Classic Capitals 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive classic capitals review reveals concerning findings about this forex broker's operations and legitimacy. Our research comes from WikiBit and various regulatory sources. Classic Capitals appears to operate without proper licensing and has attracted significant negative attention from traders and industry watchdogs. The broker lacks transparent regulatory information. Multiple sources indicate potential fraudulent activities and unsafe trading practices.

Classic Capitals primarily targets forex traders seeking trading opportunities. Our investigation suggests serious red flags that make this broker unsuitable for any serious investor. The absence of verifiable regulatory credentials creates major concerns. Combined with numerous user complaints about withdrawal issues and poor customer service, this paints a troubling picture of this broker's operations. Traders should exercise extreme caution. They should consider regulated alternatives instead of risking their capital with this questionable entity.

Important Notice

Classic Capitals operates across multiple jurisdictions without clear regulatory oversight. This makes it difficult to determine legitimate business practices in any specific region. The broker's lack of transparency regarding its regulatory status raises significant concerns about investor protection and fund security. Different regions may have varying levels of exposure to this broker's services. However, none appear to offer adequate regulatory safeguards.

This review is based on publicly available information from WikiBit, industry reports, and user feedback collected through various platforms. The broker has limited transparency. Due to this, specific trading conditions, platform details, and operational procedures could not be independently verified through official channels.

Rating Framework

Based on our comprehensive analysis, Classic Capitals receives the following ratings across six key dimensions:

Broker Overview

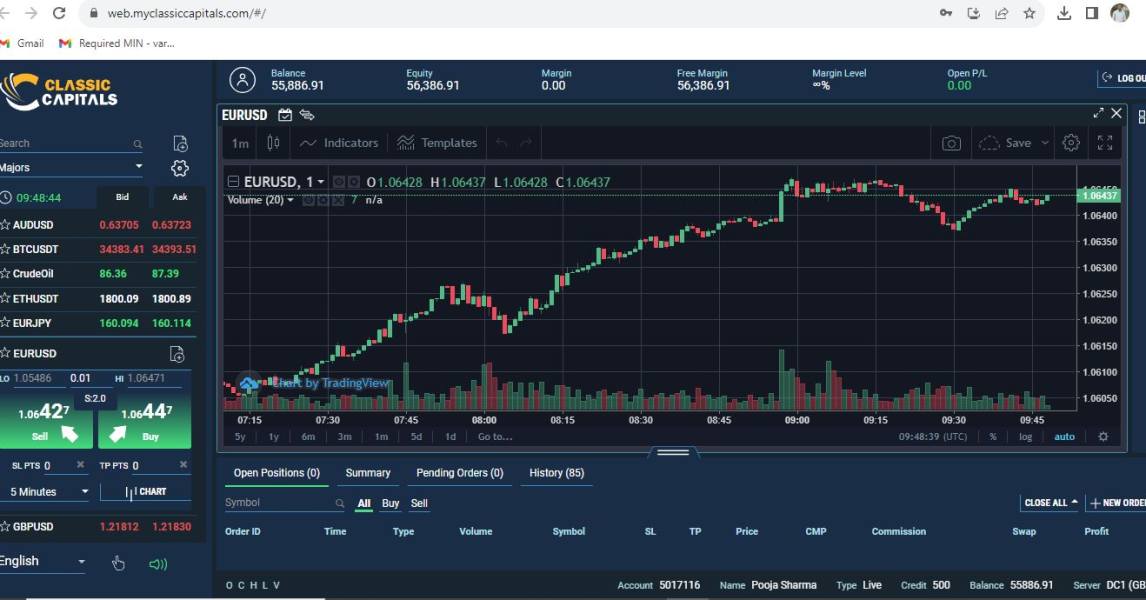

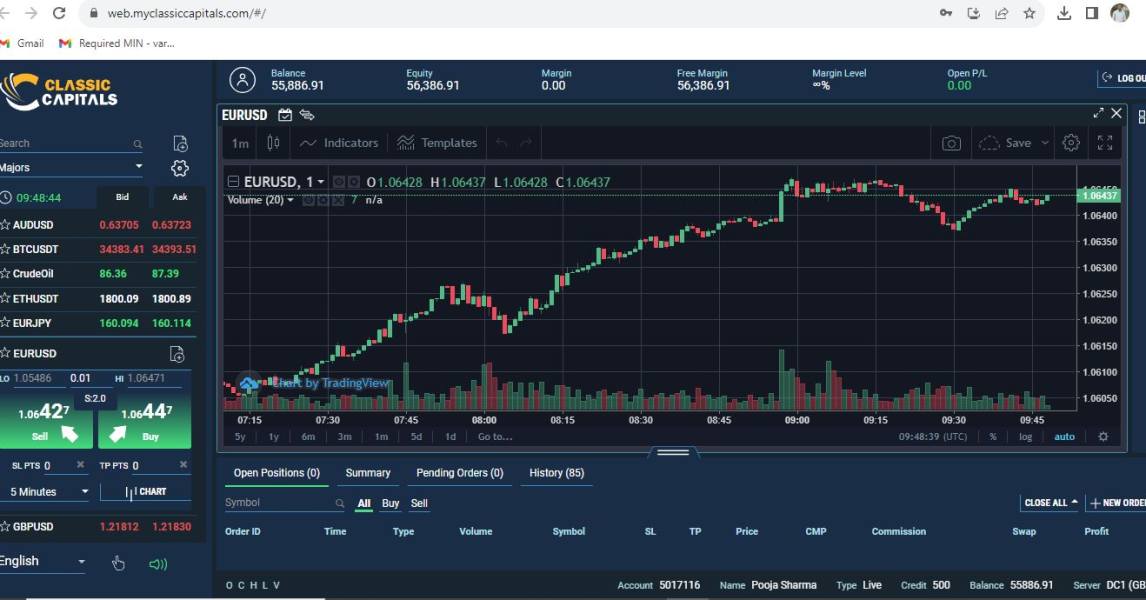

Classic Capitals presents itself as a forex trading platform. Critical information about its establishment date, company background, and business model remains missing from publicly available sources. The lack of fundamental corporate transparency immediately raises concerns about the broker's legitimacy and operational standards. According to WikiBit reports, the company fails to provide clear information about its founding, management structure, or business registration details. Legitimate brokers typically disclose this information.

The broker's business model appears to focus on attracting retail forex traders. Without transparent operational frameworks or regulatory compliance, the actual nature of their services remains questionable. This classic capitals review finds that the company's reluctance to provide basic corporate information significantly undermines investor confidence. It suggests potential regulatory evasion strategies.

Classic Capitals has not provided clear information about the trading platforms they use or the range of financial instruments available to clients. The absence of detailed platform specifications and asset class information further compounds concerns about the broker's operational legitimacy. Most reputable brokers prominently display their platform features, supported assets, and technological capabilities. This makes Classic Capitals' opacity particularly concerning.

The regulatory landscape surrounding Classic Capitals remains murky. There is no clear evidence of oversight from recognized financial authorities. This regulatory vacuum represents a significant risk factor for potential clients. It means traders would lack the protections typically afforded by licensed brokers operating under established regulatory frameworks.

Regulatory Status

Classic Capitals operates without clear regulatory oversight from recognized financial authorities. WikiBit sources indicate the broker lacks proper licensing. This represents a fundamental red flag for potential clients seeking legitimate trading services.

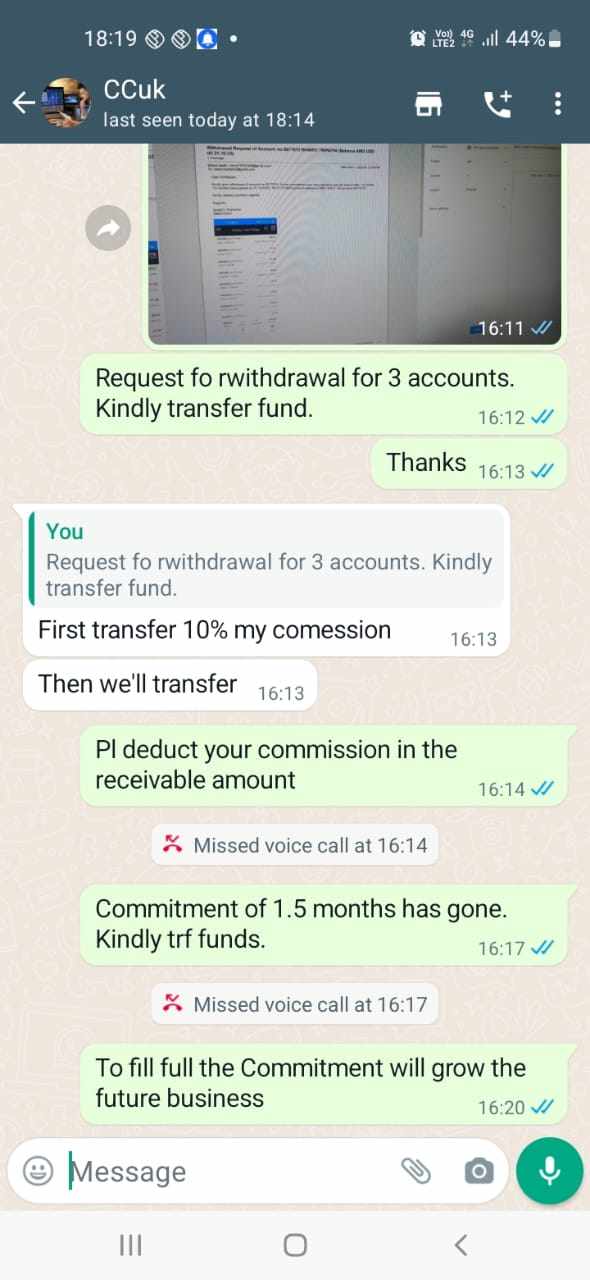

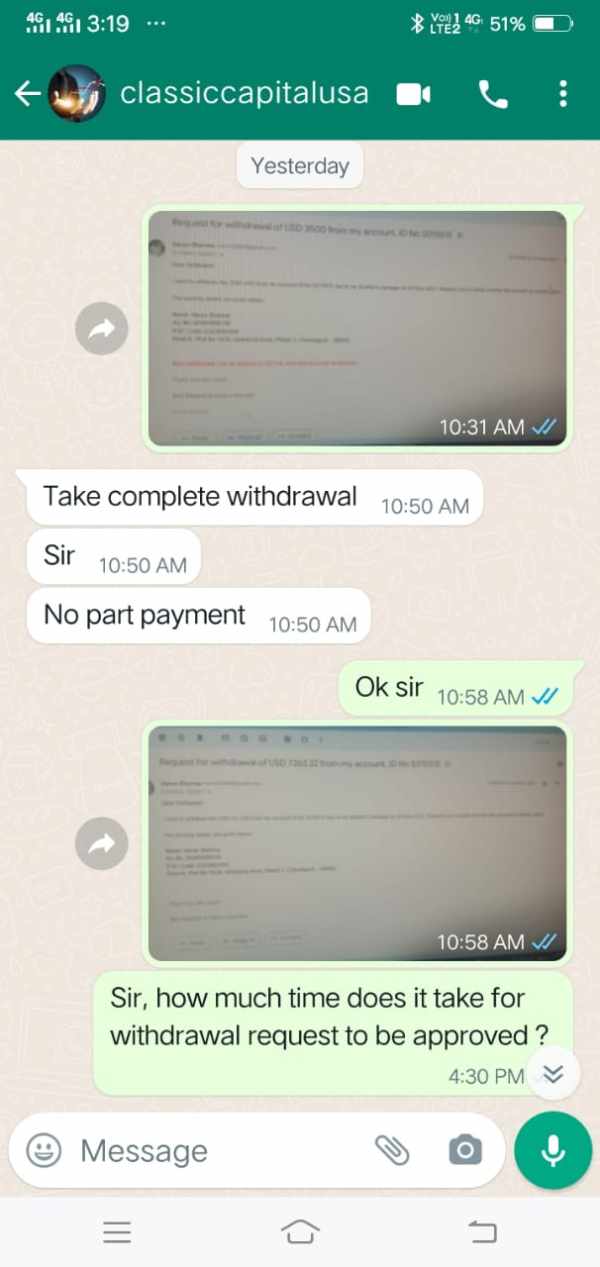

Deposit and Withdrawal Methods

Specific information about deposit and withdrawal methods remains unavailable through official channels. The lack of transparent payment processing information raises additional concerns. These concerns involve fund security and accessibility.

Minimum Deposit Requirements

Minimum deposit requirements have not been clearly specified in available documentation. This makes it impossible for potential clients to understand entry-level investment requirements.

No specific information about promotional offers or bonus programs has been identified through available sources. Unregulated brokers often use attractive bonuses to lure unsuspecting traders.

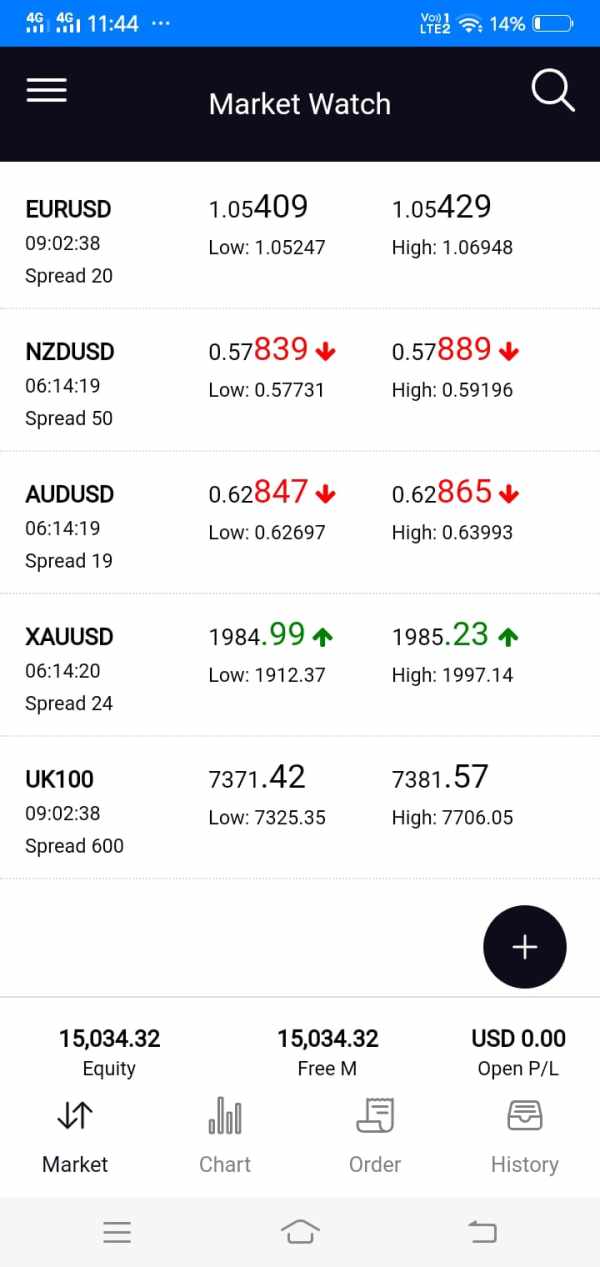

Tradeable Assets

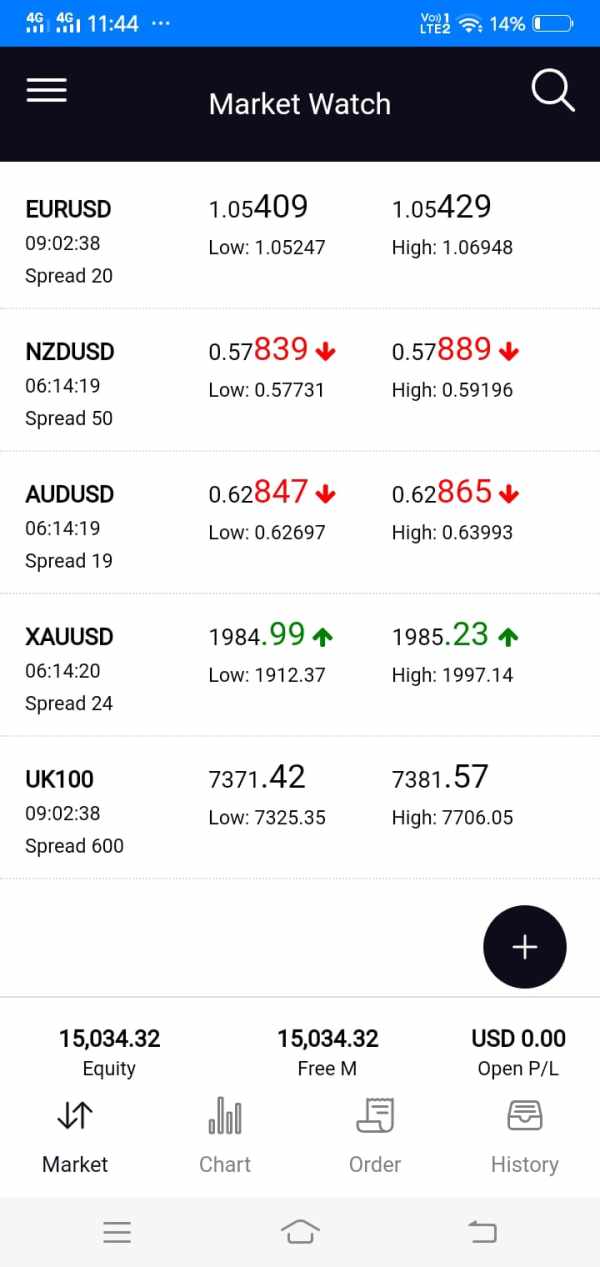

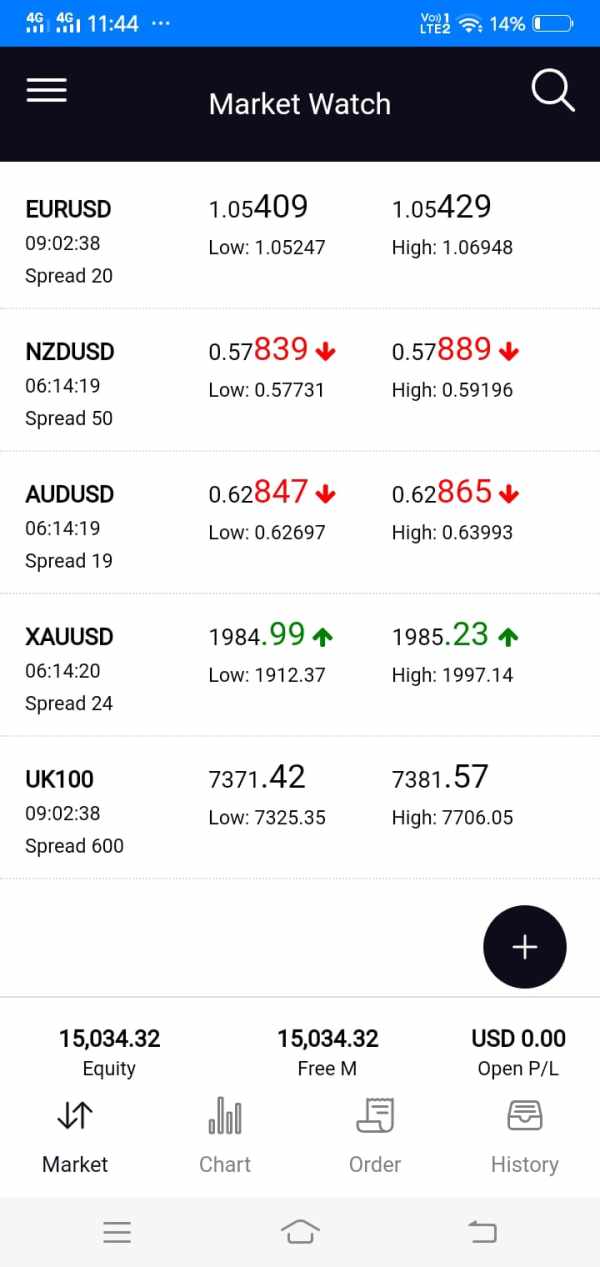

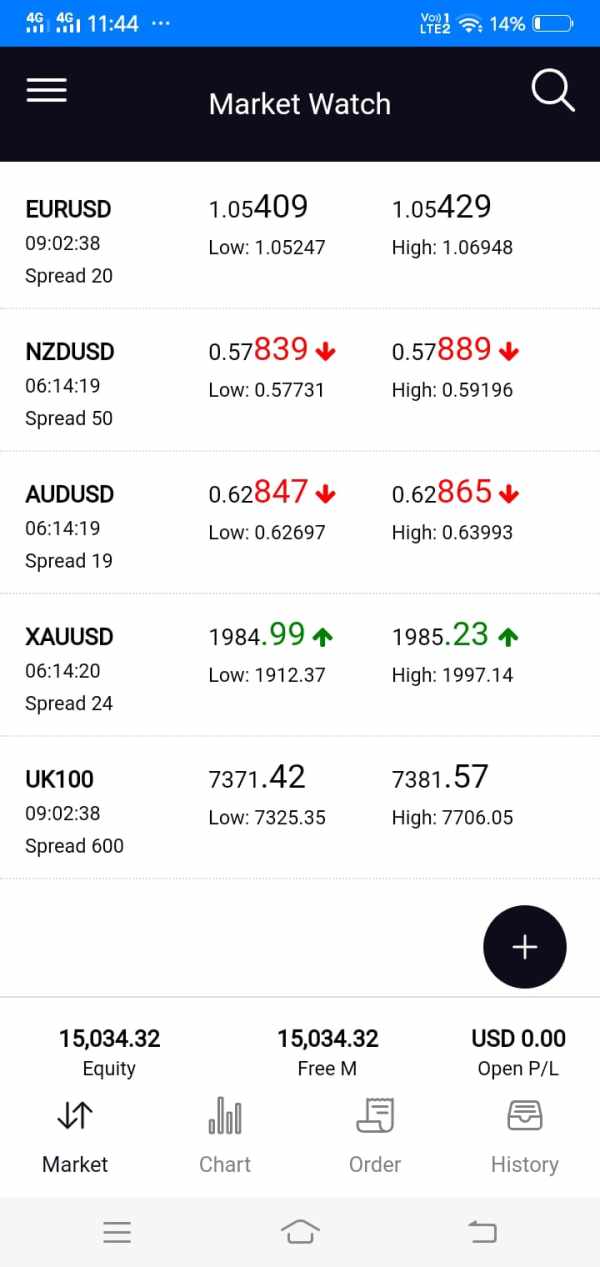

The range of tradeable instruments offered by Classic Capitals remains unclear. No comprehensive asset list is available through official or third-party sources.

Cost Structure

Detailed information about spreads, commissions, and other trading costs has not been made available. This prevents accurate cost analysis for potential clients. This classic capitals review notes that legitimate brokers typically provide transparent pricing structures.

Leverage Ratios

Specific leverage offerings have not been disclosed. This represents another area where Classic Capitals fails to meet standard transparency expectations.

Trading platform specifications and options remain undisclosed. This makes it impossible to evaluate the technological infrastructure supporting client trading activities.

Geographic Restrictions

Regional availability and restrictions have not been clearly communicated through available channels.

Customer Support Languages

Supported languages for customer service have not been specified in available documentation.

Detailed Rating Analysis

Account Conditions Analysis (Score: 2/10)

Classic Capitals receives a poor rating for account conditions due to the complete lack of transparent information about account types, features, and requirements. Legitimate forex brokers typically offer multiple account tiers with clearly defined minimum deposits, spreads, and special features such as Islamic accounts for Muslim traders. However, this broker provides no such clarity. This makes it impossible for potential clients to make informed decisions about account selection.

The absence of information about account opening procedures, verification requirements, and ongoing account management represents a significant shortcoming. Most reputable brokers provide detailed guides about their onboarding process, required documentation, and timeline expectations. Classic Capitals' failure to provide such basic information suggests either poor operational standards or deliberate opacity. This opacity is designed to obscure problematic practices.

Without clear account condition information, traders cannot assess whether the broker meets their specific needs. They also cannot compare offerings with legitimate alternatives. This classic capitals review emphasizes that the lack of account transparency alone should dissuade serious traders from considering this broker.

The tools and resources category reveals another area where Classic Capitals falls significantly short of industry standards. Professional forex brokers typically provide comprehensive trading tools including technical analysis software, economic calendars, market research, and educational resources to support client success. However, no evidence of such offerings has been identified through available sources.

Educational resources represent a crucial component of legitimate broker services. Established firms offer webinars, tutorials, market analysis, and trading guides. The absence of any educational content or learning materials suggests Classic Capitals either lacks the expertise to provide valuable guidance. Alternatively, they deliberately avoid creating resources that might expose their limitations.

Automated trading support, research capabilities, and analytical tools remain completely unspecified. This leaves potential clients without essential information about the technological support available for their trading activities. This lack of tool transparency further reinforces concerns about the broker's legitimacy and operational capacity.

Customer Service and Support Analysis (Score: 3/10)

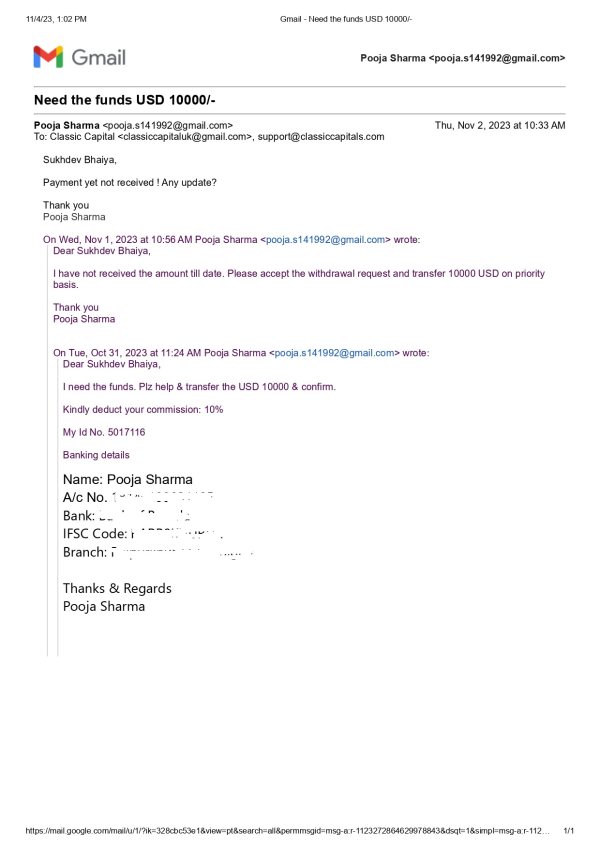

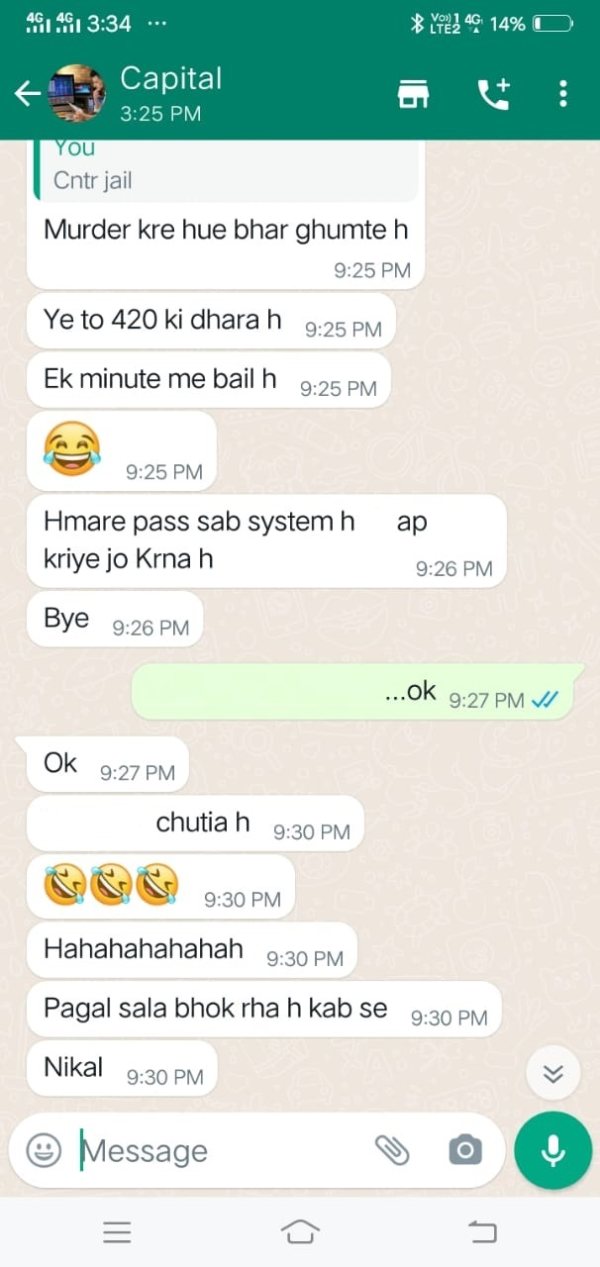

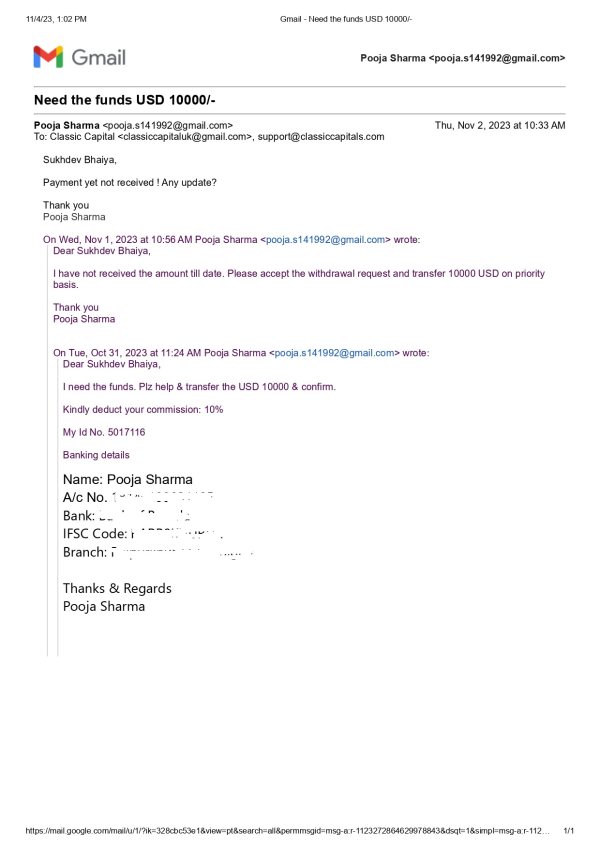

Customer service represents one of the few areas where limited information is available. However, the available feedback is predominantly negative. User reports suggest poor service quality. Some clients characterize their experiences as indicative of fraudulent operations. The lack of clearly defined customer support channels, response time commitments, and service availability hours represents a significant operational deficiency.

Professional brokers typically offer multiple contact methods including phone support, live chat, email assistance, and comprehensive FAQ sections. They also provide clear service level agreements and multilingual support for international clients. Classic Capitals appears to lack such comprehensive support infrastructure. This assessment is based on available information and user feedback.

The limited positive feedback and numerous complaints about service quality suggest systematic issues with client relations and problem resolution. Effective customer support is essential for forex trading. Technical issues or account problems can result in significant financial losses if not resolved quickly.

Trading Experience Analysis (Score: 2/10)

The trading experience evaluation is severely hampered by the lack of available information about platform performance, order execution quality, and overall trading environment. Legitimate brokers typically provide detailed specifications about execution speeds, slippage rates, platform uptime, and mobile trading capabilities. Classic Capitals has not disclosed such information. This makes it impossible to assess the actual trading experience they provide.

Platform stability and execution quality represent critical factors in forex trading success. Milliseconds can impact profitability and system reliability directly affects trader confidence. Without transparent performance metrics or user testimonials about trading conditions, potential clients cannot evaluate whether Classic Capitals can support their trading objectives.

The absence of mobile trading information, platform feature descriptions, and trading environment details suggests either inadequate technological infrastructure or deliberate concealment of platform limitations. This classic capitals review notes that such opacity is inconsistent with legitimate broker operations.

Trust and Safety Analysis (Score: 1/10)

Trust and safety represent the most concerning aspect of Classic Capitals' operations. They earn the lowest possible rating due to fundamental regulatory and transparency failures. The broker's operation without proper licensing from recognized financial authorities creates an environment where client funds lack basic protection mechanisms. Regulated brokers must provide these protections.

Fund security measures, segregated account arrangements, and investor compensation schemes remain completely unspecified. This leaves potential clients without recourse in case of operational failures or fraudulent activities. Legitimate brokers typically maintain client funds in segregated accounts with tier-one banks. They participate in investor protection programs that provide compensation in case of broker insolvency.

The overall negative industry reputation and lack of positive third-party endorsements further undermine confidence in the broker's trustworthiness. Without regulatory oversight, transparent operations, or positive industry recognition, Classic Capitals presents unacceptable risk levels. Serious traders seeking secure trading environments should avoid this broker.

User Experience Analysis (Score: 2/10)

User experience analysis reveals widespread dissatisfaction among clients who have interacted with Classic Capitals. Available feedback suggests poor overall satisfaction levels. Users report difficulties in various aspects of their trading relationships. The lack of detailed information about registration processes, account verification procedures, and fund management operations contributes to user frustration and confusion.

Interface design and platform usability cannot be properly evaluated due to insufficient information. However, the general lack of transparency suggests potential deficiencies in user-centered design principles. Professional brokers invest significantly in creating intuitive, efficient user experiences that support trader success and satisfaction.

The primary user complaints focus on concerns about fraudulent behavior and operational legitimacy. These represent fundamental issues that extend beyond typical service quality problems. Such serious allegations suggest systematic problems with the broker's approach to client relationships and business ethics. Based on available feedback, Classic Capitals is not recommended for any category of trader seeking reliable, professional forex trading services.

Conclusion

This comprehensive classic capitals review concludes that the broker presents unacceptable risks and operational deficiencies. These make it unsuitable for any serious forex trader. The combination of regulatory absence, operational opacity, and negative user feedback creates a risk profile that far exceeds any potential benefits the broker might offer.

The broker cannot be recommended for any user category. The fundamental lack of regulatory protection and transparent operations creates risks that responsible traders should avoid. The absence of clear advantages, coupled with significant red flags including potential fraudulent activities and non-transparent operations, makes Classic Capitals a broker that traders should avoid entirely.

Serious forex traders should instead focus on properly regulated brokers. These provide transparent operations, comprehensive client protections, and professional service standards that support long-term trading success.