from 0.1 pips, the lack of regulation means that traders cannot be assured of fair practices. Furthermore, the commission structure may appear reasonable at first glance, but the absence of oversight could lead to unexpected charges or unfavorable trading conditions.

Client Fund Security

The safety of client funds is paramount in the forex trading industry. Hengchang's lack of regulation raises significant concerns regarding its fund security measures. A reputable broker typically segregates client funds from its operational funds, ensuring that traders' money is protected in the event of company insolvency. However, Hengchang's unregulated status raises questions about whether it employs similar protective measures.

Additionally, the absence of investor protection mechanisms, such as negative balance protection or insurance for client funds, further heightens the risk associated with trading with Hengchang. Historical reports of fund withdrawal issues and allegations of scams add to the apprehension surrounding the safety of client funds. Traders should be particularly cautious when considering investing with a broker that lacks robust security measures.

Customer Experience and Complaints

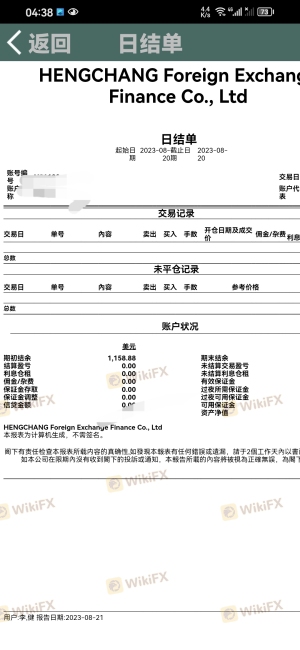

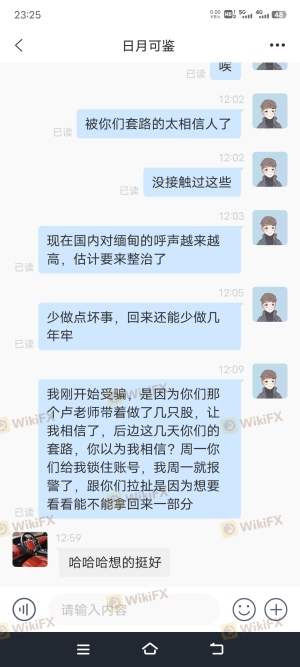

Customer feedback is a vital indicator of a broker's reliability and trustworthiness. In the case of Hengchang, numerous complaints have been reported, particularly regarding fund withdrawals and customer support responsiveness. Many users have expressed frustration over their inability to withdraw funds, leading to allegations of scams.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Inconsistent |

| Trading Platform Issues | High | Unresolved |

Typical complaints highlight significant delays in processing withdrawals and inadequate customer support, which can severely impact a trader's experience. For instance, one user reported being unable to withdraw their funds despite multiple requests, raising concerns about the reliability of Hengchang's operations. Such patterns of complaints suggest an underlying issue with customer service and operational integrity.

Platform and Trade Execution

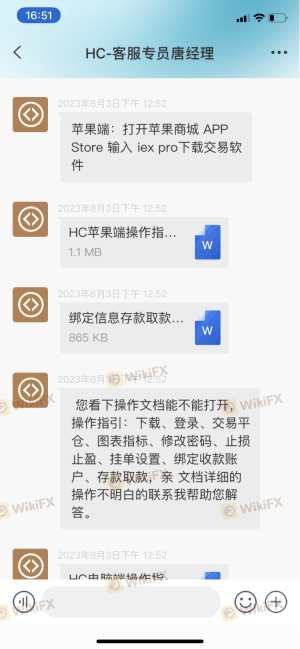

The performance and reliability of a trading platform are crucial for a successful trading experience. Hengchang claims to offer multiple trading platforms, including Hengchang Trader and IEX Pro. However, user reviews indicate mixed experiences regarding platform stability and execution quality. Traders have reported issues with slippage and occasional order rejections, which can significantly affect trading outcomes.

Moreover, any signs of platform manipulation, such as abnormal price fluctuations or inconsistent execution speeds, should be carefully scrutinized. The lack of regulatory oversight further complicates the situation, as there is no authority to hold the broker accountable for any potential misconduct on the trading platform.

Risk Assessment

Using Hengchang as a trading platform carries several inherent risks, primarily due to its unregulated status and history of customer complaints. Traders should consider the following risk factors before engaging with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Fund Safety Risk | High | Lack of fund segregation and protection |

| Customer Service Risk | Medium | Poor response to complaints |

| Platform Reliability | High | Reports of execution issues |

To mitigate these risks, traders are advised to conduct thorough research and consider opening accounts with well-regulated brokers that offer robust investor protection measures. Engaging with a broker that has a solid regulatory framework can significantly reduce the risks associated with trading.

Conclusion and Recommendations

In conclusion, the evidence suggests that Hengchang operates in a high-risk environment, primarily due to its lack of regulation and history of customer complaints. The absence of oversight raises significant concerns about the broker's legitimacy and safety for potential investors. While Hengchang may offer competitive trading conditions, the risks associated with trading on an unregulated platform outweigh the potential benefits.

For traders considering their options, it is advisable to explore alternative brokers that are well-regulated and have a proven track record of reliability and customer satisfaction. Brokers regulated by top-tier authorities, such as the FCA or ASIC, provide a safer trading environment and greater peace of mind. Ultimately, conducting thorough due diligence is essential to ensure a secure trading experience.

In summary, Is Hengchang safe? The answer leans toward caution; potential investors should be wary of the risks associated with this broker and consider more reputable alternatives for their trading needs.

Is HengChang a scam, or is it legit?

The latest exposure and evaluation content of HengChang brokers.

HengChang Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HengChang latest industry rating score is 1.38, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.38 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.