Is TCM Trader safe?

Business

License

Is TCM Trader A Scam?

Introduction

TCM Trader, a forex brokerage, has garnered attention in the trading community for its wide array of trading instruments and competitive conditions. However, as with any financial service provider, it is crucial for traders to conduct thorough due diligence before committing their funds. The forex market is rife with both legitimate brokers and potential scams, making it imperative for traders to evaluate the credibility and safety of a broker like TCM Trader. This article aims to provide an objective analysis of TCM Trader's legitimacy, using a structured framework that includes regulatory status, company background, trading conditions, customer safety measures, client experiences, platform performance, and overall risk assessment.

Regulation and Legitimacy

The regulatory status of a brokerage is a critical factor that determines its trustworthiness. TCM Trader claims to be regulated, but scrutiny reveals a more complex picture. It is important to understand the implications of regulation, as it serves as a protective measure for traders against fraud and malpractice.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | 227/14 | Cyprus | Verified |

| Financial Sector Conduct Authority (FSCA) | 47857 | South Africa | Suspicious Clone |

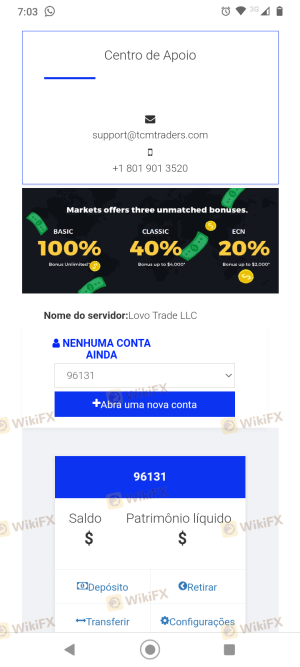

TCM Trader is regulated by the Cyprus Securities and Exchange Commission (CySEC), which is a Tier-2 regulatory authority recognized within the European Union. However, it has also been flagged as a suspicious clone by the FSCA, which raises significant concerns about its operational integrity. While CySEC provides a level of oversight, the clone status under FSCA suggests potential irregularities in TCM Trader's operations. This duality in regulatory status necessitates caution among potential clients, as it may indicate a lack of compliance with industry standards.

Company Background Investigation

Understanding the history and ownership structure of TCM Trader is essential for evaluating its credibility. Founded in 2013, TCM Trader has positioned itself as a player in the forex and CFD markets. However, the brokers ownership and management team remain somewhat opaque, with limited information disclosed publicly.

The management team‘s background and expertise are crucial indicators of a broker’s reliability. A well-experienced team can enhance a brokerage's operational standards and foster a culture of transparency. However, TCM Trader's lack of detailed information regarding its management raises concerns about the companys transparency and accountability. The absence of clear information about the company's ownership structure can be a red flag for potential investors, as it complicates the assessment of the broker's legitimacy.

Trading Conditions Analysis

The trading conditions offered by TCM Trader are a significant aspect of its appeal. However, a closer examination reveals a mixed picture. The fee structure is competitive, but there are several areas that warrant scrutiny.

| Fee Type | TCM Trader | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.2 pips | 1.0 pips |

| Commission Model | $5 per trade | $7 per trade |

| Overnight Interest Range | Variable | Variable |

While TCM Trader offers spreads starting from 0.2 pips for major currency pairs, which is below the industry average, it also charges commissions that may increase trading costs for some clients. Additionally, the variable overnight interest rates can be a source of unpredictability for traders. The combination of low spreads and additional commissions may lead to confusion about the true cost of trading, making it essential for traders to fully understand the fee structure before proceeding.

Client Fund Safety

The safety of client funds is paramount when considering whether TCM Trader is safe. The broker claims to implement several measures to protect client deposits, including segregated accounts and investor compensation schemes. However, the effectiveness of these measures remains to be seen.

TCM Trader's commitment to fund safety is critical, especially given the history of complaints regarding withdrawal issues. Traders must be aware that the lack of robust investor protection can expose them to significant risks. Moreover, any historical incidents involving fund mismanagement or security breaches can serve as important indicators of the broker's reliability.

Customer Experience and Complaints

Analyzing customer feedback is vital to understanding the overall experience with TCM Trader. Reviews from users indicate a range of experiences, with some praising the broker's trading conditions while others report significant issues.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Service | Medium | Mixed Feedback |

Common complaints revolve around withdrawal difficulties and the quality of customer service. Many users have expressed frustration over delays in accessing their funds, which raises questions about TCM Trader's operational efficiency. The company's response to these complaints has been inconsistent, with some users reporting satisfactory resolutions while others feel neglected. This inconsistency can contribute to an overall perception of unreliability.

Platform and Execution

The trading platform provided by TCM Trader plays a crucial role in the trading experience. The broker offers a user-friendly interface, but performance issues such as slippage and order rejections can undermine the trading experience.

A thorough evaluation of order execution quality is essential for any trader. Reports of slippage during volatile market conditions can significantly impact trading outcomes, leading to losses that could have been avoided. Furthermore, any indications of platform manipulation can raise serious concerns about the broker's integrity.

Risk Assessment

Engaging with TCM Trader involves various risks that potential clients must consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Clone status under FSCA |

| Withdrawal Risk | High | Historical issues reported |

| Operational Risk | Medium | Inconsistent customer service |

The regulatory risk is particularly concerning given the clone status flagged by FSCA. Traders should be aware of the potential for withdrawal issues and the implications of engaging with a broker that may not adhere to stringent regulatory standards.

Conclusion and Recommendations

In conclusion, while TCM Trader presents itself as a legitimate forex brokerage, various factors suggest that traders should exercise caution. The suspicious regulatory status, coupled with historical withdrawal issues and mixed customer feedback, raises significant concerns about the broker's safety and reliability.

For traders seeking a more secure trading experience, it may be prudent to consider alternative brokers with robust regulatory oversight and a proven track record of customer satisfaction. Ultimately, whether TCM Trader is safe or a potential scam hinges on individual risk tolerance and the importance placed on regulatory compliance and customer service quality.

Is TCM Trader a scam, or is it legit?

The latest exposure and evaluation content of TCM Trader brokers.

TCM Trader Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TCM Trader latest industry rating score is 1.38, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.38 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.