Is Classic Capitals safe?

Business

License

Is Classic Capitals Safe or a Scam?

Introduction

Classic Capitals positions itself as a player in the forex market, offering various trading instruments, including forex pairs, metals, energies, and indices. However, the rise of unregulated brokers in the forex industry has raised significant concerns among traders. Many individuals have experienced issues with withdrawals, hidden fees, and even outright fraud. Therefore, it is crucial for traders to conduct thorough evaluations of any broker before investing their hard-earned money. In this article, we will investigate the legitimacy of Classic Capitals by examining its regulatory status, company background, trading conditions, customer safety measures, and user experiences. Our analysis is based on a comprehensive review of available data from reputable sources, including user feedback and expert assessments.

Regulation and Legitimacy

The regulatory status of a forex broker is a vital aspect that determines its legitimacy. Classic Capitals claims to operate in the United States but is notably unregulated, which raises red flags regarding its operations and the safety of client funds. The absence of regulatory oversight means that there is no authority monitoring its practices, leaving traders vulnerable to potential fraud.

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of a regulatory framework can lead to questionable practices, as brokers are not held accountable for their actions. Additionally, the absence of a valid license may indicate that Classic Capitals has not met the necessary standards set by financial authorities. This situation is concerning for potential investors, as it increases the likelihood of encountering issues related to fund security, withdrawal processing, and overall trustworthiness.

Company Background Investigation

Classic Capitals is a relatively new entrant in the forex market, having been established within the last couple of years. The company's ownership structure and management team are not well-documented, which contributes to the uncertainty surrounding its operations. The lack of transparency is a significant concern, as it hinders potential clients from assessing the qualifications and experience of those behind the broker.

The management teams background is essential in understanding the broker's credibility. However, information regarding their expertise and professional history is limited, making it difficult for traders to gauge the level of reliability they can expect. Furthermore, the absence of a detailed company history raises questions about the broker's long-term viability and commitment to ethical trading practices.

Trading Conditions Analysis

When evaluating whether Classic Capitals is safe, one must consider its trading conditions. The broker offers various account types, each with different minimum deposit requirements and leverage options. However, the overall fee structure appears to be less competitive than industry standards, which may deter potential traders.

| Fee Type | Classic Capitals | Industry Average |

|---|---|---|

| Spread for Major Pairs | 1-3 pips | 1-2 pips |

| Commission Model | 5-10% | 0-2% |

| Overnight Interest Range | Variable | Variable |

The spreads offered by Classic Capitals are on the higher end compared to industry averages, which could eat into traders' profits. Additionally, the commission structure raises concerns, as a 5-10% commission is unusually high for forex trading. This fee model may indicate that the broker is attempting to capitalize on traders' losses rather than fostering a mutually beneficial trading environment.

Client Fund Security

The safety of client funds is paramount when assessing the reliability of any forex broker. Classic Capitals does not provide clear information regarding its fund security measures. There is no indication of segregated accounts or investor protection policies, which are standard practices among regulated brokers.

The absence of these safety measures poses significant risks for traders. Without segregation, client funds may be at risk of being misused for the broker's operational expenses. Furthermore, the lack of negative balance protection means that traders could potentially lose more than their initial investment, a scenario that can lead to severe financial distress.

Customer Experience and Complaints

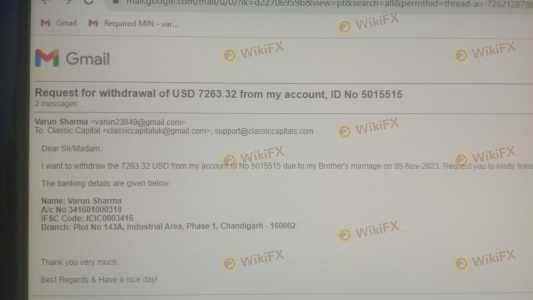

User feedback is a crucial component in determining the overall reputation of Classic Capitals. Many reviews highlight issues related to withdrawal delays, lack of customer support, and unclear terms and conditions. These complaints point to a pattern of dissatisfaction among clients, raising questions about the broker's commitment to customer service.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Support | Medium | Unresponsive |

| Fee Transparency | High | Vague explanations |

Typical user experiences reveal a concerning trend: clients often struggle to withdraw their funds after making profits. In several cases, traders have reported that their withdrawal requests were either ignored or met with excessive delays, leading to frustration and loss of trust. This pattern of behavior is alarming and suggests that Classic Capitals may not prioritize the interests of its clients.

Platform and Execution

The trading platform offered by Classic Capitals is another critical aspect to consider. User reviews indicate that the platform may suffer from stability issues, including frequent downtime and slow execution speeds. These factors can significantly impact a trader's ability to execute strategies effectively, particularly in volatile market conditions.

Moreover, reports of slippage and order rejections have emerged, raising concerns about the broker's execution quality. If traders consistently experience adverse trading conditions, it could indicate potential manipulation or a lack of infrastructure to support efficient trading.

Risk Assessment

Using Classic Capitals carries inherent risks due to its unregulated status and questionable practices. The following risk assessment summarizes the key concerns associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight leads to potential fraud. |

| Financial Security | High | Lack of fund segregation and negative balance protection. |

| Customer Service | Medium | Poor response rates and unresolved complaints. |

| Trading Conditions | High | Unusual fees and high spreads diminish profitability. |

To mitigate these risks, traders are advised to conduct thorough research, consider starting with a small deposit, and seek regulated alternatives for a safer trading environment.

Conclusion and Recommendations

In conclusion, the evidence suggests that Classic Capitals exhibits several warning signs that may categorize it as a potentially unsafe broker. The lack of regulation, transparency issues, high fees, and numerous customer complaints raise significant concerns about its reliability. For traders seeking a secure trading environment, it is advisable to avoid Classic Capitals and consider well-regulated alternatives instead. Some recommended options include brokers that are regulated by top-tier authorities, ensuring a higher level of safety and accountability. Always prioritize safety and conduct due diligence before making any investment decisions.

Is Classic Capitals a scam, or is it legit?

The latest exposure and evaluation content of Classic Capitals brokers.

Classic Capitals Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Classic Capitals latest industry rating score is 1.38, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.38 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.