Delta N1 Capital Review 1

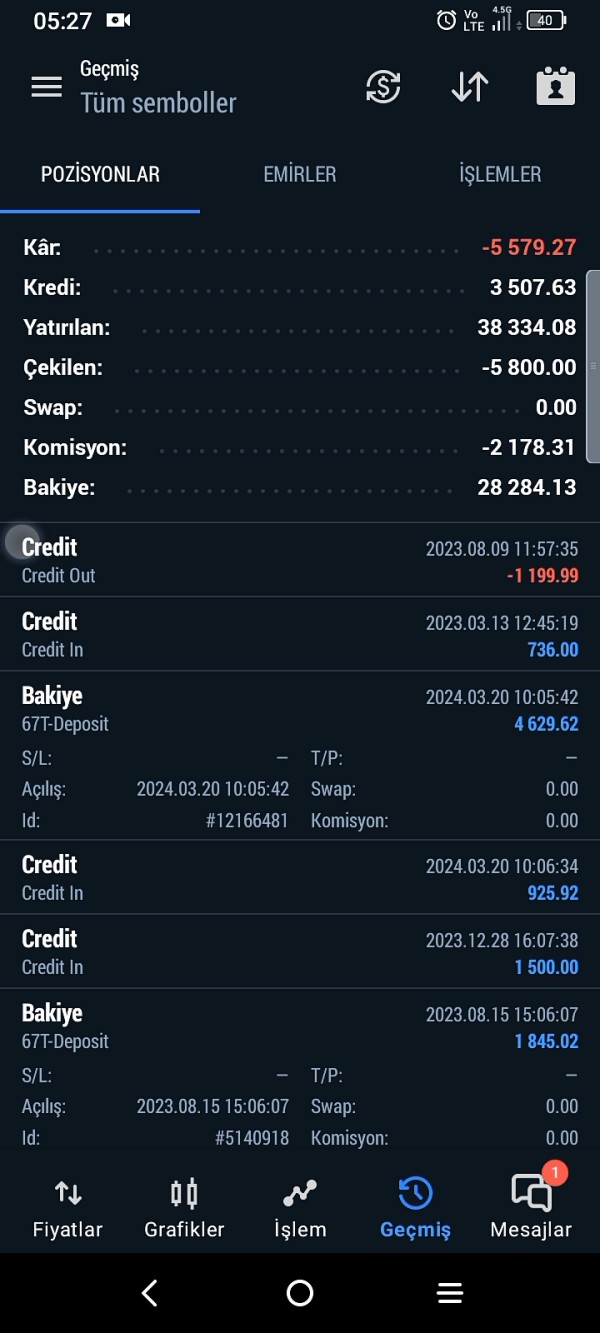

An illegal company that profits from customer losses by not transmitting any opened transactions to any exchange.

Delta N1 Capital Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

An illegal company that profits from customer losses by not transmitting any opened transactions to any exchange.

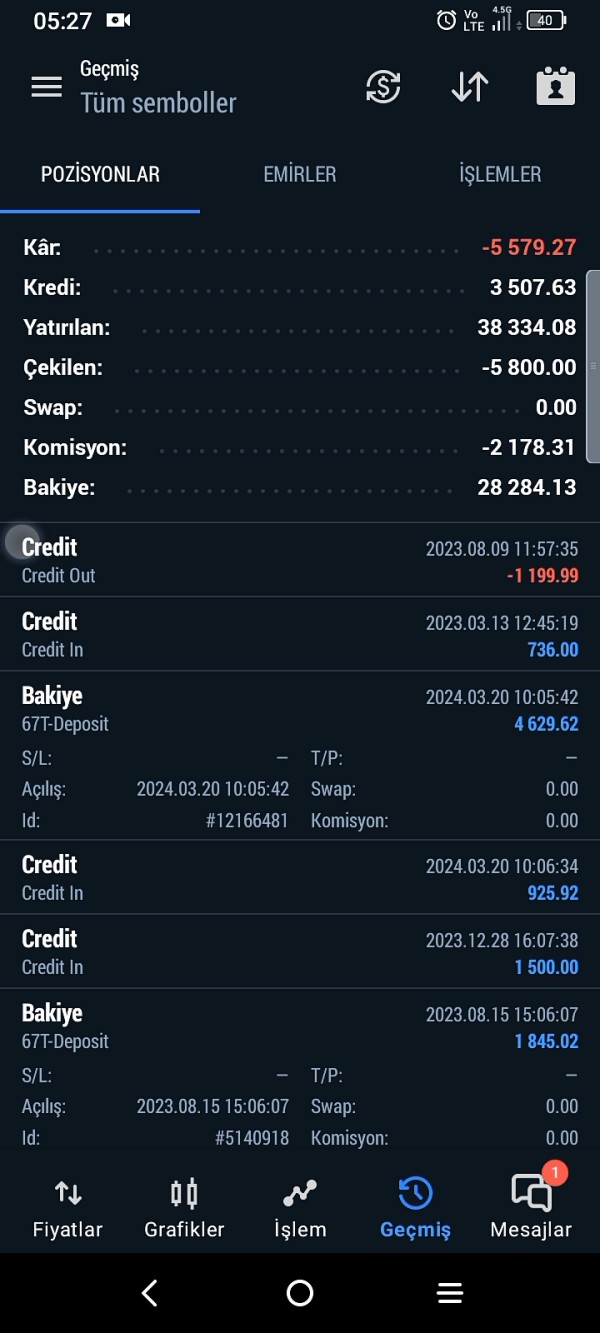

This delta n1 capital review shows big concerns about this forex broker's legitimacy and how it operates. Delta N1 Capital works as an unregulated forex broker that has faced serious claims of fraud and mismanaging customer funds. WikiFX monitoring reports say the company has been accused of being "an illegal company that profits from customer losses by not transmitting any opened transactions to any exchange."

The broker offers a low minimum deposit of $250. It also gives access to popular MetaTrader 4 and MetaTrader 5 platforms. However, these features that seem attractive are overshadowed by the lack of regulatory oversight and multiple user complaints about withdrawal issues and poor customer service.

The company targets investors who want low-barrier entry into forex trading. But the absence of proper licensing and regulatory protection makes it unsuitable for traders who prioritize fund safety. User feedback shows mixed experiences, with neutral reviews about platform functionality but significant negative exposure about the company's business practices.

The broker's spread starts at 3 pips. However, complete information about commission structures and other trading costs remains unclear. Given the serious allegations and regulatory concerns, potential investors should exercise extreme caution when considering this broker.

Regional Entity Differences: Delta N1 Capital lacks clear regulatory information across different jurisdictions. This makes it difficult to verify the legitimacy of operations in various regions. International investors should be particularly cautious as there is no evidence of proper licensing or regulatory compliance in major financial jurisdictions.

Review Methodology: This evaluation is based on available information from industry monitoring platforms, user feedback, and publicly accessible data. Due to the broker's limited transparency and lack of regulatory disclosure, some information may be incomplete or subject to change. Readers should conduct additional due diligence before making any investment decisions.

| Criteria | Score | Justification |

|---|---|---|

| Account Conditions | 4/10 | Low minimum deposit of $250, but lacks transparency in commission structure and leverage information |

| Tools and Resources | 5/10 | Provides MT4/5 platforms but limited additional trading tools and educational resources |

| Customer Service | 3/10 | Multiple user complaints about unresponsive support and alleged illegal practices |

| Trading Experience | 4/10 | Platform functionality questioned due to allegations of not transmitting trades to exchanges |

| Trust and Safety | 2/10 | Serious fraud allegations, lack of regulation, and negative industry reputation |

| User Experience | 3/10 | Poor overall satisfaction based on user feedback and exposure reports |

Delta N1 Capital presents itself as a forex trading platform. However, specific founding information and company establishment details are not readily available in public records. WikiFX monitoring reports have flagged the company for questionable business practices, with allegations suggesting it operates as "an illegal company that profits from customer losses."

This delta n1 capital review must emphasize these serious concerns that directly impact trader safety and fund security. The company's business model appears to follow the typical forex broker structure, offering currency trading services through popular MetaTrader platforms. However, the fundamental issue lies in the alleged practice of not transmitting client trades to actual exchanges, which would constitute a serious breach of standard industry practices and potentially fraudulent behavior.

The broker targets retail traders seeking accessible forex trading opportunities with a relatively low entry barrier. The $250 minimum deposit requirement positions it as accessible to novice traders, but this low threshold may also serve as a red flag when combined with the lack of proper regulatory oversight. The absence of clear information about the company's operational history, management team, and regulatory status raises significant concerns about transparency and legitimacy.

Regulatory Status: No specific regulatory authorities or license numbers have been identified in available documentation. This represents a major red flag for potential investors.

Deposit and Withdrawal Methods: Specific information about accepted payment methods, processing times, and associated fees is not clearly disclosed in available materials. The lack of transparency creates uncertainty for traders.

Minimum Deposit Requirements: The broker requires a minimum deposit of $250, which is relatively accessible but should be viewed with caution given regulatory concerns.

Bonus and Promotions: No specific promotional offers or bonus structures are detailed in the available information. This lack of clarity makes it difficult to assess the full cost structure.

Tradeable Assets: The platform focuses on forex trading, though the complete range of available currency pairs and other financial instruments remains unspecified.

Cost Structure: Spreads reportedly start at 3 pips. However, comprehensive information about commission rates, overnight fees, and other trading costs is not transparently provided.

Leverage Ratios: Specific leverage offerings are not detailed in the available documentation. This is concerning for risk management assessment.

Platform Options: The broker supports MetaTrader 4 and MetaTrader 5 platforms, which are industry-standard choices for forex trading.

Geographic Restrictions: Information about regional availability and restrictions is not clearly specified in available materials. This creates uncertainty for international traders.

Customer Support Languages: Specific language support options for customer service are not detailed in accessible documentation.

This delta n1 capital review must note that the lack of detailed information across multiple categories is itself a significant concern for potential traders.

The account conditions offered by Delta N1 Capital present a mixed picture that ultimately favors caution over opportunity. While the $250 minimum deposit requirement appears competitive and accessible to retail traders, this low barrier to entry becomes problematic when viewed alongside the broker's regulatory status and operational transparency issues.

The lack of detailed information about different account types, their specific features, and associated benefits represents a significant transparency gap. Legitimate brokers typically provide comprehensive details about various account tiers, each with distinct advantages, minimum deposits, and service levels. The absence of such information suggests either poor business practices or intentional opacity.

User feedback regarding account conditions has been notably poor. Complaints focus on unclear terms and conditions, unexpected fees, and difficulties in accessing account information. The account opening process, while presumably straightforward given the low minimum deposit, lacks the robust verification and documentation procedures typically associated with regulated brokers.

When compared to established, regulated brokers in the forex market, Delta N1 Capital's account conditions fall significantly short of industry standards. The combination of limited information disclosure, regulatory concerns, and negative user experiences contributes to the low rating in this category. This delta n1 capital review emphasizes that attractive minimum deposits cannot compensate for fundamental transparency and regulatory issues.

Delta N1 Capital's trading tools and resources offering centers primarily around the provision of MetaTrader 4 and MetaTrader 5 platforms. These are industry-standard choices that provide basic functionality for forex trading. These platforms offer essential charting tools, technical indicators, and automated trading capabilities that most traders expect from a modern trading environment.

However, the broker's offering appears limited beyond these basic platform provisions. There is no clear evidence of proprietary trading tools, advanced market analysis resources, or comprehensive educational materials that would enhance the trading experience. Many established brokers provide additional resources such as economic calendars, market sentiment indicators, trading signals, and educational webinars.

The absence of detailed information about research and analysis resources is particularly concerning. Professional traders rely on market commentary, technical analysis reports, and fundamental analysis to make informed trading decisions. The lack of such resources suggests either minimal investment in trader support or poor communication of available services.

User feedback regarding the tools and platform experience has been neutral at best. Some traders note basic functionality but lack enthusiasm about the overall offering. The limited scope of tools and resources, combined with concerns about trade execution legitimacy, significantly impacts the value proposition for serious traders.

Customer service represents one of the most problematic aspects of Delta N1 Capital's operations. This is based on available user feedback and exposure reports. Multiple complaints indicate poor responsiveness, unprofessional handling of customer inquiries, and inadequate support for account-related issues.

The specific customer service channels, operating hours, and response time guarantees are not clearly documented in available materials. This itself represents a service quality issue. Professional brokers typically provide multiple contact methods, clear service level agreements, and transparent communication about support availability.

User reports suggest significant delays in response times and inadequate resolution of customer concerns. More concerning are allegations that customer service representatives have been unhelpful when clients attempt to address withdrawal issues or question trading practices. This pattern of poor customer service often correlates with broader operational problems.

The lack of multi-language support information further limits the broker's appeal to international traders. In today's global forex market, comprehensive language support is essential for serving diverse client bases effectively. The absence of clear information about supported languages suggests limited international service capabilities.

The trading experience with Delta N1 Capital is fundamentally compromised by serious allegations about trade execution practices. WikiFX monitoring reports say the company has been accused of not transmitting client trades to actual exchanges, which would represent a fundamental breach of standard trading practices and potentially constitute fraudulent behavior.

Platform stability and execution quality are critical factors in forex trading, where price movements occur rapidly and execution delays can result in significant losses. While MetaTrader 4 and 5 platforms generally provide reliable functionality, concerns about whether trades are actually executed in the market create uncertainty about the entire trading environment.

The reported spread of 3 pips is relatively high compared to competitive brokers in the current market. Major currency pairs often trade with spreads of 1-2 pips or less. This higher spread structure, combined with execution concerns, suggests an unfavorable trading environment for active traders.

User feedback regarding trading experience has been notably negative. There are particular concerns about withdrawal difficulties and questions about trade execution transparency. The combination of execution allegations, higher spreads, and negative user experiences significantly impacts the overall trading experience rating. This delta n1 capital review emphasizes that platform availability cannot overcome fundamental execution and transparency issues.

Trust and safety represent the most critical concerns in this Delta N1 Capital evaluation. The broker operates without clear regulatory oversight from recognized financial authorities, which immediately raises significant red flags for trader fund safety and operational legitimacy.

The serious allegations of fraudulent practices, specifically claims that the company profits from customer losses by not executing trades in actual markets, represent fundamental trust violations. Such practices, if accurate, would constitute investment fraud and pose extreme risks to client funds and trading outcomes.

The absence of regulatory protection means traders have no recourse through official financial oversight bodies in case of disputes or fund recovery issues. Regulated brokers typically maintain segregated client accounts, provide investor compensation schemes, and operate under strict operational guidelines that protect trader interests.

Industry reputation monitoring through platforms like WikiFX has flagged significant concerns about the broker's legitimacy and operational practices. The presence of exposure reports and fraud allegations creates a pattern of concern that extends beyond isolated incidents to systemic operational issues.

The lack of transparency about company ownership, regulatory status, and operational procedures further undermines trust. Legitimate brokers typically provide comprehensive information about their corporate structure, regulatory compliance, and fund protection measures.

Overall user satisfaction with Delta N1 Capital appears significantly below industry standards. This is based on available feedback and exposure reports. The combination of operational concerns, customer service issues, and execution problems creates a poor overall user experience that fails to meet basic expectations for professional forex trading.

The user journey, from initial account opening through ongoing trading activities, appears fraught with difficulties and uncertainties. While the low minimum deposit may initially attract users, subsequent experiences with customer service, trade execution, and withdrawal processes appear consistently problematic.

User feedback patterns indicate particular frustration with communication difficulties, unclear fee structures, and challenges in accessing funds or closing accounts. These issues suggest systematic problems in user experience design and customer relationship management.

The absence of positive user testimonials or success stories, combined with multiple negative exposure reports, indicates a user experience that consistently fails to deliver on basic service expectations. Professional traders require reliable platforms, transparent operations, and responsive support – areas where Delta N1 Capital appears to fall significantly short.

The user demographic appears to include traders seeking low-cost entry into forex markets. However, the experience suggests these traders encounter significant challenges that outweigh any initial cost advantages. The poor user experience rating reflects the gap between marketing appeal and operational reality.

This comprehensive delta n1 capital review reveals significant concerns that make this broker unsuitable for traders prioritizing fund safety and operational transparency. The combination of serious fraud allegations, lack of regulatory oversight, and poor user feedback creates a risk profile that far outweighs any potential benefits from low minimum deposits or platform availability.

The broker may initially appeal to novice traders seeking accessible entry into forex markets. However, the regulatory and operational concerns make it inappropriate for any trader who values fund security and legitimate trading practices. The allegations of not transmitting trades to actual exchanges represent fundamental violations of standard industry practices.

Key advantages include the low $250 minimum deposit and access to popular MetaTrader platforms. However, these minor benefits are completely overshadowed by major disadvantages including fraud allegations, lack of regulation, poor customer service, high spreads, and negative user experiences. Traders seeking legitimate forex trading opportunities should consider regulated alternatives that provide proper investor protection and transparent operations.

FX Broker Capital Trading Markets Review