Is mctrading safe?

Business

License

Is MC Trading A Scam?

Introduction

MC Trading, a relatively new entrant in the forex market, has garnered attention for its claims of high leverage and a wide array of trading instruments. Established in 2023, the broker aims to attract both novice and experienced traders with promises of competitive trading conditions and advanced trading platforms. However, the influx of new brokers into the forex space often raises concerns about their legitimacy and reliability. As traders navigate this complex landscape, it becomes crucial to assess brokers carefully to avoid potential scams. This article investigates MC Trading's regulatory status, company background, trading conditions, customer experiences, and overall risk profile to determine whether MC Trading is safe or a scam.

To conduct this investigation, we analyzed various online resources, including reviews, regulatory databases, and trader feedback. We employed a structured framework that evaluates key aspects of the broker, including its regulatory compliance, financial practices, and user experiences.

Regulatory and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. A regulated broker is subject to oversight by financial authorities, which helps ensure fair practices and the protection of client funds. In the case of MC Trading, our research reveals a concerning lack of regulation.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Not Applicable | N/A | N/A | Not Verified |

MC Trading does not appear to be regulated by any recognized financial authority, which is a significant red flag. The absence of oversight means that there are no legal protections for traders, increasing the risk of fraud. Moreover, the broker has made claims about being regulated, but these have not been substantiated by any credible sources. This lack of regulatory backing raises serious questions about the broker's operational integrity and the safety of client funds.

In summary, the absence of regulation is a major concern when evaluating whether MC Trading is safe. Without oversight from a reputable authority, traders may find themselves vulnerable to fraudulent practices. Thus, it is advisable for potential clients to exercise extreme caution and consider the implications of trading with an unregulated broker.

Company Background Investigation

Understanding the company behind a trading platform is essential for assessing its reliability. MC Trading claims to operate from multiple jurisdictions, including Seychelles and Montenegro. However, the details surrounding its ownership and management remain ambiguous.

The broker's website lacks comprehensive information about its management team, which is another indicator of potential risks. A transparent broker typically provides details about its founders, executive team, and operational history. In this case, the absence of such information makes it difficult for traders to gauge the company's credibility.

Furthermore, MC Trading's operational history is relatively short, having been founded in 2023. This limited track record raises questions about the broker's experience and stability in the competitive forex market. The lack of transparency in its ownership structure and the absence of verifiable information about its management team further compound concerns regarding its legitimacy.

Overall, the company's background appears to be fraught with uncertainty. The lack of transparency and the short operational history suggest that traders should be wary of engaging with MC Trading. It is essential to prioritize brokers with established reputations and clear ownership structures to ensure a safer trading environment.

Trading Conditions Analysis

When evaluating a broker, the trading conditions they offer play a significant role in determining their attractiveness to traders. MC Trading advertises a variety of trading instruments, including forex pairs, commodities, indices, and cryptocurrencies. However, it is essential to scrutinize the costs associated with trading on this platform.

The overall fee structure of MC Trading is not clearly outlined on its website, which raises concerns about potential hidden fees. Traders should be cautious of brokers that do not provide transparent information about their costs, as this can lead to unexpected financial burdens.

| Fee Type | MC Trading | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of specific details regarding spreads, commissions, and overnight interest rates creates uncertainty for potential clients. Traders typically expect to find clear information about these costs before committing to a broker. The lack of transparency may indicate that MC Trading employs unconventional fee policies, which could be detrimental to traders' profitability.

In conclusion, while MC Trading claims to offer competitive trading conditions, the lack of detailed information on fees and spreads raises significant concerns. Traders should be vigilant and seek brokers that provide comprehensive and transparent fee structures to avoid unexpected costs.

Client Fund Security

The safety of client funds is paramount in the forex trading landscape. A reliable broker should have robust measures in place to safeguard traders' investments. In the case of MC Trading, the absence of regulatory oversight raises immediate concerns about the safety of client funds.

MC Trading has not provided clear information regarding its fund security measures, such as whether client funds are kept in segregated accounts or if there are any investor protection schemes in place. This lack of information makes it challenging to assess the level of security offered to clients.

Moreover, historical reports indicate that unregulated brokers often face issues related to fund mismanagement and withdrawal problems. Traders have raised concerns about their inability to withdraw funds, which is a common complaint against unregulated entities. The absence of a solid framework to protect client investments makes trading with MC Trading a risky endeavor.

In summary, the lack of transparency regarding fund security measures and the absence of regulatory oversight suggest that MC Trading may not prioritize the safety of client funds. Traders should be cautious and consider the risks associated with trading on platforms that do not provide adequate protections for their investments.

Customer Experience and Complaints

Analyzing customer feedback is crucial to understanding the overall experience of traders with a particular broker. In the case of MC Trading, numerous complaints have surfaced regarding withdrawal issues, poor customer support, and lack of transparency.

Common complaint patterns include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Unresponsive |

| Poor Customer Support | Medium | Limited Assistance |

| Lack of Transparency | High | No Clarification |

Many users have reported difficulties in withdrawing their funds, citing unexplained delays and unresponsive customer service. These issues are particularly concerning for traders, as they indicate a lack of commitment to client satisfaction. Furthermore, the absence of clear communication regarding these problems raises serious doubts about the broker's reliability.

One typical case involves a trader who attempted to withdraw funds after a profitable trading period but faced significant delays and a lack of communication from MC Trading's support team. This experience highlights the potential risks associated with trading on a platform that does not prioritize customer service and transparency.

In conclusion, the negative feedback and common complaints surrounding MC Trading suggest that traders may encounter significant challenges when dealing with this broker. Prospective clients should weigh these concerns carefully before deciding to engage with MC Trading.

Platform and Trade Execution

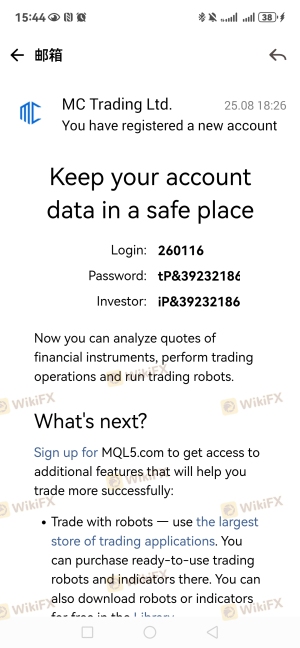

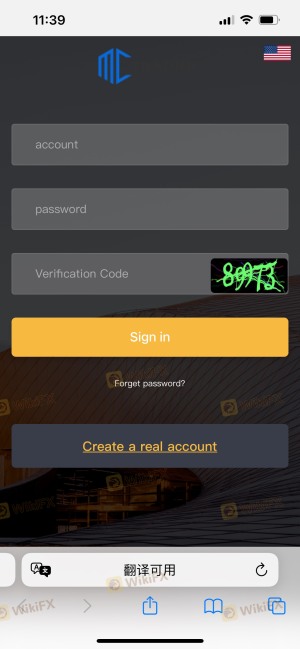

The performance and reliability of a trading platform are critical factors for traders. MC Trading claims to offer a robust trading experience through popular platforms like MetaTrader 4 and MetaTrader 5. However, user feedback regarding the platform's performance has been mixed.

Traders have reported issues with order execution quality, including slippage and rejections. These factors can significantly impact trading outcomes, especially for those employing high-frequency trading strategies. Furthermore, there are concerns about potential platform manipulation, which is often associated with unregulated brokers.

In summary, while MC Trading provides access to reputable trading platforms, the reported issues regarding execution quality and potential manipulation raise questions about the overall reliability of the trading experience. Traders should be cautious and consider these factors when evaluating whether MC Trading is a safe option.

Risk Assessment

Engaging with any broker involves inherent risks, and MC Trading is no exception. The combination of its unregulated status, lack of transparency, and negative customer experiences contributes to a high-risk assessment.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight. |

| Fund Security Risk | High | Lack of clear security measures. |

| Customer Service Risk | Medium | Poor response to complaints. |

To mitigate these risks, traders should consider the following recommendations:

- Conduct Thorough Research: Always investigate a broker's regulatory status and customer feedback before opening an account.

- Use Regulated Brokers: Opt for brokers with established regulatory oversight to ensure the safety of your funds.

- Start Small: If engaging with a new or unregulated broker, limit your initial investment until you are confident in their legitimacy.

Conclusion and Recommendations

In conclusion, the investigation into MC Trading raises several red flags that suggest it may not be a safe option for traders. The absence of regulatory oversight, lack of transparency regarding fees and fund security, and numerous customer complaints all point to significant risks associated with this broker.

For traders seeking a reliable and trustworthy forex trading experience, it is advisable to consider alternatives that are regulated by reputable authorities. Brokers such as [insert regulated brokers here] offer a safer environment with established protections for client funds. Ultimately, exercising caution and conducting thorough research is essential in navigating the forex trading landscape to avoid potential scams like MC Trading.

Is mctrading a scam, or is it legit?

The latest exposure and evaluation content of mctrading brokers.

mctrading Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

mctrading latest industry rating score is 1.38, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.38 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.