MCTrading 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive mctrading review reveals significant concerns about MC Trading's legitimacy and operational practices. Based on available information and user feedback, MC Trading presents itself as an online trading platform registered in Montenegro. The platform offers over 500 investment instruments across multiple asset classes including forex, commodities, indices, cryptocurrencies, and stocks. However, multiple warning signs suggest potential fraud risks that investors should carefully consider.

While the platform claims regulatory oversight, specific regulatory authority information and license numbers remain undisclosed. This raises transparency concerns. User feedback indicates difficulties with fund withdrawals and poor customer service experiences. Despite receiving a 5.0/5 rating on AmbitionBox, this assessment appears based on limited reviews and contradicts widespread negative feedback from other sources.

The platform targets investors seeking diversified trading opportunities across various asset classes. However, several websites have flagged MC Trading as a potentially fraudulent operation. Users report challenges in recovering their funds. This mctrading review recommends extreme caution when considering this broker, particularly given the lack of clear regulatory information and numerous red flags identified in user testimonials.

Important Notice

Regional Entity Differences: MC Trading operates from Montenegro, which may subject it to different regulatory requirements compared to major financial centers. Investors should verify local compliance and protection measures before engaging with the platform.

Review Methodology: This evaluation is based on publicly available information, user feedback, and industry reports. Due to limited transparent information from the broker itself, some details may be incomplete or unverified. Potential investors should conduct independent research and seek professional advice before making investment decisions.

Rating Framework

Broker Overview

MC Trading operates as an online trading platform registered in Montenegro. The company positions itself as a provider of diverse investment opportunities across multiple financial markets. The platform claims to offer comprehensive trading services, though specific details about its founding date and corporate structure remain unclear from available public information. The broker's business model focuses on attracting traders seeking variety in their investment portfolios.

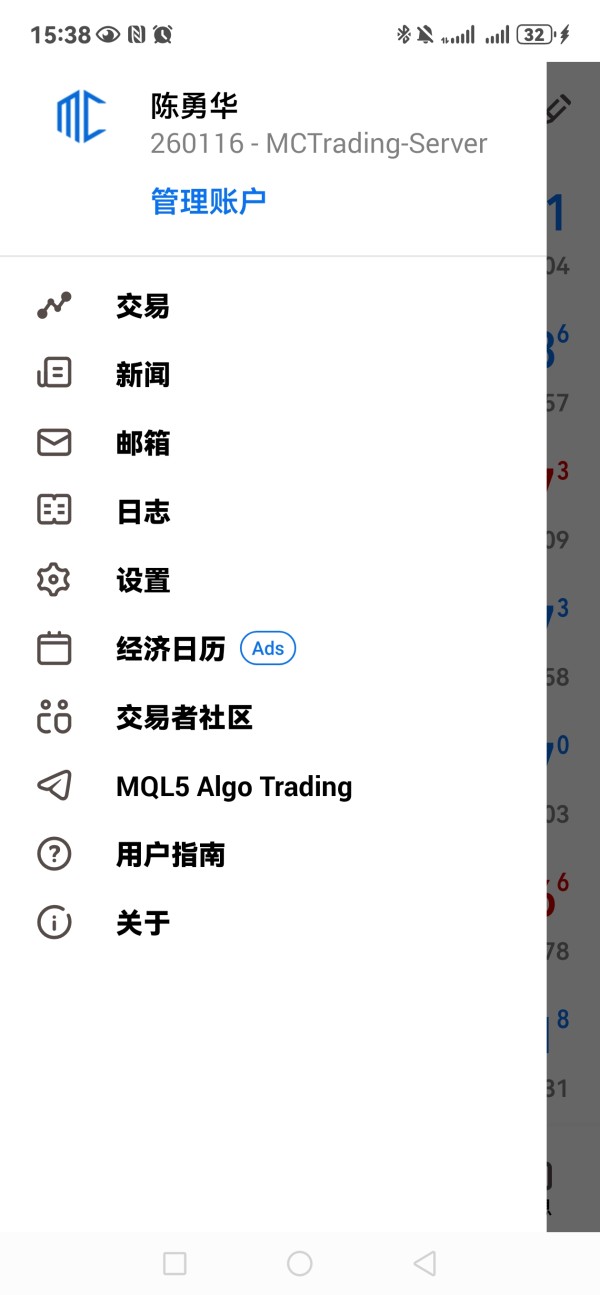

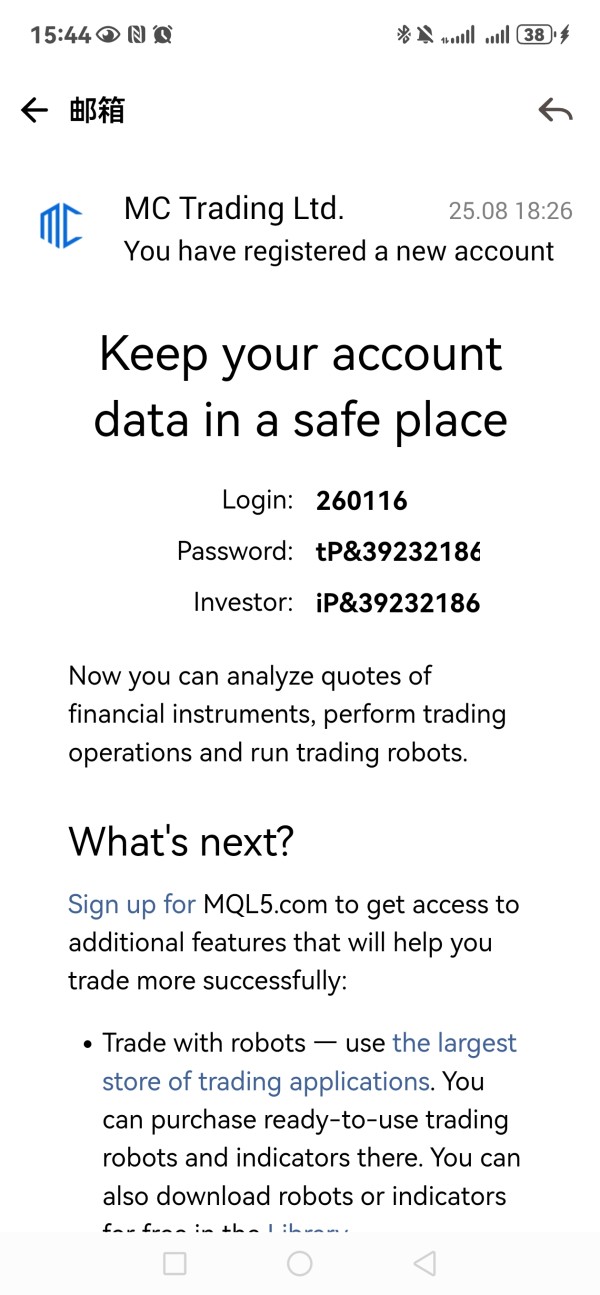

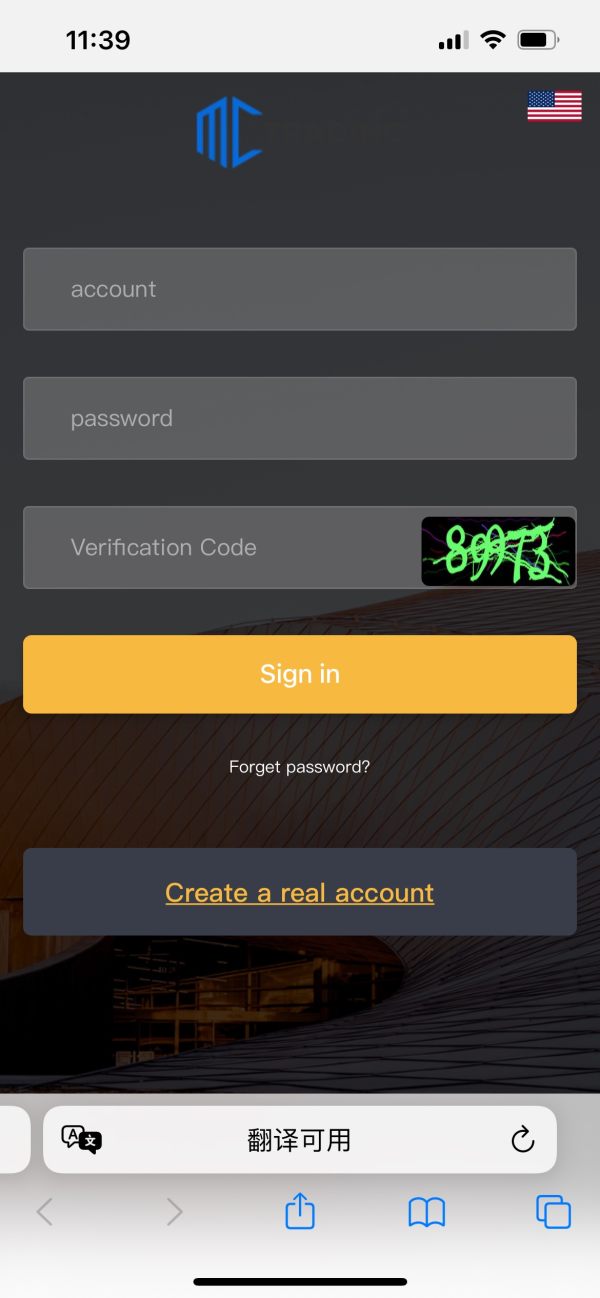

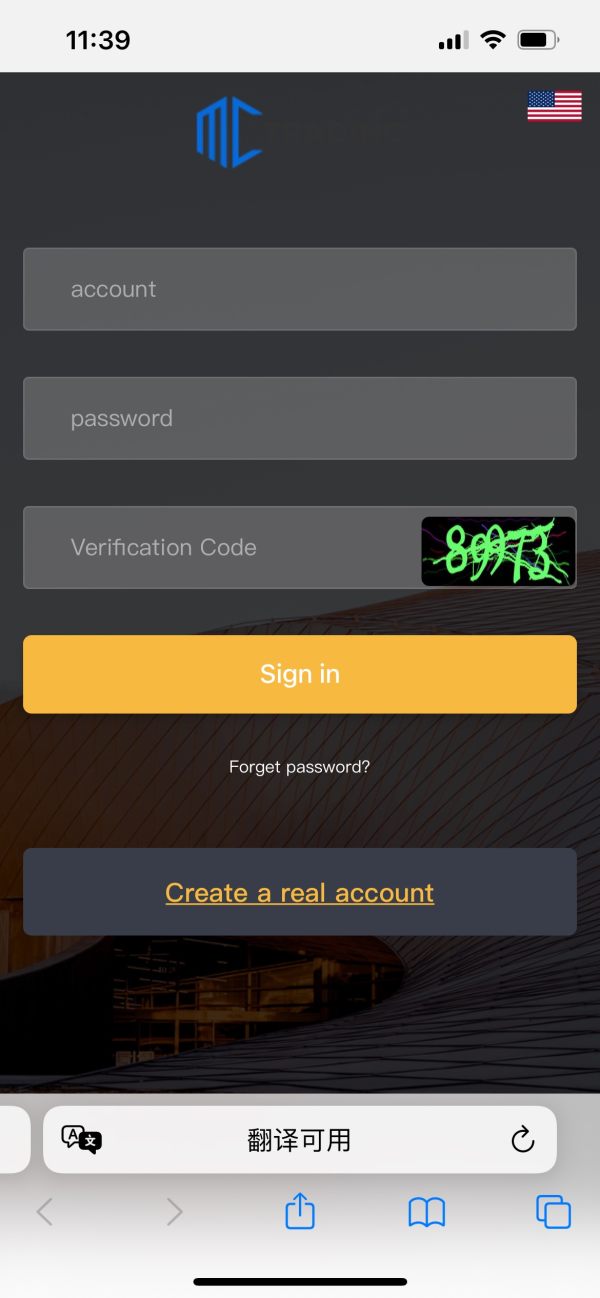

The company's operational framework appears centered on providing access to over 500 investment instruments. These span traditional forex pairs, commodities, stock indices, cryptocurrencies, and individual equities. However, critical information about the specific trading platforms used is notably absent from public materials. This includes details about MetaTrader 4 or 5, proprietary systems, or web-based interfaces. This mctrading review finds that while the company presents itself as a full-service broker, the lack of detailed operational transparency raises questions about its commitment to client education and market clarity. The absence of specific regulatory authority information further complicates the assessment of the broker's legitimacy and operational standards.

Regulatory Status: Available information does not specify the exact regulatory authorities overseeing MC Trading's operations, despite claims of regulatory compliance. This lack of transparency represents a significant concern for potential clients seeking regulated trading environments.

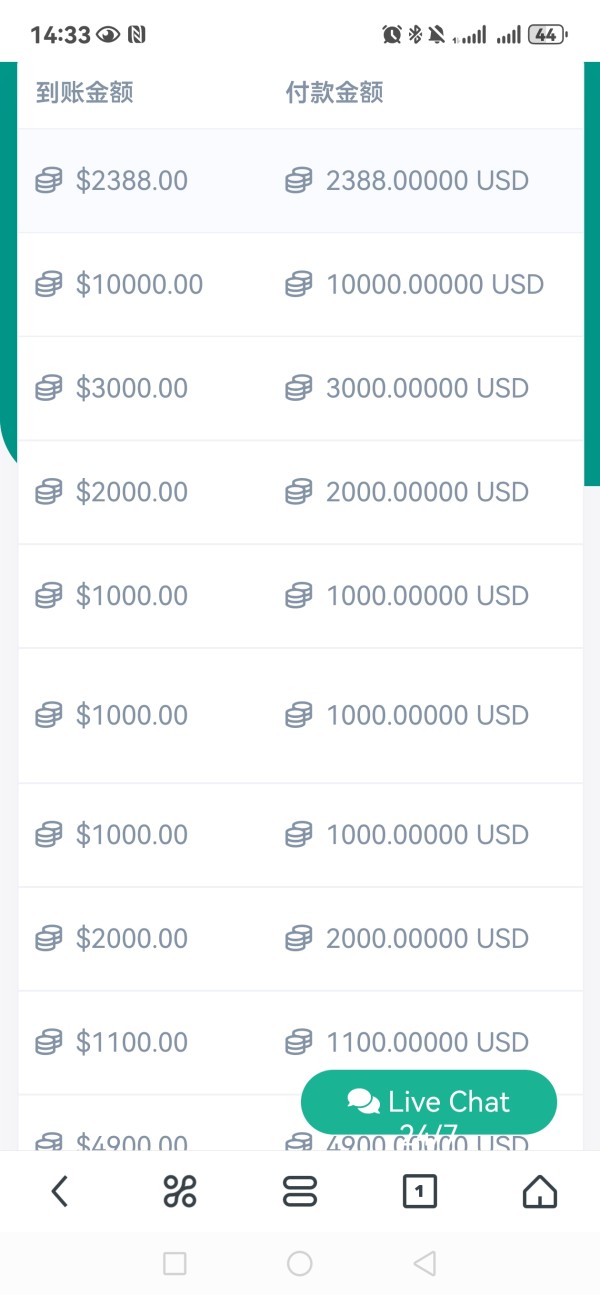

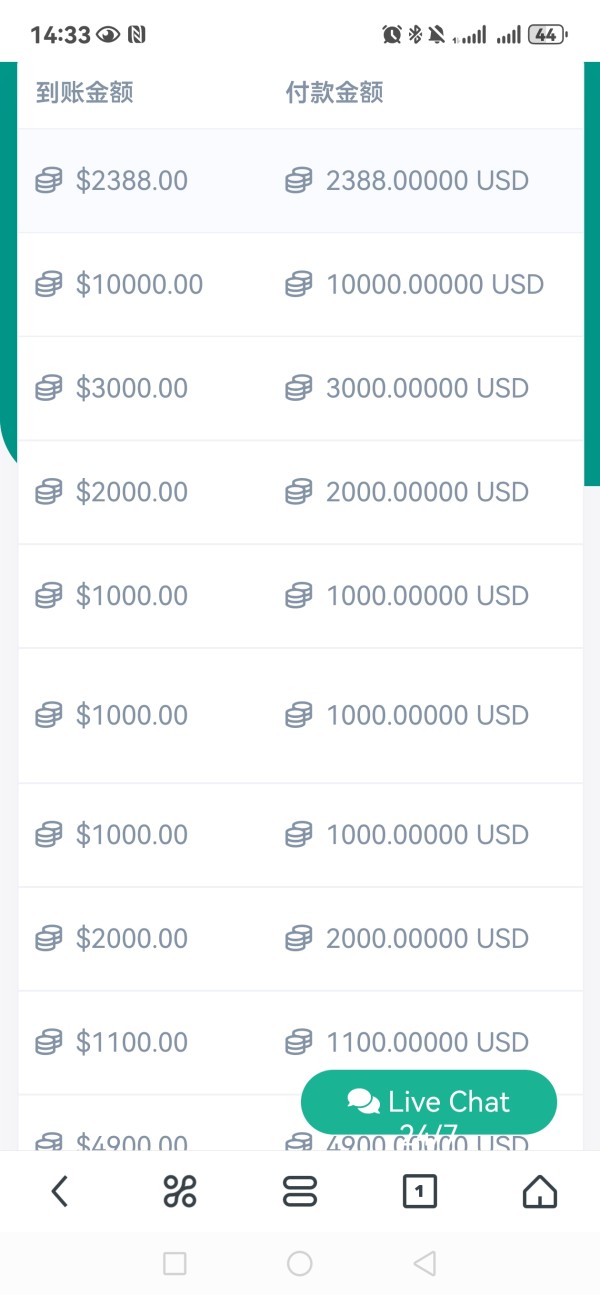

Deposit and Withdrawal Methods: Specific information regarding accepted payment methods, processing times, and associated fees is not detailed in available materials. This limits clients' ability to assess transaction convenience and costs.

Minimum Deposit Requirements: The platform has not disclosed specific minimum deposit amounts for different account types. This makes it difficult for potential traders to plan their initial investment commitments.

Promotional Offers: Details about welcome bonuses, trading incentives, or loyalty programs are not readily available in public information sources.

Tradeable Assets: MC Trading offers access to over 500 investment instruments across multiple categories. These include commodities, indices, cryptocurrencies, stocks, and forex pairs, providing substantial diversity for portfolio construction.

Cost Structure: Specific information about spreads, commission rates, overnight fees, and other trading costs remains undisclosed. This prevents accurate cost comparison with industry competitors.

Leverage Ratios: Available materials do not specify maximum leverage ratios offered for different asset classes or account types.

Platform Options: The types of trading platforms available to clients are not clearly specified in accessible information sources.

Geographic Restrictions: Information about countries or regions where services are restricted is not readily available.

Customer Support Languages: The range of languages supported by customer service teams is not specified in available materials.

This mctrading review highlights the significant information gaps that potential clients face when evaluating the broker's services and terms.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

The account conditions offered by MC Trading present several concerns for potential traders. Available information lacks specific details about different account types, their features, and associated benefits. The absence of clear minimum deposit requirements makes it difficult for investors to understand entry barriers and plan their trading capital allocation effectively.

User feedback suggests that the account opening process can be challenging. Some clients report difficulties during registration and verification procedures. The lack of transparency regarding account features limits clients' ability to choose appropriate account types for their trading needs. These features include research tools, educational resources, or premium services for higher-tier accounts.

Compared to established brokers in the industry, MC Trading's account condition transparency falls significantly short of market standards. Most reputable brokers provide detailed account comparison charts, clear fee structures, and comprehensive terms and conditions. The absence of such information in this mctrading review raises concerns about the broker's commitment to client transparency and fair dealing practices.

The overall assessment of account conditions reflects these transparency issues and user feedback indicating dissatisfaction with the account setup and management experience.

MC Trading's strongest offering appears to be its diversity of investment instruments, with over 500 options spanning multiple asset classes. This variety provides traders with substantial opportunities for portfolio diversification and access to different market sectors. The inclusion of traditional assets like forex and commodities alongside modern instruments like cryptocurrencies suggests an effort to meet diverse trading preferences.

However, the quality and depth of available trading tools remain unclear from available information. Details about research resources, market analysis, technical indicators, charting capabilities, and educational materials are not readily accessible. Most professional trading platforms provide comprehensive analytical tools, real-time market data, and educational resources to support informed decision-making.

User feedback indicates mixed experiences with the platform's tool offerings. Some appreciate the asset variety while others express concerns about tool quality and reliability. The absence of information about automated trading support, API access, or advanced order types limits the assessment of the platform's suitability for sophisticated trading strategies.

Despite the positive aspect of instrument diversity, the lack of detailed information about tool quality and functionality prevents a higher rating in this category.

Customer Service and Support Analysis (Score: 3/10)

Customer service represents one of MC Trading's most significant weaknesses based on available user feedback. Multiple sources indicate poor customer service experiences. Clients report slow response times, inadequate problem resolution, and difficulty reaching support representatives when needed.

The absence of clear information about available support channels, operating hours, and multilingual capabilities further compounds service quality concerns. Professional brokers typically offer multiple contact methods including live chat, email, phone support, and comprehensive FAQ sections. The lack of transparency about MC Trading's support infrastructure suggests limited client service priority.

User testimonials frequently mention frustration with customer service quality, particularly when attempting to resolve account issues or process withdrawal requests. The reported difficulties in obtaining timely and effective assistance indicate systemic problems with the broker's client support operations.

These service quality issues, combined with the lack of transparent support information, result in a poor rating for customer service and support capabilities.

Trading Experience Analysis (Score: 5/10)

The trading experience with MC Trading receives mixed feedback from available sources. While the platform offers access to numerous instruments, users have expressed concerns about platform stability and overall trading environment quality. The lack of specific information about execution speeds, slippage rates, and requote frequency makes it difficult to assess trading condition reliability.

Platform functionality details are not comprehensively documented in available materials. This includes charting tools, technical indicators, order management systems, and mobile trading capabilities. This information gap prevents potential users from understanding the trading environment they would encounter.

User feedback suggests variable experiences with platform performance. Some report stability issues and concerns about liquidity conditions. The absence of detailed technical performance data limits the ability to objectively assess trading quality. This includes uptime statistics, execution speed metrics, and order fill rates.

The moderate rating reflects the mixed user feedback and the significant information gaps regarding platform performance and trading conditions. This mctrading review emphasizes the need for more transparent reporting of trading environment quality and performance metrics.

Trust and Security Analysis (Score: 2/10)

Trust and security represent the most concerning aspect of MC Trading's operations. Multiple websites have flagged the broker as potentially fraudulent. This raises serious questions about operational legitimacy and client fund safety. The absence of specific regulatory authority information and license numbers significantly undermines confidence in the platform's regulatory compliance.

User reports indicate difficulties with fund withdrawals, suggesting potential issues with client money handling and operational integrity. The lack of detailed information about fund segregation, insurance coverage, and security measures for client deposits raises additional concerns about financial safety.

Company transparency appears limited. There is insufficient disclosure about corporate structure, management team, and operational history. Reputable brokers typically provide comprehensive company information, regulatory documentation, and clear policies regarding client fund protection.

The combination of fraud warnings from multiple sources, withdrawal difficulties reported by users, and lack of regulatory transparency results in a very poor trust and security rating. Potential clients should exercise extreme caution when considering this platform.

User Experience Analysis (Score: 4/10)

Overall user satisfaction with MC Trading appears below industry standards based on available feedback. While the platform received a 5.0/5 rating on AmbitionBox, this assessment appears based on limited reviews. It contrasts sharply with negative feedback from other sources.

The user interface design and platform usability information is not readily available. This limits the assessment of the platform's ease of use for both novice and experienced traders. Registration and verification processes have received criticism from users, with reports of unnecessarily complex procedures and delayed account activation.

Common user complaints center on customer service quality and withdrawal processing difficulties. These issues significantly impact the overall user experience and suggest systemic problems with client satisfaction management.

The platform may appeal to traders seeking diverse asset exposure, but the numerous reported issues with service quality and operational reliability limit its suitability for most investors. Improvements in transparency, customer service, and operational reliability would be necessary to enhance user experience significantly.

Conclusion

This comprehensive mctrading review reveals significant concerns about MC Trading's legitimacy and operational quality. While the platform offers an attractive variety of over 500 investment instruments across multiple asset classes, serious red flags regarding regulatory transparency, customer service quality, and withdrawal processing overshadow these potential benefits.

The broker may appeal to investors seeking diversified trading opportunities. However, the substantial risks associated with unclear regulatory status, reported fraud warnings, and poor customer service make it unsuitable for most traders. The lack of transparency regarding account conditions, trading costs, and company information further compounds these concerns.

Key advantages include asset diversity and broad market access. Major disadvantages encompass questionable legitimacy, poor customer service, withdrawal difficulties, and lack of regulatory transparency. Potential investors should consider well-established, clearly regulated alternatives that provide transparent operations and reliable customer support.